- Home

- »

- Advanced Interior Materials

- »

-

Living Building Materials Market Size, Industry Report, 2033GVR Report cover

![Living Building Materials Market Size, Share & Trends Report]()

Living Building Materials Market (2025 - 2033) Size, Share & Trends Analysis Report By Material Type (Self-Healing Concrete, Mycelium-Based Composites, Biocement, Algae-Based Materials), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-798-9

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Living Building Materials Market Summary

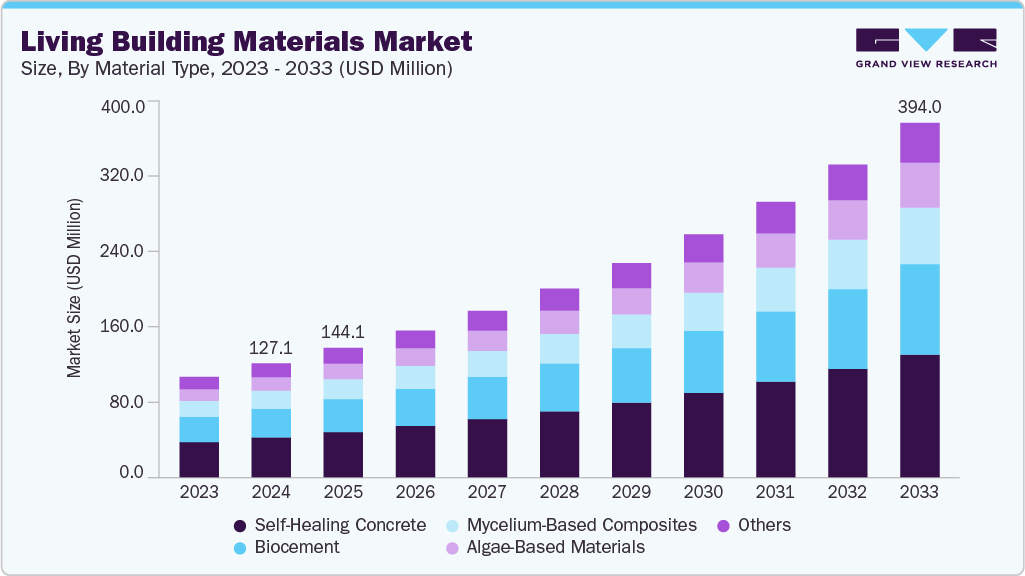

The global living building materials market size was estimated at USD 127.1 million in 2024 and is projected to reach USD 394.0 million by 2033, growing at a CAGR of 13.4% from 2025 to 2033. The demand for living building materials (LBMs) is rising as the construction industry seeks sustainable and self-healing alternatives to traditional cement and concrete.

Key Market Trends & Insights

- Asia Pacific dominated the living building materials market with the largest revenue share of 33.4% in 2024.

- The living building materials market in China is rapidly adopting LBMs to align with its carbon neutrality target by 2060.

- By material type, the algae-based materials segment is expected to grow at the fastest CAGR of 14.2% over the forecast period.

- By end use, the commercial segment is expected to grow at the fastest CAGR of 13.9% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 127.1 Million

- 2033 Projected Market Size: USD 394.0 Million

- CAGR (2025 - 2033): 13.4%

- Asia Pacific: Largest market in 2024

These materials, which incorporate biological organisms such as bacteria, fungi, or algae, actively repair cracks, reduce carbon emissions, and improve insulation. The growing awareness of the carbon footprint of conventional construction materials and the urgent need for eco-friendly infrastructure are accelerating the adoption of sustainable alternatives.Key drivers include advancements in biotechnology, increasing R&D investments in sustainable materials, and the cost benefits of reduced maintenance and repair. The integration of LBMs into smart city projects and circular construction models is also boosting market growth. In addition, global efforts to achieve net-zero carbon emissions are prompting the adoption of materials that can absorb CO₂ or produce oxygen, thereby contributing to the development of carbon-negative structures. The high thermal efficiency and long-term durability of LBMs make them ideal for use in energy-efficient buildings. Major construction firms and universities are collaborating to scale pilot projects into commercial applications, further stimulating demand.

