- Home

- »

- Automotive & Transportation

- »

-

MEA 8X8 Armored Vehicle Market, Industry Report, 2030GVR Report cover

![MEA 8X8 Armored Vehicle Market Size, Share & Trends Report]()

MEA 8X8 Armored Vehicle Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Combat Vehicles, Combat Support Vehicles), By Mode of Operation (Manned Armored Vehicles, Unmanned Armored Vehicles), By Country, And Segment Forecasts

- Report ID: GVR-3-68038-203-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

MEA 8X8 Armored Vehicle Market Trends

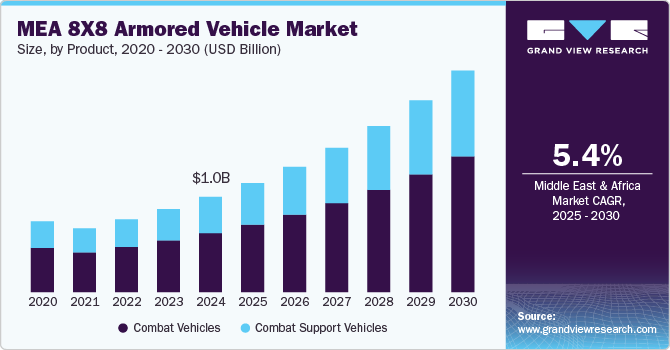

The MEA 8X8 armored vehicle market size was valued at USD 1.04 billion in 2024 and is projected to grow at a CAGR of 5.4% from 2025 to 2030.The increasing focus of armed forces on safeguarding soldiers from all sorts of internal and external threats is expected to drive growth. High emphasis on homeland security departments on countering the rising criminal activities and cross-border terrorism is anticipated to further drive the growth.

Growing terrorist activities have triggered asymmetric warfare in some nations in the Middle East and Africa. At the same time, the homeland security departments are increasingly getting concerned about the growing communal riots and organized crimes. This is propelling the demand for 8x8 armored trucks. On the other hand, growing awareness about security and safety, particularly among high-placed individuals, is also creating new opportunities in the region.

For instance, in September 2024, the Ministry of National Defense in Morocco signed an agreement with TATA Advanced Systems Limited (TASL) to domestically develop the WhAP 8×8 armored combat vehicle. The three-year deal aims to modernize the operational capabilities of the country’s Royal Armed Forces and position the country as a promising regional player in the defense sector. Such developments are expected to ensure positive market advancement.

To counter issues such as organized crimes and riots, security departments are adopting rugged armored vehicles with enhanced offensive and defensive capabilities, leading to a higher demand for 8x8 armored vehicles in the region. An 8x8 drive, also known as eight-wheel drive, is a drivetrain configuration that enables every wheel of an eight-wheeled vehicle to function as a drive wheel simultaneously. As opposed to 4x4 wheel drives, this configuration is mostly restricted to heavy-duty military and off-road vehicles, including armored vehicles, all-terrain vehicles, and tractor units. Manufacturers in this industry have been developing products that offer improved maneuverability by having the steering on the rearmost axle. Moreover, the drive can be limited to the two axles on the rear for on-road movement, which helps reduce tire wear and drivetrain stress, thus greatly improving fuel efficiency.

Countries including Qatar, Saudi Arabia, and the United Arab Emirates have a significant population of high-net-worth individuals who have invested in strengthening for personal security. This demographic has generated substantial demand for customized armored vehicles that offer advanced security features while also possessing a robust build quality. Manufacturers are launching 8x8 armored vehicles in a range of designs and aesthetics to cater to defense, commercial, and personal safety applications. The manufacturers are also manufacturing vehicles using composite materials, such as a combination of galvanized steel, stainless steel, ceramic, and aluminum, to improve vehicle resistance to corrosion and harsh external environments. The region is known for hosting various defense-focused trade shows and exhibitions, driving industry awareness among manufacturers. For instance, in February 2024, FNSS, a Turkey-based armored combat vehicle manufacturer, introduced the PARS ALPHA 8x8 Armored Fighting Vehicle at the World Defense Show held in Saudi Arabia. The vehicle features all-terrain mobility, high operational endurance, robust protection against weapons such as mines and artillery projectiles, and advanced weapons integration.

