- Home

- »

- Automotive & Transportation

- »

-

Logistics Automation Market Size, Industry Report, 2033GVR Report cover

![Logistics Automation Market Size, Share & Trends Report]()

Logistics Automation Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Function, By Logistics Type, By Organization Size (Large Enterprises, Small & Medium Enterprises), By Software Application, By Vertical, By Region, And Forecasts

- Report ID: GVR-4-68040-066-6

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Logistics Automation Market Summary

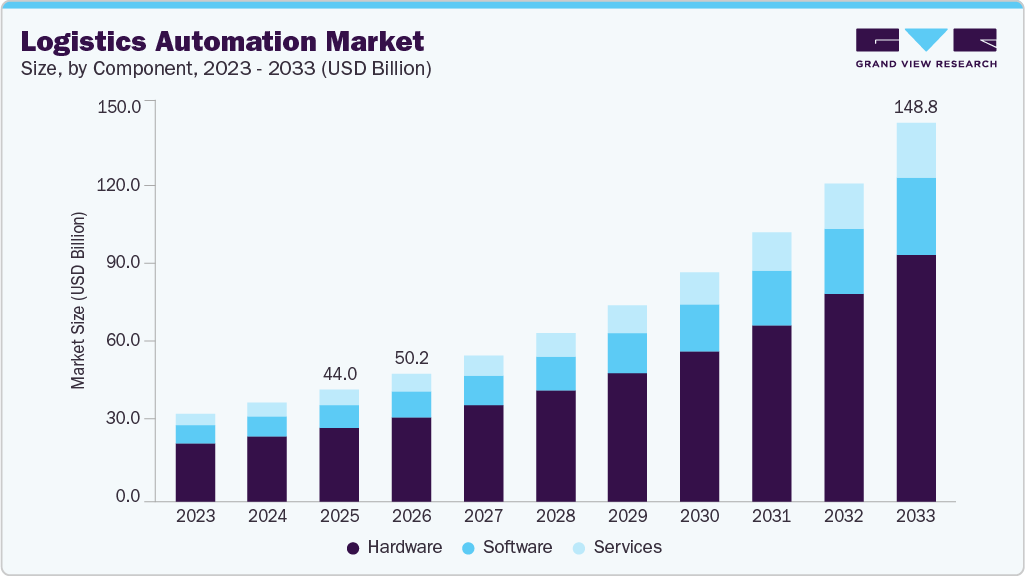

The global logistics automation market size was estimated at USD 44.02 billion in 2025 and is projected to reach USD 148.76 billion by 2033, growing at a CAGR of 16.8% from 2026 to 2033. Logistics automation encompasses hardware and software solutions that automate logistics processes, including transportation, storage, retrieval, and data management.

