- Home

- »

- Advanced Interior Materials

- »

-

Loitering Munition Market Size, Share, Industry Report, 2033GVR Report cover

![Loitering Munition Market Size, Share & Trends Report]()

Loitering Munition Market (2026 - 2033) Size, Share & Trends Analysis Report By Operational Type (Expendable Loitering Munitions, Recoverable Loitering Munitions), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-584-2

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Loitering Munition Market Summary

The global loitering munition market size was estimated at USD 4.68 billion in 2025 and is projected to reach USD 2.26 billion by 2033, exhibiting a CAGR of -10.6% from 2026 to 2033, driven by the evolving modern warfare tactics and the increasing need for precision strike capabilities. These systems offer a unique combination of surveillance and strike functionalities, allowing armed forces to identify, track, and neutralize targets with minimal collateral damage.

Key Market Trends & Insights

- Asia Pacific dominated the loitering munition market with the largest revenue share of 73.5% in 2025.

- By operational type, the expendable loitering munitions segment is expected to depict a CAGR of -10.5% over the forecast period.

- By end use, the army segment is expected to exhibit a CAGR of -10.2% over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 4.68 Billion

- 2033 Projected Market Size: USD 2.26 Billion

- CAGR (2026-2033): -10.6%

- Asia Pacific: Largest market in 2025

- Middle East and Africa: Fastest-growing market

Their relatively low cost, ease of deployment, and effectiveness in asymmetric and urban warfare scenarios further enhance their appeal. As conflicts become more dynamic and technology-driven, nations are investing in loitering munitions to enhance operational flexibility and maintain strategic superiority on the battlefield. Another key driver of the rising demand for loitering munitions is the growing emphasis on unmanned and autonomous systems in defense strategies. With heightened concerns over soldier safety and the need for remote, real-time decision-making in contested environments, militaries are turning to these munitions for their ability to loiter over target areas and strike only when an optimal opportunity is identified. Their ability to operate in GPS-denied or communication-disrupted zones also makes them highly valuable in electronic warfare scenarios. Besides, geopolitical tensions and the rise of gray-zone conflicts have led to increased investments in compact, agile, and cost-effective weaponry, with loitering munitions fitting this profile perfectly.

Innovations in AI, sensor technologies, and miniaturization have significantly enhanced the performance and adaptability of loitering munitions. Modern systems now feature advanced target recognition, swarm capabilities, extended loiter times, and improved precision guidance, making them suitable for a wider range of tactical and strategic missions. Manufacturers are also developing variants tailored for specific applications, such as anti-armor roles or suppression of enemy air defenses (SEAD). These technological advancements are not only boosting the operational utility of loitering munitions but also expanding their adoption beyond traditional military users to include special operations forces and even paramilitary units.

