- Home

- »

- Distribution & Utilities

- »

-

LPG Tankers Market Size & Share, Industry Report, 2030GVR Report cover

![LPG Tankers Market Size, Share & Trends Report]()

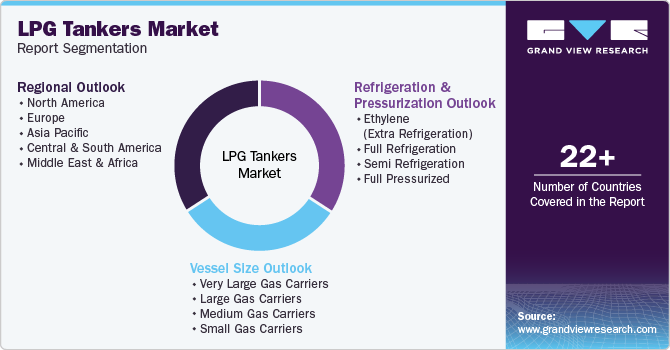

LPG Tankers Market (2025 - 2030) Size, Share & Trends Analysis Report By Vessel Size (Large, Medium, Small), By Refrigeration & Pressurization (Ethylene, Full Refrigeration, Semi Refrigeration, Full pressurized), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-034-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

LPG Tankers Market Summary

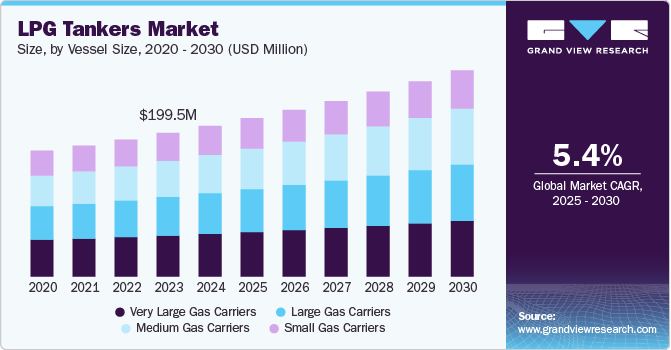

The global LPG tankers market size was estimated at USD 209.41 million in 2024 and is projected to reach USD 286.48 million by 2030, growing at a CAGR of 5.4% from 2025 to 2030. A strong rise in shale gas production is likely to propel the market growth over the coming years.

Key Market Trends & Insights

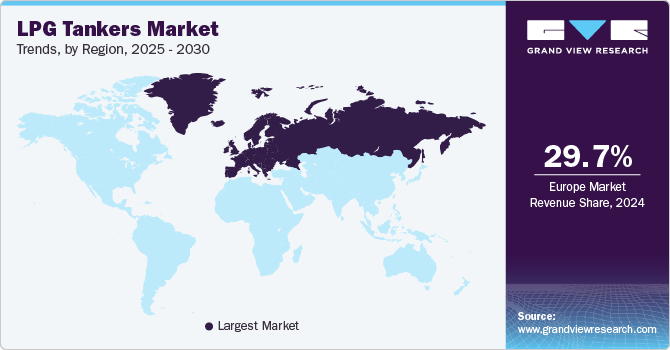

- The Europe LPG tankers market dominated globally in 2024 and accounted for the largest revenue share of over 29.72%.

- Russia led the Europe regional market in 2024 in terms of revenue.

- Based on vessel size, very large gas carriers dominated the market, with the largest revenue share of 28.35% in 2024.

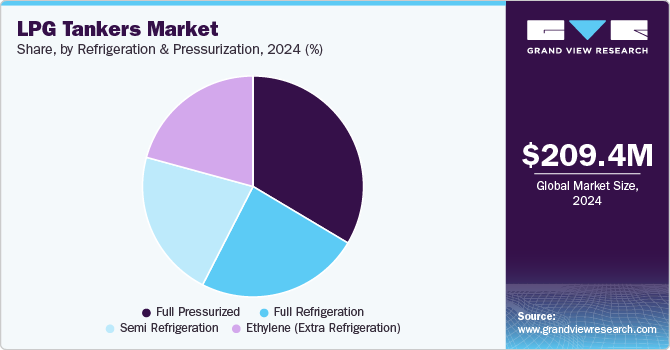

- In terms of refrigeration & pressurization, the full pressurized segment held the market with the largest revenue share of 23.99% in 2024.

