- Home

- »

- IT Services & Applications

- »

-

Marketing Attribution Software Market Size Report, 2030GVR Report cover

![Marketing Attribution Software Market Size, Share, & Trends Report]()

Marketing Attribution Software Market (2025 - 2030) Size, Share, & Trends Analysis Report By Type, By Deployment (On-premise, Cloud), By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-569-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Marketing Attribution Software Market Summary

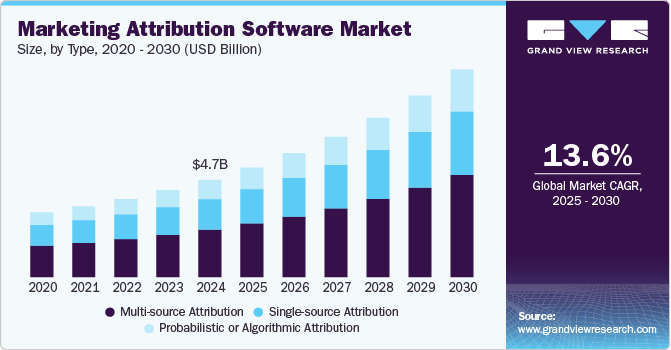

The global marketing attribution software market size was estimated at USD 4.74 billion in 2024 and is projected to reach USD 10.10 billion by 2030, growing at a CAGR of 13.6% from 2025 to 2030. The rise of multi-channel marketing is driving the market growth.

Key Market Trends & Insights

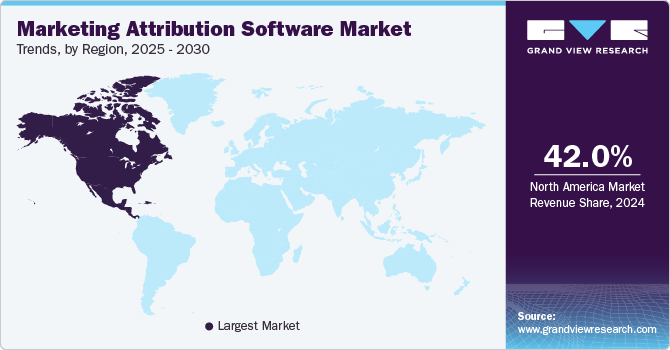

- North America marketing attribution software market held the major revenue share of over 42.0% of the global industry in 2024.

- The U.S. marketing attribution software market is projected to grow during the forecast period.

- By type, the multi-source attribution segment accounted for the largest market share of over 48.0% in 2024.

- By deployment, the on-premise segment dominated the market and accounted for a revenue share of over 59.0% in 2024.

- By enterprise size, the large enterprises segment dominated the market and accounted for a revenue share of over 66.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.74 Billion

- 2030 Projected Market Size: USD 10.10 Billion

- CAGR (2025-2030): 13.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

With consumers engaging across numerous platforms before making a purchase, brands face the challenge of tracking interactions across fragmented digital landscapes. Marketing attribution software enables organizations to capture and analyze these interactions, giving a more holistic view of the customer journey. This capability empowers marketers to allocate budgets more effectively, refine messaging, and focus on the most impactful channels, thereby increasing marketing efficiency and conversion rates.

The growth of e-commerce and digital transformation has also contributed significantly to the market’s expansion. As businesses accelerate their digital presence, particularly in the wake of global shifts such as the COVID-19 pandemic, the need to understand customer behavior in online spaces has become paramount. Marketing attribution software allows companies to gain deeper insights into how users interact with websites, ads, and content, enabling more targeted campaigns and personalized experiences. This is especially vital for e-commerce businesses that rely on accurate attribution to fine-tune their customer acquisition strategies.

The proliferation of mobile devices and apps is also contributing significantly to the market’s growth. With more consumers engaging with brands via smartphones and tablets, mobile touchpoints have become integral parts of the buyer journey. Marketing attribution software that supports cross-device and in-app tracking is increasingly in demand as businesses seek to understand how mobile interactions influence purchasing decisions. The ability to attribute actions across devices provides a more accurate and unified view of the customer path, allowing marketers to fine-tune mobile strategies and deliver consistent experiences.