Key Market Trends & Insights

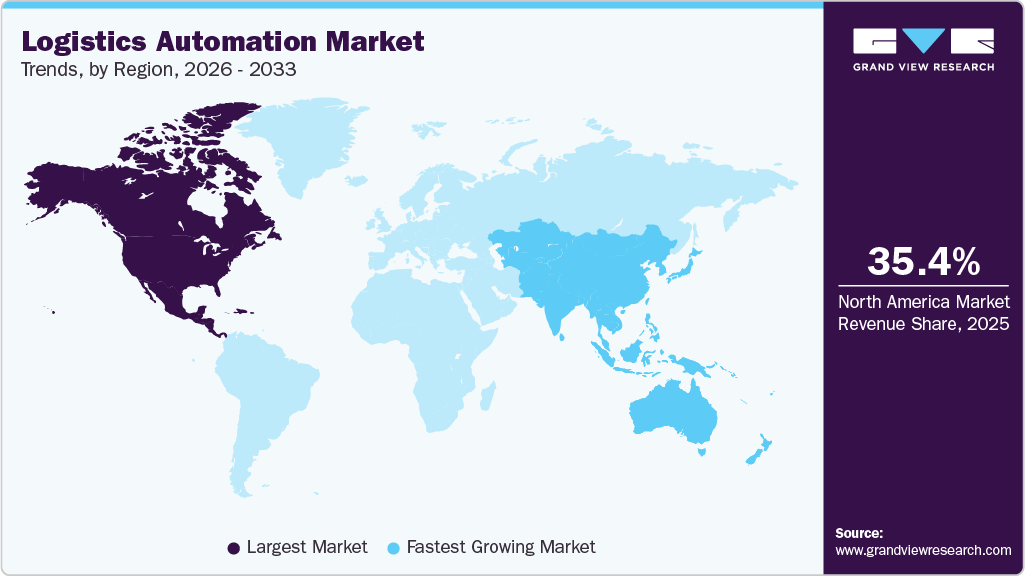

- North America logistics automation market accounted for a 35.4% share of the overall market in 2025.

- The logistics automation industry in the U.S. held a dominant position in 2025.

- By component, the hardware segment accounted for the largest share of 66.3% in 2025.

- By function, the transportation management segment dominated the market in 2025, with a market share of 61.4%.

- Based on logistics type, the sales logistics segment dominated the market in 2025, with a market share of 35.7%.

Market Size & Forecast

- 2025 Market Size: USD 44.02 Billion

- 2033 Projected Market Size: USD 148.76 Billion

- CAGR (2026-2033): 16.8%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Automating these processes improves efficiency, minimizes errors, and reduces the turnaround time. Automation solutions aid in scaling up businesses as larger volumes can be easily managed with autonomous robots, conveyor systems, and automated storage systems.The growing consumer inclination towards online shopping and rising demand for short delivery timelines are one of the major factors fueling the market's growth. High consumer demands have led to a surge in fulfillment centers for last-mile and quick deliveries. The fulfillment centers are gradually adopting automation, transitioning from mechanized support to operator-free equipment. As the automated vehicle and robotics technologies mature with time, their applications in logistics and warehousing will broaden significantly and create growth opportunities for the target market during the forecast period.

The logistics automation sector faces several challenges, including intense market competition, a lack of industry standardization, and a shortage of skilled labor needed to operate advanced systems. The complexity of automation devices and software demands specific expertise, and the scarcity of trained personnel, particularly in developing countries like India and China, can hinder market growth. Additionally, the absence of standardization complicates the creation of uniform supply chain solutions, resulting in high costs for developing specialized systems.

The degree of innovation in the logistics automation market is high. Cutting-edge technologies, including artificial intelligence, machine learning, and robotics, are continually being developed and integrated into logistics operations. These innovations enhance efficiency, accuracy, and speed in supply chain management. Advanced automation systems, including autonomous vehicles and drones, are revolutionizing last-mile delivery. Smart warehouses equipped with IoT devices and sensors are optimizing inventory management and reducing operational costs. Developing countries, in particular, struggle with the adoption of these advanced systems due to a lack of expertise. Thus, the high degree of innovation drives significant growth and transformation in the logistics automation market.

The high level of partnerships and collaboration in the logistics automation market is primarily driven by the need to pool resources and expertise to tackle the complex challenges the industry faces. Companies often collaborate to combine their technological strengths and create more comprehensive and effective automation solutions. Partnerships allow firms to share the financial burden of research and development, making innovation more affordable and feasible. Additionally, collaboration helps companies expand their market reach by leveraging each other's distribution networks and customer bases.

The rapid pace of technological advancements necessitates continuous learning and adaptation, which is more efficiently achieved through collaborative efforts. Joint ventures and alliances also facilitate the standardization of technologies and practices, addressing the industry's need for uniformity. Furthermore, partnerships enable access to a broader talent pool, helping mitigate the shortage of skilled labor. Thus, by working together, companies can better navigate regulatory landscapes and enhance their competitive edge in a highly competitive market.

Component Insights

Based on component, the market is segmented into hardware, software, and services. The hardware segment's market share was 66.3% in 2025 and is expected to grow at a CAGR of 16.5% through the forecast period. Based on the hardware, the market is further segmented into automated sorting systems, autonomous robots, conveyor systems, de-palletizing/palletizing systems, automated storage and retrieval systems, automatic identification and data collection. Due to the increasing demand for automated transportation, the autonomous robots category holds the largest market share among hardware solutions. Autonomous guided vehicles are expected to draw most of the spending in autonomous robots.

