- Home

- »

- Animal Health

- »

-

Livestock Monitoring Market Size And Share Report, 2030GVR Report cover

![Livestock Monitoring Market Size, Share & Trends Report]()

Livestock Monitoring Market Size, Share & Trends Analysis Report By Animal (Bovine, Poultry), By Solution (Hardware, Software), By Application (Milking Management, Breeding Management), By Sector, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-257-3

- Number of Report Pages: 200

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Livestock Monitoring Market Trends

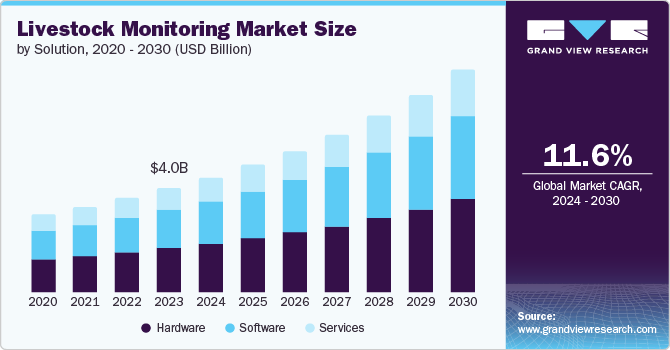

The global livestock monitoring market size was estimated at USD 4.01 billion in 2023 and is anticipated to grow at a CAGR of 11.56% from 2024 to 2030. Key factors expected to drive the market include technological advancements, rising support initiatives, increasing focus on preventive livestock monitoring and increasing dairy & meat consumption. The primary driver for this market is the growing technological advancements in the field of livestock monitoring. These advancements are in various forms like hands-free monitoring, automated technologies, penetration of Artificial Intelligence (AI), and implementation of novel technologies including drones, to name a few. For instance, in April 2023, Advantech Co. Ltd. launched a system that uses AI for early monitoring and detection of health complications in livestock. This system uses artificial intelligence (AI) and infrared vision to measure each cow's body temperature.

The system provides access to veterinary professionals and delivers daily scanning of farm animals along with comprehensive findings. It enhances the lives of farmers and their livestock as well as the general food security of their communities, with the potential for future expansion to identify growth, feeding, and environmental conditions.

Furthermore, in February 2024, the Universitat Autònoma de Barcelona (UAB) with funding from the EU, developed a platform called ClearFarm. It monitors a wide range of factors related to the behavior of the animals, their physical and mental health, their impact on the environment, and their productivity through various sensors installed throughout the farms and on the animals. The platform gathers these data and employs an algorithm to provide precise, audience-specific information on animal welfare. On one hand, a website gives farmers access to up-to-date information on the health of the animals, with an emphasis on indicators of danger that can help them anticipate issues and implement solutions. However, customers can also find out about the health background of the animal product that they buy by scanning a QR code on the packaging, for instance, which will take them to a website featuring this data.

The field of cattle management is going to experience a substantial change as a result of such developments. These methods are ground-breaking for safeguarding animals from preventable diseases and are an initial effort towards strengthening animal welfare.

Apart from the growing technological advancements, this market is also driven by the support initiatives taken by various other entities in this industry to enhance the monitoring of livestock animals like cattle, poultry, and pigs. For instance, in April 2024, the Government of Punjab, India partnered with Brazilian experts for curbing diseases in livestock animals. With the help of proper monitoring tools, this initiatives aims to monitor and study occurrence of diseases in livestock and formulate prevention & management plans to prevent possible outbreaks. This partnership will also explore joint development of vaccines & other veterinary medicines.

Furthermore, in January 2024, Astrocast partnered with Digitanimal for development of livestock monitoring solution known as Satellite IoT (SatIoT). The two companies are collaborating jointly to commercialize a tracking device that links to the worldwide satellite network of Astrocast. Farmers will be able to remotely track livestock thanks to the SatIoT-based collar. They will be able to manage their herds and implement remote farming techniques as an outcome. The companies aiming to enable every farmer in the world to track and connect their animals to the cloud.

