- Home

- »

- Organic Chemicals

- »

-

Lithium Chemicals Market Size, Share, Industry Report, 2030GVR Report cover

![Lithium Chemicals Market Size, Share & Trends Report]()

Lithium Chemicals Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Carbonate, Hydroxide, Chloride), By End Use (Automotive, Consumer Electrical, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-645-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Lithium Chemicals Market Summary

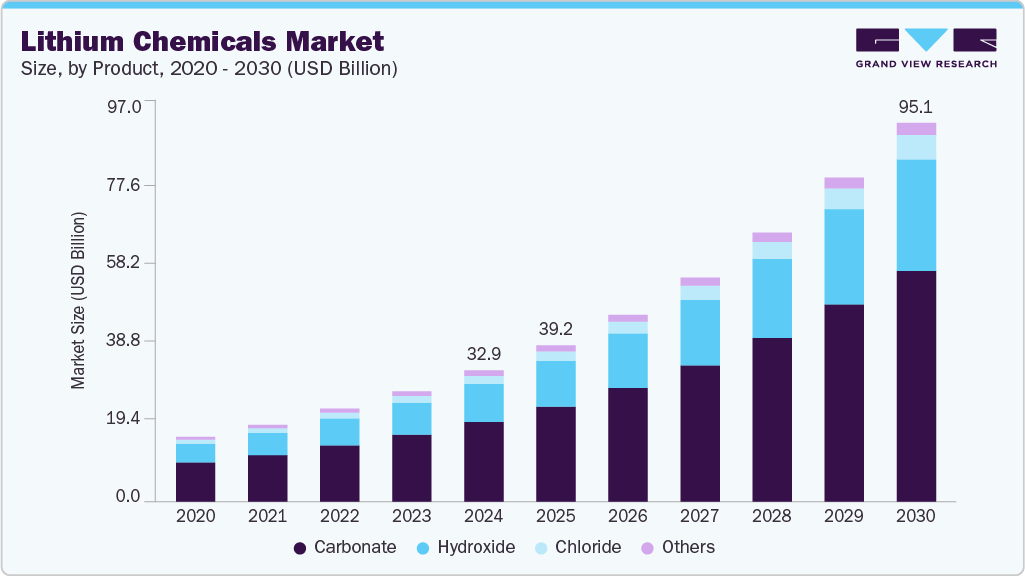

The global lithium chemicals market size was estimated at USD 32.92 billion in 2024, and is projected to reach USD 95.12 billion by 2030, growing at a CAGR of 19.4% from 2025 to 2030. The market growth is primarily driven by the surging demand for electric vehicles (EVs), energy storage solutions, and advancements in battery technologies.

Key Market Trends & Insights

- Asia Pacific dominated the global lithium chemicals market with a revenue share of 60.1% in 2024.

- The lithium chemicals market in the U.S. is expected to grow at a substantial CAGR of 19.6% from 2025 to 2030.

- By product, the chloride segment is expected to grow at a considerable CAGR of 20.3% from 2025 to 2030 in terms of revenue.

- By end use, the industrial segment is expected to grow at a considerable CAGR of 19.8% from 2025 to 2030 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 32.92 Billion

- 2030 Projected Market Size: USD 95.12 Billion

- CAGR (2025 - 2030): 19.4%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

This expansion is further supported by global initiatives aimed at reducing carbon emissions and transitioning towards sustainable energy sources. The rapid adoption of EVs is a significant contributor to the increased demand for lithium chemicals. Lithium-ion batteries, essential for EVs, rely heavily on lithium compounds such as lithium carbonate and lithium hydroxide. In addition, energy storage systems for renewable energy integration are becoming more prevalent, further driving the need for lithium-based batteries.Continuous research and development in battery technology have led to improvements in energy density, charging speed, and overall performance of lithium-ion batteries. Emerging technologies, such as solid-state batteries, promise even greater efficiency and safety, thereby increasing the demand for high-purity lithium chemicals. These advancements are crucial for applications ranging from consumer electronics to grid-scale energy storage.

