- Home

- »

- Next Generation Technologies

- »

-

Unmanned Systems Market Size, Industry Report, 2030GVR Report cover

![Unmanned Systems Market Size, Share & Trends Report]()

Unmanned Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (UAV, UGV, USV), By Technology (Semi-Autonomous, Remotely Operated), By Application (Military And Law Enforcement, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-623-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Unmanned Systems Market Summary

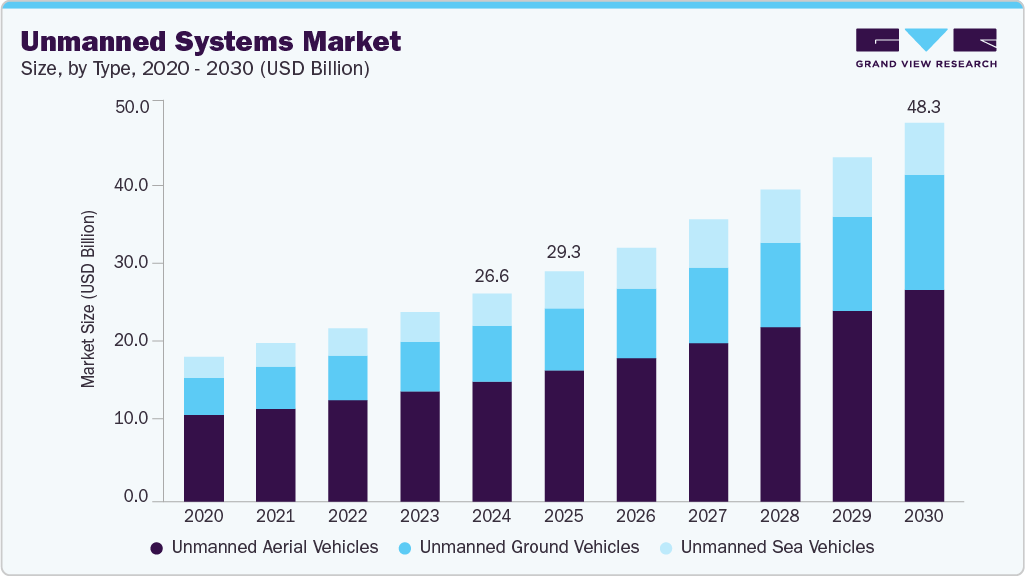

The global unmanned systems market size was estimated at USD 26.55 billion in 2024 and is projected to reach USD 48.31 billion by 2030, growing at a CAGR of 10.5% from 2025 to 2030. The growth of the market is driven by the increasing demand for automation in defense, commercial, and industrial sectors.

Key Market Trends & Insights

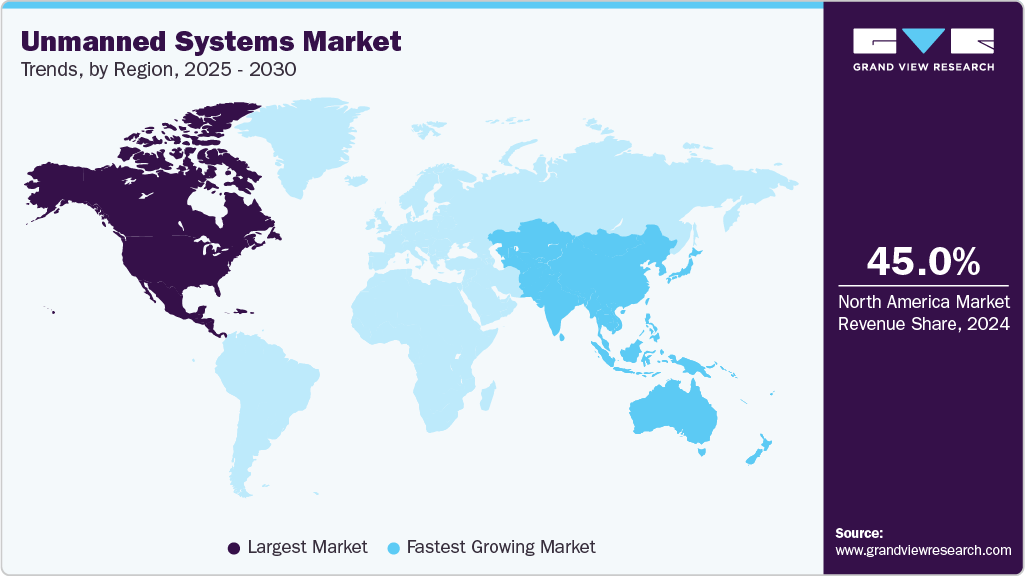

- North America unmanned systems industry accounted for the largest global revenue share of over 45% in 2024.

