- Home

- »

- Digital Media

- »

-

Live Commerce Platforms Market Size & Share Report, 2030GVR Report cover

![Live Commerce Platforms Market Size, Share & Trends Report]()

Live Commerce Platforms Market (2024 - 2030) Size, Share & Trends Analysis Report By Category (Apparel & Fashion, Cosmetics & Personal Care, Consumer Electronics, Furnishing), By Region (Asia Pacific, North America), And Segment Forecasts

- Report ID: GVR-4-68040-182-2

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Live Commerce Platforms Market Summary

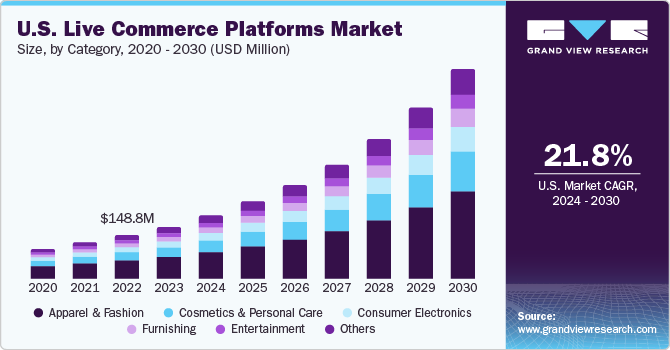

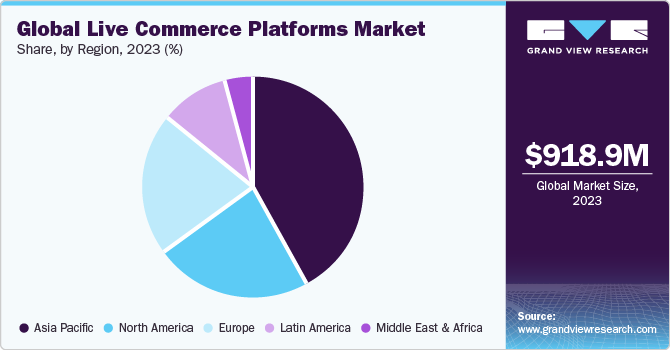

The global live commerce platforms market size was estimated at USD 918.9 million in 2023 and is expected to grow at a CAGR of 21.2% from 2024 to 2030. Factors, such as the growth of e-commerce & live commerce, the adoption of social media, and rising influencer culture are expected to drive market growth.

Key Market Trends & Insights

- North America is anticipated to witness the highest CAGR from 2024 to 2030.

- The cosmetics & personal care category is projected to grow at the fastest CAGR from 2024 to 2030.

- Bambuser AB, CommentSold, and Firework are some of the leading brands in the market.

Market Size & Forecast

- 2023 Market Size: USD 918.9 Million

- 2030 Projected Market Size: USD 3.48 Billion

- CAGR (2024-2030): 21.2%

- North America: Fastest growing market

Moreover, the advancement of technology and the creativity of market participants present significant growth opportunities for the industry. Incorporating augmented reality/virtual reality (AR/VR), artificial intelligence (AI), and 3D technologies presents opportunities for enhancing live stream experience.

Implementing augmented AR/VR for virtual try-ons, AI-enabled personalized recommendations, and innovative interactive features can improve user engagement with the help of virtual try-ons, product visualization, interactive product demos, and in-store navigation tools. In addition, safe online transactions are crucial for live commerce. Thus, a highly reliable payment system is needed to support transactions during peak processing times. A research paper published in June 2023 by KTH Royal Institute of Technology of Sweden reveals that Google's ARCore data shows a 40% adoption rate for mobile AR within the total AR mobile market.

Live commerce platform creates employment opportunities and supports entrepreneurship. Influencers, content creators, and sellers utilize the platform to monetize skills. The need for technical support, moderation, and logistics further contributes to job creation, leading to market growth. In addition, small businesses and artisans use the platform to derive benefits for their businesses by showcasing their products and services. The development of small- and medium-sized enterprises using live platforms from local reach to global leads to more investment and increased customer engagement.

According to a CNBC report, Bagriculture, a U.S.-based small business that sells pre-owned designer handbags, generated up to USD 100,000 per day through livestream shopping in 2023, compared to USD 100,000 per month through traditional brick-and-mortar sales. The COVID-19 pandemic had a positive impact on this market. Restrictions on physical stores and social gatherings during the pandemic led to a rise in online shopping, and live commerce platforms emerged as a popular alternative to traditional e-commerce. The ability to interact with hosts, ask questions, and receive personalized recommendations make live commerce attractive for consumers seeking an immersive and engaging shopping experience.

