- Home

- »

- Power Distribution Systems

- »

-

Low Power Generator Sets Market Size & Trends Report, 2030GVR Report cover

![Low Power Generator Sets Market Size, Share & Trends Report]()

Low Power Generator Sets Market Size, Share & Trends Analysis Report By Fuel Type, By Power Rating, By Application, By End-use, By Industries, By Portability, By 50-150 kVA Fuel Type, By 50-150 kVA Application, By Region, And Segment Forecasts, 2023 - 2038

- Report ID: GVR-4-68040-031-2

- Number of Report Pages: 479

- Format: PDF, Horizon Databook

- Historical Range: 2020 - 2021

- Forecast Period: 2023 - 2030

- Industry: Energy & Power

Report Overview

The global low-power generator sets market size was valued at 33.37 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 9.0 % from 2023 to 2038. Increasing demand for uninterrupted and reliable power supply for usage in power generation, telecommunication, oil & gas, marine, residential, chemical, manufacturing and construction, and healthcare applications are anticipated to fuel the growth of the market during the forecast period. Ongoing industrialization in emerging economies and an increasing number of infrastructure development projects worldwide are among the significant factors influencing global electricity demand. Growing usage of electronic equipment by different businesses has resulted in increasing demand for generators to prevent sudden stoppage of electricity supply during power outages to prevent disruption in their daily activities.

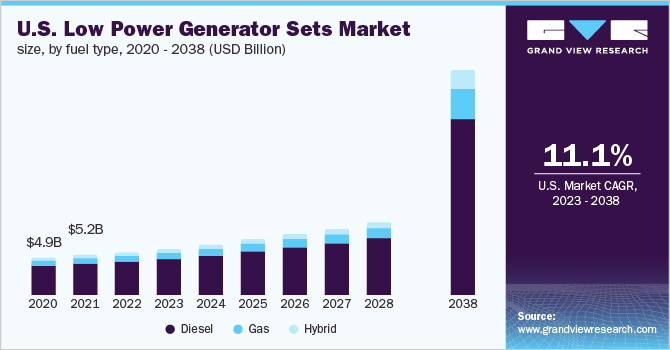

The U.S. market is anticipated to witness substantial growth in the forecast period owing to backup power systems to ensure uninterrupted power supply to important facilities, such as data centers, hospitals, and others, which require a 24/7 electric supply. The U.S. accounted for the largest share of North America's low-power gensets market and is expected to progress at the fastest growth rate over the forecast period. This is attributed due to the rising power demand; availability of shale gas reserves, the government's growing emphasis on the creation of clean energy sources, and the diesel generator sets the low total cost of ownership and operational advantages. These factors are expected to fuel the demand for diesel and natural gas generator sets in the U.S. over the forecast period.

Moreover, developing industrial and commercial facilities such as shopping malls, high-rise buildings universities, restaurants, refineries, office buildings, and others in the U.S. are driving the demand for uninterrupted electricity supply to expand businesses and perform operations efficiently. Natural calamities and worsening weather conditions due to climate change have resulted in prolonged power cuts, which is driving the demand for backup power as an essential amenity in commercial, residential, and industrial establishments. This is expected to drive the low-power gen-sets market in the U.S.

Fuel Type Insights

Diesel generator sets led the market and accounted for about 90.0% of the overall low-power gensets market in 2022. Diesel generators are utilized in a variety of applications worldwide. They are typically installed in remote areas connected to the power grid and can be used as a backup system or as the primary power source because they can be quickly turned on and off without any lag time.

A natural gas generator is a popular and effective way to produce electricity. Being one of the most affordable and efficient fuels among non-renewable resources for energy production, natural gas can be used to power both emergency and portable generators. Coal may be the only fuel that is less costly from a cost perspective. However, its high pollution level is one of its biggest drawbacks.

A hybrid generator, which is typically attached to a diesel generator, combines two energy sources to produce electricity through a battery-charged system. The battery will be charged by the generator, which will also act as the main power source, using renewable energy sources like solar or wind. The diesel generator will start up right away to start generating electricity when the battery levels start to get low.