Product Insights

The combat vehicles segment accounted for a leading revenue share of 57.6% in the regional 8x8 armored vehicle market in 2024. These vehicles are available in a variety of forms that serve different requirements of defense and military authorities, with notable ones being Armored Personnel Carriers (APCs), Infantry Fighting Vehicles (IFVs), Light Protected Vehicles (LPVs), Main Battle Tanks (MBTs), Mine-Resistant Ambush Protected (MRAP) vehicles, and tactical vehicles, among others. Increasing cases of conflicts and internal & external terrorist activities in Northern Africa and the Middle Eastern economies have helped the segment to grow considerably. Additionally, the development of electric and hybrid drivetrains that can lead to stealthier operations, improved torque control, and reduced maintenance costs are expected to compel manufacturers to launch more efficient armored vehicle designs for combat applications.

The combat support vehicles segment is anticipated to advance at a faster CAGR from 2025 to 2030. Some of the 8x8 armored vehicles that offer combat support include armored supply trucks, repair & recovery vehicles, armored command & control vehicles, and unmanned armored ground vehicles. Combat support vehicles play a crucial role in supporting military operations by providing essential assistance and capabilities that enhance the effectiveness of combat forces. They offer logistical support by transporting ammunition, fuel, food, and other supplies to frontline troops and ensure operational readiness by performing maintenance and repair operations. The increasing need for providing support to armored combat vehicles in tough terrains and conditions is anticipated to boost segment growth in the Middle Eastern & African markets.

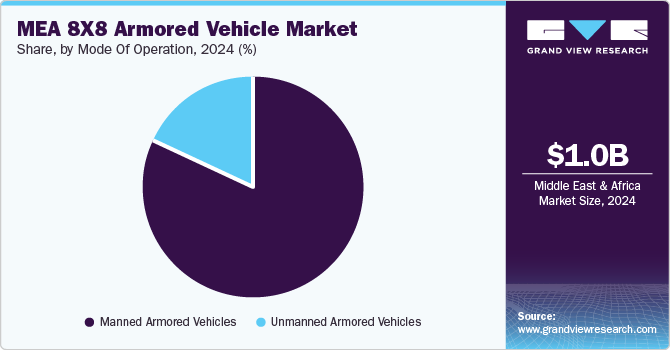

Mode of Operation Insights

Manned armored vehicles accounted for a dominant revenue share in the market in 2024, and this segment is anticipated to maintain its leading position in the coming years. These vehicles are essential for modern military operations, providing a combination of firepower, protection, and mobility. These vehicles also enhance a unit's capability to engage in direct combat, transport troops safely, and perform reconnaissance, and support roles. The use of advanced technologies such as composite armor, reactive armor and active protection systems to counter threats has been a major trend driving segment demand. Furthermore, manufacturers are aiming to incorporate components and features that can improve the mobility of armored vehicles across different terrains while ensuring crew comfort through climate control and ergonomic seating features.

The unmanned armored vehicles segment is anticipated to witness the fastest CAGR during the forecast period. Continued evolution of tactical warfare strategies and the need to protect soldiers and other personnel from risky and unnecessary conflict scenarios has encouraged the adoption of remote-operated armored vehicles. Middle Eastern economies such as Iran, Iraq, and Saudi Arabia have boosted their investments to integrate advanced AI and robotics technologies in their defense infrastructure, enhancing their capabilities in the defense sector. Unmanned armored vehicles can be easily configured for various critical roles, including reconnaissance, logistics, combat support, and explosive ordnance disposal. They can be deployed quickly in response to changing battlefield conditions, ensuring increased tactical flexibility and better situational awareness. These factors have driven segment expansion in the regional market.

Country Insights

Saudi Arabia 8X8 Armored Vehicle Market Trends

In the Middle East & Africa region, Saudi Arabia accounted for a leading revenue share of 39.3% in the market in 2024. Significant investments by the Saudi government to strengthen the country's defense and safeguard its borders in a proactive manner have enabled strong market growth. The Stockholm International Peace Research Institute (SIPRI) report, published in 2022, stated that the economy had the fifth largest defense spending globally, with a budget of USD 75 billion. The undertaking of various defense deals with technologically advanced economies has resulted in the development and acquisition of advanced armored vehicle models in various configurations, including 4x4 and 8x8. For instance, in September 2023, the U.S. Defense Security Cooperation Agency announced its intent to sell spare and repair parts to strengthen Saudi Arabia's combat vehicle fleet. These parts would be used in the Royal Saudi Land Forces fleet of Abram and M60 tanks, MRAP vehicles, mortar carriers, and light armored vehicles.