Governments worldwide are implementing policies and regulations to promote the use of clean energy and reduce reliance on fossil fuels. Incentives for EV adoption, investments in renewable energy infrastructure, and stricter emission standards are creating a favorable environment for the market’s growth.

Beyond energy storage and transportation, lithium chemicals are finding applications in other industries. In the pharmaceutical sector, lithium compounds are used to treat mood disorders. The cosmetics industry utilizes lithium derivatives for their moisturizing and skin-soothing properties. Such diversification helps stabilize the market and opens new avenues for growth.

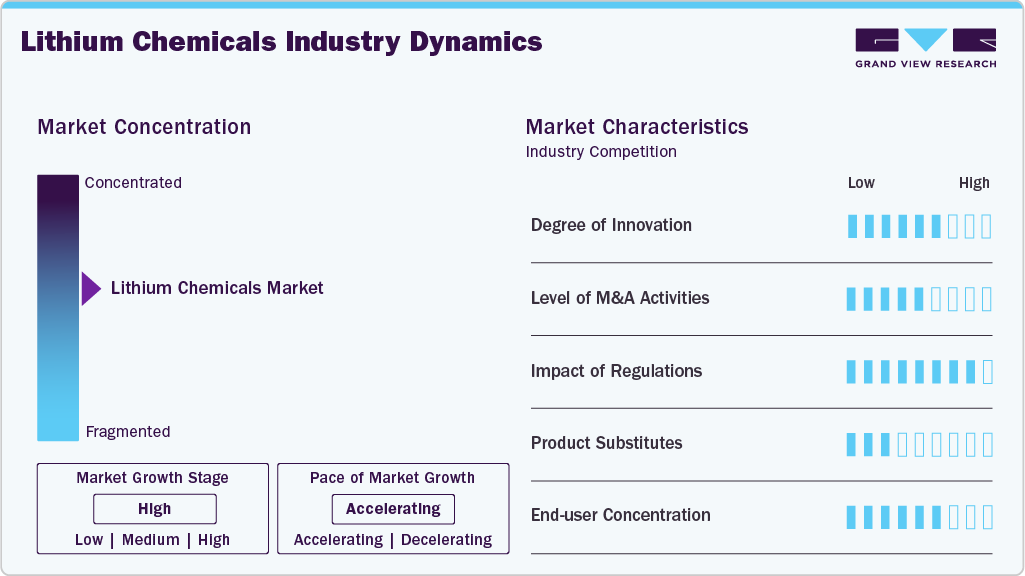

Market Concentration & Characteristics

The lithium chemicals market is moderately consolidated, with a few dominant players such as Albemarle Corporation, SQM S.A., SICHUAN BRIVO LITHIUM MATERIALS CO., LTD., and others holding substantial market shares. These key players benefit from integrated supply chains, proprietary extraction and purification technologies, and strong relationships with battery manufacturers. Their established distribution networks and investments in product innovation further reinforce their market positions.

The market is witnessing increasing participation from regional and niche players, particularly in Asia Pacific and Latin America. These entrants often leverage cost-efficient production methods and access to abundant lithium resources in countries such as China, Argentina, and Australia. This dynamic fosters price competition, especially in the bulk or commodity-grade segment, such as lithium carbonate and lithium hydroxide.

The market is technology-intensive, with ongoing R&D in extraction methods aiming to produce at scale with better efficiency and environmental profiles. Innovation in battery technologies, such as solid-state batteries and lithium iron phosphate chemistries, is also reshaping competitive dynamics and product development strategies.

Product Insights

The carbonate segment led the market and accounted for the largest revenue share of 60.7% in 2024. This growth is driven primarily due to its extensive use in lithium-ion batteries, which are integral to electric vehicles (EVs), portable electronics, and renewable energy storage systems. The dominance of lithium carbonate is attributed to its high energy density and favorable electrochemical properties, making it a preferred choice for battery manufacturers. In addition, it finds applications in the glass and ceramics industry, where it enhances product strength and thermal resistance. The pharmaceutical sector also utilizes it for the treatment of mood disorders, further diversifying its application portfolio.