Additionally, the rise of influencer and affiliate marketing has intensified the need for precise attribution tools. Brands are investing heavily in influencers and affiliate partnerships to drive awareness and conversions, but measuring the impact of these collaborations requires robust attribution frameworks. Marketing attribution software helps brands assign value to influencer-generated traffic, track affiliate referrals, and evaluate the true ROI of these programs. This is particularly crucial for performance-based marketing models where compensation is tied directly to campaign results.

Furthermore, the increasing adoption of omnichannel retail strategies is another key growth driver. IT & Telecomers are blending online and offline experiences to create seamless journeys for customers who might research a product online and complete the purchase in-store or vice versa. Marketing attribution software that can integrate data from both digital and physical channels provides critical insights into how these touchpoints influence behavior. By linking offline sales to online marketing activities, businesses gain a comprehensive understanding of campaign effectiveness and can more accurately attribute revenue across the customer experience.

Type Insights

The multi-source attribution segment accounted for the largest market share of over 48.0% in 2024. The emergence of advanced data analytics and machine learning technologies is propelling the adoption of multi-source attribution models. These technologies enable more sophisticated modeling of user behavior and can dynamically adjust attribution weights based on patterns in historical and real-time data. As AI-driven solutions become more widely available and accessible, businesses of all sizes can implement multi-source attribution to gain deeper, actionable insights. These advancements reduce the complexity previously associated with implementing such models, making them more practical and scalable.

The probabilistic or algorithmic attribution clustering segment is anticipated to grow at the fastest CAGR during the forecast period. The demand for real-time attribution and campaign agility is also fueling adoption. In fast-paced digital markets, the ability to quickly pivot strategies based on what is working is a major competitive advantage. Probabilistic attribution systems can process and analyze data in near real-time, allowing marketers to make faster, evidence-based adjustments to their tactics. This responsiveness is especially critical for industries with short sales cycles or those running time-sensitive promotions, such as e-commerce, travel, or entertainment.

Deployment Insights

The on-premise segment dominated the market and accounted for a revenue share of over 59.0% in 2024. The growing emphasis on data security and privacy is a major driver fueling the demand for the on-premise segment in the market. Organizations dealing with highly sensitive information, such as financial institutions, healthcare providers, and government agencies, often prefer on-premise solutions to retain complete control over their data. With increasing incidents of cyberattacks and growing concerns around cloud vulnerabilities, many businesses are cautious about storing critical datasets off-site. On-premise marketing attribution software ensures that sensitive information remains within the organization’s secure network, minimizing risks related to data breaches, unauthorized access, and compliance violations. This strong need for enhanced security measures continues to drive investments in on-premise clustering solutions.

The cloud segment is expected to register the fastest CAGR from 2025 to 2030. The rising complexity of data governance and auditability in large enterprises is driving market growth. With marketing teams collecting data from expanding channels, websites, mobile apps, emails, social media, and offline events having centralized control over data access, retention policies, and audit trails becomes increasingly valuable. On-premise systems offer built-in transparency and accountability features that are easier to manage internally. This is particularly beneficial when marketing attribution results are used in financial reporting or strategic planning, where accuracy and auditability are non-negotiable.

Enterprise Size Insights

The large enterprises segment dominated the market and accounted for a revenue share of over 66.0% in 2024 in the marketing attribution software industry. The adoption of omnichannel marketing strategies is propelling this segment. Large enterprises typically use a mix of digital and traditional media, including display advertising, influencer campaigns, print media, television, and in-person events, which makes it difficult to assess effectiveness without a robust attribution framework. Attribution software designed for large-scale operations can integrate data from disparate sources and present unified insights, allowing marketers to reallocate budgets efficiently across high-performing channels and reduce spending on underperforming ones.

