- Home

- »

- Medical Devices

- »

-

Long Term Care Devices Market Size, Industry Report, 2030GVR Report cover

![Long Term Care Devices Market Size, Share & Trends Report]()

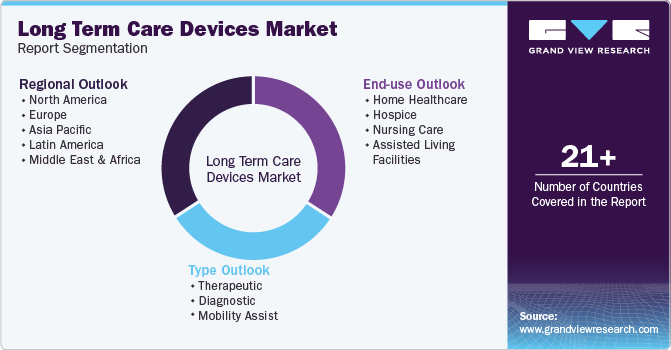

Long Term Care Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Therapeutic, Diagnostic, Mobility Assist), By End-use (Hospice, Nursing Care, Assisted Living Facilities), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-717-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Long Term Care Devices Market Summary

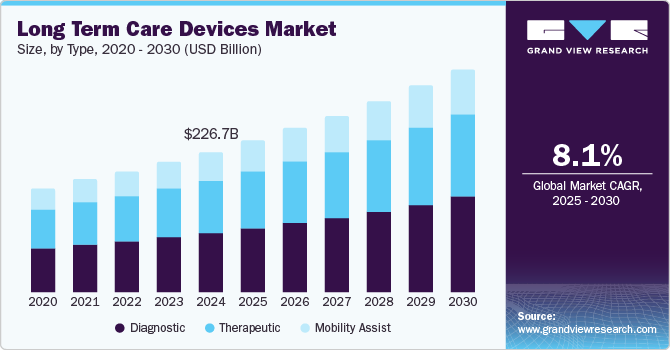

The global long term care devices market size was estimated at USD 226.7 billion in 2024 and is projected to reach USD 361.7 billion by 2030, growing at a CAGR of 8.1% from 2025 to 2030. Innovations such as telehealth solutions and remote monitoring devices are revolutionizing service delivery and enhancing overall care quality.

Key Market Trends & Insights

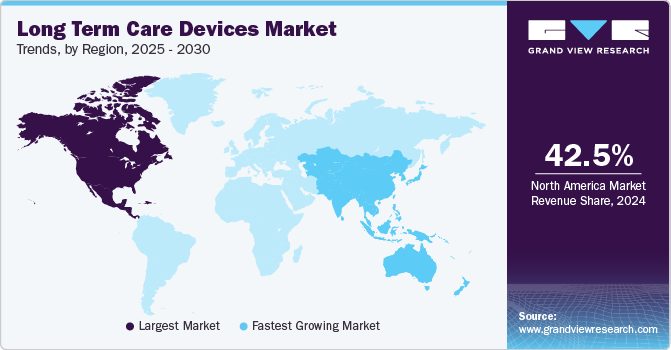

- North America long term care devices market dominated the global long term care devices market with a revenue share of 42.5% in 2024.

- The long term care devices market in the U.S. dominated the North America long term care devices market with the largest revenue share in 2024.

- By type, diagnostic devices segment dominated the market and accounted for a share of 40.6% in 2024.

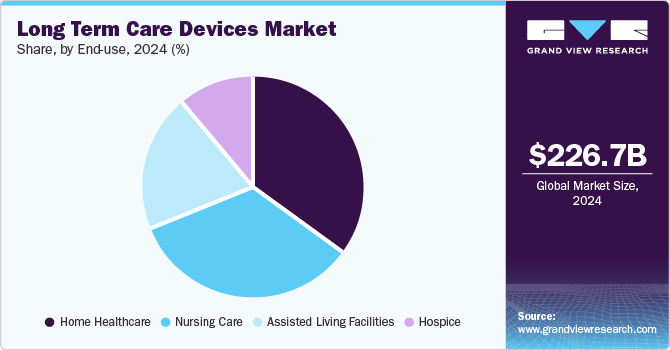

- By end-use, home healthcare segment held the largest share of 35.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 226.7 Billion

- 2030 Projected Market Size: USD 361.7 Billion

- CAGR (2025-2030): 8.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As the elderly population continues to grow, the integration of these technologies ensures effective management of patient health, ultimately providing both providers and patients with improved options for care.