Additionally, as recently as June 2024, the USDA initiated a monitoring & surveillance program in the U.S. to track spread of avian influenza in the livestock population. Under this program, the farmers and producers are required to conduct a weekly monitoring and testing of the herd to ensure timely detection and treatment of the disease. By encouraging the use of innovative monitoring tools and technologies, these kinds of initiatives drive the market by helping farmers track and manage their herds with greater proficiency and by lowering the possibility of disease outbreaks.

Because of this, the market is anticipated to grow significantly, propelled by the growing need for effective livestock management and disease prevention. Governments, companies, and trained professionals working together will speed up the development and adoption of advanced livestock monitoring systems.

Industry Dynamics

The degree of innovation in the livestock monitoring market is estimated be very high. This can be owed to growing development of livestock monitoring systems with advanced and evolving technologies like AI, Internet-of-things (IoT), and drones, among others. With no dearth of challenges in this livestock management industry, innovators are encouraged to develop efficient tools to improve current practices.

The industry is experiencing low-moderate level of M&A activities. Larger companies are making an attempt to dominate the industry space by acquiring comparatively smaller companies. Such activities also act as revenue boosting factor to their product portfolios by either enhancing the existing solution or induction of new solution. For instance, in March 2024, GEA acquired CattleEye, an agricultural software company that uses AI to monitor dairy cows. This system uses a 2D camera and software to analyze cows' movement and body data to help farmers assess their herd's health.

Impact of regulation is moderate in this industry. Regulations impact livestock monitoring systems by guaranteeing adherence to environmental, health, and safety standards, safeguarding personal information, and advancing animal welfare. They affect economic costs, market access, and innovation; adherence provides a competitive advantage. To remain compliant and viable in the market, companies require to stay up to date with changes in regulations. The global authorities are actively working to improve regulations and initiate programs to increase farmers' adoption of these technologies while maintaining meticulous supervision.

The industry has high-level of product substitutes. The deciding factor for adoption of these technologies is its cost to the farmer. Despite the presence of some globally recognized players like Delaval, GEA, Affimilk Ltd.; each and every country has a presence of alternative solutions to rival the international brands. These domestic companies capture the country-level market by providing livestock monitoring solutions at a cheaper cost, hence increasing the competition.

The industry is experiencing moderate impact of regional expansion. Companies are expanding their business across the globe by penetrating their technology into leading livestock producing countries. For example, in 2024 , Dairymaster announced its entry into China with a partnership with Beijing Kingpeng Global Husbandry Technology Co., LTD (KPGH) for implementing the former’s technology into large number of farms across the country.

Animal Insights

The bovine segment held the largest revenue share of 51.2% in 2023 and anticipated to witness the highest growth rate over the forecast period. Increased demand for livestock monitoring solution is largely due to rising consumption of beef and dairy products. To guarantee safety and stop the spread of disease, these dairy and beef products must be of the highest caliber, and as a result, they are constantly inspected by a number of public and private organizations. Additionally, the use of livestock monitors for disease prevention has increased due to consumers' and farmers' growing awareness, which is contributing to the segment's growth.

The poultry segment is expected to expand at a significant CAGR during the forecast period. The high consumption of poultry products daily is a major factor contributing to the growth of this segment. The high demand for poultry products and growing consumer awareness regarding quality products have increased the demand for animal health and monitoring. According to the U.S. Census Bureau, the U.S. population is anticipated to increase from 319 million in 2014 to 417 million in 2060. This increase in population is expected to further raise the demand for poultry products.

Solution Insights

The hardware segment dominated the market with a share of 42.7% in 2023. Sensors, GPS/RFIDs, and other hardware solutions are the sub-segments of the hardware segment. Many countries around the globe depend on animals like sheep, cattle, and buffalo for economic purposes, which makes it critical for farmers to implement efficient and effective methods to increase animal productivity and lower the rate of animal disease. This is the segment's primary driving force. The fact that hardware solutions don't harm animals, or the environment makes them appealing to many farmers who raise livestock. Products like GPS/RFIDs are least invasive but most effective in monitoring the whole livestock on a farm. It is expected that utilization of hardware will increase farming productivity and lessen farmer difficulties, increasing output, further driving the segment.