The small and medium enterprises (SMEs) segment is expected to register the fastest CAGR of 14.5% from 2025 to 2030. The rise of marketing automation and CRM tools supports this segment’s growth. As more SMEs adopt platforms like HubSpot, Zoho, and Mailchimp, the availability of attribution integrations within these systems allows them to layer in advanced analytics with minimal technical complexity. Attribution tools become natural extensions of existing workflows, helping SMEs track customer journeys from first touch to final sale within a unified dashboard. This integration simplifies campaign management and enhances overall marketing performance, making attribution software a practical and valuable investment.

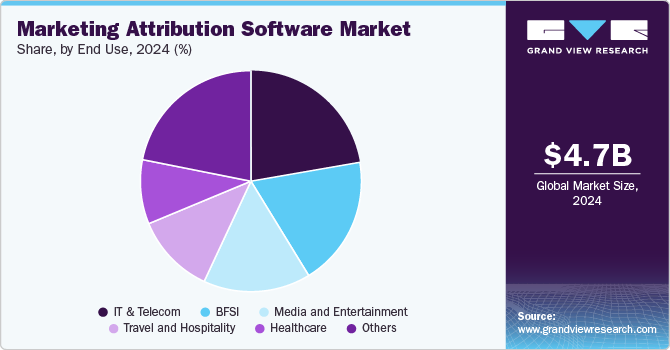

End Use Insights

The IT & telecom segment accounted for the largest market share of over 22.0% in 2024. The rise of subscription-based models and digital self-service platforms in the telecom and IT industries has made marketing attribution even more critical. As companies shift toward digital-first user acquisition and retention strategies, understanding which online efforts lead to trial sign-ups, subscriptions, or upgrades becomes essential. Attribution tools help pinpoint the highest-performing marketing assets and content types, enabling these businesses to scale growth efficiently while reducing customer acquisition costs.

The healthcare segment is anticipated to register the fastest CAGR of 15.0% during the forecast period. The expansion of telemedicine and digital health services further amplifies the need for attribution tools. With more patients accessing healthcare services remotely, digital marketing has become the primary channel for discovery and engagement. Attribution software helps providers measure the success of telehealth promotions, app downloads, or digital appointment systems, ensuring that these rapidly growing service lines are marketed effectively. Insights gained from attribution tools also aid in refining user experience and boosting digital health platform adoption rates.

Regional Insights

North America marketing attribution software market held the major revenue share of over 42.0% of the global industry in 2024. The widespread adoption of digital marketing and e-commerce is driving market growth in North America. With businesses increasingly shifting their operations online, there is a growing need for tools that can measure and optimize digital marketing effectiveness. North American companies, especially in sectors such as retail, technology, finance, and healthcare, are investing heavily in digital marketing campaigns to reach their target audiences. Marketing attribution software allows these businesses to understand which digital touchpoints, be it search engine ads, social media interactions, or email campaigns, are driving the most conversions and return on investment (ROI). By providing granular insights, attribution software helps these companies refine their strategies and allocate resources more effectively.

U.S. Marketing Attribution Software Market Trends

The U.S. marketing attribution software market is projected to grow during the forecast period. The demand for personalized marketing is fueling the growth of the attribution software market in the U.S. As consumers expect more tailored, relevant experiences from brands, businesses are under pressure to deliver customized messaging and offers. Marketing attribution software plays a key role in helping companies identify which customer segments respond best to specific types of content or advertising, enabling them to personalize their outreach effectively. By linking customer interactions across various channels and analyzing the data, attribution software helps marketers deliver the right message at the right time to the right person, improving engagement, customer loyalty, and conversion rates.