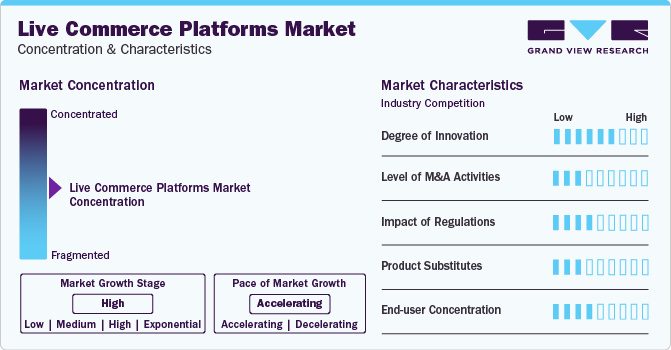

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. The market is characterized by a high degree of innovation owing to rapid technological advancements. As online shopping gained popularity, advances in technology, internet infrastructure, and the use of mobile devices made it feasible to stream live commerce smoothly. The progress of technological advancement enabled live commerce capabilities within e-commerce platforms, and increasing disposable income accelerated the industry growth.

The emergence of 5G technology has opened new opportunities that were not available with 4G, such as improved mobile broadband and reliable low-latency communication. These technical advancements aim to facilitate the development of innovative use cases, particularly in industrial sectors. VR and AR systems are a few examples of the applications that can be made possible with 5G. According to the International Telecommunication Union, young people aged between 15 and 24 years are the primary driving force of connectivity, with 75% of them using the internet globally, up from 72% in 2021. The estimated usage among the rest of the population is 65%.

The industry is characterized by a medium level of leading players' merger and acquisition (M&A) activity. The M&A activities were majorly carried out for growth and expansion by businesses.

The live commerce platform market is also subject to increasing regulatory scrutiny. It is due to concerns about the potential negative impacts, such as private information sharing and copyright issues. As a result, governments worldwide are developing regulations to govern the use of live commerce platforms.

Limited direct product substitutes exist for live commerce platforms, such associal media marketplaces, traditional e-commerce websites, and mobile shopping apps.Social media marketplaces enable businesses to sell products directly to consumers through social media profiles. Mobile shopping apps provide a convenient and streamlined shopping experience for customers.

Regional Insights

Asia Pacific dominated the market and accounted for a 41.7% share in 2023. The regional market is growing due to several favorable factors. The region has shown a high internet penetration rate and widespread smartphone usage, creating several potential customers. Social media platforms have become integral to daily life, providing live commerce platforms with a direct channel to reach their target audience. in addition, consumers in this region increasingly seek convenient and engaging shopping experiences, which live commerce platforms effectively deliver. Influencer marketing, a popular regional strategy, is effectively used by live commerce platforms to promote their products and services. According to the Internet Telecommunication Union, 64% of the population in Asia Pacific uses the Internet daily, an increase from 54% in 2019.

North America is anticipated to witness the highest CAGR from 2024 to 2030, driven by the widespread adoption of e-commerce and increasing mobile and internet connectivity. In addition, integration with popular social media platforms boosts the visibility of live commerce events. An increase in e-commerce adoption and ease of services enabling it made live commerce platforms favorable for growth. The U.S. has been a significant hub for e-commerce and technology, providing a productive foundation for the development of live commerce.

The presence of influential social media platforms and many content creators contributes to the popularity of live shopping. According to the International Trade Agreement, e-commerce sales in the U.S. increased by 24% in 2020 during the COVID-19 pandemic, as many companies turned to e-commerce for basic survival during the lockdowns. Although online sales dipped in 2022, consumers became accustomed to the convenience of online shopping, as supported by the positive growth trendline. E-commerce contributed USD 4,284 billion in revenue in 2023 and is expected to grow steadily in future.

Category Insights

The apparel & fashion category segment dominated the market and accounted for a share of 41.1% in 2023 due to the attractive attributes and interactive nature of live commerce. Partnerships with fashion influencers and industry experts significantly boosted the reach and impact of live commerce events. Influencers' credibility and popularity attract a wider audience and enhance brand perception. Key Opinion Leaders (KOLs) are influential personalities on social media platforms who are essential in promoting e-commerce live-streaming. Their participation in e-commerce live-streaming benefits businesses as they can help advertise products and services to their followers. According to the report published by the China Internet Network Information Center (CNNIC), in June 2021, China had over 1 billion influencers.

