- Home

- »

- Medical Devices

- »

-

Lower Extremity Implants Market Size & Share Report, 2030GVR Report cover

![Lower Extremity Implants Market Size, Share & Trends Report]()

Lower Extremity Implants Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Knee, Hip), By Biomaterial (Metallic Biomaterials, Ceramic Biomaterials, Polymeric Biomaterials), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-398-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Lower Extremity Implants Market Trends

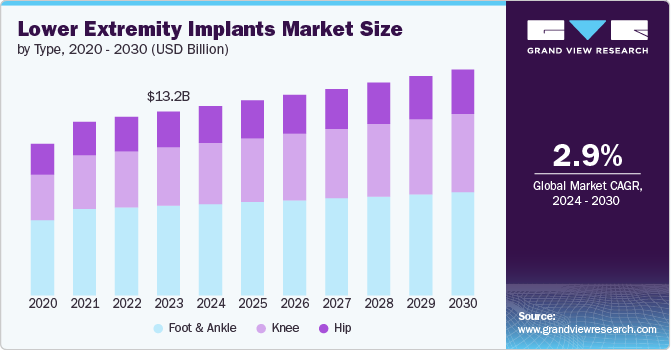

The global lower extremity implants market size was estimated at USD 13.2 billion in 2023 and is projected to grow at a CAGR of 2.96% from 2024 to 2030. The growing penetration of robots in orthopedic procedures is accelerating market growth. For instance, in July 2024, Care Hospitals in Visakhapatnam reported that they had successfully finished their first robotic knee-replacement surgery. The surgery employed the recently obtained Cuvis Robotic Joint Replacement System, a sophisticated robotic technology intended for aiding in knee replacement surgery.

Similarly, in May 2023, Think Surgical revealed that its small robotic system, TMINI, which is intended for orthopedic surgery, has received approval under FDA 510(k) for its compatibility with implants. The TMINI system is equipped with a wireless robotic handpiece, which improves surgical precision during total knee replacement surgeries.

In addition, the presence of advanced orthopedic implantable devices and the rapid development of healthcare infrastructure globally are expected to have a positive impact on market growth. The increasing awareness and availability of minimally invasive surgical techniques, which offer various benefits, are also key drivers of market growth. The increase in sports and physical activities is leading to a rise in sports-related injuries requiring medical attention, which is expected to further drive market development. According to the National Safety Council, in 2023, 3.7 million individuals received medical treatment in emergency departments for injuries related to sports and recreational equipment. The activities most linked to injuries include working out, riding bicycles, and playing basketball.

Growing prevalence of musculoskeletal disorders, reduced bone density, and weakened bones are driving market growth. As per the WHO report published in 2022, around 1.71 billion individuals globally are affected by musculoskeletal conditions. Similarly, according to a report released in 2023 by U.S. News & World Report L.P., osteoarthritis, a degenerative joint disease, impacts 15% of the worldwide population aged over 30. Therefore, by 2050, almost 1 billion people will be affected.Moreover, increasing demand for biocompatible implants with fewer toxic effects, the development of customized implants, and strong demand for technologically advanced prosthetics from end-users are compelling manufacturers to introduce innovative products.

The increasing elderly population is driving the need for orthopedic solutions on a global scale. With age, bones have a tendency to become weaker due to excessive bone mass loss, which is frequently observed between the ages of 25 and 54. Beyond the age of 55, the decline in bone density becomes even more notable, contributing to the expansion of the market. For instance, based on WHO estimates in October 2022, it is projected that by 2030, one-sixth of the global population will be 60 years old or older. The number of people aged 60 and above is expected to increase from 1 billion in 2020 to 1.4 billion in 2022. By 2050, the worldwide population of individuals aged 60 and over is anticipated to double to 2.1 billion.

The increasing need for orthopedic apps, platforms, and software solutions is also contributing to the growing demand, as these resources provide numerous advantages, including enhanced patient involvement, effective practice management, and improved clinical results. Furthermore, the growing requirement for advanced materials, such as metallic materials known for their strength and longevity, ceramic biomaterials valued for their high biocompatibility and resistance to wear, and polymeric biomaterials recognized for their flexibility and innovative characteristics, is propelling market expansion.