- On the basis of refrigeration & pressurization, the semi-refrigerated segment is expected to grow at a steady CAGR over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 209.41 million

- 2030 Projected Market Size: USD 286.48 million

- CAGR (2025-2030): 5.4%

- Europe: Largest market in 2024

Crude oil price volatility, coupled with developments in hydraulic fracturing and horizontal drilling methods resulted in major companies shifting their attention towards the production of oil and gas from shale rock. Change in focus on the production of shale gas is further projected to enhance market growth over the estimated period.

The growing trade relationships between the U.S. and the APAC region for shale gas, owing to the reduced cost of transportation, are likely to outgrow the demand for liquified petroleum gas (LPG) tankers over the forecast period.

Instability in crude oil prices caused an increasing demand for liquefied petroleum gas from petrochemical industries, which is likely to fuel demand for liquefied petroleum gas tankers over the estimated period. However, volatile crude oil prices resulted in amplified prices of LPG, resulting in weaker demand, which is projected to hinder market growth over the projected period.

Drivers, Opportunities & Restraints

The growth of the LPG tanker industry is primarily driven by the increasing demand for liquefied petroleum gas (LPG) in emerging economies, particularly in the Asia-Pacific region. This demand surge is fueled by government initiatives aimed at expanding access to clean cooking fuels and urbanization trends that elevate energy consumption. In addition, the rise in shale gas production has enhanced global LPG trading, creating a need for efficient transportation solutions. The development of trade relationships between major LPG-producing regions and countries, such as the U.S. and those in Asia, further supports market expansion as companies seek reliable logistics to meet rising consumption levels.

Technological advancements in shipbuilding and safety regulations also open avenues for innovation, enabling operators to reduce costs while improving operational efficiency. Furthermore, the ongoing shift towards using LPG as a cleaner alternative to traditional fuels enhances market potential, positioning LPG tankers as essential components in the global energy supply chain.

The LPG tanker market faces several significant restraints that could hinder its growth. One major challenge is the stringent regulatory environment, which imposes high compliance costs related to safety and environmental standards, compelling companies to invest heavily in safety equipment, maintenance, and training. This can be particularly burdensome for smaller operators who may struggle with the financial implications of these regulations.

Vessel Size Insights

Based on vessel size, very large gas carriers dominated the market, with the largest revenue share of 28.35% in 2024. Very large gas carriers are widely used for the transportation of LPG for longer distances across various countries. Growing LPG trade relationships between countries, such as the Middle East and Asian countries, Western Africa and Europe, and the United States, is the major factor boosting the segment growth. However, the LGC is anticipated to take over the forecast period by a small margin. Large gas carriers also have a significant share in the global market.

In addition, the ongoing trade relationships between major LPG-producing nations and growing investments in shipbuilding technology are expected to further enhance the market's expansion. With a focus on environmental sustainability and innovations in carrier design, the VLGC market is well-positioned to capitalize on the rising global energy demands and shifting fuel preferences.

Refrigeration & Pressurization Insights

Based on refrigeration & pressurization, the full pressurized segment held the market with the largest revenue share of 23.99% in 2024. The full pressurized segment will maintain its lead throughout the forecast period. The market is anticipated to have steady growth in all segments as the amount of LPG transported increases. Fully refrigerated types are VLGCs that are capable of transporting 15,000 m3 to 85,000 m3 of gas and are suitable for long distances. Vessels used in such ships are proficient in bearing a minimum working temperature of -500 C and a maximum working pressure of around 0.28 kg/cm2. Carriers for ethylene are observed as a discrete segment in the industry since they need extra refrigeration for safe transportation across the world.

The semi-refrigerated segment is expected to grow at a steady CAGR over the forecast period. These vessels are similar to full-pressure vessels as they have a Type C tank. In this case, the pressure vessel is usually rated for a maximum working pressure of 57 bars. The size of the ship is up to 7,500 m3, and is mainly used for transporting liquid gas. Decompression can reduce the thickness of the tank compared to a fully pressurized container but at the expense of additional freezing systems and tank insulation. The tanks of these ships are made of steel that can withstand temperatures of up to 10 °C and can be cylindrical, conical, or spherical. A small ship carrier is generally the full-pressure type. The semi-refrigerated techniques are used for the shipment spaces around 7,500m3.