The cosmetics & personal care category is projected to grow at the fastest CAGR from 2024 to 2030. The segment growth is attributed to visual appeal, real-time interaction between hosts and viewers, live demonstrations, smooth purchasing options, and influencer marketing. Live commerce often includes entertainment elements, such as live tutorials and Q&A sessions, making the experience informative and entertaining. The majority customers or viewers are Gen Z and millennials. Young consumers are under considerable influence by the recommendation and prefer to purchase live-streaming programs.

Luxury brands have been adopting an omnichannel approach to attract and engage younger consumers, specifically Gen-Z and millennials. These consumers prioritize self-care and research before making a purchase. In 2022, Gen-Z and millennials accelerated the expansion of luxury products, and by 2030, they are predicted to make up one-third of the market. 66% of this demographic have used emerging digital touchpoints, such as virtual try-on, live streaming commerce, or social commerce.

Key Companies & Market Share Insights

Some of the key players operating in the market include Bambuser AB, CommentSold, and Firework.

-

CommentSold is a live commerce platform that enables businesses and brands to create a live shopping experience for their customers. It allows companies to sell products directly through their social media accounts and websites and to interact with customers in real time

-

Bambuser is a live commerce-enabling platform that allows businesses to integrate live video shopping features into e-commerce websites and mobile applications. The platform enables brands and retailers to engage with audiences in real-time, showcase products through live video broadcasts, and facilitate interactive shopping experiences

-

Livescale,giosg.com Ltd., and TalkShopLive are some emerging players in the live commerce platform market.

-

Livescale platform enables e-commerce businesses and brands to integrate live video into online shopping experiences. With the help of the Livescale platform, companies host live video streams showcasing their products, allowing customers to engage with the content in real time and make purchases directly within the video stream

-

TalkShopLive is a live commerce platform that helps businesses of all sizes engage in interactive commerce through real-time video broadcasts. Sellers, including influencers and celebrities, utilize the platform to showcase and sell products, engaging with their audience directly during live events

Key Live Commerce Platform Companies:

- CommentSold

- GhostRetail Inc.

- Firework

- ShopShops

- TalkShopLive

- Restream, Inc.

- Bambuser AB

- Livescale

- giosg.com Ltd.

- Klarna Bank AB (publ)

Recent Developments

-

In October 2023, TalkShopLive, a U.S.-based live commerce platform, launched a new app for mobile merchants. The app allows users to use the platform tools, such as viewing product details, highlighting essential products during sales, tracking sales, interacting with customers during broadcasts, and getting ratings

-

In February 2023, Bambuser AB announced a partnership with TikTok Shop to provide an improved and more accessible livestream shopping experience for its sellers in the U.S. market. The collaboration is expected to be implemented gradually, and the initial phase focuses on determining revenue based on parameters such as the number of participating sellers, show creators, TikTok creators, and TikTok live sales

-

In November 2022, Firework announced a partnership with Snowflake Inc., a U.S.-based data cloud company. The partnership is anticipated to bring speed and smooth performance to Firework’s video commerce platform

Live Commerce Platforms Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.10 billion

Revenue forecast in 2030

USD 3.48 billion

Growth rate

CAGR of 21.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Category and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; The Netherlands; China; Japan; India; South Korea; Australia; Brazil; Mexico; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

CommentSold; GhostRetail, Inc.; Firework; ShopShops; TalkShopLive; Restream, Inc.; Bambuser AB; Livescale; giosg.com Ltd.; Klarna Bank AB (publ)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Live Commerce Platforms Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global live commerce platforms market report based on category and region:

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Apparel & Fashion

-

Cosmetics & Personal Care

-

Consumer Electronics

-

Furnishing

-

Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global live commerce platforms market size was estimated at USD 918.9 million in 2023 and is expected to reach USD 1.10 billion in 2024.

b. The global live commerce platforms market is expected to grow at a compound annual growth rate of 21.2% from 2024 to 2030 to reach USD 3.48 billion by 2030

b. Asia Pacific dominated the live commerce platforms market with a market share of 41.7% in 2022. The region has shown a high internet penetration rate and widespread smartphone usage, creating several potential customers. Social media platforms have become integral to daily life, providing live commerce platforms with a direct channel to reach their target audience.

b. Some key players operating in the live commerce platforms market include CommentSold, GhostRetail Inc., Firework, ShopShops, TalkShopLive, Restream, Inc., Bambuser AB, Livescale, giosg.com Ltd., and Klarna Bank AB (publ).

b. Factors such as the growth of e-commerce & live commerce, the adoption of social media, and the rising influencer culture are expected to drive market growth. Moreover, the advancement of technology and the creativity of marketers present significant growth opportunities for the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.