- Home

- »

- Medical Devices

- »

-

Medical Device Analytical Testing Outsourcing Market Report, 2030GVR Report cover

![Medical Device Analytical Testing Outsourcing Market Size, Share & Trends Report]()

Medical Device Analytical Testing Outsourcing Market (2025 - 2030) Size, Share & Trends Analysis Report By Services, By Therapeutic Areas, By End Use, By Device Type, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-366-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

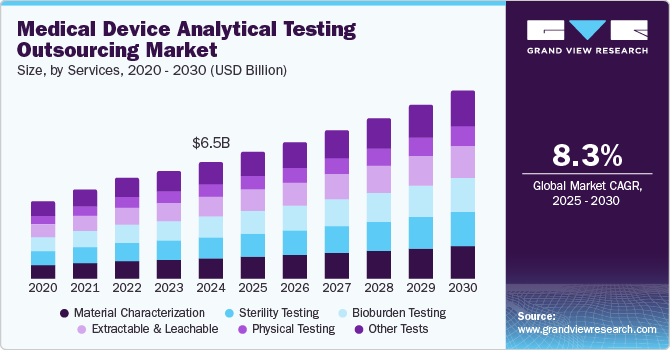

The global medical device analytical testing outsourcing market size was estimated at USD 6.54 billion in 2024 and is projected to grow at a CAGR of 8.3% from 2025 to 2030. The market growth worldwide is driven by the increasing prevalence of chronic diseases. According to the CDC, as of 2023, approximately 37 million adults in the U.S. are living with diabetes, representing about 11.3% of the adult population. This number is projected to rise, heightening the demand for reliable medical devices that assist in monitoring and managing diabetes and other chronic conditions.

In addition, according to the American Heart Association, cardiovascular diseases cause an estimated 224.4 deaths per 100,000 (age-adjusted) in the U.S. These statistics underscore the critical need for dependable medical devices such as heart monitors and stents. This rising prevalence necessitates comprehensive analytical testing to ensure devices meet safety and regulatory compliance.

Stringent regulatory requirements imposed by authorities such as the FDA and EMA further propel the outsourcing of analytical testing. In 2023, the FDA documented a significant increase in medical device submissions, with over 20,000 applications for new devices. This surge highlights the critical need for manufacturers to ensure compliance with stringent guidelines, prompting many to outsource testing to specialized laboratories that can effectively mitigate risks associated with product failures. Moreover, by 2024, compliance with Europe’s Medical Device Regulation (MDR) has led to increased pre-market scrutiny, with an estimated 50% of new device applications requiring additional testing compared to previous years.

Technological advancements in analytical testing methods are also a significant driver behind this market trend. Innovations such as mass spectrometry and chromatography have enhanced testing accuracy and efficiency, with reports indicating a 30% increase in testing efficiency as of 2023. Manufacturers are increasingly recognizing the advantages of outsourcing these specialized services, allowing them to leverage cutting-edge technologies rather than incurring the costs associated with developing them in-house. Furthermore, projected global investments in research and development for analytical testing technologies are anticipated to rise, signifying a shift towards embracing advanced methodologies to meet regulatory standards and improve patient outcomes.

Cost efficiency considerations play a crucial role in driving manufacturers toward outsourcing analytical testing. By contracting specialized laboratories, companies can significantly reduce operational costs related to maintaining in-house testing facilities. This strategic move enables manufacturers, particularly small and medium-sized enterprises, to concentrate on their core competencies while benefiting from the expertise of external labs. As the demand for rapid turnaround times increases, outsourcing offers manufacturers the advantage of quick and reliable testing services, facilitating faster product development and market entry. Collectively, these factors underscore the growing importance of the medical device analytical testing outsourcing market in an evolving healthcare landscape.

Services Insights

Material characterization dominated the market and accounted for a share of 18.1% in 2024, driven by its vital function in ensuring that materials utilized in medical devices comply with stringent safety and regulatory standards. This testing is crucial for verifying material properties, compatibility, and performance, which directly impact patient safety and the overall efficacy of the devices.

Bioburden testing is expected to grow lucratively over the forecast period, supported by its critical importance in ensuring product safety and compliance with regulatory standards. Heightened concerns regarding microbial contamination in medical devices necessitate comprehensive bioburden testing, driving manufacturers to outsource these specialized services to improve quality assurance and reduce the risks of product failures.

Therapeutic Area Insights

The cardiology segment led the market with a revenue share of 22.2% in 2024, attributed to the increasing global prevalence of cardiovascular diseases, a leading cause of mortality. This demand is further intensified by advancements in cardiac device technology and the necessity for stringent safety and efficacy testing, encouraging manufacturers to outsource analytical testing services.

The general & plastic surgery segment is expected to grow at the fastest CAGR of 10.6% over the forecast period. The rising volume of surgical procedures and advancements in surgical devices are driving market growth. The heightened demand for safety and efficacy in implants and instruments requires thorough testing, leading manufacturers to outsource analytical services to ensure compliance with strict regulatory standards and improve patient outcomes.