The software segment is expected to showcase lucrative growth over the forecast period. This segment is further bifurcated into on-premise, and cloud based on the modality. The primary driver of this segment over the forecast period is the increased adoption of cloud-based software for monitoring of livestock animals. Previously, on-premise software were used on farms, however, due to advancement of technologies, the use of cloud software has increased in the recent past. This can be attributed to ease of operation, low ownership & maintenance costs, fast connectivity, and easy accessibility. In addition, to cope with the dynamic world, cloud-based approach provides hassle-free and easy-to-immediate app updates for the latest releases. In turn, lowered IT costs, improved communication capacity, scalability, data storage, accessibility, disaster recovery, and other benefits have contributed to growth of small- and medium-sized businesses, driving the segment.

Application Insights

The milking management segment dominated the market with a share of over 24.3% in 2023. Its crucial role in dairy revenue and productivity gains accounts for its dominance. Technological developments in data analytics and automated milking systems improve farm management and monitoring effectiveness. Through early identification of issues and stress reduction, these systems enhance animal health. They also save labor costs and connect traceability and quality standards requirements. Their adoption is further fueled by the growing consumer demand for premium dairy products and the scalability of these solutions, which provide a substantial return on investment.

The behavioral monitoring segment is expected to grow with the fastest CAGR over the forecast period. Amidst the growing importance of preventive veterinary health among animal owners, analysis of livestock behavior patterns is set to gain traction in the market. Any disease triggers an animal to alter its usual behavior, such as sleeping in different places, withdrawing from the herd, or modifying its eating schedule. A farmer can easily identify and keep an eye on an animal thanks to sensors that identify changes in the animal's body. In behavioral monitoring, animal's movements are tracked and identified by the installed sensors. These records help farmers with potential decision making, like seeking advice from a veterinarian. Additionally, they also receive alerts from sensors via messages or other channels. For example, accelerometers-which track an animal's movements and activities-can be used by farmers to study how the animals move.