The Chloride segment is expected to grow fastest with a CAGR of 20.3% from 2025 to 2030 during the forecast period. Its hygroscopic nature makes lithium chloride highly effective in moisture absorption, which is essential for various industrial processes. Furthermore, its role in the synthesis of lithium metal positions it as a critical component in next-generation battery technologies. The increasing demand for efficient energy storage solutions and the growth of the electronics industry are key drivers propelling the market forward.

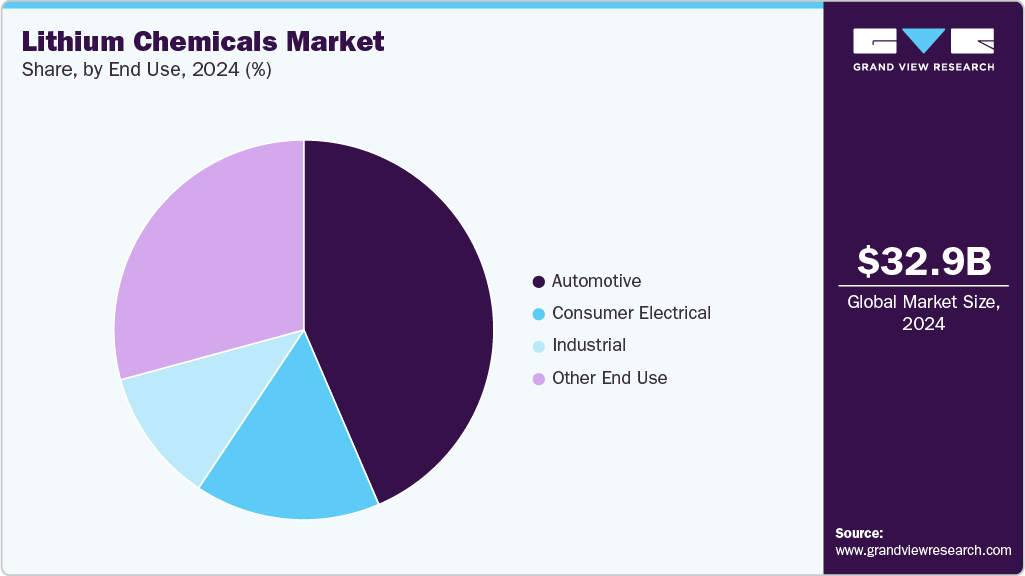

End Use Insights

The automotive segment dominated the market with a revenue share of 43.5% in 2024. This dominance is attributed to the increasing production of EVs, which rely heavily on lithium-ion batteries for energy storage. Governments worldwide are implementing stringent emission regulations, incentivizing the shift from internal combustion engine vehicles to EVs, further propelling lithium demand in this sector.

The Industrial segment is expected to grow fastest with a CAGR of 19.8% from 2025 to 2030 during the forecast period. This surge is driven by the escalating demand for lithium in various industrial applications, including energy storage systems, aerospace, and manufacturing processes. The transition towards renewable energy sources necessitates efficient energy storage solutions, where lithium-ion batteries play a crucial role. In addition, advancements in battery technologies and the development of solid-state batteries are expanding lithium's applicability in industrial settings.

Regional Insights

Asia Pacific market dominated the global landscape with a revenue share of 60.1% in 2024. This is primarily attributed to the region's robust demand from the electric vehicle (EV) and energy storage sectors. Countries such as China, Japan, and South Korea are at the forefront, driven by aggressive EV adoption targets and substantial investments in battery manufacturing infrastructure. China's extensive battery production capacity and its position as a major EV market underscore its pivotal role in the lithium supply chain. In addition, government policies promoting renewable energy and clean transportation further bolster the region's market growth.

China lithium chemicals market stands as a central player in the market, propelled by its expansive EV industry and commitment to renewable energy. The nation's strategic initiatives, such as subsidies for EV purchases and investments in charging infrastructure, have accelerated lithium demand. Moreover, China's being a major player in battery manufacturing reinforces its significant consumption of lithium compounds. The government's emphasis on reducing carbon emissions and promoting sustainable technologies continues to drive the market forward.