- The U.S. unmanned systems industry dominated the regional North American market with a share of over 65% in 2024.

- By type, the unmanned aerial vehicles (UAV) segment dominated the market with a revenue share of over 57% in 2024.

- By technology, the semi-autonomous segment held the largest market share in 2024.

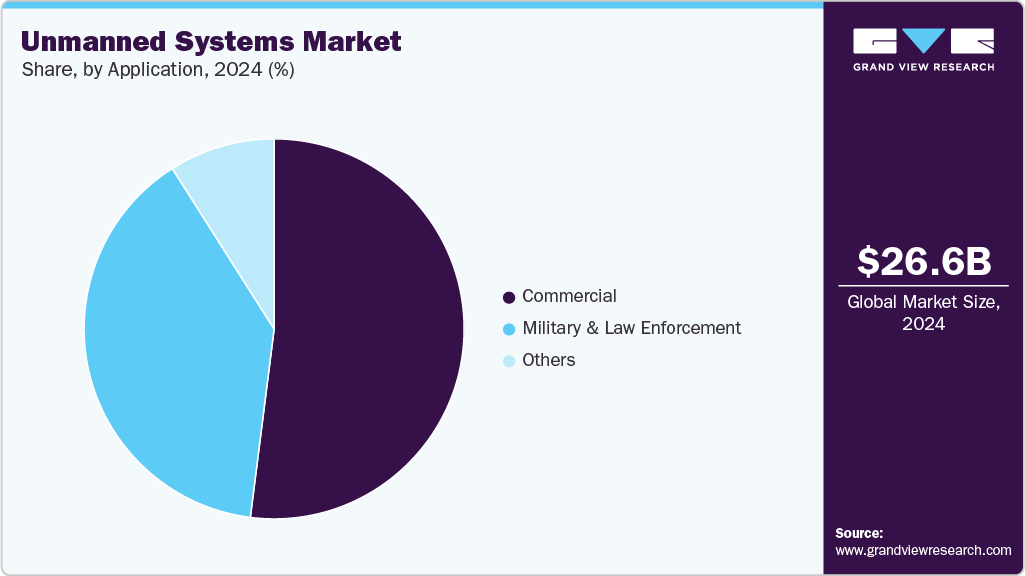

- By application, the military and law enforcement segment accounted for a significant market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 26.55 Billion

- 2030 Projected Market Size: USD 48.31 Billion

- CAGR (2025-2030): 10.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Advancements in artificial intelligence, sensor technology, and real-time data processing are facilitating the development of highly efficient unmanned aerial, ground, and marine systems. Furthermore, rising defense budgets and the need for surveillance, reconnaissance, and border security are contributing to greater adoption in military applications. In the commercial sector, the increasing use of these systems in agriculture, logistics, and infrastructure inspection is broadening the market's reach. Collectively, these factors support a strong outlook for the market in the coming years.The growing geopolitical tensions and cross-border conflicts are significantly driving demand for unmanned systems in defense applications. Governments are rapidly allocating budgets to develop autonomous aerial, ground, and underwater platforms for intelligence, surveillance, and reconnaissance (ISR) operations. As traditional combat strategies evolve, unmanned systems offer a low-risk and cost-effective alternative for high-risk missions. Major defense contractors are forming public-private partnerships to accelerate innovation. This increased investment acts as a primary catalyst for the unmanned systems industry’s sustained growth.

There is a growing emphasis on autonomous surface and underwater vehicles for oceanographic research, seabed mapping, and naval operations. These systems reduce human exposure to deep-sea missions and enable prolonged underwater surveillance. Energy and offshore industries are increasingly using unmanned maritime platforms for pipeline inspection and environmental monitoring. Technological advances in underwater communication and propulsion systems are boosting reliability and endurance. As maritime applications expand, they represent a vital growth frontier for the unmanned systems industry.

The demand for extended operational range and reduced downtime is leading to innovations in power systems for unmanned platforms. Companies are investing in hybrid propulsion systems, solar integration, and battery optimization technologies. Efficient energy management is critical for long-endurance missions in remote or inaccessible areas. This trend is particularly relevant for drones used in environmental monitoring and disaster response. Advancements in energy solutions are enhancing operational viability and broadening market adoption across the unmanned systems industry.