Regional Insights

The North America LPG tankers market is driven by several key factors, notably the region's abundant shale gas reserves, which significantly bolster LPG production and exports. As one of the top exporters of LPG globally, North America benefits from increasing domestic and international demand for liquefied petroleum gas, particularly for residential heating and cooking applications.

U.S. LPG Tankers Market Trends

The LPG tankers market in the U.S. is driven by the growing trend towards cleaner energy sources that further enhance the appeal of LPG as an alternative fuel, contributing to its rising consumption in the U.S. In addition, the establishment of strong trade relationships with countries in Asia and Europe facilitates ongoing export opportunities, thereby stimulating the need for efficient LPG transportation solutions. These dynamics collectively position the North American LPG tanker industry for sustained growth in the coming years.

Europe LPG Tankers Market Trends

Europe LPG tankers market dominated globally in 2024 and accounted for the largest revenue share of over 29.72%. Russia led the Europe regional market in 2024 in terms of revenue. The market in Europe is primarily driven by a rise in the demand for LPG due to government initiatives and low domestic production for LPG, which leads to higher demand for LPG tankers to facilitate import. North America, the Middle East, and Western Africa are the key regional markets for LPG tankers on account of the growing exports of liquefied petroleum gas to regions, such as Europe and the Asia Pacific. North America is one of the top exporters of LPG in the world, after Qatar and Australia. The presence of abundant proven reserves of shale gas in the region drives the market.

The LPG tankers market in Europe is primarily driven by a significant increase in demand for liquefied petroleum gas, largely fueled by government initiatives aimed at promoting cleaner energy sources and reducing reliance on fossil fuels. With many European countries facing low domestic LPG production, the need for imports has surged, leading to heightened demand for LPG tankers to facilitate this trade. In addition, the region's focus on technological advancements and innovative shipping solutions supports the expansion of the market.

The LPG tankers market in Russia is characterized by its significant role as a key player in the European LPG supply chain, driven by the country's substantial liquefied petroleum gas production capabilities. Russia's strategic position allows it to serve as a major exporter of LPG, particularly to European markets, where demand is rising due to government initiatives promoting cleaner energy sources and limited domestic production. However, the market faces challenges, including geopolitical tensions and economic sanctions that have affected trade dynamics and investment flows.

The LPG tankers market in Italy is influenced by several dynamic factors, primarily driven by the country's increasing reliance on liquefied petroleum gas as a cleaner energy source. As Italy's domestic LPG production is limited, the nation heavily depends on imports to meet its energy needs, which significantly boosts demand for LPG tankers.

Asia Pacific LPG Tankers Market Trends

The LPG tankers market in the Asia-Pacific region is experiencing significant growth, driven by rapid industrialization and urbanization in developing countries such as China, India, and Japan. As these nations increasingly rely on liquefied petroleum gas for residential, industrial, and transportation needs, the demand for LPG tankers has surged. The absence of extensive gas pipeline networks in the region necessitates the importation of LPG via maritime routes, further fueling the need for efficient tanker solutions.

The LPG tankers market in China is a crucial segment of the broader Asia-Pacific LPG industry, characterized by rapid growth driven by the country's increasing demand for liquefied petroleum gas. As one of the largest consumers and importers of LPG, China relies heavily on maritime transportation to meet its energy needs, given the lack of extensive pipeline infrastructure. The market is supported by robust domestic production and a thriving petrochemical sector, which further stimulates demand for LPG tankers.

The LPG tankers market in Japan is driven by the country's increasing reliance on liquefied petroleum gas as a key energy source, particularly due to its limited domestic natural gas production. As Japan seeks to diversify its energy portfolio and reduce carbon emissions, LPG has emerged as a cleaner alternative for heating, cooking, and industrial applications. The absence of extensive pipeline infrastructure necessitates the import of LPG via maritime routes, creating a robust demand for LPG tankers.

Central & South America LPG Tankers Market Trends

The LPG tankers market in Central and South America is driven by the combination of rising consumption and infrastructural developments. The establishment of trade agreements with major LPG-producing nations is facilitating imports, thereby enhancing regional supply chains. However, challenges such as fluctuating global LPG prices and competition from alternative energy sources may impact market stability.