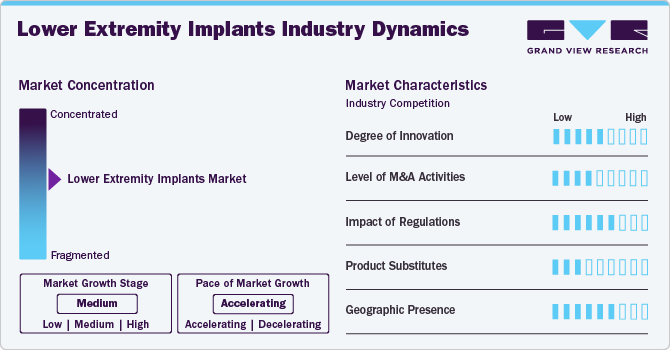

Market Concentration & Characteristics

The market has seen significant innovation in recent years, driven by advancements in materials, design, and surgical techniques. Innovations in materials, such as biocompatible metals and polymers, have improved the durability and functionality of implants, reduced the risk of complications and increased patient satisfaction. The integration of digital technologies, such as 3D printing, has enabled personalized implants that better fit individual anatomical structures, enhancing outcomes. In October 2023, Exactech received clearance from the U.S. Food and Drug Administration (FDA) for its new Vantage ankle 3D and 3D+ tibial implants, which are 3D-printed.

Regulations play a critical role in shaping the market, influencing product development, safety, and market access. Regulatory bodies, such as the FDA in the U.S. and the EMA in the European Union, set strict standards for designing, manufacturing, and clinically testing implants. These regulations ensure that products are safe, effective, and of high quality before they are available to patients.

Mergers and acquisitions in the global market occur at a moderate to high frequency, reflecting strategic consolidation among companies to broaden product offerings and expand market reach. For instance, in December 2023, Henry Schein is preparing to penetrate the global market. To implement this plan, the company has reached an agreement to purchase a controlling stake in TriMed, a developer of orthopedic solutions for the foot and ankle, as well as the hand and wrist markets.

In the market, product substitutes play a significant role by offering alternative treatment options to traditional surgical implants. These substitutes include physical therapy, orthotic devices, and injectable treatments such as hyaluronic acid or corticosteroids. They can provide pain relief and improve joint function without requiring surgery. In addition, advancements in regenerative medicine, such as stem cell therapy and platelet-rich plasma (PRP) injections, offer promising non-surgical alternatives for conditions like osteoarthritis and tendon injuries.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Rising research and development activities create more opportunities for market players to enter new regions. In February 2022, DePuy Synthes completed the acquisition of CrossRoads Extremity Systems, a company specializing in ankle and foot solutions based in Tennessee. This company offers a wide range of sterilized implants and instrumentation systems designed for specific procedures and cleared for use in lower extremity cases.

Type Insights

Based on type, the foot & ankle segment led the market with largest revenue share of 48.88% in 2023. The increasing prevalence of foot and ankle disorders, such as fractures, arthritis, and deformities, is driving market growth. According to an article published by Wolters Kluwer Health, Inc. in 2023, ankle fractures account for approximately 9% of all fractures and are the second most common type of fracture in the lower extremity. Similarly , in 2023, the NIH report indicated that the ankle joint is frequently injured and is a common type of fracture that orthopedic surgeons treat. Ankle fractures are estimated to occur at a rate of around 187 per 100,000 individuals annually. Furthermore, the growing awareness and acceptance of orthopedic solutions among patients and healthcare providers contributes to market expansion.