Unmanned systems are increasingly leveraging edge computing to process vast volumes of data in real time without relying on cloud connectivity. This capability is critical in latency-sensitive scenarios such as surveillance, emergency response, and precision agriculture. Edge-enabled platforms can operate autonomously in bandwidth-constrained or denied environments. Integration with 5G networks further amplifies their ability to transmit and act on high-fidelity data streams. Edge computing is emerging as a cornerstone for scaling intelligent operations in the unmanned systems industry.

Type Insights

The unmanned aerial vehicles (UAV) segment dominated the market with a revenue share of over 57% in 2024. Artificial intelligence (AI) and autonomy are transforming UAV operations by enabling real-time data processing, adaptive flight paths, and reduced operator intervention. These technologies enhance mission efficiency, safety, and scalability across all UAV sizes, particularly in complex environments. The trend toward autonomous swarm capabilities and machine learning-driven analytics is opening new frontiers for both commercial and defense applications. This integration is expected to accelerate UAV deployment, optimize lifecycle costs, and create competitive differentiation for market leaders.

The unmanned ground vehicles (UGV) segment is expected to witness the fastest CAGR of over 13% from 2025 to 2030. The defense sector remains the primary driver for UGV adoption, leveraging these systems for reconnaissance, bomb disposal, and hazardous environment operations. Enhanced mobility options such as wheeled, tracked, and legged platforms allow UGVs to operate in diverse terrains, increasing their tactical utility. Rising geopolitical tensions and the emphasis on soldier safety are further accelerating investment in advanced UGV technologies. This sustained demand positions defense as a cornerstone market supporting steady UGV growth.

Technology Insights

The semi-autonomous segment held the largest market share in 2024. Semi-autonomous unmanned systems offer enhanced safety features by allowing human operators to intervene during complex or unexpected situations, addressing regulatory concerns related to fully autonomous operations. This balance facilitates compliance with evolving national and international standards, particularly in commercial airspace and industrial environments. Regulatory bodies often prefer semi-autonomy as a phased approach to broader autonomy adoption. Consequently, semi-autonomous platforms benefit from favorable regulatory acceptance, accelerating deployment in various sectors.

The fully autonomous segment is expected to witness the fastest CAGR from 2025 to 2030. The scope of fully autonomous unmanned systems is broadening beyond traditional defense uses to include commercial sectors such as last-mile delivery, precision agriculture, environmental monitoring, and mining. Autonomous drones and ground vehicles can perform repetitive or hazardous tasks with minimal supervision, improving safety and productivity. This diversification of use cases is attracting significant investment and driving rapid market growth. Companies are also exploring autonomous swarm technologies for coordinated operations, enhancing mission scalability.

Application Insights

The military and law enforcement segment accounted for a significant market share in 2024. There is an increasing focus on interoperability and coordinated operations across aerial, ground, and maritime unmanned platforms. Military and law enforcement agencies are investing in integrated systems that can share data and operate collaboratively in contested environments. This multi-domain approach enhances situational awareness and force multiplier effects during complex missions. This trend supports the development of unified command and control architectures and expands opportunities for vendors offering comprehensive unmanned solutions.

The commercial segment is expected to witness the fastest CAGR from 2025 to 2030, owing to the integration of unmanned systems with IoT networks and advanced data analytics platforms. the unmanned systems industry is evolving into a key enabler of intelligent automation. This fusion allows companies to convert sensor data into actionable insights, significantly improving real-time monitoring, predictive maintenance, and asset optimization. As a result, sectors such as energy, logistics, and infrastructure are seeing enhanced operational efficiency and reduced downtime. The convergence of these technologies is also fostering innovative, data-driven business models that unlock new revenue opportunities.

Regional Insights

North America unmanned systems industry accounted for the largest global revenue share of over 45% in 2024, driven by increased defense modernization budgets and cross-border surveillance needs. The North American market is experiencing rapid technological innovation. U.S. and Canadian agencies are accelerating procurement of UAVs, UGVs, and maritime drones to strengthen homeland security and disaster response. This surge is catalyzing investment in AI-based autonomy, interoperable payloads, and hybrid propulsion systems across the region.

U.S. Unmanned Systems Market Trends

The U.S. unmanned systems industry dominated the regional North American market with a share of over 65% in 2024. The growing demand for real-time ISR (Intelligence, Surveillance, Reconnaissance) capabilities is propelling the adoption of advanced unmanned aerial systems in the U.S. defense and homeland security sectors. Government programs like the MQ-25 Stingray and increasing commercial applications in agriculture and logistics are broadening market scope. This multifaceted deployment is reinforcing the U.S. as the global leader in unmanned systems innovation.

