- Home

- »

- Organic Chemicals

- »

-

Maleic Anhydride Market Size, Share & Trends Report, 2030GVR Report cover

![Maleic Anhydride Market Size, Share & Trends Report]()

Maleic Anhydride Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Unsaturated Polyester Resins, Copolymers, Additives), By Region (Asia Pacific, North America, Europe), And Segment Forecasts

- Report ID: 978-1-68038-191-7

- Number of Report Pages: 158

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Maleic Anhydride Market Summary

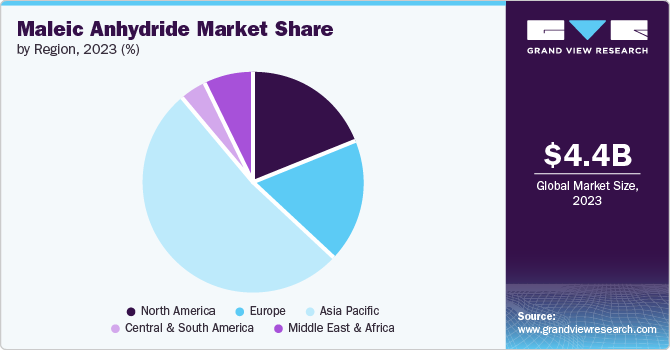

The global maleic anhydride market size was estimated at USD 4,386.1 million in 2023 and is projected to grow at a CAGR of 4.2% from 2024 to 2030. The product market's growth is attributed to the increasing demand for unsaturated polyester resins (UPR), the prime component used in fiberglass-reinforced resins.

Key Market Trends & Insights

- Asia Pacific is a prominent consumer of maleic anhydride globally, with a revenue share of 52.1% in 2023.

- By application, the 1,4-butanediol (BDO) segment is expected to witness growth at 5.1% CAGR.

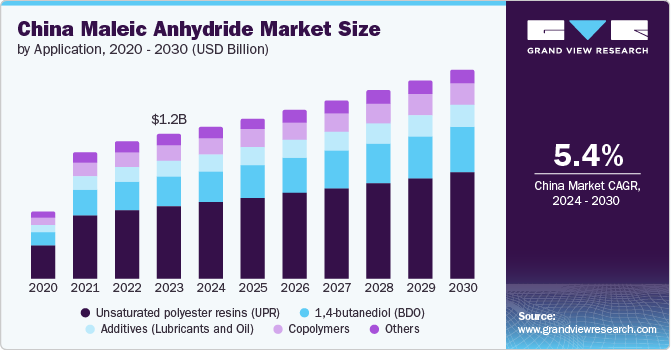

- China to witness market growth of CAGR 5.4%

Market Size & Forecast

- 2023 Market Size: USD 4,386.1 Million

- 2030 Projected Market Size: USD 5,863.1 Million

- CAGR (2024-2030):4.2%

These resins are further used in automotive and marine applications and in construction products like sinks, countertops, and tubs.

The U.S. is the largest product consumer in North America, with a revenue share of 82.9% in 2023. This is attributed to the country's expanding agricultural, automotive, and construction industries. According to the TST Europe, the total construction spending in the US reached $1.98 trillion in 2023, marking a 7.4% increase from the previous year. This growth was primarily driven by nonresidential construction, which saw a 17.6% year-over-year increase, while residential construction spending decreased by 3% due to rising interest rates and inflation. Furthermore, the country constructs structures worth over USD 1.8 trillion each year. These factors are expected to contribute to the growth of the product market in the U.S.

Drivers, Opportunities & Restraints

Unsaturated polymer resins are widely used as body fillers for rapid reconstruction and repair of damaged vehicle parts. They also function as putty for car painting in the automobile industry. Applying UPR gives the vehicle a smooth surface by removing any traces of damage. Furthermore, it also provides good adhesion to paint, thereby increasing the lifespan of the applied coat. UPR is widely used for bumpers, doors, roofs, and interiors to repair damages caused during accidents. Thus, the growing car accident cases on a global level are expected to propel the demand for UPR, which, in turn, will drive the demand for maleic anhydride.

Maleic anhydride is used in various industries, including automotive, building & construction, pharmaceuticals, personal care & cosmetics, and more. The increasing demand for unsaturated polyester resins (UPR) in automotive and construction applications is expected to drive the demand for maleic anhydride. Furthermore, applying additives in the automotive sector to enhance fuel efficiency and reduce emissions boosts maleic anhydride demand.

