- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

LTCC And HTCC Market Size & Share, Industry Report 2030GVR Report cover

![LTCC And HTCC Market Size, Share & Trends Report]()

LTCC And HTCC Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (LTCC, HTCC), By Application (Automotive, Telecommunication, Aerospace & Defense, Consumer Electronics), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-592-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

LTCC And HTCC Market Summary

The global LTCC and HTCC market size was estimated at USD 3.33 billion in 2024 and is projected to reach USD 4.63 billion by 2030, growing at a CAGR of 5.8% from 2025 to 2030. This growth is attributed to the increasing demand for automotive electronics, particularly for advanced driver assistance systems and safety features.

Key Market Trends & Insights

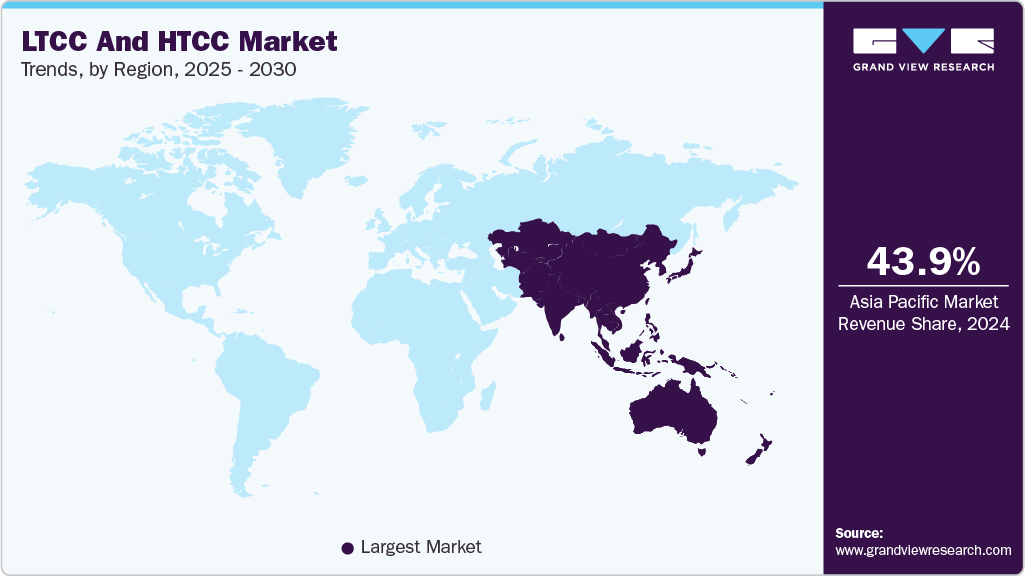

- The LTCC and HTCC market in the Asia Pacific dominated the market and accounted for the largest revenue share of 43.9% in 2024.

- China LTCC and HTCC market led the Asia Pacific market and accounted for the largest revenue share in 2024

- By type, LTCC (Low-Temperature Co-fired Ceramic) type dominated the market and accounted for the largest revenue share of 73.3% in 2024.

- By application, the telecommunications application segment dominated the market and accounted for the largest revenue share of 32.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.33 Billion

- 2030 Projected Market Size: USD 4.63 Billion

- CAGR (2025-2030): 5.8%

- Asia Pacific: Largest market in 2024

In addition, rising investments in wireless communication technologies, including 5G, also enhance the need for high-performance ceramic substrates. Furthermore, the trend towards miniaturization in electronics and the need for efficient thermal management further propels the adoption of LTCC (Low-Temperature Co-fired Ceramic) and HTCC (High-Temperature Co-fired Ceramic) across various industries, including telecommunications and aerospace.LTCC and HTCC are innovative ceramic technologies that play a crucial role in the microelectronics industry, particularly for applications requiring compact and high-performance electronic components. Both types of co-fired ceramics involve firing a ceramic substrate along with conductive, resistive, and dielectric materials in a kiln, but they operate at different temperature ranges-LTCC at temperatures below 900°C and HTCC above 1600°C. This distinction allows LTCC to integrate sensitive components, while HTCC offers enhanced durability and thermal performance.