In 2024, it is projected that approximately 20% of the U.S. population will be aged 65 or older, while countries in Europe, such as Germany and France, will experience similar trends with over 21% of their populations falling within the same age bracket. This demographic shift is leading to an increased demand for cost-effective long-term care solutions, as many elderly individuals require ongoing support that traditional hospital care may not provide. As seniors increasingly opt for home-based care, the home healthcare industry is expanding rapidly, facilitating the provision of personalized care that aligns with the growing demand for long-term care devices. According to a BMC Geriatrics study, 85% of U.S. citizens aged 65 and older have at least one chronic health condition, while 60% suffer from two or more chronic conditions. This highlights the critical need for specialized care and devices for effective chronic disease management.

Government support and funding are critical enablers of market growth in long-term care. The European Union has observed a rise in public spending on long-term care services by approximately 1% of GDP, which aims to enhance access and quality of care for the elderly. Notably, Germany has introduced mandatory long-term care insurance, known as Pflegeversicherung, which has improved service accessibility for millions of citizens. Similarly, the UK government’s Adult Social Care Reform is expected to address the needs of its aging population, projecting that by 2025, one in four adults over 65 will require long-term care support. These initiatives are essential for accommodating a burgeoning elderly demographic, projected to exceed 50 million in Europe by 2024 by the European Commission’s Budgetary Projections 2022-2070.

Alongside demographic and government factors, economic considerations play a vital role in market dynamics. Assisted living facilities provide essential residential services for seniors, while skilled private nursing care significantly impacts the demand for long-term care devices. Long-term care facilities generally offer more affordable options compared to hospital stays; the average cost of a semi-private room in a nursing home in the U.S. is approximately USD 8,000 per month, while home health aide services fall between USD 4,000 and USD 5,000 monthly. This economic advantage encourages families to pursue long-term care solutions over traditional hospitalization, making such services more attractive. Collectively, these drivers outline a robust framework for the future expansion of the long-term care industry, positioning it to meet the evolving needs of a diverse patient base.

Type Insights

Diagnostic devices dominated the market and accounted for a share of 40.6% in 2024, owing to the rising prevalence of chronic diseases in the elderly, necessitating regular monitoring. Technological advancements have improved the accuracy and accessibility of these devices, enhancing treatment outcomes and fostering their adoption in long-term care environments.

Mobility assist devices are anticipated to witness rapid growth over the forecast period. The increasing aging population is facing mobility challenges. These devices, including walkers and wheelchairs, promote independence and enhance the quality of life for seniors. Growing awareness of fall prevention and rehabilitation further drives their popularity in long-term care.

End-use Insights

Home healthcare held the largest share of 35.0% in 2024, aided by the preference among elderly individuals for receiving care in familiar surroundings. Advancements in telehealth and portable medical devices enable effective home monitoring and treatment, while cost-effectiveness and improved patient outcomes further augment demand for such services.

The hospice segment is projected to grow lucratively over the forecast period. Hospice offers specialized care for terminally ill patients, emphasizing comfort and quality of life. Growing awareness of palliative care options and comprehensive family support contribute to this trend, enhancing its attractiveness within the industry. For instance, in June 2024, Sanctuary Hospice awarded Medline a multi-year prime vendor agreement, standardizing incontinence, wound care, and nutrition practices while enhancing clinical support and education for caregivers across multiple counties.

Regional Insights

North America long term care devices market dominated the global long term care devices market with a revenue share of 42.5% in 2024, driven by a rapidly aging population, which increases the demand for long-term care solutions. Favorable government policies and expanded insurance coverage enhance accessibility to essential devices. Furthermore, technological advancements and a robust healthcare infrastructure are propelling market growth in the region.

U.S. Long Term Care Devices Market Trends

The long term care devices market in the U.S. dominated the North America long term care devices market with the largest revenue share in 2024. The U.S. is experiencing a high prevalence of chronic diseases among the elderly and rising healthcare expenditures. Moreover, strong government initiatives and a well-established healthcare system foster innovation and accessibility, ensuring comprehensive care for older adults. For instance, in November 2024, Fresenius Medical Care secured a Mechanical Circulatory Support agreement with Premier, facilitating broader access to the Novalung ECMO System for over 4,350 member hospitals across the U.S.

Europe Long Term Care Devices Market Trends

Europe long term care devices market held substantial market share in 2024 due to the increasing aging population and heightened demand for comprehensive care solutions. Government initiatives focused on improving access to long-term care services, combined with significant investments in healthcare infrastructure, are key drivers of market expansion. Growing awareness of chronic disease management among older adults further stimulates the demand for specialized devices.

The long term care devices market in Germany is expected to grow in the forecast period, fueled by the country’s robust healthcare system and mandatory long-term care insurance, which boost service accessibility for millions. The rising elderly population necessitates innovative care solutions, supported by government initiatives for elderly care.

Asia Pacific Long Term Care Devices Market Trends

Asia Pacific long term care devices market is expected to register the fastest CAGR of 9.1% in the forecast period. Growing healthcare expenditures and heightened awareness of chronic disease management among older adults fuel demand for long-term care solutions. Moreover, government initiatives aimed at enhancing healthcare infrastructure contribute to the region’s strong growth prospects in this sector.