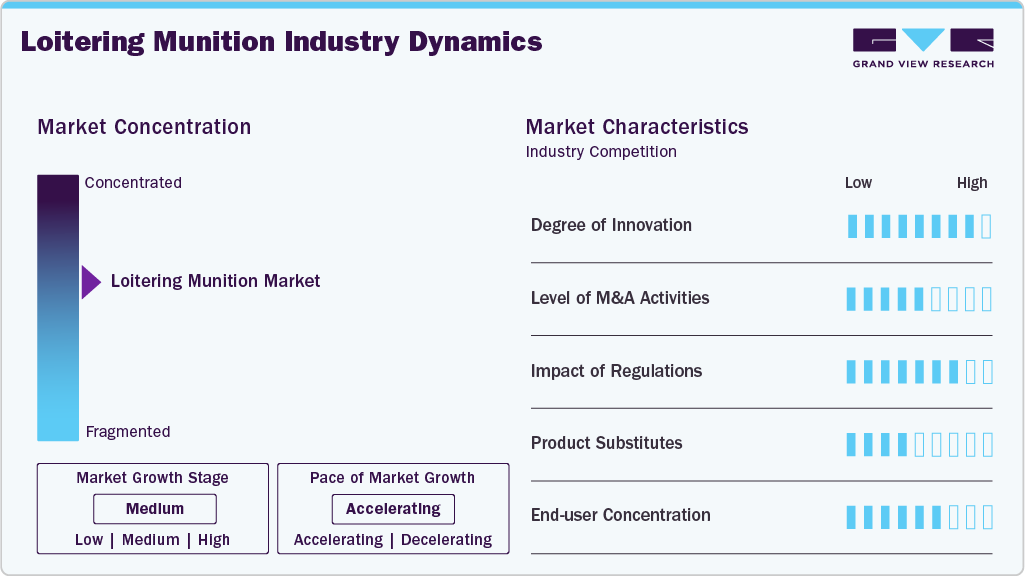

Market Concentration & Characteristics

The market for loitering munitions is currently moderately concentrated, with a few key players dominating global production and innovation. Major defense contractors such as AeroVironment, Israel Aerospace Industries (IAI), Uvision, and China’s CASC hold significant market shares, leveraging their technological expertise, strong government ties, and established defense supply chains. However, the market is witnessing an increased entry of new players, including startups and mid-sized defense firms, especially in regions such as Europe and the Asia Pacific, where indigenous development is being prioritized. This trend is gradually reducing barriers to entry and fostering competitive innovation.

In terms of substitutes, loitering munitions face competition from conventional unmanned aerial vehicles (UAVs), cruise missiles, and precision-guided artillery. However, these alternatives often lack the combined real-time surveillance and strike capabilities that loitering munitions offer in a single, cost-effective platform. While UAVs can conduct reconnaissance and airstrikes, they usually require complex support systems and are more expensive. Similarly, cruise missiles provide powerful strike capabilities but are not reusable and lack in-flight target adaptability. As a result, while substitutes exist, they often fall short in versatility and tactical flexibility, making loitering munitions a unique and increasingly preferred option in modern combat operations.

Operational Type Insights

The expendable loitering munitions segment led the market, accounting for the largest revenue share of 80.7% in 2025, driven by their cost-effectiveness, simplicity, and proven utility in real combat scenarios. Designed for one-time use, these munitions combine surveillance and precision strike capabilities in a disposable format, making them ideal for high-risk missions where recovery is impractical or unnecessary. Their ease of deployment, minimal logistical requirements, and suitability for swarm tactics have made them particularly attractive to militaries engaged in asymmetric warfare, counterterrorism operations, and rapid-response strikes. As a result, defense forces worldwide have heavily invested in expendable variants, such as the Switchblade and Harop, which have demonstrated tactical effectiveness in various conflict zones.

Recoverable loitering munitions are expected to witness a CAGR of -11.2% over the forecast period. While currently a smaller segment, they are gaining traction due to an increasing emphasis on cost efficiency and mission flexibility. These reusable systems are designed to return to base if a strike is not executed, allowing for multiple uses and reducing overall operational expenses. Technological advancements in autonomous navigation, safe landing mechanisms, and real-time communication are making recoverable platforms increasingly viable. In addition, their utility in training, surveillance-only missions, and long-term reconnaissance tasks is expanding their appeal among defense forces aiming to maximize resource utilization without compromising mission readiness.

End Use Insights

The army segment dominated the market and accounted for the largest revenue share of 72.4% in 2025, due to its extensive involvement in ground-based operations where these weapons provide critical tactical advantages. Loitering munitions are particularly well-suited for supporting infantry and armored units by delivering precision strikes against enemy positions, tanks, and fortified installations, especially in contested or urban environments. Their portability, ease of deployment, and real-time surveillance capabilities make them ideal for land-based warfare, counterinsurgency, and border security missions. Armies in conflict-prone regions have been early adopters, recognizing the strategic value of these technologies in enhancing combat effectiveness while minimizing risks to personnel.