The growing demand for miniaturized electronics is a significant driver of market growth for LTCC and HTCC substrates. Industries such as automotive, telecommunications, and consumer electronics are increasingly adopting these substrates to meet the consumer preference for smaller, lightweight devices without compromising performance. In the automotive sector, the integration of advanced electronics for safety features, connectivity, and autonomous functionalities has led to a heightened demand for reliable substrates such as LTCC and HTCC. These technologies provide exceptional thermal conductivity and mechanical strength, making them ideal for rigorous automotive applications.

Furthermore, the rising investments in wireless communication technology and the increasing penetration of electronics in vehicles are expected to further propel market growth. Applications of LTCC and HTCC include capacitors, inductors, transformers, and hybrid circuits, which are essential in military electronics, Micro Electromechanical Systems (MEMS), microprocessors, and RF applications. As industries continue to evolve towards more sophisticated electronic solutions, the relevance of LTCC and HTCC technologies will only increase.

Type Insights

LTCC (Low-Temperature Co-fired Ceramic) type dominated the market and accounted for the largest revenue share of 73.3% in 2024, primarily driven by the increasing demand for miniaturized electronic devices across various sectors. As industries such as telecommunications, automotive, and consumer electronics strive for smaller, more efficient components, LTCC technology enables the production of compact devices at lower costs. Furthermore, the rise of advanced communication technologies, including 5G, also fuels the need for high-density substrates that can handle complex electronic functions while maintaining thermal stability, further propelling market expansion.

HTCC (High-Temperature Co-fired Ceramic) type is expected to grow at a CAGR of 5.0% from 2025 to 2030, driven by the rising demand for robust electronic components capable of operating in extreme conditions. Industries such as aerospace and automotive require HTCC substrates due to their superior thermal conductivity and mechanical strength. In addition, the increasing integration of advanced electronics in vehicles for safety and connectivity features also drives demand. Moreover, the growing trend toward high-performance applications in military and industrial sectors necessitates reliable HTCC solutions, contributing significantly to market growth.

Application Insights

The telecommunications application segment dominated the market and accounted for the largest revenue share of 32.6% in 2024. This growth is attributed to the growing demand for advanced wireless communication technologies. In addition, the rise of 5G networks and the increasing need for high-frequency applications, such as RF modules and integrated antenna arrays, are significant contributors to this growth. Furthermore, LTCC technology, with its excellent thermal conductivity and high-frequency performance, is increasingly utilized in devices such as Bluetooth modules and satellite communications, enhancing overall communication efficiency and reliability.

The automotive sector is expected to grow at a CAGR of 5.9% over the forecast period, owing to the increasing integration of electronic systems in vehicles for safety, connectivity, and performance enhancement. In addition, Advanced Driver Assistance Systems (ADAS), infotainment systems, and telematics require robust electronic components that can withstand harsh conditions. Furthermore, LTCC and HTCC technologies provide the necessary thermal stability and mechanical strength, making them ideal for automotive applications. As consumers prioritize vehicle safety and manufacturers adopt more sophisticated electronic solutions, the market for LTCC and HTCC in automotive applications is expected to continue its significant growth trajectory.

Regional Insights

The LTCC and HTCC market in the Asia Pacific dominated the market and accounted for the largest revenue share of 43.9% in 2024. This growth is attributed to the rapid expansion of the microelectronics manufacturing sector. In addition, countries such as China, South Korea, and Japan are at the forefront, benefiting from substantial investments in semiconductor production and consumer electronics. Moreover, the rising demand for electric vehicles (EVs) and advanced telecommunications infrastructure, particularly with the rollout of 5G technology, further fuels market growth. The region's strong manufacturing base and competitive pricing enhance its market position.

