- Home

- »

- Plastics, Polymers & Resins

- »

-

MEA Polypropylene Compounds Market Size Report, 2030GVR Report cover

![MEA Polypropylene Compounds Market Size, Share & Trends Report]()

MEA Polypropylene Compounds Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Mineral Filled PP Compounds), By Application (Fiber, Film & Sheet), By End Use (Electrical & Electronics), And Segment Forecasts

- Report ID: 978-1-68038-631-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

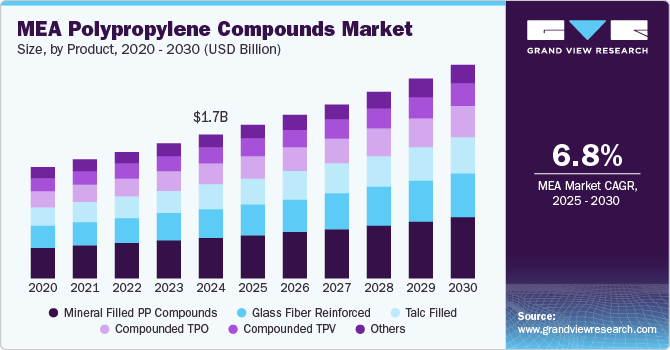

The MEA polypropylene compounds market size was valued at USD 1.72 billion in 2024 and is expected to grow at a CAGR of 6.8% from 2025 to 2030. The market growth can be attributed to the increasing demand from key automotive, packaging, and construction sectors. In addition, rapid urbanization, rising disposable incomes, and a shift towards lightweight materials enhance fuel efficiency in vehicles. Furthermore, expanding the electronics sector, particularly in South Africa, also supports market demand.

Polypropylene compounds are thermoplastic resins created by blending one or more base polyolefins with various additives, which enhance their properties and expand their applications. In the Middle East and Africa, these compounds are extensively utilized across diverse sectors, such as automotive, packaging, construction, and consumer goods.

The rising trend of green buildings drives demand for eco-friendly plastics in construction as energy-efficient structures gain popularity. In the food industry, polypropylene is crucial for packaging as it maintains the safety and integrity of contents while extending shelf life. Furthermore, advancements in packaging technology are leading to the development of more secure and versatile materials that improve product visibility and reduce spoilage. The rapid growth of the construction sector in emerging economies is expected to boost the polypropylene compounds market further.

Moreover, the automotive industry's increasing preference for lightweight materials is anticipated to enhance fuel efficiency and vehicle performance. As populations grow and living standards rise, the demand for lightweight materials continues to surge, contributing significantly to market expansion.

Product Insights

The mineral-filled polypropylene (PP) compounds held the dominant position in the market and accounted for the largest revenue share of 27.7% in 2024. This growth can be attributed to strong demand from various industries, particularly automotive and electrical sectors. In addition, these compounds enhance performance through improved heat resistance and stiffness, allowing for thinner parts that reduce overall production costs. Furthermore, their applications include automotive HVAC systems, fan blades, and food containers, making them essential for manufacturers seeking efficiency and cost-effectiveness in their products.

The glass-fiber-reinforced segment is expected to grow at a CAGR of 7.1% over the forecast period, driven by its superior strength and lightweight properties, which are crucial for the automotive industry. These compounds help improve fuel efficiency by reducing vehicle weight while maintaining structural integrity. In addition, as the demand for lightweight materials continues to rise, especially in electric vehicles, glass fiber-reinforced PP compounds are positioned to play a significant role in meeting industry standards for performance and sustainability.

Application Insights

The film & sheet segment led the market and accounted for the largest revenue share of 29.4% in 2024, owing to the increasing demand for flexible packaging solutions across various industries. As consumer preferences shift towards lightweight and durable materials, polypropylene films and sheets are favored for their excellent barrier properties, moisture resistance, and recyclability. In addition, this trend is further supported by expanding the packaging industry, particularly in food and consumer goods, where effective preservation and product visibility are essential.

The raffia application segment is expected to grow at a CAGR of 6.9% from 2025 to 2030, primarily driven by their use in producing woven bags, agricultural films, and industrial packaging. Furthermore, the growing agricultural sector in the region necessitates robust and reliable packaging solutions to protect products during transport and storage. Moreover, their lightweight nature and strength make raffia products ideal for various applications, including bulk packaging and construction materials.

End Use Insights

The automotive segment dominated the market and accounted for the largest revenue share of 53.4% in 2024, driven by the increasing demand for lightweight materials that enhance fuel efficiency and reduce carbon emissions. In addition, stringent government regulations to lower greenhouse gas emissions are pushing manufacturers to adopt advanced materials, such as polypropylene compounds, which offer superior performance compared to traditional materials. Furthermore, the rising production of vehicles in emerging markets and the shift towards electric vehicles further contribute to the demand for these compounds in automotive applications.