Emerging trends include the development of self-healing bioconcrete, photosynthetic facades, and bio-bricks that grow using microbial processes rather than being kiln-fired. Startups are experimenting with genetically modified bacteria that secrete calcium carbonate for structural repair, while algae-based panels are being used for carbon capture and aesthetic building designs. Integration of AI and data analytics in monitoring LBM performance is also gaining traction. Another key trend is the use of modular construction with bio-grown components that are biodegradable and recyclable. The convergence of synthetic biology and construction technology is expected to redefine sustainability standards in the coming decade.

Market Concentration & Characteristics

The living building materials industry is still in a nascent stage, characterized by a limited number of specialized startups, university spin-offs, and R&D-driven enterprises. Prominent players, such as bioMASON, Basilisk, and ECOncrete, are leading the way in microbial-based construction solutions. However, large construction and cement manufacturers are gradually entering the segment through collaborations and strategic partnerships. As commercialization increases, consolidation is expected over the next five years. Currently, the market exhibits moderate concentration, with innovation and IP ownership being key differentiators among players.

The main substitutes for living building materials are traditional materials such as concrete, bricks, and prefabricated composites. While LBMs offer superior sustainability and self-repair capabilities, their adoption is limited by high initial costs, low scalability, and uncertain long-term performance data. However, as production becomes more cost-efficient and environmental regulations tighten, the threat from conventional materials will gradually decline. Hybrid models combining LBMs with conventional materials are also emerging, reducing substitution threats while easing market transition.

Material Type Insights

The self-healing concrete segment led the market with the largest revenue share of 35.4% in 2024, due to its ability to automatically repair micro-cracks through bacterial, chemical, or encapsulated healing agents. This innovation significantly extends the lifespan of structures while minimizing maintenance and repair costs, making it ideal for large-scale infrastructure such as bridges, tunnels, and residential complexes. Governments and construction companies are increasingly adopting self-healing concrete to achieve long-term sustainability and cost efficiency. Its proven durability, reduction in lifecycle emissions, and compatibility with conventional building methods have made it the most commercially viable and widely adopted living material to date.

The algae-based materials segment is expected to grow at the fastest CAGR of 14.2% over the forecast period. These materials leverage the natural photosynthetic ability of algae to capture and store carbon, producing bio-cement, bio-bricks, and bioplastics that help lower the environmental footprint of construction. The growing emphasis on carbon-neutral and regenerative design principles has fueled R&D investments in algae-based composites and façade systems. Startups and research institutions are also exploring algae integration into building envelopes for natural air purification and oxygen generation. As climate-positive construction gains traction, algae-based materials are expected to become a mainstream sustainable building option in the years to come.

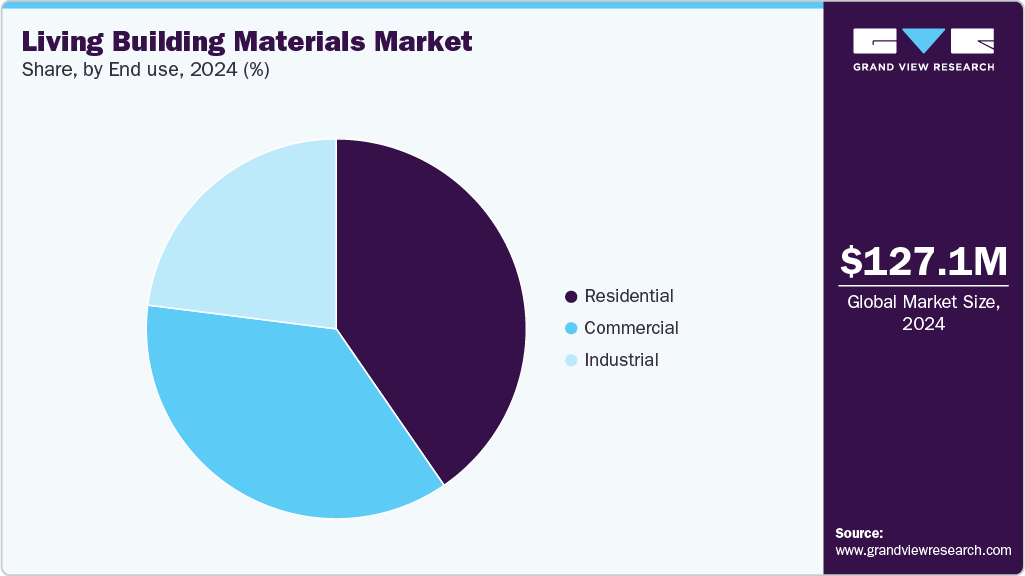

End Use Insights

The residential segment held the highest revenue market share of 40.4% in 2024, as sustainable housing becomes a major focus for urban planners and developers. Consumers are increasingly opting for eco-friendly homes that offer improved energy efficiency, enhanced air quality, and increased structural durability. Living materials such as bio-based insulation, mycelium panels, and self-healing concrete are being integrated into new housing projects to meet green building standards like LEED and IGBC. Government incentives for sustainable housing, combined with rising awareness of climate impacts, have further accelerated adoption. The ease of incorporating these materials into small- and medium-scale residential designs also supports their widespread implementation across both urban and semi-urban areas.