North America Lithium Chemicals Market Trends

The North American market is expected to grow fastest with a CAGR of 19.5% during the forecast period. It is experiencing rapid growth, fueled by increasing EV adoption and the push for energy independence. The U.S., in particular, is investing heavily in domestic lithium production and battery manufacturing to reduce reliance on foreign sources. Initiatives provide incentives for clean energy projects, including lithium extraction and processing. Furthermore, collaborations between automakers and mining companies aim to secure a stable lithium supply chain to meet the burgeoning demand from the EV sector.

U.S. Lithium Chemicals Market is expanding rapidly, driven by government-backed efforts to build a resilient domestic supply chain and reduce reliance on imports. Strong federal support, including investments in battery manufacturing and sustainable extraction technologies, is fueling growth. Rising EV demand and clean energy goals are attracting both established players and start-ups, positioning the U.S. as a key hub for innovation and energy independence.

Europe Lithium Chemicals Market Trends

Europe's market is expanding steadily, driven by stringent environmental regulations and a strong commitment to sustainability. The European Union's Green Deal and the push for carbon neutrality have led to increased investments in EVs and renewable energy storage solutions. Countries such as Germany and France are investing in domestic battery production facilities, aiming to establish a self-reliant supply chain. In addition, the EU's classification of lithium as a critical raw material underscores its strategic importance, prompting efforts to develop local lithium sources and reduce dependency on imports.

Germany lithium chemicals market growth is propelled by its advanced automotive and tech industries, supported by strong environmental policies and innovation incentives. As Europe’s industrial engine, Germany is investing in lithium supply chain resilience, battery-grade production, and green technologies. Collaboration across industry, research, and government is driving sustainable growth.

Latin America Lithium Chemicals Market Trends

Latin America is emerging as a crucial region in the global market, primarily due to its abundant lithium reserves in countries such as Chile, Argentina, and Bolivia, collectively known as the "Lithium Triangle." These nations are attracting significant foreign investments to develop lithium extraction and processing capabilities. Chile has well-established lithium mining operations, while Argentina is rapidly expanding its production capacity. The region's strategic importance is further amplified by global efforts to diversify lithium sources and ensure a stable supply for the growing EV and energy storage markets.

Middle East & Africa Lithium Chemicals Market Trends

The Middle East and Africa are witnessing gradual growth in the market, driven by increasing interest in renewable energy and electric mobility. Countries such as the Democratic Republic of Congo and Zimbabwe possess significant lithium reserves, attracting investments for exploration and development. In the Middle East, nations such as the UAE and Saudi Arabia are exploring opportunities to integrate lithium-based energy storage solutions into their renewable energy projects.

Key Lithium Chemicals Company Insights

Some of the key players operating in the market include Albemarle Corporation, Arcadium Lithium, SQM S.A., SICHUAN BRIVO LITHIUM MATERIALS CO., LTD.

-

Albemarle Corporation, headquartered in North Carolina, is a leading global producer of bromine, lithium, catalyst solution and other offerings. With a diversified portfolio, Albemarle operates lithium extraction and conversion facilities across the U.S., Australia, and South America. The company is renowned for its high-quality lithium hydroxide and lithium carbonate products, essential for electric vehicle batteries and energy storage systems. Albemarle's commitment to innovation and sustainability is evident in its continuous efforts to optimize resource extraction and reduce environmental impact.

-

Arcadium Lithium, formed in January 2024 through the merger of Livent and Allkem, rapidly became a significant player in the lithium industry. With operations spanning Argentina, Australia, and Canada and processing facilities in multiple countries, the company boasts an annual production capacity of 75,000 tons of lithium carbonate equivalent. Arcadium's vertically integrated structure enables it to supply high-purity lithium hydroxide and carbonate to major automakers and battery manufacturers worldwide.

Infinitylithium and Critical Elements Lithium Corporation are some of the emerging market participants in the lithium chemicals market industry.

