- Home

- »

- Next Generation Technologies

- »

-

Mass Notification System Market Size, Industry Report, 2033GVR Report cover

![Mass Notification System Market Size, Share, & Trends Report]()

Mass Notification System Market (2026 - 2033) Size, Share, & Trends Analysis Report By Component (Hardware, Software, Service), By Solution, By Enterprise Size, By Application, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-759-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Mass Notification System Market Summary

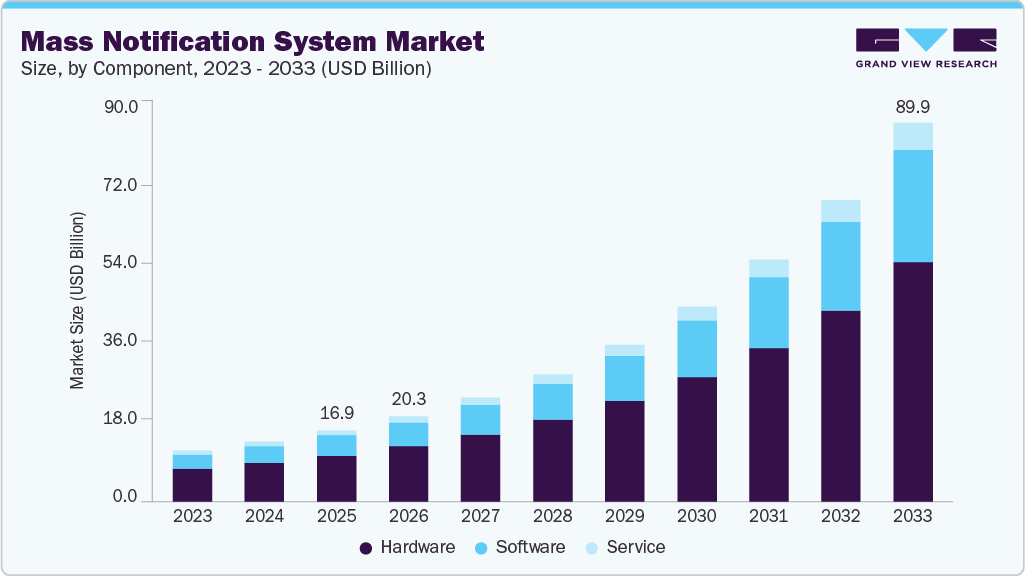

The global mass notification system market size was valued at USD 16.89 billion in 2025 and is expected to reach USD 89.96 billion by 2033, growing at a CAGR of 23.7% from 2026 to 2033. The adoption of MNS is expected to grow significantly over the forecast period due to the rising demand for these systems to facilitate effective and more secure communication with the workforce within the shortest time interval across various industries and industry verticals.

Key Market Trends & Insights

- North America mass notification system market held the largest market share of over 34.0% in the global industry in 2025.

- The mass notification system market in the U.S. is growing significantly at a CAGR of 20.1% from 2026 to 2033.

- By component, the hardware segment accounted for the largest market share of nearly 64.8% in 2025.

- By solution, the in-building solutions segment dominated the market and accounted for the largest market share in 2025.

- By enterprise size, the large enterprises segment accounted for the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 16.89 Billion

- 2033 Projected Market Size: USD 89.96 Billion

- CAGR (2026-2033): 23.7%

- North America: Largest market in 2025

The increasing adoption of MNS by educational institutions bodes well for the growth of the market. Continued urbanization is prompting MNS developers to focus on developing more accurate and reliable MNS, catering to the growing need for notification systems to alert employees in the event of an emergency. Such MNS is expected to play a vital role in strengthening public safety by broadcasting information about disaster management to the masses. Market players are actively launching new products to gain a competitive edge over their rivals.The widespread usage of mass notification systems across hospitals and medical institutions and the rising use of Internet Protocol (IP)-based notification devices are the main factors propelling the market for mass notification systems. COVID-19 pandemic lockdowns forced the shutdown of businesses, including offices and retail outlets, and transportation, manufacturing, and distribution limitations. However, mass notification systems are a common requirement for timely and relevant health, safety, and new procedure information throughout the pandemic.

Security personnel and the general public are alerted to disasters through mass notification systems. These catastrophes can be man-made or natural, such as a gas leak from a reactor inside an industrial plant or natural disasters like a hurricane or a tornado. By providing clear voice communications to listen to instructions, be safe, and prevent fear during such critical occasions, these devices also efficiently communicate the appropriate course of action to panic-stricken people. These situations have highlighted the need for technologies that can support the general public while working within an organization or at a remote location and help them mitigate risk. As a result, a multimodal system has been implemented to ensure that each user is informed of an emergency via various communication channels.