Europe Unmanned Systems Market Trends

The Europe unmanned systems industry is expected to grow at a CAGR of 9% from 2025 to 2030, primarily driven by geopolitical instability and EU-funded defense initiatives. the European unmanned systems industry is undergoing strategic transformation. The EU’s permanent structured cooperation (PESCO) is fostering collaboration among member states to develop interoperable and standardized unmanned platforms. This cooperative momentum is expanding regional manufacturing capacity and strengthening Europe's technological sovereignty in autonomous systems.

The UK unmanned systems industry is expected to grow at a significant rate in the coming years, owing to heightened investments in maritime surveillance and border security. The UK is scaling its adoption of unmanned aerial and underwater vehicles. The Royal Navy’s autonomous mine-hunting programs and commercial interest in delivery drones are accelerating deployment. These initiatives are positioning the UK as a pioneer in multi-domain unmanned operations.

The Germany unmanned systems industry is witnessing rising demand for dual-use technologies that are shaping its market, especially in precision agriculture and industrial inspection. Domestic manufacturers are focusing on scalable drone platforms with AI-enhanced analytics and regulatory compliance. This approach is fostering public-private partnerships and encouraging sustainable adoption across both civil and defense sectors.

Asia Pacific Unmanned Systems Market Trends

The Asia Pacific unmanned systems industry is expected to grow at the fastest CAGR of over 14% from 2025 to 2030, driven by escalating defense spending and smart city infrastructure development. the Asia Pacific unmanned systems industry is expanding rapidly. Countries are investing in UAVs for border surveillance, traffic monitoring, and disaster management. Regional governments are also fostering indigenous innovation and manufacturing to reduce reliance on Western imports.

China unmanned systems industry is gaining traction due to the growing demand for commercial drone applications in logistics, construction, and mapping, which is fueling China’s dominance in the market. Domestic giants like DJI are leading with affordable, scalable platforms supported by government subsidies and export incentives. This momentum is reinforcing China’s position as a global hub for both consumer and industrial UAV deployment.

The Japan unmanned systems industry is rapidly expanding, owing to labor shortages and aging demographics, Japan is increasingly relying on unmanned ground and aerial systems in agriculture and infrastructure inspection. Government support for automation in smart farming and transportation is driving R&D in lightweight, autonomous platforms. This trend is positioning Japan as a technology-first market focused on societal problem-solving through unmanned solutions.

Key Unmanned Systems Company Insights

Some of the key players operating in the market are Northrop Grumman Corporation and Boeing, among others.

-

Northrop Grumman Corporation is a global leader in defense technology, renowned for its advanced unmanned aerial systems (UAS) such as the RQ-4 Global Hawk and MQ-4C Triton. The company specializes in high-altitude, long-endurance autonomous platforms used primarily for intelligence, surveillance, and reconnaissance (ISR) missions. Its focus on integrating AI and multi-domain capabilities into unmanned systems strengthens its strategic position in defense-oriented autonomous technologies.

-

Boeing plays a pivotal role in the unmanned systems industry through its subsidiary Insitu and its development of the MQ-25 Stingray and other autonomous platforms. The company focuses on integrating unmanned technologies into military aviation, emphasizing endurance, autonomy, and networked operations. Boeing’s strong aerospace foundation enables it to push the boundaries of unmanned flight systems for both defense and commercial applications.

Teledyne Technologies Inc. and Textron Inc. are some of the emerging market participants in the unmanned systems industry.

-

Teledyne Technologies Inc. is an emerging force in the unmanned systems industry, particularly known for its unmanned underwater vehicles (UUVs) and remote sensing solutions. The company focuses on marine robotics and data acquisition platforms used in oceanography, offshore energy, and defense. With a growing portfolio of autonomous maritime systems, Teledyne is gaining traction in high-precision, low-intervention unmanned operations.

-

Textron Inc., through its subsidiary Textron Systems, is emerging as a strong competitor in tactical unmanned systems with offerings like the Aerosonde and Shadow UAS. The company focuses on multi-mission capabilities for surveillance, target acquisition, and strike support in military operations. With increased investment in autonomous technologies, Textron is positioning itself to scale further in defense and border security applications.

Key Unmanned Systems Companies:

The following are the leading companies in the unmanned systems market. These companies collectively hold the largest market share and dictate industry trends.