The knee segment is projected to grow at the fastest CAGR during the forecast period. Increasing incidence of knee osteoarthritis and related degenerative joint diseases are boosting segment growth. As the global population ages and obesity rates rise, the prevalence of these conditions has surged, leading to a higher demand for knee replacement surgeries. For instance , according to a report published by the Osteoarthritis (OA) Action Alliance, the annual incidence of knee OA is highest among individuals aged 55 to 64. Moreover, increasing product launches are fostering segmental growth. For instance, in October 2023, Medacta Group S.A. revealed the introduction of GMK SpheriKA, the femoral component optimized for Kinematic Alignment (KA) and the first of its kind globally approved for total knee replacement.

Biomaterial Insights

Based on biomaterial, the metallic biomaterials segment led the market with the largest revenue share of 40.84% in 2023. The materials, including titanium and cobalt-chromium alloys, are well-known for their high strength, durability, and biocompatibility. They are ideal for use in weight-bearing applications in the lower extremities. Increasing popularity of metallic biomaterials implants among the healthcare professionals are supplementing market growth. For instance, according to the MDPI report, most implants, around 70-80%, are composed of metallic biomaterials. The most frequently used metals for medical purposes are CoCrMo alloys, 316L stainless steel, Titanium, and its alloys such as NiTi and Ti6Al4V alloys. Moreover, advancements in metallurgical processes have significantly improved the quality and performance of metallic biomaterials. Innovations such as porous and surface-modified metals enhance Osseo integration, thereby escalating segmental growth.

The natural biomaterials segment is projected to grow at the fastest CAGR during the forecast period. Natural biomaterials such as collagen, hyaluronic acid, and other bio-derived substances are becoming more popular in the market for lower extremity implants. This growth is driven by the increasing preference for biocompatible and bioresorbable materials that reduce the risk of immune reactions and other complications associated with synthetic implants. For instance, according to the 2023 MDPI report, natural polymers were utilized as the initial biodegradable biomaterials in medical uses as a result of their enhanced biological performance, exceptional biodegradability, and extensive chemical adaptability compared to conventional synthetic materials.

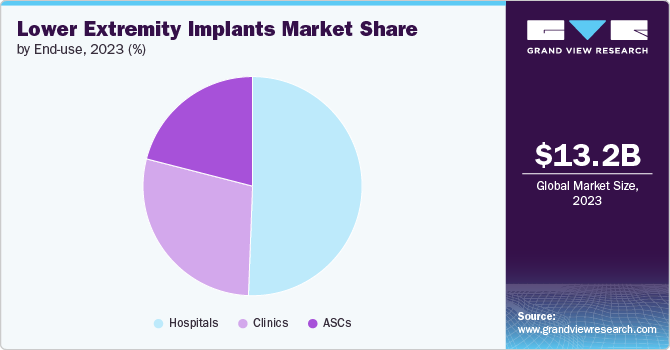

End-use Insights

Based on end use, the hospitals segment led the market with the largest revenue share of 50.56% in 2023. The rising hospital admissions for bone fractures and injuries from traffic accidents are expected to fuel market expansion. Furthermore, the favorable reimbursement policies for patients opting for hospital visits instead of outpatient facilities, along with a considerable number of hospitals and primary care centers in developed and developing countries, are crucial factors driving the high demand for hospital services. Moreover, rapid adoption of new technologies and surgical techniques, such as robotic-assisted surgery and computer-navigated systems in the hospitals are propelling market growth. In October 2020, Toronto hospital, Humber River Hospital conducted innovative, robot-assisted knee replacement surgeries using the Zimmer ROSA system.

The ASCs segment is expected to grow at a significant CAGR over the forecast period. ASCs provide benefits such as shorter wait times, rapid discharge, lower procedure costs, and increased efficiency. In addition, increasing demand for outpatient surgical procedures are driving segmental growth. Moreover, increasing number of ASCS across the globe is fostering market growth. For instance , according to the report released by IBISWorld, the number of Ambulatory Surgery Centers businesses in the U.S. has risen by 5% from 2022, reaching a total of 5,828 as of 2023.