- Infinitylithium, based in Australia, is advancing the San José Lithium Project in the Extremadura region of Spain. This fully integrated project aims to produce battery-grade lithium hydroxide, catering to Europe's growing demand for electric vehicles and energy storage solutions. Infinity's strategic location and commitment to sustainable mining practices position it as a promising contributor to the European lithium supply chain.

Key Lithium Chemicals Companies:

The following are the leading companies in the lithium chemicals market. These companies collectively hold the largest market share and dictate industry trends.

- Infinitylithium

- ProChem, Inc. International

- Arcadium Lithium

- Talison Lithium Pty Ltd

- SICHUAN BRIVO LITHIUM MATERIALS CO., LTD.

- Neometals Ltd

- ANDRITZ Sovema S.p.A.

- Ganfeng Lithium Co., Ltd.

- Critical Elements Lithium Corporation

- Altura Mining

- Lithium Americas Corp.

- The Pallinghurst Group

- SQM S.A.

- Albemarle Corporation

- Mody Chemi-Pharma Limited

- Pilbara Minerals Limited

Recent Development

-

In March 2025, Rio Tinto completed its acquisition of Arcadium Lithium for USD6.7 billion, integrating Arcadium's lithium assets, including the Rincon project, into its portfolio. This strategic move aims to bolster Rio Tinto's position in the lithium market amid growing demand for battery materials.

-

In December 2024, Lithium Americas Corp. finalized a joint venture with General Motors for the Thacker Pass lithium project in Nevada. GM invested USD 625 million for a 38% stake, and the project secured a US D2.26 billion loan from the U.S. government. The mine is expected to produce 40,000 metric tons of lithium carbonate annually.

Lithium Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 39.25 billion

Revenue forecast in 2030

USD 95.12 billion

Growth rate

CAGR of 19.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Infinitylithium; ProChem, Inc. International; Arcadium Lithium; Talison Lithium Pty Ltd; SICHUAN BRIVO LITHIUM MATERIALS CO., LTD.; Neometals Ltd; ANDRITZ Sovema S.p.A.; Ganfeng Lithium Co., Ltd.; Critical Elements Lithium Corporation; Altura Mining; Lithium Americas Corp.; The Pallinghurst Group; SQM S.A.; Albemarle Corporation; Mody Chemi-Pharma Limited; Pilbara Minerals Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lithium Chemicals Market Report Segmentation

This report forecasts volume & revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lithium chemicals market report based on product, end use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Carbonate

-

Hydroxide

-

Chloride

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Automotive

-

Consumer Electrical

-

Industrial

-

Other End Use

-

-

Region Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global lithium chemicals market size was estimated at USD 32.92 billion in 2024 and is expected to reach USD 39.25 billion in 2025.

b. The global lithium chemicals market is expected to grow at a compound annual growth rate of 19.4% from 2025 to 2030 to reach USD 95.12 billion in 2030.

b. Asia Pacific lithium chemicals market dominated the global landscape with a revenue share of 60.1% in 2024. This is primarily attributed to the region's robust demand from the electric vehicle (EV) and energy storage sectors. Countries like China, Japan, and South Korea are at the forefront, driven by aggressive EV adoption targets and substantial investments in battery manufacturing infrastructure.

b. Some key players operating in the lithium chemicals market include Infinitylithium, ProChem, Inc. International, Arcadium Lithium, Talison Lithium Pty Ltd, SICHUAN BRIVO LITHIUM MATERIALS CO., LTD., Neometals Ltd, ANDRITZ Sovema S.p.A., Ganfeng Lithium Co., Ltd., Critical Elements Lithium Corporation, Altura Mining, Lithium Americas Corp., The Pallinghurst Group, SQM S.A., Albemarle Corporation, Mody Chemi-Pharma Limited, Pilbara Minerals Limited.

b. Lithium chemicals market is poised for significant growth, driven by the increasing demand for EVs, advancements in battery technology, supportive government policies, and diversification into various industries. Strategic investments and supply chain enhancements further reinforce the market's positive outlook.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.