End Use Insights

Hospitals dominated the market with a revenue share of 87.2% in 2024, driven by rising patient volumes and increased budget allocations from hospital administrations. The demand for advanced technology-based medical devices further supports the need for efficient analytical testing, making hospitals key platforms for outsourcing these services to contract developers.

Other healthcare settings, including diagnostic centers, ambulatory care centers, and specialty care centers, are projected to capture significant market shares in the coming years. In 2024, the consumables segment comprised approximately 61.3% of hospital-based medical device analytical testing services, highlighting the critical need for high-quality disposable items to ensure safety and regulatory compliance.

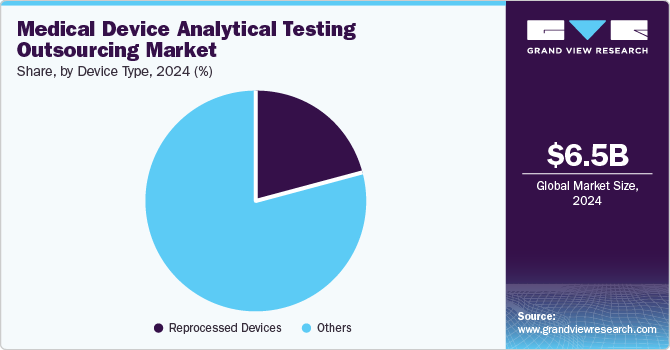

Device Type Insights

The others segment accounted for the largest revenue share of 78.7% in 2024, encompassing single-use, high-cost therapeutic and monitoring devices. This substantial share is primarily driven by the rising demand for contract outsourcing services globally, along with an increasing number of specialized medical devices necessitating efficient testing solutions.

Reprocessed devices are projected to grow at the fastest CAGR of 10.0% over the forecast period. Reprocessed devices, which undergo cleaning, sterilization, and refurbishment for reuse, enable healthcare providers to lower costs while ensuring quality care. Strict regulatory mandates require comprehensive analytical testing for safety and efficacy, leading manufacturers to outsource these services to specialized laboratories, facilitating compliance and expediting market entry.

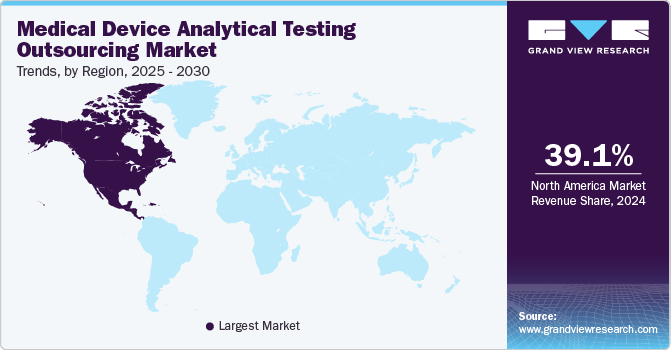

Regional Insights

North America medical device analytical testing outsourcing market dominated the global market with a revenue share of 39.1% in 2024. North America features a strong healthcare infrastructure and a rigorous regulatory framework. The presence of prominent medical device manufacturers and a high demand for FDA compliance propel outsourcing requirements. Furthermore, technological advancements and an emphasis on innovation enhance the region’s appeal for analytical testing services.

U.S. Medical Device Analytical Testing Outsourcing Market Trends

The medical device analytical testing outsourcing market in the U.S. dominated North America with the largest revenue share in 2024. The substantial U.S. patient population and significant investments in healthcare innovation are driving market growth. The rising complexity of medical devices and stringent FDA regulations require specialized testing services, leading manufacturers to outsource analytical testing to ensure compliance, enhance product safety, and expedite time-to-market.

Europe Medical Device Analytical Testing Outsourcing Market Trends

Europe medical device analytical testing outsourcing market held substantial market share in 2024 due to stringent regulatory requirements and a heightened focus on patient safety. The enforcement of the Medical Device Regulation (MDR) has intensified scrutiny on device approvals, increasing demand for specialized testing services, while technological advancements and rising healthcare expenditures also support market growth.

The medical device analytical testing outsourcing market in Germany is expected to grow in the forecast period. The nation’s strong healthcare system and substantial investment in medical technology are fueling demand for analytical testing services. Moreover, stringent European Union regulations require manufacturers to secure compliance, prompting many to outsource testing and related services to meet these rigorous standards effectively.

Asia Pacific Medical Device Analytical Testing Outsourcing Market Trends

Asia Pacific medical device analytical testing outsourcing market is expected to register the fastest CAGR of 8.9% in the forecast period. The increasing incidence of chronic diseases is creating a demand for advanced medical devices, thereby boosting the need for analytical testing services. Furthermore, enhancements in regulatory frameworks and technological innovations are facilitating market growth in this region, contributing to a more robust healthcare environment.