Regional Insights

North America dominated the lower extremity implants market with the revenue share of 48.8% in 2023. The growth is attributed to the increasing demand for advanced healthcare services. Furthermore, the presence of major industry players, comprehensive reimbursement coverage, and well-established healthcare infrastructure are driving regional growth. Moreover, the growing number of middle-aged and elderly patients opting for orthopedic implantable devices, the increase in prevalence of low bone density, and the introduction of biodegradable implants and internal fixation devices are fostering market growth.

U.S. Lower Extremity Implants Market Trends

Thelower extremity implants market in U.S. held a significant share of North America market in 2023. Rising number of joint surgical procedures, advancing technological developments, and a high prevalence of orthopedic disorders are driving U.S. market growth. Furthermore, increasing product approval and launches are fostering market growth. In February 2021, a 3D-printed talus implant, Patient Specific Talus Spacer, received U.S. FDA approval for humanitarian use. It is the first implant of its kind worldwide to replace the talus for treating avascular necrosis (AVN) of the ankle joint.

TheCanada lower extremity implants market is anticipated to register at the fastest CAGR during the forecast period. Increasing product approval will boost market growth. In February 2024, Tyber Medical LLC, a manufacturer of orthopedic devices, was granted approval from Health Canada for its anatomical plating system. This system comprises a diverse selection of titanium and stainless-steel plates. Before this, the collection had been granted approval for FDA 510(k) in the U.S.

Europe Lower Extremity Implants Market Trends

The lower extremity implants market in Europeis anticipated to grow at a notable CAGR during the forecast period. Increasing healthcare spending coupled with surging number of geriatric people suffering from osteoporosis, osteoarthritis, obesity, and bone injuries are boosting market growth.As of January 2023, Eurostat reported that the population of the EU had reached 448.8 million, with 21.3% of the people aged 65 or older. The World Economic Forum report predicts that over 30% of the EU population will be 65 or older by 2100.

The UK lower extremity implants marketis one of the major markets in the region, experiencing notable growth due to the rising demand for orthopedic procedures, including the implantation of lower extremity devices. In addition, advancements in medical technology, such as minimally invasive surgical techniques and the development of biocompatible implant materials are fueling market growth.

The lower extremity implants market in Germany is anticipated to grow at a notable CAGR during the forecast period, propelled by an increasing orthopedic procedure. In addition, the high prevalence of chronic conditions affecting the joints, such as arthritis, contributes to the increasing demand for lower extremity implants. According to the 2024 report from the International Osteoporosis Foundation (IOF), nearly 5.6 million people in the country are affected by osteoporosis, with 4.5 million being women.

Asia Pacific Lower Extremity Implants Market Trends

The lower extremity implants marketinAsia Pacific is expected to register at a significant CAGR during the forecast period. The healthcare infrastructure is rapidly advancing in major countries like India, China, and Japan, fueling the need for orthopedic implants in the region. There is a growing demand for orthopedic implants due to the increasing number of orthopedic surgeries and the expanding medical tourism industry. The rising prevalence of chronic orthopedic conditions and improved diagnostic technologies are contributing to the growth in the number of orthopedic implant procedures in the region.

The China lower extremity implants market held the largest share of Asia Pacific in 2023.The country's large and aging population is fostering market growth.According to the WHO report, it is estimated that by 2040, the proportion of individuals aged 60 and above in China will increase to 28%, largely because of increased life expectancy and reduced fertility rates.

The lower extremity implants market in India is anticipated to register a considerable growth during the forecast period. Increasing adoption of robotic surgery will boost market growth. In April 2024 , in Kharadi, Manipal Hospital unveiled advanced robotic technology for orthopedic surgeries. The goal of this technology is to enhance knee replacement and joint treatments through robotic-assisted surgeries.

Latin America Lower Extremity Implants Market Trends

The lower extremity implants market in Latin America is anticipated to register at the fastest CAGR during the forecast period. Improving healthcare infrastructure and increasing awareness of advanced medical treatments are driving market growth. In addition, the rising prevalence of chronic conditions such as obesity and diabetes, which are associated with joint degeneration, are supplementing market growth.