The navy segment is also experiencing rapid growth, driven by the increasing need for maritime domain awareness and defense against asymmetric threats such as small boats, drones, and coastal missile systems. Naval forces are now exploring loitering munitions as a cost-effective alternative to traditional missiles for surveillance and precision targeting in littoral and open-sea environments. Their ability to be launched from ships or submarines and loiter over areas of interest allows navies to enhance situational awareness, conduct reconnaissance, and strike targets with minimal collateral damage. As naval warfare modernizes and shifts toward more agile, networked systems, loitering munitions are emerging as a valuable addition to the naval arsenal.

Regional Insights

The Asia Pacific loitering munition industry dominated the market and accounted for the largest revenue share of approximately 73.5% in 2025, driven by increasing military expenditures, regional security tensions, and a strong push for indigenous defense capabilities. Countries such as China, India, and South Korea are actively developing and deploying loitering munitions to enhance border security and tactical strike precision. The region’s focus on modernizing armed forces and investing in advanced unmanned systems is driving large-scale adoption. Moreover, ongoing territorial disputes and the need for rapid-response systems further fuel demand, making the Asia Pacific the most significant contributor to market growth.

The loitering munition industry in China has played a central role in the Asia Pacific market, driven by its strategic focus on unmanned warfare and force modernization. The Chinese military has rapidly developed and deployed various loitering munitions, such as the CH and WS series, through domestic defense giants like CASC and NORINCO. With increasing tensions in the South China Sea and a strong emphasis on AI-enabled autonomous weapons, China continues to expand its capabilities in this segment, aiming to reduce reliance on traditional missile systems and gain tactical superiority.

North America Loitering Munition Market Trends

North America loitering munition industry is a key player in the global market, propelled by high defense budgets, advanced R&D infrastructure, and consistent demand from the U.S. military. The region has been at the forefront of developing cutting-edge loitering systems for use in counterterrorism, urban warfare, and reconnaissance missions. A growing focus on precision warfare and the integration of unmanned systems across all service branches further strengthens the region’s leadership in technological innovation and deployment.

U.S. Loitering Munition Market Trends

The U.S. loitering munition industry dominates within North America, with companies like AeroVironment leading the development of combat-proven systems such as the Switchblade series. The U.S. Department of Defense continues to invest in expanding loitering munitions capabilities to support diverse missions across global theaters. The U.S. military’s emphasis on rapid, agile, and precise strike capabilities, coupled with increasing adoption in special operations and infantry units, keeps the country at the forefront of global demand and innovation.

Europe Loitering Munition Market Trends

The loitering munition industry in Europe is witnessing steady growth, driven by NATO modernization efforts, regional security concerns, and the ongoing war in Ukraine. European nations are increasingly recognizing the value of loitering munitions for border surveillance, tactical strikes, and air defense suppression. Collaborative initiatives and joint development projects across the EU are also fostering technological advancements and expanding market presence, with several countries shifting defense budgets to prioritize unmanned capabilities.

The Germany loitering munition industry is emerging as a notable contributor within Europe, with a growing interest in integrating loitering munitions into its armed forces as part of broader modernization plans. The German defense sector is actively exploring partnerships and procurement deals to strengthen its capabilities in precision-guided systems. The country’s strategic position within NATO and its commitment to upgrading military technology have positioned it as a potential leader in the regional adoption of loitering munitions.

Central & South America Loitering Munition Market Trends

The loitering munition industry in Central & South America has a relatively smaller share in the global market but is gradually expanding due to rising internal security needs and a growing interest in cost-effective, high-precision weaponry. Countries such as Brazil and Colombia are exploring loitering munitions for border surveillance, anti-narcotics operations, and counterinsurgency efforts. Although constrained by limited defense budgets, the region is showing a steady interest in adopting unmanned systems to enhance situational awareness and reduce operational risks.

Middle East & Africa Loitering Munition Market Trends

The loitering munition industry in the Middle East & Africa is experiencing rising demand for exploding drones, driven by persistent regional conflicts, counterterrorism operations, and the need for advanced precision-strike capabilities. Countries, including Israel and the UAE, are leading in both deployment and export of these systems. Israel, in particular, is a major innovator and exporter of loitering munitions, having used them extensively in real combat scenarios. Meanwhile, African nations are beginning to adopt these systems for internal security and border control missions, spurring gradual market growth.