The software segment is further segmented into the following categories: warehouse management system and transportation management system. The warehouse management software automates and optimizes various warehouse processes, including tracking, inventory storage, receiving, and workload planning, among others, and is expected to be the fastest-growing software solution during the forecast period. The service segment is anticipated to grow at the fastest CAGR of 17.7% throughout the forecast period. The market's continued expansion is primarily due to the increased demand for the deployment and integration of logistics automation.

Function Insights

Based on transportation mode, the market is segmented into inventory & storage management and transportation management. The transportation management segment dominated the market in 2025, with a market share of 61.4%. It is anticipated to grow at a CAGR of 16.0% through the forecast period. Autonomous robots, conveyor systems, and de-palletizing/palletizing systems are used for transportation management. Autonomous robots such as autonomous guided vehicles (AGV) and autonomous mobile robots (AMR) are motorized solutions that transport materials and products throughout the warehouse or manufacturing facility.

The inventory & storage management segment is expected to grow at the fastest CAGR of 17.9% through the forecast period. The inventory & storage management includes automated storage systems and automated retrieval systems. Autonomous storage systems enable the warehouses with the automated storage of crates or pallets on racks or shelves, while automated retrieval systems handle the product dispatch from the warehouse. Automating the inventory and storage process simplifies and accelerates tracking and tracing products in large warehouses.

Logistics Type Insights

Based on logistics type, the market is segmented into sales logistics, production logistics, recovery logistics, and procurement logistics. Among these, the sales logistics segment dominated the market in 2025, with a market share of 35.7%. It is anticipated to grow at a CAGR of 16.9% through the forecast period. Sales logistics is the most critical aspect of the supply chain as it involves moving or delivering the goods to the end consumer. Sales logistics include order management, inventory management, shipping management, and vendor management. Automation solutions, such as autonomous robots and automated storage and retrieval systems, improve efficiency and reduce delivery turnaround time, and are therefore being increasingly adopted in sales logistics operations.

The production logistics segment is expected to grow at the fastest CAGR of 17.3% throughout the forecast period. Businesses heavily emphasize optimizing production processes, including time and cost optimization, to improve profitability. Logistics is one of the major expenditures of a business, and automation highly aids in minimizing or at least optimizing the expenditures to a large extent. Production logistics includes inventory management of raw materials, transportation within the manufacturing unit, and distribution.

Organization Size Insights

Based on organization size, the market is segmented into small & medium enterprises (SMEs) and large enterprises. The large enterprises' segment dominated the market in 2025, with a market share of 63.0%. It is anticipated to grow at a CAGR of 16.2% through the forecast period. Large enterprises handle vast volumes of products throughout the entire supply chain processes, which encompass raw materials, inventory, and final products. Given the enhanced productivity, large enterprises are increasingly adopting automation solutions, such as robots, in manufacturing units and inventory warehouses for handling raw materials.

The SME segment is expected to grow at a considerable CAGR of 17.8% through the forecast period. Small and medium enterprises focus heavily on cost efficiency and adopt automation solutions to minimize labor costs. Numerous startups are emerging in the e-commerce fulfillment service industry, with fulfillment centers increasingly adopting automated sorting systems for processes like kitting and bundling. Automation allows small and medium enterprises to compete more effectively with large enterprises.

Software Application Insights

Based on software applications, the market is segmented into inventory management, yard management, order management, labor management, vendor management, shipping management, customer support, and others. Among these, the order management segment dominated the market in 2025, accounting for 18.6% market share. It is anticipated to grow at a CAGR of 17.3% through the forecast period. Order management includes management of the entire lifecycle, including order entry, fulfillment of the order, delivery, and post-sale services. The adoption of order management is increasing as it offers visibility to both businesses and customers.