The long term care devices market in Singapore is expected to register the fastest growth in the Asia Pacific market over the forecast period. The country’s sophisticated healthcare infrastructure supports innovative long-term care solutions, and increasing awareness of elderly care needs drives demand for specialized devices. Furthermore, Singapore’s commitment to promoting healthy aging, along with government initiatives dedicated to enhancing healthcare services for its aging population, are fueling market growth in the country.

Key Long Term Care Devices Company Insights

Some key companies operating in the market include Abbott; Medtronic Plc; B. Braun Medical Inc.; 3M; Baxter; among others. Strategic initiatives involve mergers, acquisitions, and partnerships to expand product offerings and improve service delivery, with an emphasis on innovation in telehealth and mobility devices. For instance, in July 2024, Roche completed its acquisition of LumiraDx’s Point of Care technology, enhancing its diagnostics portfolio and advancing access to diagnostic testing, particularly in primary care and underserved regions.

-

B. Braun Medical Inc. specializes in the development and manufacturing of medical devices and solutions for diverse healthcare needs, including long-term care. Their product portfolio features vascular access devices and infusion therapy systems aimed at enhancing patient safety and treatment efficiency.

-

McKesson Corporation offers varied medical supplies and healthcare management solutions, focusing on operational efficiency and improved patient care.

Key Long Term Care Devices Companies:

The following are the leading companies in the long term care devices market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Medtronic Plc

- B. Braun Medical Inc.

- 3M

- Baxter

- F. Hoffmann-La Roche Ltd

- MCKESSON CORPORATION

- Medline Industries, LP.

- Fresenius Medical Care AG

- Cardinal Health

- GF Health Products, Inc.

Recent Developments

-

In October 2024, Roche presented data at CTAD showcasing the Elecsys Amyloid Plasma Panel’s effectiveness in accurately ruling out Alzheimer’s disease-related amyloid pathology, enhancing diagnostic clarity for early cognitive decline detection.

-

In September 2024, Vetter Senior Living appointed Medline as prime vendor after 40 years with a previous partner, enhancing clinical and resident care across its 30-plus facilities through a multi-year contract.

-

In August 2024, Medtronic received FDA approval for the Simplera CGM and established a global partnership with Abbott to enhance continuous glucose monitoring options for diabetes management and care integration.

Long Term Care Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 244.5 billion

Revenue forecast in 2030

USD 361.7 billion

Growth rate

CAGR of 8.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Abbott; Medtronic Plc; B. Braun Medical Inc.; 3M; Baxter; F. Hoffmann-La Roche Ltd; MCKESSON CORPORATION; Medline Industries, LP.; Fresenius Medical Care AG; Cardinal Health; GF Health Products, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Long Term Care Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global long term care devices market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Therapeutic

-

Home Respiratory Equipment

-

Insulin Delivery

-

Home IV Pumps

-

Home Dialysis Equipment

-

Other Therapeutic Equipment

-

-

Diagnostic

-

Diabetic Care Unit

-

Blood Pressure Monitors

-

Multipara Diagnostic Monitors

-

Home Pregnancy & Fertility Kits

-

Apnea & Sleep Monitors

-

Holter Monitors

-

Heart Rate Meters

-

Other Diagnostic Equipment

-

-

Mobility Assist

-

Wheel Chair

-

Home Medical Furniture

-

Walking Assist Devices

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Home Healthcare

-

Hospice

-

Nursing Care

-

Assisted Living Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global long term care devices market size was estimated at USD 226.7 billion in 2024 and is expected to reach USD 244.50 billion in 2025.

b. The global long term care devices market is expected to grow at a compound annual growth rate of 8.15% from 2025 to 2030 to reach USD 361.70 billion by 2030.

b. North America dominated the long term care devices market with a share of 42.47% in 2024. This is attributable to high demand for DME, an increase in Medicare coverage over DMEs at LTC facilities, a rise in the aging population, and a streamlined regulatory framework.

b. Some key players operating in the long term care devices market include McKesson Medical-Surgical Inc.; Medline Industries, Inc.; Medtronic Plc; B. Braun Melsungen AG; 3M Healthcare; Baxter International Inc.; F. Hoffmann-La Roche AG; Arkray, Inc.; Becton, Dickinson, and Company; Omron Healthcare, Inc.; Fresenius Medical Care AG & Co. KGaA; Cardinal Health; GE Healthcare; GF Health Products, Inc.; Hill-Rom Holdings, Inc.; and Koninklijke Philips N.V.

b. Key factors that are driving market growth include aging population, which creates a patient pool seeking long-term care at home and at-home skilled nursing facilities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.