The commercial segment is expected to grow at the fastest CAGR of 13.9% over the forecast period, as companies and institutions align with global sustainability goals. Corporate campuses, educational facilities, and retail centers are adopting materials such as bio-cement, algae-based facades, and eco-concrete to reduce operational emissions and enhance occupant well-being. This growth is driven by stricter building codes, green certifications, and an increasing focus on ESG compliance among investors. In addition, the shift toward sustainable urban infrastructure and net-zero energy buildings is encouraging architects and developers to explore living materials that combine aesthetics with functionality.

Regional Insights

Theliving building materials market in North America is witnessing growing investment in living materials through public research grants and venture capital funding. The U.S. Department of Energy and National Science Foundation are actively promoting sustainable building technologies. Increasing awareness among builders and architects is boosting the adoption of bio-cement and algae-based panels. The region’s strong focus on climate resilience aligns well with self-healing infrastructure solutions. Collaborations between startups and universities are accelerating the validation of products. Canada and the U.S. are also exploring pilot projects in climate-adaptive construction.

U.S. Living Building Materials Market Trends

The living building materials market in the U.S. is leading North America’s LBM innovation, with companies like bioMASON and Prometheus Materials commercializing bio-cement. Federal sustainability goals and LEED-certified project incentives are driving early adoption of sustainable practices. Startups are attracting significant investment from green infrastructure funds. Universities are testing living concrete in bridges, walls, and pavements. Corporate commitments toward carbon-neutral construction are fueling partnerships across industries. These developments position the U.S. as a key hub for scalable LBM production and innovation.

Asia Pacific Living Building Materials Market Trends

Asia Pacific dominated the global living building materials market with the largest revenue share of 33.4% in 2024. This is attributed to the increasing adoption of sustainable urban development practices in China, Japan, India, and Singapore. Rapid infrastructure growth, increasing government initiatives for green construction, and low-cost biotechnology research and development are accelerating regional adoption. Countries are investing in self-healing concrete and microbial-based bricks to reduce maintenance costs in high-density cities. Academic institutions across India and China are developing scalable LBM prototypes, while Japan’s “Green Innovation Fund” promotes the development of bio-based infrastructure materials.

Theliving building materials market in China is rapidly adopting LBMs to align with its carbon neutrality target by 2060. Major research institutes are investigating the phenomenon of bacteria-induced calcium carbonate deposition in concrete. The 14th Five-Year Plan supports green construction technologies and bio-cement innovations. Large-scale infrastructure projects are integrating microbial self-healing systems to reduce maintenance costs. Partnerships between construction firms and biotech startups are increasing commercialization potential. Government-backed eco-urban development programs are further accelerating market adoption.

Europe Living Building Materials Market Trends

Theliving building materials market in Europe remains at the forefront of LBM research, supported by strong policy backing and net-zero mandates. The EU’s Horizon research program and regional sustainability funds support the development of bio-based construction technologies. Countries like the Netherlands and the UK are testing living concrete in public projects. Collaborative R&D between academia and industry is accelerating the scalability of innovations. Strict emission reduction regulations are incentivizing innovation in bio-receptive materials. The region’s mature construction standards ensure a structured framework for integrating LBMs.

TheGermany living building materials market is advancing living material research through universities like TU Dresden and RWTH Aachen. The country’s focus on engineering excellence and precision manufacturing supports bio-cement testing. Federal R&D programs and private grants are promoting microbial construction projects. Sustainable architecture trends are promoting the use of low-emission, regenerative materials. Local pilot projects are exploring self-repairing infrastructure for bridges and tunnels. Germany’s innovation ecosystem positions it as a European leader in LBM commercialization.