Moreover,the adoption of mass notification systems is expected to grow significantly over the forecast period due to the rising demand for systems that facilitate secure and effective communication with the workforce within the shortest time interval across various industries. The increasing adoption of technology by educational institutions is contributing to market growth. The rising urbanization has enabled MNS developers to focus on developing more accurate and reliable systems owing to the growing need for alert and notification systems to alert employees in an emergency. This enhancement in MNS is expected to offer benefits such as strengthened public safety and the ability to broadcast events on disaster management to the masses over the forecast period. Organizations are launching new products to gain a competitive edge over other market players.

Mass notification systems are in increasing demand due to the growing adoption of various technologies by end-use sectors, including the Internet of Things (IoT), cloud computing, and data analytics. These technologies continually enhance user interaction and strengthen safety precautions, offering a wide range of alternatives and capabilities that extend beyond the scope of traditional applications. Additionally, mass notification systems enable enterprises, local administrations, and governmental bodies to send one-way communications to individuals or groups and notify them of emergencies, upcoming events, and natural disasters. For instance, in April 2023, BlackBerry launched an integrated solution combining its CylanceGUARD Managed Detection and Response (MDR) solution with the AtHoc Critical Event Management (CEM) solution. The new solution ensures secure bi-directional communication during cyber incidents, even if usual communication channels fail. Organizations using this integration can quickly deploy secure communications and manage incident response within the CylanceGUARD platform.

Component Insights

The hardware segment accounted for the largest market share of 64.8% in 2025. The hardware segment encompasses a wide range of hardware components and devices necessary for deploying the mass notification software. Hardware components perform a crucial role in mass notification systems. Furthermore, the increasing adoption of managed notification systems across hospitals and medical facilities and the growing implementation of IP-based notification devices encourage market vendors to partner with notification hardware providers to offer a seamless experience of mass notification systems within end users’ existing infrastructure.

The software segment is expected to grow at a CAGR of 24.4% during the forecast period. Software helps impart compatibility and interoperability into notification hardware. The growing adoption of artificial intelligence (AI) and cloud-based services for notification systems is expected to boost the demand for associated software to ensure the compatibility of devices and operating systems for various applications. Compatibility enables users to incorporate add-on features into their existing hardware through software updates. The software used in mass notification systems demands an efficient communication infrastructure and adequate bandwidth to facilitate simultaneous delivery of multiple notifications.

Solution Insights

The in-building solutions segment accounted for the largest market share in 2025. In-building mass notification solutions use visual signaling, voice communication, and other communication methods to provide occupants with instructions and information inside and outside a building. It offers precise details on the actions and directions to be followed. Instant communication, real-time alerts, more clarity in messages, autonomous control units, and supervised emergency voice communication systems are some of the benefits driving the adoption of in-building solutions.

The distributed recipient solutions segment is expected to grow significantly during the forecast period. It envisions a mass notification system to warn specific targeted individuals and groups in a contiguous area of risks and threats. The market is expected to witness an increase in demand for more cloud-based, or Software-as-a-Service (SaaS)-based DRS and personal alerting systems. Several group-based or dynamic zone mass notification systems have already been established over the public and private cloud. The ease of integrating SaaS solutions with the existing mass notification system is expected to drive the growth of the segment over the forecast period.

Enterprise Size Insights

The large enterprises segment accounted for the largest market share in 2025. Large enterprises often have employees working from remote locations. Such enterprises prefer mass notification systems to ensure employee safety during emergencies. Mass notification systems also offer a robust network for employees of large enterprises to stay connected. Large organizations are also opting for mass notification systems as part of the efforts to improve internal communication, enhance business practices, and gain a competitive edge over their peers.

The SMEs segment is expected to grow significantly over the forecast period. SMEs are finding mass notification systems lucrative owing to the benefits, such as ease of deployment, simple interfaces, and affordable pricing, associated with these systems. Hence, SMEs are increasingly adopting mass notification systems to ensure a reliable network to send notifications during emergencies and meet other communication requirements. Government funding being provided to SMEs to embrace digitization is also encouraging SMEs to invest in mass notification systems.