N-butane and benzene are the primary feedstock used to manufacture maleic anhydride. Globally, the prices of benzene and n-butane depend on the price trends of crude oil and naphtha. Crude oil volatility has been the major reason for the high fluctuation in benzene prices. Crude oil pricing and downstream demand highly influence the global petroleum derivatives industry.

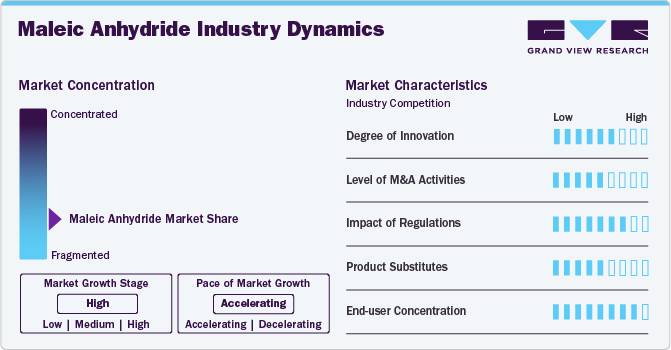

Industry Dynamics

The market is highly competitive, with the presence of a large number of independent small-scale and large-scale manufacturers and suppliers. This fragmentation is evident in the market's structure, with players entering into acquisitions and expansion plans to maintain their position in the market. For instance, in 2023, PETRONAS Chemicals Group Berhad (PCG) has announced its acquisition of the 113 kilo-tonnes per annum (ktpa) Maleic Anhydride (MAn) plant situated in Gebeng, Kuantan, from BASF PETRONAS Chemicals Sdn. Bhd. (BPC).

Key players operating in the maleic anhydride market include prominent names, such as INEOS, Huntsman International LLC, Lanxess A.G., Mitsubishi Chemical Corp., NIPPON SHOKUBAI CO., LTD., and others. These players are actively involved in strategic initiatives such as acquisitions and expansions to cater to the growing demand, showcasing a robust and dynamic market. The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

The maleic anhydride market is influenced by evolving regulatory landscapes, and manufacturers need to navigate these hurdles through strategic partnerships, efficient supply chain management, and continuous adaptation to regulatory changes. The development of bio-based maleic anhydride and exploring untapped markets are identified as opportunities in the market, driven by the growing emphasis on renewable and sustainable solutions.

Application Insights & Trends

“1,4-butanediol (BDO) segment is expected to witness growth at 5.1% CAGR”

The unsaturated polyester resins (UPR) segment is projected to reach USD 2,953.8 million by 2030. Unsaturated polymer resin is one of the most popular thermostat polymers utilized as a matrix in various application industries such as aerospace and construction. It possesses excellent resistance to abrasion, corrosion, chemicals, and heat, superior structural strength, high impact strength, and exceptional compressive strength, along with environmentally friendly characteristics, which make it an excellent choice for applications in the marine, construction, transport, wind energy, and electrical industries.

1,4-butanediol (BDO) is another application anticipated to witness the fastest growth over the forecast period. 1, 4-butanediol (BDO) is manufactured from maleic anhydride by Davy Process Technology (DPT). BDO is further used as an intermediate chemical to produce polybutylene terephthalate (PBT), polytetramethylene ether glycol (PTMEG), tetrahydrofuran (THF), gamma-butyrolactone (GBL), and polyurethane (PU). These chemicals are used in engineering plastics, medicines, fibers, cosmetics, pesticides, artificial leather, hardeners, solvents, plasticizers, and rust removers.

Additives in the application segment are expected to grow rapidly over the forecast period due to the growing automotive industry worldwide. Additives are primarily used to improve the fuel efficiency of gasoline, diesel, distillate fuels, and others; modify burn and combustion rates under high temperatures; and reduce harmful emissions. Growing environmental concerns about toxic gaseous emissions have prompted regulatory agencies across the globe to mandate various norms, such as the Clean Fuel Program in the U.S. Such mandates have further prompted oil marketers to blend specialty fuel additives in transportation fuel.

Regional Insights

“China to witness market growth of CAGR 5.4%”

Asia Pacific is a prominent consumer of maleic anhydride globally, with a revenue share of 52.1% in 2023. The Asia Pacific maleic anhydride market will likely grow over the forecast period. This can be attributed to advancements in the region's pharmaceuticals, construction, and personal care & cosmetics industries. In the construction and pharmaceutical industries, maleic anhydride is used as an unsaturated polymer resin, whereas in the personal care and cosmetics industry, it is used in hair fixatives and styling formulas.