The medical device analytical testing outsourcing market in India is expected to register the fastest CAGR over the forecast period. The nation’s heightened emphasis on regulatory compliance and quality assurance is driving the demand for specialized testing services. Furthermore, escalating investments in research and development, coupled with a highly skilled workforce, establish India as a pivotal player in the analytical testing outsourcing sector.

Key Medical Device Analytical Testing Outsourcing Company Insights

Some key companies operating in the market include SGS Société Générale de Surveillance SA; Toxikon, Inc. (Laboratory Corporation of America Holdings); Eurofins Scientific; among others. Key strategic initiatives encompass partnerships with research institutions, improvement of regulatory compliance capabilities, and automation adoption to enhance efficiency and reduce turnaround times, fostering market growth and innovation.

-

Toxikon, Inc. delivers extensive preclinical contract research services, emphasizing in vivo and in vitro testing for pharmaceuticals, biotechnology, and medical devices. As a Labcorp subsidiary, it enhances nonclinical development through analytical testing to ensure product safety and regulatory compliance.

-

Eurofins Scientific stands as a global leader in laboratory services, focusing on bioanalytical testing and regulatory compliance for medical devices. The company provides comprehensive analytical services, including biocompatibility testing and microbiological assessments, ensuring products meet high safety standards for market approval.

Key Medical Device Analytical Testing Outsourcing Companies:

The following are the leading companies in the medical device analytical testing outsourcing market. These companies collectively hold the largest market share and dictate industry trends.

- SGS Société Générale de Surveillance SA

- Toxikon, Inc. (Laboratory Corporation of America Holdings)

- Eurofins Scientific

- Pace Analytical Services, LLC

- Intertek Group plc

- Wuxi AppTec

- North American Science Associates, LLC

- Envigo (Inotiv)

- Charles River Laboratories

Recent Developments

-

In October 2024, SGS announced its expansion in Lincolnshire, Illinois, enhancing biopharmaceutical testing capabilities. The facility added new instrumentation and services, supporting efficient product development and regulatory compliance for clients in the pharmaceutical sector.

-

In September 2024, Pace Life Sciences acquired Catalent’s Analytical Services Laboratory in Research Triangle Park, enhancing its small molecule capabilities and expanding its service network for biopharma and pharmaceutical clients nationwide.

-

In September 2024, Eurofins Scientific acquired Infinity Laboratories, significantly enhancing its BioPharma Product Testing capabilities across the U.S. and expanding its microbiology, chemistry, and packaging testing service offerings.

Medical Device Analytical Testing Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.05 billion

Revenue forecast in 2030

USD 10.53 billion

Growth rate

CAGR of 8.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Services, therapeutic areas, end use, device type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

SGS Société Générale de Surveillance SA; Toxikon, Inc. (Laboratory Corporation of America Holdings); Eurofins Scientific; Pace Analytical Services, LLC; Intertek Group plc; Wuxi AppTec; North American Science Associates, LLC; Envigo (Inotiv); Charles River Laboratories

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Device Analytical Testing Outsourcing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical device analytical testing outsourcing market report based on services, therapeutic areas, end use, device type, and region:

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Extractable and Leachable

-

Material Characterization

-

Physical Testing

-

Bioburden Testing

-

Sterility Testing

-

Other Tests

-

-

Therapeutic Areas Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiology

-

Diagnostic Imaging

-

Orthopedic

-

IVD

-

Ophthalmic

-

General & Plastic Surgery

-

Drug Delivery

-

Endoscopy

-

Dental

-

Diabetes Care

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Equipment

-

Consumables

-

Syringes

-

Wound Care

-

Others

-

-

-

Others

-

-

Device Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Reprocessed Devices

-

Hospital

-

Others

-

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical device analytical testing outsourcing market size was estimated at USD 6.54 billion in 2024 and is expected to reach USD 7.05 billion in 2025.

b. The global medical device analytical testing outsourcing market is expected to grow at a compound annual growth rate of 8.35% from 2025 to 2030 to reach USD 10.53 billion by 2030.

b. The Asia Pacific dominated the medical device analytical testing outsourcing market with a share of 42.22% in 2024. This is attributable to the fact that it is one of the top manufacturing hubs of highly reliable, complex, and high-end medical devices.

b. Some key players operating in the medical device analytical testing outsourcing market include SGS SA; Toxikon, Inc.; Eurofins Scientific; Pace Analytical Services, LLC; Intertek Group plc; WuXi AppTec.; NORTH AMERICAN SCIENCE ASSOCIATES INC.; Envigo; Charles River Laboratories International Inc.; and Medical Device Testing Services.

b. Key factors that are driving the medical device analytical testing outsourcing market growth include complexity in product design, intensifying competition, an increasing number of small-sized medical device manufacturers lacking in-house testing infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.