Application Insights

The business continuity & disaster recovery (BCDR) segment accounted for the largest market share in 2025. Business continuity and disaster recovery are closely connected practices that help a company operate during a crisis. The primary goal of these practices is to reduce the impact of outages and other disturbances on business operations. Business Continuity & Disaster Recovery (BCDR) policies enable organizations to enhance processes, quickly recover from a disaster, minimize reputational damage, mitigate the risks of data loss, and reduce the likelihood of potential emergencies. Thus, BCDR policies are necessary for the corporate sector to mitigate risks.

The public alert & warning segment is expected to grow significantly during the forecast period. A mass notification system is essential for the rapid and reliable dissemination of critical information during emergencies. These systems are designed to quickly alert the public about imminent threats, such as natural disasters, hazardous materials incidents, or security threats. The Integrated Public Alert and Warning System (IPAWS) is the government's official system for notifying the public about significant situations in U.S. FEMA is closely related to CodeRED, an approved IPAWS alert origination mechanism for various industries. The demand for the application has increased due to its improved ability to draft more appropriate, practical, and accessible alerts and warning messages to create awareness.

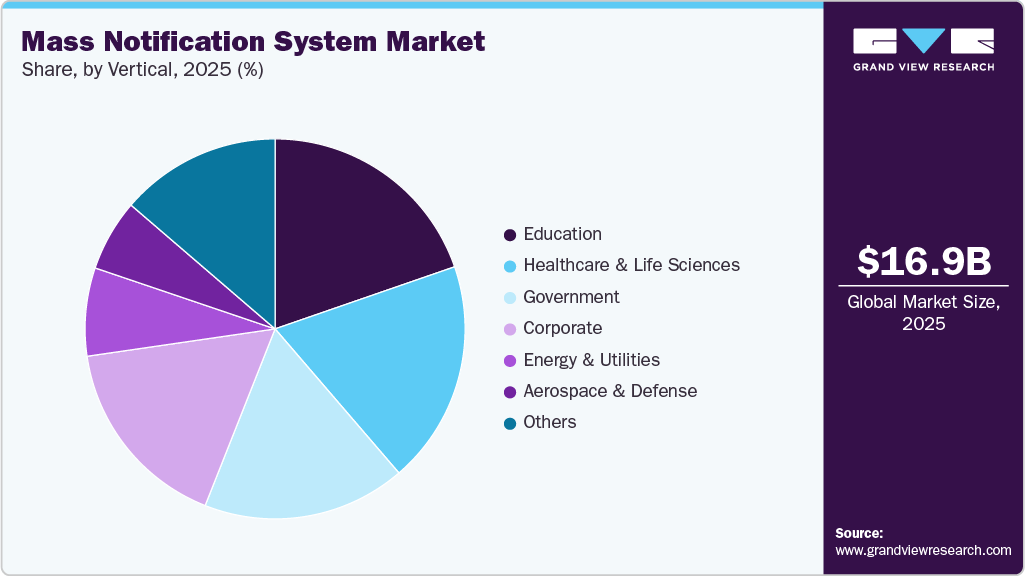

Vertical Insights

The education segment held the largest market share in 2025 and is expected to dominate the mass notification system industry by 2030. A mass notification system for schools allows people to send endless messages to the audience over various channels, including text, mobile app push notification, voice, email, social media, and other bespoke channels. Conventional communication channels, such as cell phones and internet connections, may be disrupted in an emergency, necessitating platforms with multi-channel delivery capabilities to ensure that everyone receives messages. A disaster can strike with little or no warning, and without proper and effective protocols in place to alert students and staff members, the safety of individuals can be compromised, thereby driving the need for mass notification systems. Vendors, such as Single Wire and Desktop Alert, offer enhanced mass notification systems related to lockdowns, severe weather alerts, hazardous material spills, and campus invasions, among other emergencies, for the education sector.

The healthcare & life science segment is expected to grow significantly over the forecast period. A multi-functional mass notification system for hospitals can typically send relevant information to patients, employees, visitors, emergency services, and the public. Conventionally, hospitals communicate during emergencies via phones, alerts, emails, and pagers. However, these approaches do not achieve the purpose of effective communication during emergencies. As a result, many hospitals and healthcare institutions rely on mass notification systems. Mass notification systems for hospitals, first employed for emergency communication, are evolving in terms of their form and function.

Regional Insights

The North America held the largest market share of 34.0% in the mass notification system industry in 2025.The rising number of mass shooting incidents in recent years is the key factor leading to the adoption of mass notification systems in the region. Further, the 9/11 terrorist attack in 2001 has created a massive demand for alert notifications and public awareness systems. Due to the following factors, strict public safety & security initiatives have been effectuated across the region, including efficient security, monitoring, and emergency alert systems. These programs will create the potential growth opportunity for mass notification systems in the region during the forecast period.