The inventory management segment is expected to grow at the fastest CAGR of 18.0% through the forecast period. Inventory management includes keeping track of the inventory levels, managing the inventory of each product, forecasting demand, and accounting for the entire inventory. Efficient inventory management is critical for a successful business as both excess and low inventory can be disastrous in the probability of a company. The demand forecasting of products depending on historical sales is highly beneficial in the maintenance of optimum inventory levels.

Vertical Insights

Based on vertical, the market is segmented into retail & e-commerce, automotive, healthcare, electronics & semiconductors, and others. The retail and e-commerce segment dominated the market in 2025, with a market share of 29.4%. The retail & e-commerce sector uses logistics automation solutions in order to meet the increasing volumes of orders and shipments. Logistics automation solutions improve reliability and ensure timely delivery, which aligns with the retail and e-commerce industry's interests.

The healthcare segment is anticipated to register a significant market share over the forecast period. Logistics automation solutions for the healthcare industry provide safe and secure handling, storage, and retrieval of healthcare products such as pharmaceuticals and vaccines. The healthcare sector demands a high level of accuracy and accountability in order to ensure the safety of the products, and automation significantly helps to ensure it. Pharmaceutical products require precise inventory management to avoid shortages and track expiration duration.

Regional Insights

North America led the overall market in 2025, with a market share of 35.4%. The region's growth can be attributed to the presence of several logistics automation solution providers and several logistics companies, such as DHL, UPS, and FedEx Corporation, among others, in North America. In addition, the speedy implementation of modern technologies and the existence of modern infrastructure in the region a supportive factor in the growth of the target market. The U.S. is expected to maintain its dominance over the forecast period due to the rapid growth of the e-commerce sector in the country.

U.S. Logistics Automation Market Trends

The growth of the logistics automation market in the U.S. is driven by its well-established technological infrastructure and the presence of IT giants like Google, Microsoft, and Meta. The U.S. leads in technological infrastructure, ranking first in the frontier technologies readiness index in 2022, and is a major hub for robotics research and logistics automation, with significant contributions from companies like FORTNA Inc. and Honeywell International Inc. The rapid growth of automation is expected to drive the demand for logistics solutions. For instance, according to the International Federation of Robotics (IFR), in 2021, 34,987 robots were installed in the U.S. This represents the rapid growth of automation in the country. The trend is expected to propel the demand for logistics automation solutions such as Autonomous Mobile Robots (AMRs) and Automated Guided Vehicles (AGVs).

Asia Pacific Logistics Automation Market Trends

The Asia-Pacific is expected to grow at the fastest CAGR of 17.3% over the forecast period. Asia Pacific is expected to experience rapid economic growth, especially in e-commerce. Moreover, the Asia Pacific includes several countries that are hubs of logistical activity, such as Singapore, Indonesia, China, and India. Furthermore, the rising technological advancements and increasing adoption of Industry 4.0 in countries such as China, India, Japan, and those in Southeast Asia are expected to significantly boost the demand for logistics automation over the forecast period.

The logistics automation market in China is experiencing rapid growth, fueled by the country's leadership in Research and Development (R&D) of advanced technologies. With a substantial number of patents in frontier technologies, such as the Internet of Things (IoT) and Artificial Intelligence (AI), China is poised for significant advancements in automation. Additionally, China's industrial sector, the largest globally, provides a solid foundation for the adoption of logistics automation systems, supported by substantial growth in equipment and high-tech manufacturing. The combination of these factors is driving robust growth in the logistics automation market in China.

Europe Logistics Automation Market Trends

Europe's well-developed technological infrastructure, particularly in Western countries, coupled with rising internet adoption and online shopping trends, is driving growth in the European logistics automation market. Countries such as Sweden, the Netherlands, Germany, and Finland are at the forefront of frontier technology readiness, further boosting the region's potential for automation. Leading companies in the region, including Cargotec, KNAPP AG, TGW Logistics Group, and Swisslog Holding AG, are contributing to market growth. Government investments in R&D, combined with increasing online shopping and proactive government initiatives, are key factors propelling the growth of logistics automation in Europe.

