- Home

- »

- Biotechnology

- »

-

Polymeric Biomaterials Market Size And Share Report, 2030GVR Report cover

![Polymeric Biomaterials Market Size, Share & Trends Report]()

Polymeric Biomaterials Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Polylactic Acid (PLA), Polyglycolic Acid (PGA), Polyurethane), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-088-6

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polymeric Biomaterials Market Size & Trends

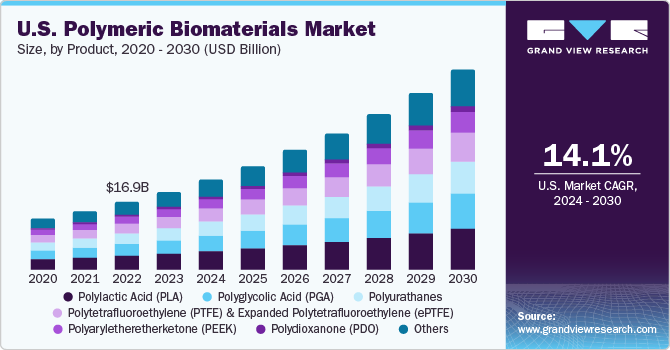

The global polymeric biomaterials market size was estimated at USD 51.13 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 16.54% from 2024 to 2030. Major factors driving market expansion include frequent innovations in polymeric biomaterials, growing applications of polymeric biomaterials in tissue engineering, a rising prevalence of chronic diseases, and a growing requirement for polymeric biomaterials in surgeries.

The COVID-19 pandemic adversely impacted the market owing to several lockdown hindrances in supply chain operations, and decreased clinical research activities. Despite these challenges, the market is expected to witness strong growth prospects in the long term due to an increasing adoption of polymeric biomaterials for devising new therapeutic strategies for COVID-19 treatment. For instance, according to an article published in the Emergent Materials Journal in April 2021, biomaterial substances were studied for the controlled delivery of drugs, such as interleukin 6 (IL-6) inhibitors, for COVID-19 treatment. As a result, with increasing demand for novel therapeutics for COVID-19, the market is expected to witness significant growth in the coming years.

Technologically advanced polymeric biomaterials are offering a promising solution to challenges faced by autologous or allograft-based treatments, such as shortage of donors, possible immune rejection, and size or modality mismatches. Polymeric artificial constructs that mimic structural and functional properties of the extracellular matrix show application in promoting cell growth. Moreover, several advanced polymeric substances are also being introduced to complement existing implant solutions and to improve their efficiency. For instance, in March 2022, Evonik expanded its offerings for 3D-printable biomaterials with the launch of its osteoconductive VESTAKEEP iC4800 3DF PEEK filament, which can improve the fusion between implants and bone. Such innovations are expected to expand the growth prospects for the polymeric biomaterial market.

According to the White House in September 2022, the Department of Energy had plans to announce USD 178 million for the advancement of innovative research in the area of bioproducts, biomaterials, and biotechnology. Increasing government support through funding and initiatives also contributes extensively to market growth. Additionally, increasing demand for biomaterials in several healthcare areas, for instance, 3D printing in medicine, tissue engineering, implants, biotechnology, diagnostic systems, nanomaterials, and bioimaging is anticipated to aid market expansion.

Market Dynamics

In the past few years, extensive investments in research and development (R&D) activities have greatly enhanced the reliability and safety of polymeric biomaterials. These advances have created a wide range of applications for biomaterials in implants and tissue scaffolds, especially in areas such as tissue regeneration and cartilage repair. However, the traditional approach of implanting cell-laden biomimetic constructs through open surgeries can result in severe inflammation at the incision site. To address this issue, there is a growing demand for minimally invasive cell delivery systems, particularly in the regenerative medicine field. Injectable hydrogels that are based on polymeric biomaterials have been considered to be a promising solution in this regard. These biomaterials possess the ability to undergo a flexible sol-gel transition and adaptively fill defects, enabling minimally invasive interventions.

Several synthetic polymers, such as Poly (lactic-co-glycolic acid) (PLGA), Polyethylene Glycol (PEG), and Polycaprolactone (PCL), are widely utilized in cell delivery applications. Similarly, composite hydrogels incorporating inorganic constructs have also been investigated for their potential to facilitate minimally invasive cell delivery for tissue repair purposes. Moreover, the utilization of polymeric biomaterials as tissue scaffolds is witnessing an upward trend. These scaffolds serve as temporary frameworks that support cell adhesion, cell proliferation, and tissue development. They can also be customized to possess specific characteristics like porosity, mechanical properties, and degradation rates, enabling them to effectively guide tissue growth and eventual substitution with natural tissue.