Power Rating Insights

The 50-150 kVA sub-segment led the market and accounted for 37.61% of the global share in 2022 owing to critical equipment applications, such as hospitals and industries, to power civil work and construction sites.

0-50 kVA accounted for the second-highest market share. They are very popular for commercial and residential power backup operations. Nowadays, people use various electrical appliances in their homes such as water pumps, geysers, AC units, and others, which require more power to function.

150-350kVA are industrial generators, which are used as standby power, and are a robust type of equipment designed with legal standards to perform efficiently and properly during power outages. The industrial sector in emerging economies, including Brazil, India, and China, has highly contributed to the demand for power backup systems owing to the high industrial load in these countries which is expected to drive demand for this segment in the forecasted period.

50-150 kVA Generator Sets Market Insights

In 2022, diesel-fueled generator sets have the highest market share of about 88.0% in the 50 kVA to 150 kVA low-power generator sets market. Diesel generators with lower power ratings are used for construction and commercial applications. These generators are widely used as they are affordable and easier to maintain as compared to power generators with different fuel types. Diesel-fueled generators are generally cheaper than gas and hybrid generators. However, diesel-powered generators have higher emissions than gas generators.

In 2022, Prime or continuous power generators held the largest share of more than 55.0% in the 50 kVA to 150 kVA low-power generator sets market. Prime or continuous power generators with 50 kVA-150 kVA rating are used in mining, construction, and oil & gas applications. These types of generators are used in remote places with no electricity grids. Construction and mining applications require generator sets that are portable and can be moved to new locations. This makes the generator sets with low power rating ideal for such applications as they can be moved over small distances for power generation.

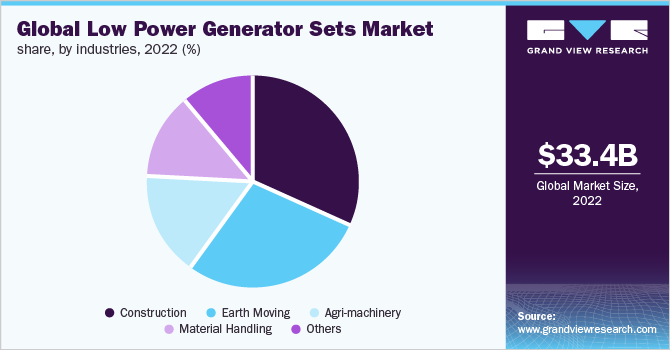

Industries Insights

The industries segment consists of construction, earth moving, material handling, agri-machinery, and others. The construction segment led the market and accounted for 31.98% of the global revenue share in 2022. In the construction field, portable generators are used mostly because of their ease of handling compared to a stationary generators. These generators can be moved easily from one place to another because they either are mounted on bases with wheels or have wheels attached to them. The expansion of the construction industry is expected to drive the demand for low-power gensets during the forecast period.

The earthmoving industry requires diesel generators to operate machinery on the construction site. Construction sites do not have a connection to the power grid and are required to generate power onsite to power the heavy machinery. Portable diesel generators with relatively low power ratings are used on construction sites as they are required to be often moved during or after construction from one site to another

Material handling equipment requires an uninterrupted power supply for hassle-free operation of the material handling facility. Material handling facilities use standby generators as a backup power source because the standby generator installed in the material handling facility immediately follows a utility outage and the automatic transfer switch detects the loss of power; quickly starts the generator and then switches the electrical load to the generator.

Generators play a significant role in the agricultural sector. Generators supply the energy required in a variety of circumstances to keep farms operating efficiently. Farms occasionally experience power outages that can last for days. However, the growing demand for agricultural produce at the global level is expected to foster the need for an uninterrupted power supply, thereby driving the demand for generator sets in coming years.

Application Insights

The application segment consists of stand-by, peak shaving, and prime or continuous power. In 2022, prime or continuous power dominated the application segment with a market share of 52.32% owing to the demand for continuous power requirement mining, marine, and military operations.