Central & South America Living Building Materials Market Trends

The living building materials market in Central & South America is slowly emerging with pilot projects focused on eco-cement and sustainable housing. Brazil, Mexico, and Chile are exploring bio-based alternatives to traditional cement to curb emissions. Growing public awareness of sustainable construction is improving acceptance. Limited R&D funding and access to technology, however, constrain large-scale adoption. International collaborations are helping transfer bioconstruction expertise to local manufacturers. As climate resilience becomes a regional priority, adoption is expected to accelerate in the medium term.

Middle East & Africa Living Building Materials Market Trends

The living building materials market in the Middle East is integrating LBMs into sustainable city projects under national visions like Saudi Vision 2030. The UAE is testing self-healing concretes for durability in desert climates and to achieve green building certifications. Construction of smart, energy-efficient infrastructure is creating new opportunities for living materials. Africa’s focus remains on cost-effective, durable solutions for infrastructure longevity. Research collaborations are emerging in Egypt and South Africa for microbial-based concretes. Regional growth will depend on government funding and technology partnerships with global firms.

Key Living Building Materials Company Insights

Some of the key players operating in the market include Biomason and Mykor.

-

bioMASON develops biocement by using microorganisms to grow concrete-like materials without traditional cement, significantly cutting carbon emissions. Its products, such as bioLITH tiles, offer sustainable, scalable alternatives to carbon-intensive construction materials.

-

Mykor creates bio-based insulation panels made from mycelium and industrial waste, offering carbon-negative and fire-safe insulation solutions. The company focuses on replacing synthetic materials with biodegradable, circular alternatives in green building projects.

ECOncrete and Sathi USA are some of the emerging market participants in the living building materials industry.

-

ECOncrete Tech Ltd designs bio-enhancing concrete for marine and coastal construction, promoting ecological growth on infrastructure surfaces. Its products help reduce environmental impact while maintaining structural performance in waterfront developments.

-

Sathi USA manufactures ground granulated blast-furnace slag (GGBFS) cement, a sustainable substitute for traditional cement. Its slag-based products lower CO₂ emissions and improve concrete strength and durability, aligning with sustainable construction goals.

Key Living Building Materials Companies:

The following are the leading companies in the living building materials market. These companies collectively hold the largest Market share and dictate industry trends.

- Biomason

- Prometheus Materials, Inc

- ECOncrete

- Mykor

- Basilisk

- EnviraBoard Ltd

- Sathi USA

- Mimicrete

- Ecovative Design

Recent Developments

-

In October 2025, Prometheus Materials, the leader in sustainable construction materials, announced a landmark collaboration with Skidmore, Owings & Merrill (SOM), Skanska USA, D’Annunzio Group Inc., and Brothers II Concrete to bring its innovative ProZERO carbon-negative cement and concrete to the New York Climate Exchange’s climate campus on Governors Island.

-

In July 2024, EnviraBoard Ltd launched their SEED funding round and announced their carbon-negative building boards made from recycled paper sludge.

Living Building Materials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 144.1 million

Revenue forecast in 2033

USD 394.0 million

Growth rate

CAGR of 13.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material type, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; China; Japan; India; South Korea; Saudi Arabia; UAE; Egypt; Kuwait; Qatar

Key companies profiled

Biomason; Prometheus Materials, Inc; ECOncrete; Mykor; Basilisk; EnviraBoard Ltd; Sathi USA; Mimicrete; Ecovative Design

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Living Building Materials Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global living building materials market report based on the material type, end use, and region:

-

Material Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Self-Healing Concrete

-

Mycelium-Based Composites

-

Biocement

-

Algae-Based Materials

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Industrial

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Qatar

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global living building materials market size was estimated at USD 127.1 million in 2024 and is expected to reach USD 144.1 million in 2025.

b. The global living building materials market is expected to grow at a compound annual growth rate of 13.4% from 2025 to 2033 to reach USD 394.0 million by 2033.

b. The self-healing concrete segment held the highest revenue market share of 35.4% in 2024, due to its ability to automatically repair micro-cracks through bacterial, chemical, or encapsulated healing agents.

b. Some of the key players operating in the living building materials market include Biomason, Prometheus Materials, Inc, ECOncrete, Mykor, Basilisk, EnviraBoard Ltd, Sathi USA, Mimicrete, and Ecovative Design.

b. Rising focus on sustainable construction, carbon-neutral technologies, and self-regenerative materials is driving the growth of the living building materials market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.