Product Insights

Based on product, the market is segmented into Polylactic Acid (PLA), Polyglycolic Acid (PGA), Polyurethanes, Polytetrafluoroethylene (PTFE) & expanded polytetrafluoroethylene (ePTFE), Polyaryletheretherketone (PEEK), Polydioxanone (PDO), and others. The polylactic acid (PLA) segment dominated the market with a revenue share of 20.85% in 2023. The growth is attributed to the extensive application of PLA with fixation devices, such as dissolvable suture meshes and resorbable plates & screws, owing to the increasing preference for PLA over metallic implants. Furthermore, homopolymers in the PLA family, such as Poly-L-Lactic Acid (PLLA), have been widely studied to harness their mechanical properties and tailorable biodegradability.

The Polytetrafluoroethylene (PTFE) and expanded polytetrafluoroethylene (ePTFE) segment is anticipated to showcase the fastest CAGR of 21.79% from 2024 to 2030. The rising demand for the treatment of non-self-containing bone defects and multi-walled defects in vertical augmentations is driving demand for polymeric biomaterials. Moreover, metallic stents for palliative treatment of unresectable malignant esophageal strictures are coated with PTFE introducer sheaths, which also contribute to its growth.

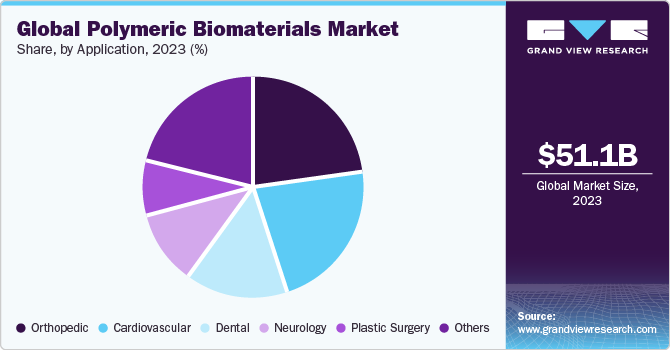

Application Insights

Based on application, the market is segmented into plastic surgery, dental, neurology, cardiovascular, orthopedic, and others. The orthopedic segment dominated the market with a revenue share of 23.49% in 2023. The segment growth is attributed to the growing incidence of orthopedic diseases. As per Southeast Orthopedic Specialists, incidences arising due to orthopedic conditions are anticipated to rise in the U.S., aided by the growing geriatric population. As of June 2023, approximately 45 million adults who were 65 years of age and older were living in the country. This number is expected to rise to around 98 million by 2060. Additionally, osteoarthritis impacts 33.3% of the elderly population each year. Thus, the increasing incidence rates of such disorders are encouraging scientists to discover novel and more effective treatment options that are based on polymeric biomaterials.

The plastic surgery segment is anticipated to witness the fastest CAGR of 21.37% from 2024 to 2030. The strong segment growth is on account of its extensive adoption in rhinoplasty, breast augmentation, and face lifts. A survey conducted by the International Society of Aesthetic Plastic Surgery found that approximately 365,000 breast augmentation surgeries were performed in 2021, which was a jump of 44% from the previous year. Moreover, around 148,000 women underwent implant replacement and implant removal surgeries in 2021.

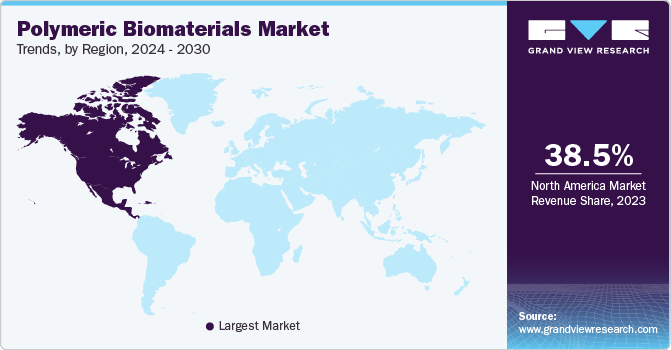

Regional Insights

North America held the largest market share of 38.49% in 2023. The large share of this region is due to a rise in the number of surgical procedures for orthopedic injuries and cosmetic surgeries and the need for sustainable biomaterials in this region. Moreover, the presence of major market players involved in the manufacturing and development of innovative solutions for reconstructive surgical procedures is positively impacting the market. In addition, homegrown companies form strategic partnerships with each other as well as foreign-established enterprises to enhance their presence in the medical implants market, which in turn is expected to boost market growth in the coming years.

Asia Pacific is anticipated to showcase the fastest CAGR of 21.41% from 2024 to 2030. The regional growth is expected to be aided by an increasing demand for dental implants and a rising geriatric population. As per the Ministry of Health and Family Welfare, more than 60% of Indians presently suffer from dental cavities, while over 85% experience periodontal disorders. Moreover, oral cancer is considered to be an important health issue in India. Thus, an increasing prevalence of such conditions is expected to drive the regional market growth.

Key Companies & Market Share Insights

The increasing demand for polymeric biomaterial for various applications has resulted in numerous market opportunities for key players to capitalize on. Major players are adopting various strategies such as acquisitions, mergers, and collaborations to expand their market share.