Standby load diesel generators are the most common type of generator sets and are used for emergency power during power failures. The demand for standby load generators is expected to increase over the forecast period owing to the increased adoption of power backup infrastructure in residential and commercial applications and an increase in demand from data centers to keep the computing infrastructure operational.

Peak shaving generators are used to cover a shortfall in electricity production. These types of generators are mostly used in power generation facilities such as solar power plants or wind farms. The demand for peak-shaving diesel generators is expected to be restrained as they are being replaced with energy storage systems (ESS) which can store the electricity generated to supply during peak demand.

End-use Insights

The industrial sector accounted for the largest market share of 35.62% in 2022 owing to the backup power source and for peak load applications in the utility, power generation, and oil & gas sectors. Low-power gen-sets are used in residential sector for stand-by application as a backup in emergencies and continuous power generation. The demand for residential generator sets is high in places with low infrastructure development. Generator sets are the only power generation source available and have extended operational time.

Generator sets are also used in various applications in commercial sectors such as IT & Telecom, Healthcare hospitality, and others to maintain interrupted power supply. Generator sets are used for continuous power supply to cell towers located in remote areas where there is no existing power grid infrastructure.

Portability Insights

The portable low generator sets dominated the portability segment with a market share of 74.08% in 2022. The rising adoption of portable generators in small shops and for outdoor events is gaining traction owing to the easy operation and ease of transportation. Further, an increasing number of construction projects is expected over the forecast period globally, which is likely to act as one of the key factors driving the demand for portable generators.

Stationary generating sets have gained momentum due to the high demand for uninterruptible power supply from residential, commercial, and industrial end-users. Further, areas prone to power cuts and areas experiencing natural calamities, such as cyclones and earthquakes, contribute to higher demand for stationary generator sets compared to areas with better power distribution infrastructure and areas that are less prone to natural calamities.

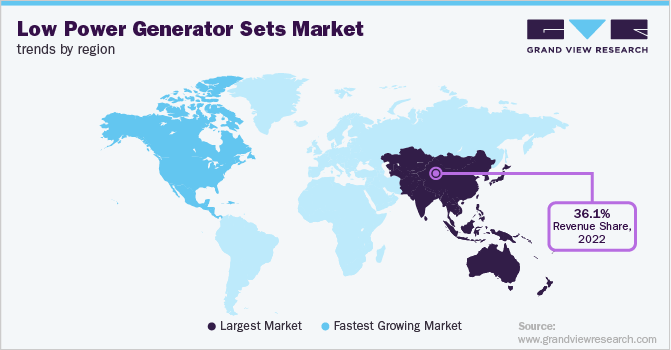

Regional Insights

Asia Pacific dominated the global market in 2022 and accounted for the largest revenue share of over 36.10%. The high growth of the industrial sector in India, China, South Korea, and Japan has triggered the demand for industrial diesel generators in the region. The development of oil & gas, heavy equipment, and process companies in China, owing to low labor and utility costs, has been one of the factors responsible for the penetration of the diesel generator market in the region. This is attributed to the fact that low-power gen-sets are used on a large scale in manufacturing facilities for backup operations.

North America is expected to witness a significant growth rate during the forecast period owing to the rising need for efficient backup power systems. The U.S. accounted for the largest share of the North America generator sets market anticipated to progress at the fastest growth rate over the forecast period. Canada is another important generator sets market in North America. This is attributed to the rising power demand; availability of shale gas reserves, the government's growing emphasis on the creation of clean energy sources, and the diesel generator sets the low total cost of ownership and operational advantages. These factors are expected to fuel the demand in North America over the forecast period.

Key Companies & Market Share Insights

The low-power generator sets industry is a highly competitive market owing to the presence of major industries across the region, as these companies are concentrated and highly competitive. Some of the prominent players operating in the global low-power generator sets market are:

-

Ashok Leyland

-

Atlas Copco AB

-

Caterpillar Inc.

-

Cooper Corporation

-

Cummins Inc.

-

Generac Holdings Inc.

-

General Electric

-

Kohler Co.

-

Mitsubishi Heavy Industries Ltd.