The logistics automation market in the UK is growing due to the country's well-developed technological infrastructure and high internet adoption rates, which create a conducive environment for automation. Furthermore, the increasing demand for online shopping is driving the need for efficient logistics solutions, prompting companies to invest in automation. Moreover, government initiatives and support for R&D in automation technologies are further fueling the growth of the market in the UK.

Key Logistics Automation Company Insights

Some of the key companies operating in the Logistics Automation Market include SAP., Jungheinrich AG, and Daifuku Co., Ltd., among others.

-

Jungheinrich AG is a supplier of warehousing technology and material handling equipment, offering extensive products and services. Its diverse product portfolio encompasses a wide range of equipment, including reach trucks, tow tractors, counterbalanced forklift trucks, shuttle and pallet carriers, order pickers, driverless transport systems, high rack stackers, rack servicing cranes, automatic high-rack silo conveyors, and materials handling systems. In addition, Jungheinrich AG provides various electric pedestrian trucks, explosion-proof forklifts, electric pedestrian stackers, batteries, and associated accessories. The company specializes in internal logistics services and delivers innovative solutions in warehousing technology.

-

Daifuku Co., Ltd. is an engineering, designing, manufacturing, installation, consultation, and after-sales service company for logistics systems and material handling equipment. The company caters to various industries, including automobile, transportation & warehousing, and commerce & retail. It has operations in 26 countries across Asia Pacific, Europe, and North America.

Kardex and One Network Enterprises are some of the emerging market companies in the target market.

-

Kardex is a specialized supplier that provides material handling systems and automated storage solutions. Its extensive range of offerings is designed to meet the diverse needs of various industries. These offerings include buffering and sequencing solutions, automated storage and retrieval systems, document storage solutions, order fulfillment-controlled systems, and general contractor solutions. Kardex also offers specific modules, such as the horizontal carousel module, vertical buffer module, and storage solutions for totes, bins, trays, pallets, as well as heavy or oversized loads.

-

One Network Enterprises is a global technology company specializing in the development and implementation of advanced supply chain management solutions. With a focus on creating intelligent, end-to-end networks, the company offers a transformative platform that enables organizations to optimize their supply chain operations, collaborate effectively, and drive superior business outcomes. One Network Enterprises differentiates itself by offering a unique, cloud-based platform known as the Real Time Value Network (RTVN).

Key Logistics Automation Companies:

The following are the leading companies in the logistics automation market. These companies collectively hold the largest market share and dictate industry trends.

- Dematic (Kion Group AG)

- Daifuku Co., Ltd.

- Swisslog Holding AG (KUKA AG)

- Honeywell International Inc.

- Murata Machinery, Ltd.

- Jungheinrich AG

- KNAPP AG

- TGW Logistics Group

- Kardex

- Mecalux, S.A.

- BEUMER GROUP

- SSI SCHÄFER AG

- Vanderlande Industries B.V.

- WITRON Logistik

- Oracle

- One Network Enterprises

- SAP

Recent Developments

-

In December 2025, PTC launched its Arena AI Engine to automate PLM and QMS workflows by streamlining document review, improving compliance accuracy, and accelerating change management through AI-driven summaries, comparisons, and enhanced revision visibility.

-

In December 2025, Advanced Intralogistics partnered with AlphaOne Robotics to deploy the Sigma Unloader, an AI-driven robotic trailer unloading system that boosts dock throughput, reduces manual labor, and cuts processing time by up to 85 percent.

-

In September 2025, Damon unveiled full-scenario logistics and warehouse automation solutions at Logis-Tech Tokyo 2025, showcasing high-density storage, high-speed sorting, embodied AI robotics, and new systems including its Intelligent Four-Way Shuttle and Multi-Belt Sorter.

-

In February 2024, Dematic announced a partnership with Canadian logistics company Groupe Robert and opened Quebec's first fully automated cold storage facility for third-party logistics. The facility features a high-capacity Automated Storage and Retrieval System (AS/RS) with 130-foot-tall cranes for managing fresh and frozen products. It also prioritizes sustainability and advanced fire safety measures and aims to enhance supply chain efficiency and serve as a central hub for manufacturers distributing products across North America.