Europe Marketing Attribution Software Market Trends

The marketing attribution software market in Europe is expected to grow at a CAGR of 12.3% from 2025 to 2030. The regulatory landscape in Europe, particularly with data privacy laws such as the General Data Protection Regulation (GDPR), is also driving the adoption of marketing attribution software. As businesses are increasingly required to handle customer data responsibly and with full transparency, attribution software providers have responded by ensuring that their solutions comply with privacy regulations. GDPR has made businesses more cautious about how they collect, store, and use customer data, and marketing attribution software is being designed to ensure compliance while still providing valuable performance insights. European businesses are particularly keen on solutions that allow them to track customer interactions without violating privacy laws, making compliance a critical factor for attribution tool adoption in the region.

The marketing attribution software industry in the Germany is grow during the forecast period. The increasing importance of personalization in marketing strategies is fueling the need for marketing attribution software in Germany. Consumers today expect tailored experiences, and businesses are investing in strategies that cater to individual preferences and behaviors. Marketing attribution software allows companies to track which content and messaging resonate most with different customer segments, enabling them to personalize campaigns for maximum impact. In industries such as retail and e-commerce, where personalization can significantly improve customer engagement and conversion rates, attribution software is crucial for optimizing the customer experience. By understanding the effectiveness of personalized marketing efforts, businesses can improve customer loyalty and enhance their overall marketing strategies.

Asia Pacific Marketing Attribution Software Market Trends

The demand for marketing attribution software in the Asia Pacific is expected to register the fastest CAGR of 15.7% from 2025 to 2030. The growth of e-commerce in the Asia Pacific drives the marketing attribution software market growth. With countries like China, India, and Japan leading the way in online shopping, businesses are increasingly relying on digital marketing strategies to reach and retain consumers. E-commerce giants and local retailers alike are using a mix of digital channels to engage with customers, ranging from online advertisements to social media promotions and email marketing campaigns. Attribution software plays a crucial role in helping businesses understand which digital touchpoints are driving traffic, generating leads, and converting customers. As e-commerce continues to expand across the region, businesses are looking for tools that can provide a comprehensive view of the customer journey, making attribution software an essential investment.

The marketing attribution software industry in China is projected to grow during the forecast period. The rise of social commerce is another significant driver in China’s marketing attribution software market. Platforms like WeChat, Douyin (the Chinese version of TikTok), and Xiaohongshu have transformed social media into powerful commerce channels, enabling users to discover, review, and purchase products directly through social apps. This shift towards social commerce has created new challenges for marketers, who need to track and measure customer interactions across these platforms to understand how they contribute to conversions. Marketing attribution software helps businesses capture data from social media interactions, analyze customer touchpoints, and optimize their social commerce strategies. As social commerce continues to expand in China, the need for attribution software to track the effectiveness of social media marketing efforts becomes more critical.

Key Marketing Attribution Software Company Insights

Some of the key companies operating in the market are IBM Corporation, Salesforce, Inc., and Adobe. among others are some of the leading participants in the market.

-

Adobe is a global digital media and marketing solutions company offering a comprehensive suite of tools for businesses to create, manage, and optimize content. Among its diverse product portfolio, Adobe offers marketing attribution software that helps businesses track and analyze customer interactions across multiple channels, allowing them to measure the effectiveness of their marketing efforts.

-

IBM Corporation is a global technology and consulting company that offers a wide range of solutions for businesses across various industries. Among its offerings, IBM also provides marketing attribution software, which helps companies to measure the effectiveness of their marketing efforts across multiple channels. IBM's marketing attribution software is designed to give companies a detailed understanding of how their marketing activities influence customer decisions. By tracking customer interactions across various touchpoints, such as online ads, social media, email campaigns, and website visits, IBM's attribution tools help businesses identify which channels and strategies contribute most to their marketing success.

OptiMine, ActiveDEMAND, and LeadsRx, Inc are some of the emerging market participants in the marketing attribution software market.