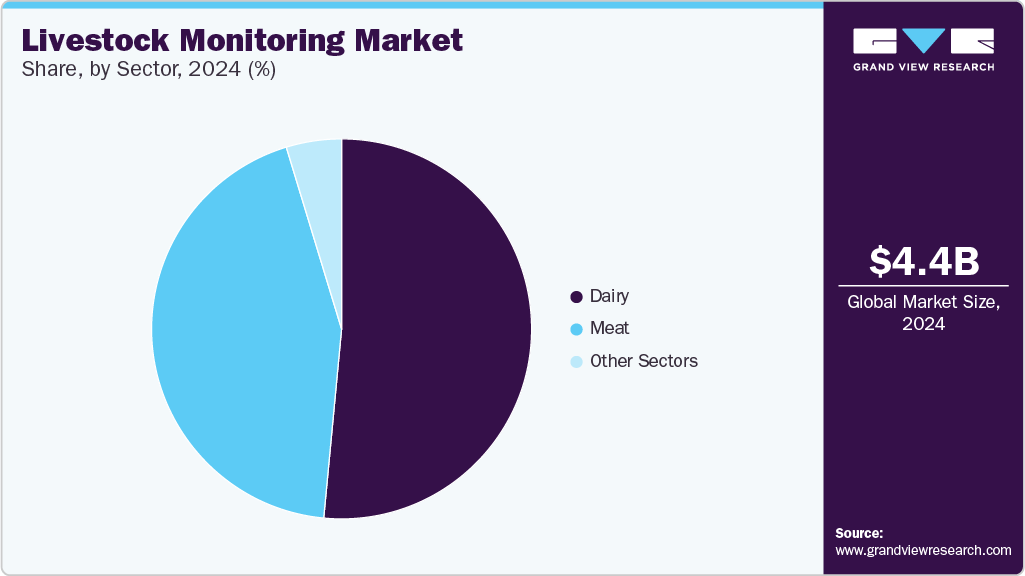

Sector Insights

The dairy segment dominated the market in 2023 and is expected to grow at a CAGR of 11.36% over the forecast period. The dairy sector is dominated by countries like India and China, among others. These countries are the leading producers of milk and have the largest bovine population in the world. These factors result in the adoption of various advanced technologies in ensuring that the dairy production does not get affected due to health complications. Authorities in these countries are involved in collaborating with global experts to ensure effective monitoring and treatment practices are used for the livestock population. Furthermore, the segment is also driven by the large scale consumption of dairy products like milk, cheese, and others. For example, according to 2023 data by FAO, between the period 1992 to 2022 the production of milk has increased by about 77% owing the high demand.

The meat segment is anticipated to grow at the highest CAGR over the forecast period. This can be to two main factors; increasing meat consumptions and substantial growth in meat production. For instance, according to a data forecasts by OECD, global production of meat is estimated to grow 14% by 2030. Furthermore, according to July 2024 data by USDA, pork meat production in China is estimated to grow at a rate of 56% higher in 2024 in comparison to 2020. These factors drive the producers to implement best animal health monitoring practices, providing a lucrative market growth.

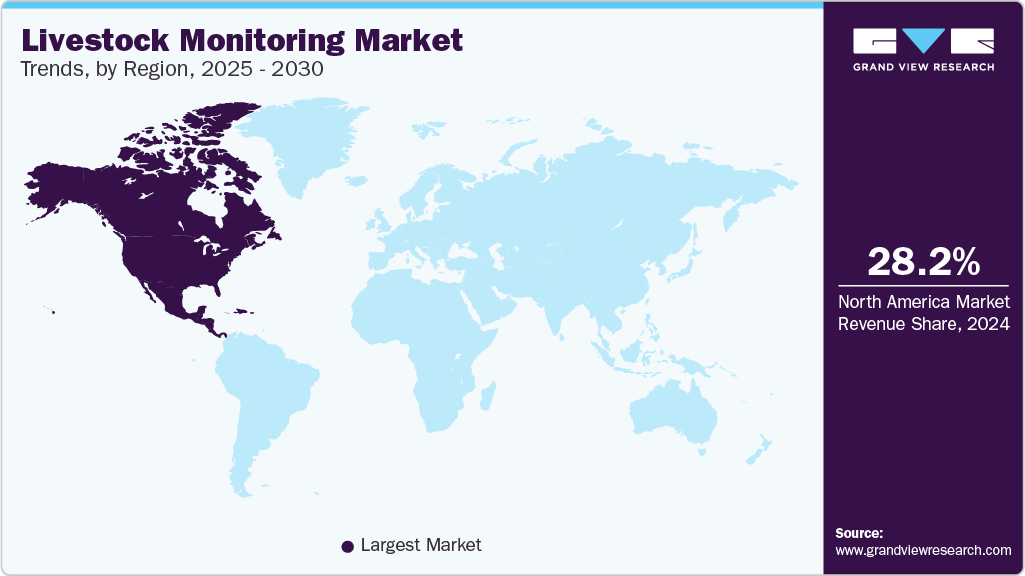

Regional Insights

North America market dominated the global market with a share of 28.5% in 2023 due to the increased demand for technology to monitor sick animals due to the prevalence of zoonotic diseases. With 18.0% of the world's production in 2023, the United States is the world's top producer of bovine meat, according to data released by National Beef Wire in June 2024. This is the factor that motivates the need to stop foodborne and zoonotic illnesses linked to livestock animals. Furthermore, the market is expanding due to the steady advancements in sensor technology.