U.S. Mass Notification System Market Trends

The mass notification system industry in the U.S. is growing significantly from 2026 to 2033. The increasing integration of advanced technologies such as Artificial Intelligence (AI) and the Internet of Things (IoT) into mass notification systems opens the possibility of producing, sending, and interpreting emergency-related data to improve crisis decision-making.

Asia Pacific Mass Notification System Market Trends

The mass notification system industry in Asia Pacific is growing significantly from 2026 to 2033. The rising focus of government agencies on enhancing public safety and security and increasing deployment of IP-based notification devices are the major factors propelling the growth of the mass notification system market across the Asia Pacific region. In addition, the increasing trend of bring your own device (BYOD) in businesses and educational institutions has allowed mass notification system providers to engage more customers by introducing innovative solutions that can be accessed through any digital device, which is expected to drive the growth of the market in Asia Pacific region over the forecast period.

The mass notification system market in China is growing significantly from 2026 to 2033. China has a set of regulatory frameworks that drive the growth of its mass notification system market. The People's Republic of China's Emergency Response law states that the unit that experiences a natural disaster, a catastrophic accident, or a public health event must deploy its rescue teams and employees to save the victims, scatter and evacuate those in danger and arrange for their relocation, and take control of the danger's sources.

The mass notification system market in India is growing significantly from 2026 to 2033. The expanding industrialization in India is expected to offer a promising market to the vendors of mass notification systems. Several government authorities take cognizance of funding hazard surveillance and mass notification systems to lower the probability of property damage, environmental harm, human injury, fatalities, and loss of livelihoods.

The mass notification system market in Japan is growing significantly from 2026 to 2033. Japan is highly susceptible to natural disasters, including earthquakes, tsunamis, typhoons, and volcanic eruptions. The frequent occurrence of these natural hazards necessitates robust and efficient communication systems in place to ensure public safety. Mass notification systems are crucial in disseminating timely alerts and instructions to the public during emergencies.

Europe Mass Notification System Market Trends

The mass notification system industry in Europe is growing significantly from 2026 to 2033. Regulatory mandates and standards also significantly contribute to the growth of mass notification systems in Europe. The European Union has established stringent regulations mandating member states to implement effective public alert systems. For example, the European Electronic Communications Code (EECC) decrees that all EU countries develop and maintain a public warning system to send alerts to mobile phones during emergencies for man-made and natural calamities.

The mass notification system market in the UK is growing significantly from 2026 to 2033. Government bodies are increasingly supporting the development of statewide emergency warning systems to assist the general public during national emergencies such as terrorist attacks, public health issues, industrial accidents, flooding, and earthquakes. Mass notification systems enable the government to reach the population immediately with critical information during the crisis.

The mass notification system market in Germany is growing significantly from 2026 to 2033. The demand for mass notification systems is rising in Germany due to events such as the Munich Mall mass shooting, the Cologne assaults, and the Berlin attacks, among others. These incidents have underscored the need for robust public safety measures, driving the demand for mass notification systems nationwide.

The mass notification system market in France is growing significantly from 2026 to 2033. The favorable government initiatives generate significant demand for mass notification systems in France. For instance, in June 2022, the government launched FR-Alert, a mobile phone alert system designed to notify the population in case of emergencies.

Middle East & Africa Mass Notification System Market Trends

The mass notification system market in the Middle East & Africa region is growing significantly from 2026 to 2033. The need to ensure public safety has become paramount as public and private infrastructure continues to expand and construction activities surge in the Middle East. This trend has engendered the widespread adoption of mass notification systems across the region.

Key Mass Notification System Company Insights

Some of the key players operating in the market include OnSolve; Eaton, and Honeywell International Inc.; among others.

-

Eaton Corporation is a global power management company providing energy-efficient solutions for managing hydraulic, electrical, and mechanical power. Eaton’s products and services are designed to help customers manage power more safely, efficiently, and sustainably. The company offers a range of mass notification solutions designed to deliver critical information during emergencies, ensuring the safety and security of people in various settings such as commercial buildings, educational institutions, healthcare facilities, industrial sites, and public venues.

-

OnSolve is a provider of critical event management solutions, which proactively reduce physical dangers and help enterprises maintain agility during a crisis. For emergency notifications, IT alerting, disaster recovery, and other relevant solutions, the company provides cloud-based notification and communication solutions. The company has evolved into a complete Critical Event Management (CEM) solution provider, serving Verticalrs such as government, utilities, manufacturing, healthcare, and retail entities.