India Maleic Anhydride Market Trends

The growing pharmaceutical industry in the region boosts the demand for maleic anhydride. According to the India Brand Equity Foundation, the Indian pharmaceuticals industry supplies over 50% of the global demand for different vaccines, making it the third-largest industry in terms of pharmaceutical production worldwide.

North America Maleic Anhydride Market Trends

The North American maleic anhydride market is anticipated to witness the fastest growth over the forecast period owing to the region's growing agricultural, automotive, and construction industries. Maleic anhydride is mainly used to manufacture unsaturated polymer resins, which are used in the construction, pharmaceutical, and agricultural industries.

U.S. Maleic Anhydride Market Trends

The price dynamics of maleic anhydride in the U.S. are influenced by factors such as the prices of butane and trade dynamics. The market is experiencing fluctuations due to factors like demand-supply dynamics and trade pressures, including the impact of the trade war with China.

Europe Maleic Anhydride Market Trends

The advancing automotive and construction industries are expected to drive the regional demand for maleic anhydride as it is widely used to produce unsaturated polymer resins, which are further used in the automobile, construction, and pharmaceutical industries.

Germany Maleic Anhydride Market Trends

Germany plays a significant role in the global maleic anhydride market, as evidenced by its position as one of the top exporters of maleic anhydride. The market size and growth are influenced by factors such as the expanding automotive and construction industries, which drive the demand for maleic anhydride.

Central & South America Maleic Anhydride Market Trends

The demand for maleic anhydride in Central and South America is expected to expand due to the region's expanding automotive, construction, and food & beverage sectors, rapid industrialization, and growing population. This trend will likely drive the demand for maleic anhydride in the forecast period.

Argentina Maleic Anhydride Market Trends

The growing use of maleic anhydride in the automotive sector and rapid expansion in the wind energy and construction sectors are expected to fuel the market growth during the forecast period. These trends indicate a positive outlook for the maleic anhydride market in Argentina, with opportunities for growth and expansion in various industries.

Middle East & Africa Maleic Anhydride Market Trends

The demand for maleic anhydride in the MEA region is driven by its use in various applications, including agriculture, construction, personal care, cosmetics, pharmaceuticals, and other industries. In addition, the growing use of maleic anhydride in the automotive sector, wind energy, and construction industries is expected to fuel market growth in the region.

Saudi Arabia Maleic Anhydride Market Trends

Fluctuations in crude oil prices have been identified as a challenge for the maleic anhydride market, impacting the market dynamics and pricing trends. The maleic anhydride market in Saudi Arabia is part of the global market, influenced by factors such as raw material costs, trade operations, and supply-demand dynamics.

Key Maleic Anhydride Company Insights

Some of the key players operating in the market includeHuntsman International LLC, Mitsubishi Chemical Corporation,LANXESS A.G., INEOS, and Nippon Shokubai Co., Ltd. among others.

-

Mitsubishi Chemical Corporation is a provider of performance products and industrial materials. It is a subsidiary of Mitsubishi Chemical Holdings Corporation (MCHC), an investment holding group based in Japan. The company operates in three domains: performance products, industrial materials, and other businesses. It has regional offices and overseas subsidiaries in the US, Germany, Hong Kong, Singapore, and China

-

Lanxess A.G. is a Germany-based specialty chemicals company formed as a spin-off from Bayer A.G.’s chemical operations and polymer activities. The company is involved in the manufacturing and distribution of additives, chemical intermediates, plastics, and specialty chemicals

Polynt Group, Thirumalai Chemicals Ltd., Jiangyin Shunfei, and others, are some of the emerging market participants in the maleic anhydride market.

-

Polynt Group specializes in the production, sales, and R&D of chemical intermediates, organic hydrides, and their derivatives. It specializes in chemicals, resins, intermediates, special additives, compounds, plasticizers, gel coats, catalysts, composites, vinyl ester resins, bonding pastes, unsaturated polyester resins, SPP, GPP, carbon fiber, malic acid, and bonding pastes. The company has two production units for maleic anhydride in Northern Italy with production capacities of 36,000 and 60,000 tons per annum

-

Thirumalai Chemicals Ltd. started with the production of phthalic anhydride, although its current product portfolio comprises maleic anhydride, fumaric acid, malic acid, and fine chemicals & derivatives. Its products cater to industries ranging from construction, food & beverage, pharmaceuticals, lubricants, agriculture, co-polymers, paints & coatings, chemical intermediates, plastic, dyes, polyesters, textiles, and industrial applications

Key Maleic Anhydride Companies:

The following are the leading companies in the maleic anhydride market. These companies collectively hold the largest market share and dictate industry trends.