Key Loitering Munition Company Insights

Some of the key players operating in the market include AeroVironment, Inc. and Elbit Systems LTD, among others.

-

AeroVironment is a leading U.S.-based defense technology company specializing in unmanned aerial systems (UAS). It is best known in the loitering munitions segment for its Switchblade series, widely used by the U.S. military and allied forces. The company focuses on compact, portable systems designed for tactical operations, and it continues to innovate with new versions, such as the Switchblade 600, for anti-armor roles. AeroVironment's strong R&D capabilities and proven battlefield performance make it a dominant force in this market.

-

Elbit Systems is a major Israeli defense contractor known for its advanced aerospace and defense solutions. In the loitering munitions market, Elbit offers systems such as the SkyStriker, an autonomous, electro-optically guided munition capable of long-endurance and precision strikes. The company leverages its experience in UAVs and electro-optical technology to develop versatile, combat-proven loitering platforms for global clients.

Rheinmetall AG and Uvision are some of the emerging market participants in the market.

-

Rheinmetall, a prominent German defense company, is gradually expanding into the loitering munitions space as part of its broader focus on modern warfare systems. It has entered into partnerships and R&D initiatives aimed at integrating loitering capabilities into its existing defense solutions. As Europe boosts investment in unmanned and precision-guided systems, Rheinmetall is positioning itself as a strong future player.

-

Uvision is an Israeli defense firm specializing exclusively in loitering munition systems. Its Hero family of loitering munitions ranges from man-portable models to long-range variants, catering to diverse battlefield requirements. Uvision has garnered attention for its innovative design, operational flexibility, and international partnerships, positioning it as one of the most promising emerging players in this rapidly evolving market.

Key Loitering Munition Companies:

The following are the leading companies in the loitering munition market. These companies collectively hold the largest market share and dictate industry trends.

- AeroVironment, Inc.

- Elbit Systems LTD

- Rheinmetall AG

- Uvision

- Israel Aerospace Industries

- Thales Group

- Paramount Group

- Embention

- WB Group

- ZALA Aero Group

Recent Developments

-

In October 2025, UVision unveiled its Autonomous Multi-Launch Loitering Munition System at AUSA 2025. This system allows for the simultaneous launch and management of multiple HERO 120 munitions, enhancing operational flexibility and mission efficiency.

-

In September 2023, Elbit Systems unveiled the Find-And-Strike (FAST) Capsule, integrating the Skylark III UAS and SkyStriker loitering munition, providing a unique strike capability that combines intelligence gathering and precision engagement.

Loitering Munition Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 4.95 billion

Revenue forecast in 2033

USD 2.26 billion

Growth rate

CAGR of -10.6% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Operational type, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

AeroVironment, Inc.; Elbit Systems LTD; Rheinmetall AG; Uvision; Israel Aerospace Industries; Thales Group; Paramount Group; Embention; WB Group; ZALA Aero Group

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Loitering Munition Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global loitering munition market report based on operational type, end use, and region.

-

Operational Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Expendable Loitering Munitions

-

Recoverable Loitering Munitions

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Army

-

Navy

-

Airforce

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global loitering munition market size was estimated at USD 4.68 billion in 2025 and is expected to reach USD 4.95 billion in 2026.

b. The global loitering munition market is expected to grow at a compound annual growth rate of -10.6% from 2026 to 2033 to reach USD 2.26 billion by 2033.

b. The expendable loitering munitions segment led the market and accounted for the largest revenue share of 80.7% in 2025, driven by their cost-effectiveness, simplicity, and proven utility in real combat scenarios.

b. AeroVironment, Inc., Elbit Systems LTD, Rheinmetall AG, Uvision, Israel Aerospace Industries , Thales Group , Paramount Group , Embention, WB Group, and ZALA Aero Group are prominent companies in the Loitering Munition Market.

b. Key factors affecting the loitering munitions market include rising defense budgets, technological advancements, geopolitical tensions, and increasing demand for precision strike capabilities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.