DesktopAlert.Net and Singlewire Software, LLC are some of the emerging market participants in the mass notification system market.

-

The company offers IP-based mass notification solutions that enable organizations, corporations, and emergency response communities to communicate instantly across the globe. DesktopAlert.Net offers advanced communications tools that enable corporates to deliver hazard and threat warnings directly through email, computer screens, mobile devices, large displays, kiosks, and SMS. Moreover, the mass notification solution is based on a network-centric and scalable enterprise-wide mass notification platform architecture.

-

Singlewire Software, LLC. develops solutions that help detect threats, manage incidents, and notify about threats. The company is known for its flagship product, InformaCast, which enables users to quickly and effectively disseminate critical information across various channels, including mobile devices, IP phones, desktop computers, and overhead paging systems.

Key Mass Notification System Companies:

The following are the leading companies in the mass notification system market. These companies collectively hold the largest market share and dictate industry trends.

- AlertMedia

- American Signal Corporation

- Anthology Inc.

- BlackBerry Limited

- DesktopAlert.Net

- Eaton

- Everbridge

- Honeywell International Inc.

- Motorola Solutions, Inc.

- Omnilert

- OnSolve

- Rave Mobile Safety

- Regroup Mass Notification

- Singlewire Software, LLC.

- xMatters

Recent Developments

-

In June 2024, Toronto Zoo chose Everbridge's mass notification system to enhance safety for its staff and visitors. The system would rapidly communicate critical information via SMS, emails, desktop alerts, and voice messages during emergencies. The Everbridge mass notification system was selected owing to benefits such as easy deployment and efficient broadcast of emergency messages and critical alerts through multiple channels.

-

In September 2023, Everbridge Inc. launched Everbridge 360, a comprehensive critical event management and public warning software, at the Global Security Exchange (GSX) 2023 conference. The new platform consolidates risk intelligence, communications, collaboration, and coordination capabilities into a single interface, enhancing organizational response to crises. Key benefits include faster critical communications, reduced errors, and quicker onboarding for new users. Everbridge 360 aims to improve operational resilience by enabling seamless application transitions and accelerating response times during critical events.

Mass Notification System Market Scope

Report Attribute

Details

Market size value in 2026

USD 20.29 billion

Revenue forecast in 2033

USD 89.96 billion

Growth rate

CAGR of 23.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, Solution, Enterprise Size, Application, Vertical, and Region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; Kuwait; South Africa

Key companies profiled

AlertMedia; American Signal Corporation; Anthology Inc.; BlackBerry Limited; DesktopAlert.Net; Eaton; Everbridge; Honeywell International Inc.; Motorola Solutions, Inc.; Omnilert; OnSolve; Rave Mobile Safety; Regroup Mass Notification; Singlewire Software, LLC.; xMatters

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mass Notification System Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2021to 2033 in each of the sub-segments. For the purpose of this study, Grand View Research has segmented the global mass notification system market report based on component, solution, enterprise size, application, vertical, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Solution Outlook (Revenue, USD Billion, 2021 - 2033)

-

Wide-area Solutions

-

In-building Solutions

-

Distributed Recipient Solutions

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Small & Medium Enterprises (SMEs)

-

Large Enterprises

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Public Alert & Warning

-

Interoperable Emergency Communication (IEC)

-

Business Continuity & Disaster Recovery (BCDR)

-

-

Vertical Outlook (Revenue, USD Billion, 2021 - 2033)

-

Corporate

-

Education

-

Energy & Utilities

-

Healthcare & Life Sciences

-

Aerospace & Defense

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global mass notification system market size was estimated at USD 16.89 billion in 2025 and is expected to reach USD 20.29 billion in 2026.

b. The global mass notification system market is expected to grow at a compound annual growth rate of 23.7% from 2026 to 2033 to reach USD 89.96 billion by 2033.

b. North America dominated the mass notification system market with a share of over 34% in 2025. This is attributable to the increasing adoption of these systems in the education sector.

b. Some key players operating in the mass notification system market include BlackBerry Limited; Blackboard Inc.; Desktop Alert, Inc.; Eaton; Everbridge; Honeywell International Inc; Motorola Solutions, Inc.; OnSolve; Singlewire Software, LLC; and xMatters.

b. Key factors that are driving the mass notification system market growth include increasing adoption of mass notification systems for lone worker safety, growing need for efficient communication systems, and increasing adoption across diversified industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.