U.S. Livestock Monitoring Market Trends

The market in the U.S. is growing as result of increasing animal health care spending and the rising adoption of livestock monitoring equipment for production animals. According to USDA, farm production expenditure accounted for USD 457.2 billion in 2022, a 15.2% rise in comparison USD 392.9 billion in 2021. In addition, increasing demand for milk production is anticipated to boost the market. According to International Service for the Acquisition of Agri-biotech Applications (ISAAA), the demand for meat and milk production is anticipated to double by 2050 in developing countries, where the population is expected to double. This increasing demand in the future is expected to drive the country’s market growth.

Europe Livestock Monitoring Market Trends

The Europe market is expected to grow due to favorable trade organizations, like the European Free Trade Association (EFTA), between Liechtenstein, Iceland, Norway, & Switzerland, which has facilitated trade between countries and increased growth opportunities in the region. With rising awareness and environmental issues, Europe is experiencing growth of milk-producing cattle. According to 2023 publications from The Vegan Society, about 2.6 million individuals i.e. 3.2% of the population of Germany are vegans and this trend is expected to rise in the future . This has raised the demand for milk and its derivatives, to fulfill calcium & protein requirements, creating new avenues for regional market growth.

Germany Livestock Monitoring Market Trends

The market in Germany possessed the largest share of the European market. Growing animal adoption is expected to fuel the market in Germany. As per March 2024 AHDB data, Germany has the highest dairy cow population in the Europe i.e. around 17% of the overall population. Furthermore, the country has over 50,000 agricultural holdings that conduct dairy farming. According to the International Committee for Animal Recording (ICAR), 50% of the German farms specialize in livestock.

Asia Pacific Livestock Monitoring Market Trends

The Asia Pacific market is expected to grow at the fastest CAGR over the forecast period. The Asia Pacific region's population is growing, its metropolitan centers are becoming more quickly urbanized, its disposable income is rising, and these factors have combined to increase the proportion of food consumed derived from animals. Additionally, the region has profited from global livestock production constantly since the 1900s, and growth in this area is predicted to continue during the forecast period. Furthermore, the region's market growth can be ascribed to the notably elevated population of cattle. For example, over 30% of all cattle worldwide are found in China and India. The demand for meat and milk production has increased due to the large population of livestock.

The market in India is expected to grow at the fastest rate in Asia Pacific region over the forecast period. This can be attributed increasing involvement of government sector in promoting accurate and timely health monitoring and treatment practices in the country. For instance, in March 2024, the Prime Minister of India launched a digital platform - “Bharat Pashudhan”, to increase traceability of livestock animals in India.

Latin America Livestock Monitoring Market Trends

Latin America market is expected to continue to grow during the forecast period. Various factors such as high prevalence of diseases and rising demand for monitoring equipment are positively influencing the market growth. Favorable government initiatives & intervention in the livestock sector are expected to fuel the market growth in Latin America.

The Brazil market growth can be attributed to a large number of cattle herds and high beef production. For instance, according to the 2024 data by USDA, Brazil has the second-largest cattle herd, accounting for about 192 million head. Moreover, the country is the world’s largest exporter of beef. This has increased awareness regarding animal health among owners and subsequently the demand for veterinary medicines in the country. The market is also driven by the fact that the country is one of the largest producer of meat in the world. According to January 2024 data by GeeksforGeeks, the country ranks third in the world for meat production.

Middle East & Africa Livestock Monitoring Market Trends

The Saudi Arabia market is driven by growing awareness regarding animal health among pet and livestock owners coupled with rising animal adoption is boosting the market in Middle East and Africa. Based on animal type, cattle dominated and holds the majority of the market share, thereby driving the market growth. Increasing number of initiatives being undertaken by the government for encouraging animal healthcare facilities is expected to boost the market in this region.

The market in South Africa is driven by increasing livestock production, rising prevalence of zoonotic diseases, and growing concerns for animal health. South Africa comprises a rich diversity in terms of available livestock resources, vegetation, and climate zones. The livestock sector in the country has been characterized by a dual system of sophisticated commercial sectors employing modern technology versus a developing sector that includes emerging and smallholder farmers. This leads to the increased adoption of livestock monitoring systems in the country, which is driving the market. Favorable initiatives undertaken by certain companies are creating growth opportunities, which is boosting the market growth.