Key Polymeric Biomaterials Companies:

- Stryker

- BASF SE

- Evonik Industries AG

- DSM

- Bezwada Biomedical, LLC

- Corbion

- Victrex plc (Invibio Ltd.)

- International Polymer Engineering

- Covalon Technologies Ltd.

- Medtronic

- Abbott

- Elixir Medical

- REVA Medical, LLC

- Meril Life Sciences Pvt. Ltd.

- MicroPort Scientific Corporation

Recent Developments

-

In March 2023, Invibio Ltd launched its PEEK-OPTIMA AM filament, which has been optimized for additive manufacturing for medical devices.

-

In February 2023, Victrex plc (Invibio Ltd.)expanded Invibio’s medical R&D and manufacturing capabilities by announcing the opening of a new product development facility in Leeds, UK.

-

In January 2023, MicroPort Scientific Corporation received marketing approval for its Firehawk Liberty Rapamycin Target Eluting Coronary Stent System in Russia.

Polymeric Biomaterials Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 59.42 billion

Revenue forecast in 2030

USD 148.87 billion

Growth rate

CAGR of 16.54% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report Updated

November 2023

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia;UAE; Kuwait

Key companies profiled

Stryker; BASF SE; Evonik Industries AG; DSM; Bezwada Biomedical, LLC; Corbion; Victrex plc (Invibio Ltd.); International Polymer Engineering; Covalon Technologies Ltd.; Medtronic; Abbott; Elixir Medical; REVA Medical, LLC; Meril Life Sciences Pvt. Ltd.; MicroPort Scientific Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polymeric Biomaterials Market Report Segmentation

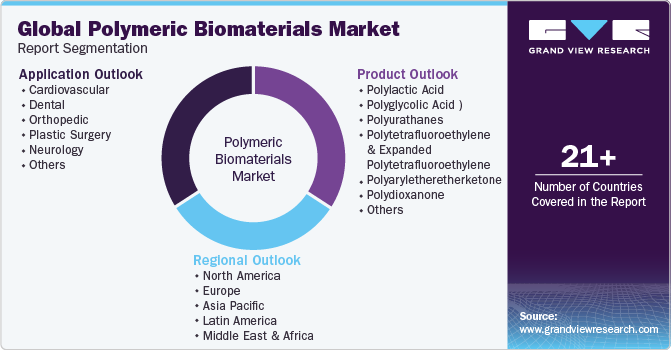

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polymeric biomaterials market report based on product, application, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Polylactic Acid (PLA)

-

Polyglycolic Acid (PGA)

-

Polyurethanes

-

Polytetrafluoroethylene (PTFE) & Expanded Polytetrafluoroethylene (ePTFE)

-

Polyaryletheretherketone (PEEK)

-

Polydioxanone (PDO)

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cardiovascular

-

Bioresorbable Stents

-

Vascular Grafts

-

Sensors

-

Guidewires

-

Implantable Cardiac Defibrillators

-

Pacemakers

-

Others

-

-

Dental

-

Tissue Regeneration Materials

-

Dental Implants

-

Bone Grafts & Substitutes

-

Dental Membranes

-

Dental Sutures

-

Others

-

-

Orthopedic

-

Joint Replacement Polymeric Biomaterials

-

Tissue Fixation Products

-

Suture Anchors

-

Others

-

-

Orthobiologics

-

Viscosupplementation

-

Spine Biomaterials

-

Others

-

-

Plastic Surgery

-

Facial Wrinkle Treatment

-

Soft Tissue Fillers

-

Craniofacial Surgery

-

Sutures

-

Others

-

-

Bioengineered Skins

-

Peripheral Nerve Repair

-

Acellular Dermal Matrices

-

Others

-

-

Neurology

-

Neural Stem Cell Encapsulation

-

Shunting Systems

-

Hydrogel Scaffold For CNS Repair

-

Cortical Neural Prosthetics

-

Others

-

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global polymeric biomaterials market accounted for USD 51.13 billion in 2023 and is expected reach USD 59.42 billion in 2024

b. The global polymeric biomaterials market is expected to grow at a CAGR of 16.54% from 2024 to 2030 to reach USD 148.87 billion by 2030

b. Based on the product, the Polylactic Acid (PLA) segment held the largest market share in 2023. The segment growth is attributed to the wide application of several types of PLA blends in the field of drug delivery, manufacturing of implants & sutures, and tissue engineering applications.

b. Some of the key players in the global polymeric biomaterials market include Stryker, BASF SE, Evonik Industries AG, DSM, Bezwada Biomedical, LLC, Corbion, Victrex plc (Invibio Ltd.), International Polymer Engineering, Covalon Technologies Ltd., and Medtronic.

b. The major factors driving the market are innovations in polymeric biomaterials, increasing applications of polymeric biomaterials in tissue engineering, and the rising prevalence of chronic diseases, along with the growing need for polymeric biomaterials in surgical procedures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.