-

In May 2023, Swisslog Holding AG announced a partnership with Northern Tool + Equipment to implement a Swisslog Automation Solution within the latter’s facility in Fort Mill in the U.S. state of South Carolina. The collaboration aimed to address the omnichannel distribution requirements of Northern Tool + Equipment. The solution, designed by Swisslog Holding AG’s experts, features the AutoStore system optimized using SynQ software from Swisslog Holding AG. Anticipated to be fully operational by October 2023, the solution would significantly enhance the efficiency and effectiveness of Northern Tool + Equipment's operations.

-

In March 2023, Jungheinrich AG announced the acquisition of Storage Solutions, a material handling solution provider based in the U.S. Storage Solutions provides warehouse and distribution centers with solutions and services, such as lifecycle services, workflow optimization, and safety inspections. Jungheinrich AG was looking forward to leveraging the acquisition to expand its presence in the U.S.

Logistics Automation Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 50.16 billion

Revenue forecast in 2033

USD 148.76 billion

Growth rate

CAGR of 16.8% from 2026 to 2033

Actual data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, function, logistics type, organization size, software application, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Dematic (Kion Group AG); Daifuku Co., Ltd.; Honeywell International Inc.; Swisslog Holding AG (KUKA AG); Murata Machinery, Ltd.; Jungheinrich AG; TGW Logistics Group; KNAPP AG; Kardex; Mecalux, S.A.; BEUMER GROUP; SSI SCHÄFER AG; Vanderlande Industries B.V.; WITRON Logistik; Oracle; One Network Enterprises; SAP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Logistics Automation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global logistics automation market report based on component, function, logistics type, organization size, software application, vertical, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Autonomous Robots (AGV, AMR)

-

Automated Storage and Retrieval Systems (AS/RS)

-

Automated Sorting Systems

-

De-palletizing/Palletizing Systems

-

Conveyor Systems

-

Automatic Identification and Data Collection (AIDC)

-

-

Software

-

Warehouse Management System

-

Transportation Management System

-

-

Services

-

Consulting

-

Deployment & Integration

-

Support & Maintenance

-

-

-

Function Outlook (Revenue, USD Million, 2021 - 2033)

-

Inventory & Storage Management

-

Transportation Management

-

-

Logistics Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Sales Logistics

-

Production Logistics

-

Recovery Logistics

-

Procurement Logistics

-

-

Organization Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Software Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Inventory Management

-

Order Management

-

Yard Management

-

Shipping Management

-

Labor Management

-

Vendor Management

-

Customer Support

-

Others

-

-

Vertical Outlook (Revenue, USD Million, 2021 - 2033)

-

Retail & E-commerce

-

Healthcare

-

Automotive

-

Aerospace & Defense

-

Electronics & Semiconductors

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global logistics automation market size was estimated at USD 44.02 billion in 2025 and is projected to reach USD 148.76 billion by 2033.

b. The global logistics automation market is expected to grow at a compound annual growth rate of 16.8% from 2026 to 2033 to reach USD 148.76 billion by 2033.

b. The sales logistics segment dominated the market in 2025, with a market share of 35.7%. Sales logistics is the most critical aspect of the supply chain as it involves moving or delivering the goods to the end consumer. Sales logistics include order management, inventory management, shipping management, and vendor management.

b. Major players operating in the logistics automation market include Dematic Corp. (Kion Group AG), Daifuku Co. Limited, Swisslog Holding AG (KUKA AG), Honeywell International Inc., Jungheinrich AG, Murata Machinery Ltd, and Knapp AG.

b. The major factors attributing to the growth of the logistics automation market are the rapid growth of the e-commerce sector, which has led to a surge of e-commerce fulfillment centers; increasing adoption of automation equipment such as robots, conveyor systems, and storage systems; and supportive government initiatives to build a robust logistics infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.