The Brazil lower extremity implants marketis anticipated to register at a considerable CAGR during the forecast period. Increasing adoption of new technologies is anticipated to boost market growth in Brazil. In July 2021, Stryker introduced its Mako SmartRobotics for the Brazilian market. The Mako System, can conduct total knee, partial knee, and total hip replacements, making it the sole technology of its kind that can be utilized throughout the joint replacement service line.

MEA Lower Extremity Implants Market Trends

The lower extremity implants market in MEA is expected to grow at the fastest CAGR during the forecast period. Growing awareness of orthopedic health and an increasing incidence of lifestyle-related conditions such as obesity and diabetes are escalating market growth. Furthermore, increasing sports related injuries is supplementing market growth.

Key Lower Extremity Implants Company Insights

The competitive scenario in the global market is highly competitive, with key players such as Stryker, Johnson & Johnson (DePuy Synthes), Zimmer Biomet, and Smith + Nephew holding significant positions. The major companies are undertaking various strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Lower Extremity Implants Companies:

The following are the leading companies in the lower extremity implants market. These companies collectively hold the largest market share and dictate industry trends.

- Stryker

- Johnson & Johnson (DePuy Synthes)

- Zimmer Biomet

- Smith + Nephew

- Össur

- DJO Global

- Acumed, LLC

- Arthrex, Inc.

- CONMED

- Orthofix

Recent Developments:

-

In February 2024, Restor3d, Inc, a company that offers tailored musculoskeletal implants, introduced its 3D printed foot and ankle products at the American College of Foot & Ankle Surgeons (ACFAS) Annual Conference in Tampa, Florida.

-

In February 2024, The Asian Orthopaedic Institute (AOI) at SIMS Hospital in Chennai has launched a new ceramic knee replacement system.

-

In January 2024, Extremity Medical LLC, an innovative medical engineering company, announced a strategic collaboration with Henry Schein, Inc. Through this partnership, Extremity Medical will expand the accessibility of its advanced orthopedic extremity implant systems to a worldwide patient population.

-

In October 2023, DePuy Synthes obtained 510(k) clearance from the U.S. FDA for its TriLEAP Lower Extremity Anatomic Plating System. The TriLEAP System offers a variety of traditional and contoured plates designed to accommodate multiple screw diameters, along with tools for use in bone and bone fragment reduction, internal fusion, and fixation.

Lower Extremity Implant Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.64 billion

Revenue forecast in 2030

USD 16.25 billion

Growth rate

CAGR of 2.96% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, biomaterial, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Stryker, Johnson & Johnson (DePuy Synthes); Zimmer Biomet; Smith + Nephew; Össur, DJO Global; Acumed, LLC; Arthrex, Inc.; CONMED; Orthofix

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lower Extremity Implants Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lower extremity implants market report based on type, biomaterial, end-use and region:

-

Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Knee

-

Hip

-

Foot & Ankle

-

-

Biomaterial Outlook (Revenue, USD Million; 2018 - 2030)

-

Metallic Biomaterials

-

Ceramic Biomaterials

-

Polymeric Biomaterials

-

Natural Biomaterials

-

-

End-use Outlook (Revenue, USD Million; 2018 - 2030)

-

Hospitals

-

ASCs

-

Clinics

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global lower extremity implants market size was estimated at USD 13.2 billion in 2023 and is expected to reach USD 13.64 billion in 2024.

b. The global lower extremity implants market is expected to grow at a compound annual growth rate of 2.96% from 2024 to 2030 to reach USD 16.25 billion by 2030.

b. The foot & ankle segment held the largest share of 48.9% in 2023. The increasing prevalence of foot and ankle disorders, such as fractures, arthritis, and deformities, is driving market growth.

b. Some of the key players are Stryker, Johnson & Johnson (DePuySynthes), Zimmer Biomet, Smith + Nephew, Össur, DJO Global, Acumed, LLC, Arthrex, Inc., CONMED, Orthofix.

b. The growing penetration of robots in orthopedic procedures is accelerating market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.