-

Wartsila Corporation

Low Power Generator Sets Market Report Scope

Report Attribute

Details

Market size revenue in 2023

USD35.35 billion

Revenue forecast in 2038

USD 128.58 billion

Growth rate

CAGR of 9.0% from 2023 to 2038

Base year for estimation

2022

Historical data

2020 - 2021

Forecast period

2023 - 2038

Quantitative units

Revenue in million/billion, Volume in units, and CAGR from 2023 to 2038

Report coverage

Revenue forecast, Volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Fuel type, power rating, application, end-use, industries, portability,50-150 kVAfuel type, 50-150 kVAapplication, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East; Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Spain; Italy; Portugal; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kenya; Angola

Key companies profiled

Atlas Copco AB; Caterpillar Inc.; Cummins Inc.; Generac Holdings Inc.; General Electric; AKSA Power Generation; Cooper Corporation; Kohler Co.; Mitsubishi Heavy Industries Ltd.; MTU Onsite Energy; Wartsila Corporation; Doosan Corporation; Ashok Leyland; Sunrise Power

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Low Power Generator Sets Market Segmentation

This report forecasts volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2038. For this study, Grand View Research has segmented the global low power generator sets market report based on fuel type, power rating, application, end-use, industries, portability, 50-150 kVA fuel type, 50-150 kVA application, and region:

-

Fuel Type Outlook (Volume, Units; Revenue, USD Million; 2020 - 2038)

-

Diesel

-

Gas

-

Hybrid (Hydrogen bases, CNG, LNG, Biofuels, And Others)

-

-

Power Rating Outlook (Volume, Units; Revenue, USD Million; 2020 - 2038)

-

0-50 kVA

-

50-150 kVA

-

151-350 kVA

-

-

Application Outlook (Volume, Units; Revenue, USD Million; 2020 - 2038)

-

Stand-by

-

Peak Shaving

-

Prime or Continuous Power

-

-

End-use Outlook (Volume, Units; Revenue, USD Million; 2020 - 2038)

-

Industrial

-

Utility

-

Power generation

-

Oil & Gas

-

-

Commercial

-

IT & Telecom

-

Healthcare

-

Others

-

-

Residential

-

-

Industries Outlook (Volume, Units; Revenue, USD Million; 2020 - 2038)

-

Construction

-

Earth Moving

-

Material Handling

-

Agri-machinery

-

Others

-

-

Portability Outlook (Volume, Units; Revenue, USD Million; 2020 - 2038)

-

Stationary

-

Portable

-

-

50-150 kVA Fuel Type Outlook (Revenue, USD Million; 2020 - 2038)

-

Diesel

-

Gas

-

Hybrid (Hydrogen bases, CNG, LNG, Biofuels, and Others)

-

-

50-150 kVA Application Outlook (Revenue, USD Million; 2020 - 2038)

-

Stand-by

-

Peak Shaving

-

Prime or Continuous Power

-

-

Regional Outlook (Volume, Units; Revenue, USD Million; 2020 - 2038)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

Portugal

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East

-

Saudi Arabia

-

UAE

-

-

Africa

-

South Africa

-

Kenya

-

Angola

-

-

Frequently Asked Questions About This Report

b. The Global Low Power Generator Sets Market size was estimated at USD 33.37 Billion in 2022 and is expected to reach 35.34 Billion in 2023

b. The Global Low Power Generator Sets Market is expected to witness a compound annual growth rate of 9.0% from 2023 to 2038 to reach USD 128.57 Billion by 2038

b. Diesel was the largest fuel type segment accounting for 89.55% of the total revenue in 2022 owing to its wide range of applications in industrial, residential, and commercial

b. Some of the key players operating in the Low Power Generator Sets Market include Atlas Copco AB, Caterpillar Inc., Cummins Inc. ,Generac Holdings Inc., General Electric, Cooper Corporation, Kohler Co., Mitsubishi Heavy Industries Ltd., Wartsila Corporation, and Ashok Leyland among others

b. Key factors driving the growth of the Low Power Generator Sets Market market includes increasing global energy requirements and ongoing economic growth in developing regions

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."