China LTCC And HTCC Market Trends

China LTCC and HTCC market led the Asia Pacific market and accounted for the largest revenue share in 2024, driven by significant government support for technological advancements and manufacturing capabilities. In addition, the country's focus on becoming a global leader in semiconductor technologies has led to increased production of high-performance electronic components. Furthermore, the booming automotive sector, particularly in electric and autonomous vehicles, creates a robust demand for reliable substrates such as LTCC and HTCC. This combination of government initiatives and industry growth positions China as a key player in the global market.

North America LTCC And HTCC Market Trends

North America LTCC and HTCC market is expected to grow significantly over the forecast period, primarily driven by the increasing demand for LTCC printed circuit boards (PCBs) across various industries, including automotive, aerospace, and telecommunications. In addition, the flourishing wireless communication sector, particularly with the rollout of 5G technology, further enhances market prospects. Furthermore, the rising interest in power electronic products, known for their compact size and lightweight nature, is expected to create new opportunities for manufacturers in this region.

The LTCC and HTCC market in the U.S. led the North American market and accounted for the largest revenue share in 2024, driven by advancements in emerging technologies such as the Internet of Things (IoT) and 5G networks. In addition, increased research spending on next-generation wireless technologies and collaborations among research institutions are anticipated to fuel market expansion. Furthermore, the growing integration of electronic devices and sensors in vehicles aligns with the demand for high-performance substrates such as LTCC and HTCC.

Europe LTCC And HTCC Market Trends

The growth of Europe LTCC and HTCC market is expected to be fueled by an increasing focus on automotive electronics and smart technologies. The region's commitment to sustainability drives demand for electric vehicles, which require high-performance electronic components. Furthermore, Europe's robust telecommunications infrastructure development supports adopting LTCC and HTCC technologies. As manufacturers seek to enhance product reliability while reducing size and weight, these substrates play a crucial role in meeting industry demands.

Latin America LTCC And HTCC Market Trends

The LTCC and HTCC market in Latin Americais expected to grow at a CAGR of 5.0% over the forecast period, owing to increasing investments in telecommunications infrastructure and consumer electronics. The region's expanding automotive industry is also contributing to this growth as manufacturers seek to incorporate advanced electronic components into vehicles. Furthermore, government initiatives aimed at promoting local manufacturing capabilities are expected to enhance market opportunities for LTCC and HTCC technologies in various applications.

Key LTCC And HTCC Company Insights

Key companies in the global LTCC and HTCC industry include Hitachi Metals Ltd., Kyocera Corporation, and others. These companies adopt various strategies to enhance their competitive edge, including new product launches, mergers, and strategic partnerships. By focusing on innovative product development, they aim to meet the evolving needs of diverse industries. In addition, collaborations and agreements with other firms help expand their market reach and technological capabilities. Furthermore, mergers and acquisitions are employed to consolidate resources, streamline operations, and enhance overall market presence, ensuring sustained growth in a competitive landscape.

-

TDK Corporation specializes in the manufacturing of electronic components and materials. The company produces a wide range of products, including filters, antennas, and RF components that utilize LTCC technology for high-frequency applications. TDK operates primarily in the electronics segment, focusing on telecommunications, automotive, and industrial applications.

-

NGK Spark Plug Ltd. manufactures various products, including spark plugs, sensors, and ceramic substrates that leverage HTCC technology for high-performance applications. NGK operates predominantly in the automotive and industrial segments, providing advanced solutions that enhance vehicle performance and reliability.

Key LTCC And HTCC Companies:

The following are the leading companies in the LTCC and HTCC market. These companies collectively hold the largest market share and dictate industry trends.

- Hitachi Metals Ltd.

- Kyocera Corporation

- Murata Manufacturing Co., Ltd.

- TDK Corporation

- NGK Spark Plug Ltd.

- Yokowo Co., Ltd.

- KOA Corporation

- Maruwa Co. Ltd.