UAE 8X8 Armored Vehicle Market Trends

The UAE, meanwhile, is expected to witness substantial growth in the regional market during the forecast period. A growing need to ensure the establishment of a technologically advanced defense and military ecosystem to safeguard citizens and improve law enforcement in the economy is aiding the demand for armored vehicles with advanced capabilities. As per the CIA Factbook, the UAE ranks sixth in terms of military expenditure as a percentage of the country's GDP. The UAE government is consistently entering into new procurement and supply agreements with other major regional and global countries to strengthen its defense setup and provide advanced parts and components to other nations aiming to develop and strengthen their military infrastructure. As a result, the demand for advanced armored vehicles is anticipated to improve steadily in the coming years in the economy.

Key MEA 8X8 Armored Vehicle Company Insights

Some key companies involved in the MEA 8X8 armored vehicle market include BAE Systems, General Dynamics, and Rheinmetall AG, among others.

-

BAE Systems is a major global defense contractor and systems integrator that provides defense and security solutions developed for sea, air, and land. The company’s product offerings include advanced electronics, cybersecurity and intelligence solutions, information technology solutions, and support services. BAE Systems is involved in the designing, manufacturing, upgrading, and support of combat vehicles while also providing ammunition, precision munitions, artillery systems, and missile launchers. The product range for ground-based combat includes armored multi-purpose vehicles (AMPVs), the CV90, the CV90 IFV, Bradley Fighting Vehicle, and ADAPTIV, among others. In September 2024, BAE Systems Australia launched the Autonomous Tactical Light Armour System (ATLAS) Collaborative Combat Variant, a modular 8x8 unmanned ground vehicle.

Key MEA 8X8 Armored Vehicle Companies:

- BAE Systems

- General Dynamics Corporation

- IVECO S.p.A

- KNDS Deutschland GmbH & Co

- Lockheed Martin Corporation

- Lockheed Martin Corporation

- Rheinmetall AG

- STREIT Group

Recent Developments

-

In June 2024, EDGE, Abu Dhabi-based conglomerate that develops advanced defence and technology solutions, announced a cooperation agreement with KNDS, a European military land system manufacturer, at the Eurosatory 2024 event in Paris. The partnership aims to strengthen the companies’ commercial and industrial relations in the land defence segment and enhance their collaboration in the development and production of munitions and weapons systems.

MEA 8X8 Armored Vehicle Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.10 billion

Revenue Forecast in 2030

USD 1.43 billion

Growth Rate

CAGR of 5.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2017 - 2023

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, mode of operation, country

Country scope

South Africa, Saudi Arabia, UAE

Key companies profiled

BAE Systems; General Dynamics Corporation; IVECO S.p.A; KNDS Deutschland GmbH & Co; Lockheed Martin Corporation; Oshkosh Defense, LLC; Rheinmetall AG; STREIT Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

MEA 8X8 Armored Vehicle Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the MEA 8X8 armored vehicle market report based on product, mode of operation, and country.

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Combat Vehicles

-

Armored Personnel Carrier (APC)

-

Infantry Fighting Vehicles (IFV)

-

Light Protected Vehicles (LPV)

-

Main Battle Tanks (MBT)

-

Mine-resistant Ambush Protected (MRAP) Vehicles

-

Tactical Vehicle

-

Others

-

-

Combat Support Vehicles

-

Armored Supply Trucks

-

Armored Command & Control Vehicles

-

Repair & Recovery Vehicles

-

Unmanned Armored Ground Vehicles

-

-

-

Mode of Operation Outlook (Revenue, USD Million, 2017 - 2030)

-

Manned Armored Vehicles

-

Unmanned Armored Vehicles

-

-

Country Outlook (Revenue, USD Million, 2017 - 2030)

-

South Africa

-

Saudi Arabia

-

UAE

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.