-

ActiveDEMAND is a marketing automation platform designed to streamline customer acquisition and engagement for small to medium-sized businesses, with a strong emphasis on serving digital marketing agencies and senior living operators. ActiveDEMAND offers a comprehensive suite of tools that integrate marketing automation, customer data management, and attribution analytics into a single platform. ActiveDEMAND provides end-to-end attribution reporting, allowing businesses to track the entire customer journey from initial contact to conversion

-

LeadsRx is a marketing analytics company that offers a comprehensive multi-touch attribution platform designed to help businesses optimize their marketing strategies. The company's flagship product, LeadsRx Attribution, utilizes a proprietary Universal Conversion Tracking Pixel to capture first-party data across all marketing channels, including digital, television, radio, podcasts, and offline events. This pixel enables real-time, impartial analysis of customer journeys, providing insights into touchpoint performance and return on ad spend (ROAS).

Key Marketing Attribution Software Companies:

The following are the leading companies in the marketing attribution software market. These companies collectively hold the largest market share and dictate industry trends.

- ActiveDEMAND

- Adobe

- Factors.AI

- HubSpot, Inc.

- IBM Corporation

- LeadsRx, Inc

- Northbeam

- OptiMine

- Rockerbox, Inc.

- Roivenue

- Salesforce, Inc.

- Stackline

Recent Developments

-

In April 2025, ScanmarQED, a provider of marketing analytics solutions, acquired Roivenue. This acquisition enhances ScanmarQED's position as a comprehensive provider of marketing analytics solutions across European and North American markets. Roivenue's AI-driven technology will complement ScanmarQED's existing marketing mix modeling capabilities, offering customers a complete view of their marketing performance.

-

In February 2025, DoubleVerify, a global software platform specializing in digital media measurement, data, and analytics, has acquired Rockerbox. This strategic acquisition strengthens DV’s comprehensive suite of data solutions, expanding its capabilities in end-to-end media performance measurement and AI-driven campaign activation. Integrating Rockerbox represents a significant milestone in DV’s evolution—from focusing on media quality protection and performance measurement to enabling advertisers to achieve key ad KPIs. With this move, DV empowers brands to measure, optimize, and drive meaningful business outcomes more effectively.

-

In January 2025, Stackline partnered with Gigi, an innovative ad tech company that simplifies unified buying and measurement for Streaming TV advertising through Amazon Marketing Cloud and the Amazon DSP. This alliance combines Stackline’s sophisticated audience and multi-retailer attribution capabilities with Gigi’s advanced first-party data collaboration tools. Together, they enable brands to reach highly targeted and engaged audiences across premium Streaming TV ad placements.

Marketing Attribution Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.34 billion

Revenue forecast in 2030

USD 10.10 billion

Growth rate

CAGR of 13.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, deployment, enterprise size, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

IBM Corporation; Salesforce, Inc.; Adobe; Eaton Corporation Inc.; Rockerbox, Inc.; HubSpot, Inc.; OptiMine; Factors.AI; LeadsRx, Inc; Northbeam; Stackline; Roivenue

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Marketing Attribution Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global marketing attribution software market report based on type, deployment, enterprise size, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-source Attribution

-

Multi-source Attribution

-

Probabilistic or Algorithmic Attribution

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises (SMEs)

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

IT & Telecom

-

BFSI

-

Media and Entertainment

-

Healthcare

-

Travel and Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global marketing attribution software market size was estimated at USD 4.74 billion in 2024 and is expected to reach USD 5.34 billion in 2025.

b. The global marketing attribution software market is expected to grow at a compound annual growth rate of 13.6% from 2025 to 2030 to reach USD 10.10 billion by 2030.

b. North America held the major share of 42.0% of the marketing attribution software industry in 2024. The widespread adoption of digital marketing and e-commerce is driving market growth in North America.

b. Some key players operating in the market include Accenture, Tata Communications Limited, IBM, Microsoft, Rackspace Technology, Infosys Limited, NTT DATA Group Corporation, Spark NZ, Cisco Systems, Inc., Locuz

b. The rise of multi-channel marketing and The growth of e-commerce and digital transformation is driving marketing attribution software market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.