Recent Developments

-

In March 2023, Kyocera showcased its advanced solutions for high-speed optics, at OFC 2023, highlighting the role of LTCC (Low-Temperature Co-fired Ceramic) and HTCC (High-Temperature Co-fired Ceramic) technologies. The event featured Kyocera's innovative ceramic packages that support a remarkable increase in optical data rates, exceeding 5,000 times. The company emphasized its contributions to optoelectronics and introduced new ceramics designed for enhanced mechanical reliability in co-packaged optics and silicon photonics applications.

LTCC And HTCC Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.49 billion

Revenue forecast in 2030

USD 4.63 billion

Growth Rate

CAGR of 5.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, China, India, Japan, Taiwan, Germany, UK, France, Italy, Spain, Benelux, Nordic, Poland

Key companies profiled

Hitachi Metals Ltd.; Kyocera Corporation; Murata Manufacturing Co., Ltd.; TDK Corporation; NGK Spark Plug Ltd.; Yokowo Co., Ltd.; KOA Corporation; Maruwa Co. Ltd.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global LTCC And HTCC Market Report Segmentation

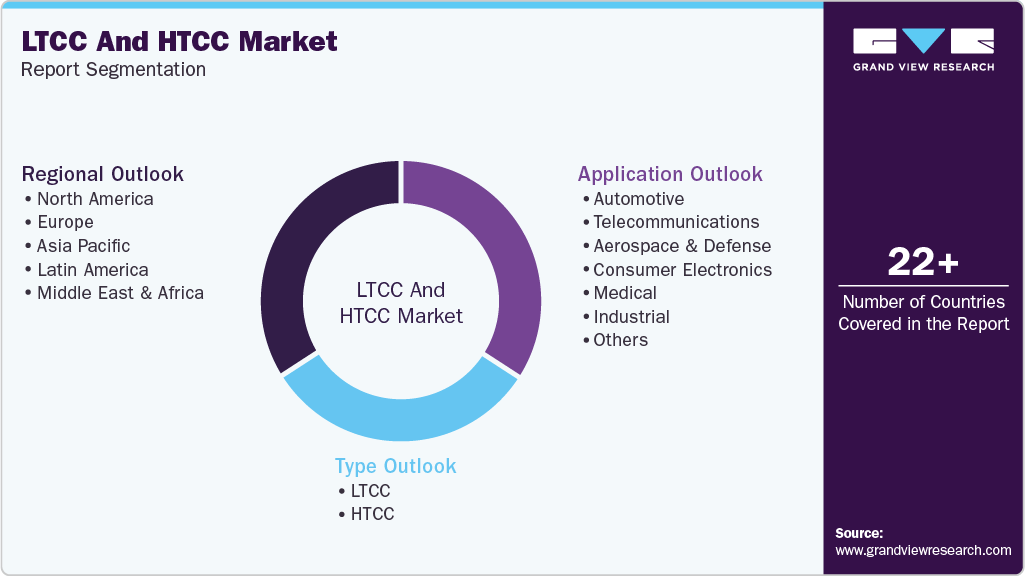

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global LTCC and HTCC market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

LTCC

-

HTCC

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Telecommunications

-

Aerospace & Defense

-

Consumer Electronics

-

Medical

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Benelux

-

Nordic

-

Poland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Taiwan

-

-

Latin America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global LTCC and HTCC market size was estimated at USD 3.33 billion in 2024 and is expected to reach USD 3.49 billion in 2025.

b. The global LTCC and HTCC market is expected to grow at a compound annual growth rate of 5.8% from 2025 to 2030 to reach USD 4.63 billion by 2030.

b. Based on the application segment, telecommunications held the largest revenue share of 32.6% in 2024.

b. The key players operating in the LTCC and HTCC market include Hitachi Metals Ltd, KOA Corporation, Kyocera Corporation, TDK Corporation, NGK Spark Plug Ltd., Maruwa Co. Ltd., and Murata Manufacturing Ltd.

b. The growing demand for automotive electronics coupled with rising investments in the wireless communication technology are the growth drivers for the LTCC and HTCC market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.