Middle East & Africa LPG Tankers Market Trends

The LPG tankers market in the Middle East and Africa is experiencing significant trends driven by increasing demand for liquefied petroleum gas as a cleaner energy source. In the Middle East, countries like Saudi Arabia are leveraging their substantial reserves of crude oil and natural gas to boost LPG production, with major companies such as Saudi Aramco leading the way. This growth is supported by rising domestic consumption and export opportunities, particularly to neighboring regions.

Key LPG Tankers Company Insights

The LPG tankers industry is characterized by a competitive landscape featuring several key players that dominate the industry. Major companies include Samsung Heavy Industries, Mitsubishi Heavy Industries, HD Hyundai Heavy Industries, Hanwha Ocean, and Mitsui OSK Lines, which are recognized for their advanced shipbuilding capabilities and significant market shares.

Key LPG Tankers Companies:

The following are the leading companies in the LPG tankers market. These companies collectively hold the largest market share and dictate industry trends.

- BW Group

- Dorian LPG Ltd.

- EXMAR

- Hyundai Heavy Industries Co., Ltd

- Kawasaki Heavy Industries, Ltd

- Mitsubishi Heavy Industries, Ltd.

- Namura Shipbuilding Co., Ltd.

- PT Pertamina (Persero)

- StealthGas Inc.

- The Great Eastern Shipping Co. Ltd.

Recent Developments

-

In October 2024, Hyundai Mipo secured a contract to build two LPG carriers, each with a capacity of 45,000 cubic meters, for a shipowner based in Oceania. The deal, valued at $164 million, includes scheduled deliveries in the latter half of 2027.

-

In July 2024, PT Pertamina International Shipping (PIS) entered into a new partnership with global commodity trader BGN to enhance its fleet of large LPG tankers. This collaboration focuses on the joint development and operation of new vessels specifically designed for transporting liquefied petroleum gas.

LPG Tankers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 220.03 million

Revenue forecast in 2030

USD 286.48 million

Growth rate

CAGR of 5.4% from 2025 to 2030

Historical data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Vessel size, refrigeration & pressurization, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Russia; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

StealthGas Inc.; Dorian LPG Ltd.; BW Group; Hyundai Heavy Industries Co., Ltd.; Kawasaki Heavy Industries, Ltd; Mitsubishi Heavy Industries, Ltd.; EXMAR, PT Pertamina (Persero); The Great Eastern Shipping Co. Ltd.; Namura Shipbuilding Co., Ltd.; Kuwait Oil Tanker Co. S.A.K.; DAE SUN Shipbuilding and Engineering Co. Ltd.; STX Corp.; Teekay Corp.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global LPG Tankers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global LPG tankers market report based on vessel size, refrigeration & pressurization, and region:

-

Vessel Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Very Large Gas Carriers

-

Large Gas Carriers

-

Medium Gas Carriers

-

Small Gas Carriers

-

-

Refrigeration & Pressurization Outlook (Revenue, USD Million, 2018 - 2030)

-

Ethylene (Extra refrigeration)

-

Full refrigeration

-

Semi refrigeration

-

Full pressurized

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global LPG tanker market size was estimated at USD 209.41 million in 2024 and is expected to reach USD 220.03 million in 2025.

b. The global LPG tanker market is expected to grow at a compounded annual growth rate of 5.4% from 2025 to 2030 to reach USD 286.48 million by 2030.

b. Europe dominated the LPG tanker market with the highest share of 29.72% in 2024. Strong growth in shale gas production is further likely to propel the LPG tanker market demand over the upcoming years.

b. Some key players operating in the LPG tanker market include StealthGas Inc., Dorian LPG Ltd., BW Group, Hyundai Heavy Industries Co., Ltd., Kawasaki Heavy Industries, Ltd., MITSUBISHI HEAVY INDUSTRIES, LTD., The Great Eastern Shipping Co. Ltd., Kuwait Oil Tanker Company, DAE Sun Shipbuilding, and Engineering Co.

b. Growing trade relations and increasing shale gas extraction are some of the prominent factors which are expected to drive the growth of the LPG Tanker Market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.