Key Livestock Monitoring Company Insights

Companies in this industry are actively involved in bringing in novel technologies into the livestock monitoring industry. They are engaged in launching novel and enhanced solutions to disrupt the market by providing better alternatives to the existing products. Industry players are also forming crucial alliances with other players to either develop innovative technologies or enhance their existing products with an aim of dominating in the market.

Key Livestock Monitoring Companies:

The following are the leading companies in the livestock monitoring market. These companies collectively hold the largest market share and dictate industry trends.

- Afimilk Ltd.

- DeLaval

- BouMatic

- Merck & Co., Inc. (Allflex)

- Zoetis

- Lely

- Moocall

- GEA Group Aktiengesellschaft

- Fullwood Packo

- Dairymaster

- Fancom BV

- Nysbys

- PsiBorg Technologies Pvt. Ltd

- Boehringer Ingelheim

Recent Developments

-

In July 2024, Fancom BV collaborated with OptiFarm for development of a novel livestock management software using AI models. The testing of this product is currently underway in select locations in Netherlands.

-

In April 2024, BouMatic partnered with Brolis Sensor Technology to develop integrations between technologies of both companies a develop novel products for dairy farming.

-

In April 2024, Merck launched SENSEHUB Dairy Youngstock, that has activity monitoring capabilities for use in cattle population.

-

In January 2024, Nikon launched NiLIMO, a platform that utilizes AI for enabling the farmer to monitor their livestock animals for 24 hours and 365 days of the year. The AI used in this system notifies the owner at the time of calving period of the livestock.

-

In January 2024, Practo India launched Verdant Impact, an animal husbandry platform for livestock that has RFID-based health monitoring and telemedicine features.

-

In September 2023, John Deere and DeLaval partnered to develop a digital system for farm and herd monitoring of dairy operations.

Livestock Monitoring Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.42 billion

Revenue forecast in 2030

USD 8.53 billion

Growth Rate

CAGR of 11.56% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, solution, application, sector, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Afimilk Ltd.; DeLaval; BouMatic; Merck & Co., Inc. (Allflex); Zoetis; Lely; Moocall; GEA Group Aktiengesellschaft; Fullwood Packo; Dairymaster; Fancom BV; Nysbys; PsiBorg Technologies Pvt. Ltd; Boehringer Ingelheim

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Livestock Monitoring Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global livestock monitoring market report based on animal, solution, application, sector, and region.

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Bovine

-

Poultry

-

Swine

-

Other Animals

-

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Sensors

-

GPS/RFID

-

Other Hardware

-

-

Software

-

On-premise

-

Cloud

-

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Milking Management

-

Breeding Management

-

Feeding Management

-

Health Monitoring

-

Behavioral Monitoring

-

Other Applications

-

-

Sector Outlook (Revenue, USD Million, 2018 - 2030)

-

Dairy

-

Meat

-

Other Sectors

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global livestock monitoring market size was estimated at USD 4.01 billion in 2023 and is expected to reach USD 4.42 billion in 2024.

b. The global livestock monitoring market is expected to grow at a compound annual growth rate of 11.56% from 2024 to 2030 to reach USD 8.53 billion by 2030.

b. By application, behavioral monitoring segment is expected to grow with the highest CAGR in the market over 2024-2030. Amidst the growing importance of preventive veterinary health among animal owners, analysis of livestock behavior patterns is set to gain traction in the market.

b. Some key players in the livestock monitoring market include Afimilk Ltd., DeLaval, BouMatic, Merck & Co., Inc. (Allflex), Zoetis, Lely, Moocall, GEA Group Aktiengesellschaft, Fullwood Packo, Dairymaster, Fancom BV, Nysbys, PsiBorg Technologies Pvt. Ltd and Boehringer Ingelheim

b. Key factors driving the market growth include technological advancements, rising support initiatives, increasing focus on preventive livestock monitoring and increasing dairy & meat consumption.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."