- Cepsa

- INEOS

- Huntsman International LLC

- Lanxess A.G.

- Mitsubishi Chemical Corporation

- MOL Hungarian Oil & Gas Plc

- Nippon Shokubai Co., Ltd.

- Polynt Group

- Thirumalai Chemicals Ltd.

- Jiangyin Shunfei

- Tianjin Bohai Chemicals.

Recent Developments

-

In June 2023, PETRONAS Chemicals Group Berhad (PCG) announced its acquisition of the 113 kilo-tonnes per annum (ktpa) Maleic Anhydride (MAn) plant situated in Gebeng, Kuantan, from BASF PETRONAS Chemicals Sdn. Bhd. (BPC)

-

In November 2023, Clariant announced the acquisition of Jiangsu Shenghong Petrochemical Co., Ltd. The contract entails the utilization of Clariant's SynDane 3142 LA catalyst to establish a new maleic anhydride (MA) production facility in Lianyungang, Jiangsu province

-

In October 2023, Huntsman announced a maleic anhydride production at its Moers facility in Germany following an unforeseen maintenance shutdown that temporarily suspended operations. The Moers plant is known for its significant annual production capacity of 105,000 tons of maleic anhydride.

Maleic Anhydride Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4,565.9 million

Revenue forecast in 2030

USD 5,863.1 million

Growth rate

CAGR of 4.2% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; China; India; Japan; South Korea; Brazil

Key companies profiled

Cepsa; INEOS; Huntsman International LLC; Lanxess A.G.; Mitsubishi Chemical Corporation; MOL Hungarian Oil & Gas Plc; Nippon Shokubai Co.; Ltd.; Polynt Group; Thirumalai Chemicals Ltd.; Jiangyin Shunfei; Tianjin Bohai Chemicals

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Maleic Anhydride Market Report Segmentation

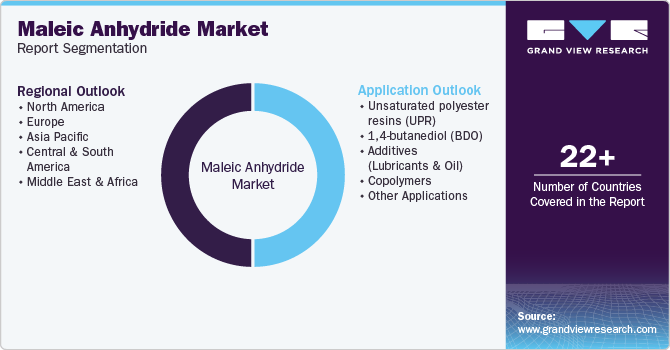

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the maleic anhydride market report based on application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Unsaturated polyester resins (UPR)

-

1,4-butanediol (BDO)

-

Additives (Lubricants and Oil)

-

Copolymers

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global maleic anhydride market size was valued at USD 4,386.1 million in 2023.The growth for the product market is attributed to the increasing demand for unsaturated polyester resins (UPR).

b. The global maleic anhydride market is expected to grow at a compound annual growth rate of 4.2% from 2024 to 2030 to reach USD 5,863.1 million by 2030.

b. Key factors that are driving the market growth include rising demand for unsaturated polyester resins (UPR), which is the prime component used in fiberglass reinforced resins, which is further used in automotive & marine applications and in construction products like sinks, countertops, and tubs.

b. Some key players operating in the maleic anhydride market include Cepsa; INEOS; Huntsman International LLC; Lanxess A.G.; Mitsubishi Chemical Corporation; MOL Hungarian Oil & Gas Plc; Nippon Shokubai Co.; Ltd.; Polynt Group; Thirumalai Chemicals Ltd.; Jiangyin Shunfei; Tianjin Bohai Chemicals.

b. Unsaturated polyester resins dominated the maleic anhydride market with a share of USD 2,199.9 million in 2023. This is attributable its application in various industries including electrical, automotive, marine, and construction on account of their cost-effectiveness, high performance, and eco-friendly characteristics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.