The electrical and electronics segment is expected to grow at a CAGR of 6.8% over the forecast period, owing to its excellent insulating properties, chemical resistance, and lightweight characteristics. In addition, as the region experiences rapid urbanization and technological advancements, there is a growing need for durable materials in consumer electronics and electrical components. Furthermore, the increasing adoption of smart technologies and energy-efficient solutions in homes and industries also drives the demand for polypropylene compounds, making them essential for manufacturers aiming to meet evolving consumer preferences and regulatory standards.

Regional Insights

GCC Countries Polypropylene Compounds Market Trends

The GCC countries' polypropylene compounds market dominated the MEA market and accounted for the largest revenue share of 41.4% in 2024. This growth can be attributed to the robust demand from the automotive and construction sectors. In addition, rapid urbanization and infrastructure development, particularly in Saudi Arabia, the UAE, and Qatar, are fostering significant investments in real estate and transportation. Furthermore, the increasing focus on lightweight materials to enhance fuel efficiency aligns with stringent environmental regulations, further propelling the adoption of polypropylene compounds in various applications across these industries.

South Africa Polypropylene Compounds Market Trends

The polypropylene compounds market in South Africa is expected to grow at a CAGR of 6.8% over the forecast period, owing to rising consumer demand for durable and versatile materials in packaging and automotive applications. Furthermore, the country's growing manufacturing sector is increasingly incorporating polypropylene compounds to meet the needs of modern consumers seeking sustainable and efficient solutions. Moreover, government initiatives aimed at boosting local production capabilities and reducing reliance on imports are encouraging investments in polypropylene production, thereby enhancing the market's growth potential in the region.

Key MEA Polypropylene Compounds Company Insights

Key MEA polypropylene compounds industry players include Mitsui Chemicals, Inc., Solvay, PolyOne Corporation, and others. These companies are adopting various strategies to enhance their competitive edge. These include investing in research and development to innovate advanced formulations, expanding production capacities to meet rising demand, and forming strategic partnerships for technology sharing. In addition, companies are focusing on sustainability initiatives by incorporating recycled materials into their products and optimizing supply chains to improve efficiency.

-

SABIC produces a wide range of polypropylene products, including impact-modified, mineral-filled, and glass fiber-reinforced compounds. These materials are utilized in diverse sectors such as automotive, electrical and electronics, consumer goods, and construction.

-

Borealis AG manufactures glass fiber-reinforced and mineral-filled polypropylene compounds that enhance mechanical properties and processing efficiency. The company operates in the plastics segment, focusing on automotive, packaging, and infrastructure applications.

Key MEA Polypropylene Compounds Companies:

- LyondellBasell Industries Holdings B.V.

- Sumitomo Chemical Co., Ltd.

- Mitsui Chemicals, Inc.

- Solvay

- Polyone Corporation

- Repsol

- SABIC

- Exxon Mobil Corporation

- Borealis AG

- Saudi Polymers LLC

- GAP Polymers

Recent Developments

-

In December 2023, Borealis launched Borcycle GD3600SY, a glass-fiber reinforced polypropylene compound containing 65% post-consumer recycled (PCR) material, aimed at the automotive sector. Collaborating with Plastivaloire and Stellantis, Borealis emphasized sustainability, aligning with European regulations that mandate increased recycled plastic usage in vehicles.

-

In July 2023, SABIC unveiled two new polypropylene compounds, SABIC PP compound H1090 and STAMAX 30YH611, designed for extruding and thermoforming complex components in electric vehicle (EV) battery packs. These innovative materials were reinforced with 30% glass fiber and are intumescent, providing flame-retardant properties essential for safety. They were intended for top covers and module separators, offering advantages over traditional metal forming methods, including cost-effectiveness and enhanced thermal insulation.

MEA Polypropylene Compounds Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.83 billion

Revenue forecast in 2030

USD 2.55 billion

Growth rate

CAGR of 6.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

Middle East & Africa

Country scope

GCC countries, South Africa, Rest of MEA

Key companies profiled

LyondellBasell Industries Holdings B.V.; Sumitomo Chemical Co., Ltd.; Mitsui Chemicals, Inc.; Solvay; Polyone Corporation; Repsol; SABIC; Exxon Mobil Corporation; Borealis AG; Saudi Polymers LLC; GAP Polymers

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

MEA Polypropylene Compounds Market Report Segmentation

This report forecasts revenue growth at regional and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, View Research has segmented the MEA polypropylene compounds market report based on product, application, end use, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Mineral Filled PP Compounds

-

Compounded TPO

-

Compounded TPV

-

Glass Fiber Reinforced

-

Talc Filled

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fiber

-

Film & Sheet

-

Raffia

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Building & Construction

-

Electrical & Electronics

-

Textile

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Middle East & Africa

-

GCC Countries

-

South Africa

-

Rest of MEA

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.