- Northrop Grumman

- Lockheed Martin Corporation

- Teledyne Technologies Inc.

- BAE Systems

- DJI

- Thales

- Israel Aerospace Industries

- Boeing

- General Dynamics Corporation

- Textron Inc.

- L3Harris Technologies Inc.

- Elbit Systems Ltd.

Recent Developments

-

In May 2025, Airbus U.S. Space & Defense and L3Harris Technologies announced a strategic partnership to enhance the Airbus MQ-72C Logistics Connector, an unmanned variant of the UH-72 Lakota helicopter. This collaboration leverages L3Harris' advanced digital backbone and integrated command and control systems, facilitating rapid integration of third-party, commercial off-the-shelf hardware to maximize system versatility and mission adaptability. The initiative aims to accelerate the development of unmanned operations, providing the U.S. Marine Corps with a modular, open-systems platform capable of supporting a wide range of logistics missions in contested and austere environments.

-

In May 2025, Cyberlux Corporation partnered with Optical Knowledge Systems, Inc. (OKSI) to advance UAS capabilities for operations in GPS- and RF-denied environments. The collaboration integrates OKSI’s OMNISCIENCE autonomy suited into Cyberlux platforms, enabling autonomous navigation, target detection, and terminal guidance without dependence on traditional communication systems. This enhancement significantly strengthens mission effectiveness and resilience in highly contested or signal-degraded areas.

-

In April 2025, HD Hyundai Heavy Industries (HD HHI) entered a strategic partnership with U.S.-based defense technology firm Anduril Industries to jointly develop advanced unmanned surface vessels (USVs). The collaboration aims to integrate HD HHI’s autonomous navigation systems with Anduril’s mission autonomy technologies, creating AI-driven platforms capable of executing complex naval operations with minimal human intervention. This initiative not only addresses challenges such as declining military personnel but also positions both companies to expand their presence in the global defense market.

-

In January 2025, Redwire Corporation announced its acquisition of Edge Autonomy for USD 925 million, marking a significant expansion into the unmanned aerial systems (UAS) sector. This strategic move positions Redwire to integrate Edge Autonomy's advanced drone technologies with its existing space infrastructure capabilities, enhancing its offerings in defense and intelligence markets. The acquisition underscores Redwire's commitment to diversifying its portfolio and strengthening its role in national security and aerospace innovation.

Unmanned Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 29.30 billion

Revenue forecast in 2030

USD 48.31 billion

Growth rate

CAGR of 10.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, application, and region

Regional

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; Saudi Arabia; U.A.E.; South Africa

Key companies profiled

Northrop Grumman; Lockheed Martin Corporation; Teledyne Technologies Inc.; BAE Systems; DJI; Thales; Israel Aerospace Industries; Boeing; General Dynamics Corporation; Textron Inc.; L3Harris Technologies Inc.; Elbit Systems Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Unmanned Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global unmanned systems market report based on type, technology, application, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Unmanned Aerial Vehicles

-

Small UAVs

-

Medium UAVs

-

Large UAVs

-

-

Unmanned Ground Vehicles

-

Wheeled

-

Tracked

-

Legged

-

Hybrid

-

-

Unmanned Sea Vehicles

-

Unmanned Underwater Vehicles (UUVs)

-

Unmanned Surface Vehicles (USVs)

-

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Semi-Autonomous

-

Remotely Operated

-

Fully Autonomous

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Military and Law Enforcement

-

Commercial

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. North America dominated the unmanned systems market with a share of over 45% in 2024, driven by increased defense modernization budgets and cross-border surveillance needs, the North American unmanned systems market is experiencing rapid technological innovation. U.S. and Canadian agencies are accelerating procurement of UAVs, UGVs, and maritime drones to strengthen homeland security and disaster response.

b. Some key players operating in the unmanned systems market include Northrop Grumman, Lockheed Martin Corporation, Teledyne Technologies Inc., BAE Systems, DJI, Thales, Israel Aerospace Industries, Boeing, General Dynamics Corporation, Textron Inc., L3Harris Technologies Inc., and Elbit Systems Ltd.

b. Key factors that are driving the market growth include integration of advanced AI and edge computing, diverse multi-domain applications, and advancements in AI, sensor fusion, & communication technologies.

b. The global unmanned systems market size was estimated at USD 26.55 billion in 2024 and is expected to reach USD 29.30 billion in 2025.

b. The global unmanned systems market is expected to grow at a compound annual growth rate of 10.5% from 2025 to 2030 to reach USD 48.31 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.