- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Medical Device Coating Market Size & Share Report, 2030GVR Report cover

![Medical Device Coating Market Size, Share & Trends Report]()

Medical Device Coating Market Size, Share & Trends Analysis Report By Product (Drug-eluting, Hydrophilic, Antimicrobial), By Application (Neurology, Cardiovascular, Dentistry), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-231-0

- Number of Report Pages: 122

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Report Overview

The global medical device coating market size was valued at USD 12.90 billion in 2022 and is anticipated to grow at a compound annual growth rate of 8.0% from 2023 to 2030. The increasing global demand for ventilators, catheters, cardiovascular devices, guide wires, sutures, syringes, mandrels, stents, and other devices used in the healthcare field due to rising government expenditures on healthcare facilities post-COVID-19 will drive market growth. In addition, factors, such as the rising geriatric population, increasing demand for early disease detection & non-invasive treatments, and high demand for high-quality healthcare, are anticipated to drive the demand for medical device coatings in the coming years.

The product is crucial for protecting several types of devices used in the medical sector. These coatings boost the maneuverability and performance of medical devices and also protect them from pathogens and microbial factors. In addition, it offers excellent thermal stability, dielectric properties, and dry-film lubricity. This is expected to provide tremendous market potential over the forecast years. A rise in the frequency of Hospital-acquired Infections(HAIs) is fueling the growth of the market.

For instance, the use of contaminated devices can spread HAIs, requiring medical device coating to stop the spread of the infection as these coatings have antimicrobial properties. These coatings are materials that enhance a medical device’s performance & mobility and are used to protect the surfaces of several medical devices, including those used in dentistry, neurology, and other fields. Moreover, it provides excellent thermal stability, dry-film lubricity, and dielectric properties, which is likely to generate significant market potential over the forecast period.

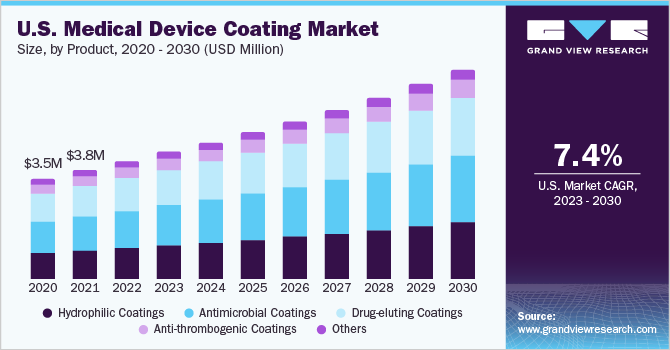

Product Insights

Antimicrobial coatings dominated the product segment in 2022 and accounted for the largest share of more than 31.60% of the overall revenue. This is attributed to their lower price and higher compatibility with different device materials, such as composite materials, carbon fiber, metal, stainless steel, and plastic. The segment is predicted to grow as a result of the rising R&D efforts and increasing implantable device usage. In addition, the prevalence of healthcare infections, such as pneumonia, linked to ventilators and catheter-associated urinary tract infections is forcing medical device manufacturers to coat their products with anti-microbial agents. Increasing research and development activities and growing awareness regarding HAIs have led to the dominant share of antimicrobial coatings.

For instance, according to a 2018 report from the U.S. Centers for Disease Control and Prevention, approximately 1.7 million hospitalized patients develop Healthcare-associated Infections (HCAIs) annually while receiving treatment for other medical conditions. The need to prevent germs from growing is boosting the demand for antimicrobial coatings. Hydrophilic coatings are likely to grow at the highest CAGR over the forecast period owing to their wide usage in medical devices, such as pacemakers. The product demand will also be driven by its benefits, such as reduced friction, optical clarity, improved durability & lubricity, and the ability to withstand maintenance procedures including sterilization, storage, and cleaning. Devices like tubes benefit from hydrophilic surface coatings that improve their wettability, thereby improving their interaction with biological tissues.

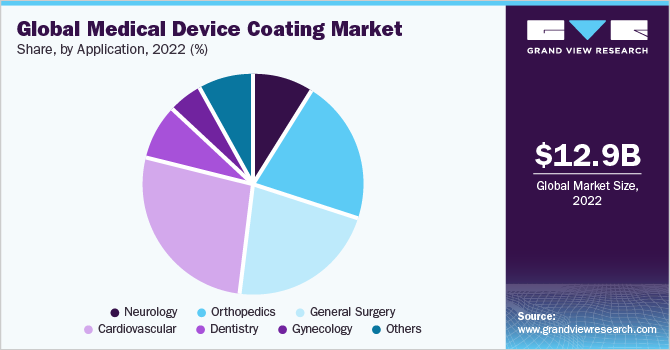

Application Insights

On the basis of applications, the global industry has been further categorized into neurology, orthopedics, general surgery, cardiovascular, dentistry, gynecology, and others. The cardiovascular application segment dominated the industry in 2022 and accounted for the maximum share of more than 26.65% of the overall revenue. The high share of the segment can be attributed to the growing popularity of cardiac pacemakers and implants. In addition, the growth is fueled by the rising demand for drug-eluting coatings used for coronary stents. The increasing geriatric population, and high consumption of unhealthy diets, coupled with sedentary lifestyles, are likely to increase the occurrence of Cardiovascular Diseases(CVDs).

Moreover, the segment is expected to grow as a result of favorable government policies, such as reimbursement coverage, and an increase in healthcare spending. On the other hand, the neurology segment is estimated to register the fastest growth rate during the forecast period. General surgery application emerged as the second-largest application segment in 2022 and is predicted to witness prominent growth over the forecast years. This is attributed to the growing product usage in a variety of parts, including CPUs, graphics cards, chipsets, and hard disks.

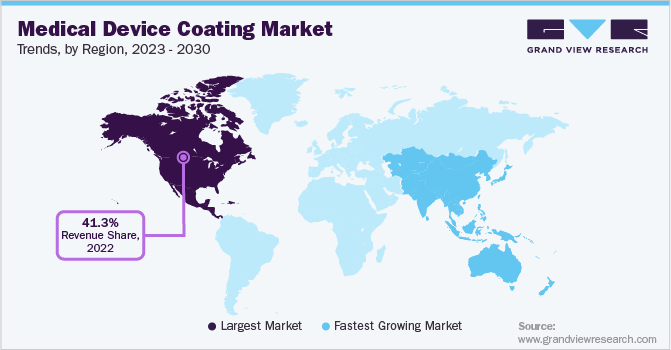

Regional Insights

The North America region dominated the global industry in 2022 and accounted for the largest share of more than 41.35% of the overall revenue. The high share of this region can be attributed to favorable healthcare resources coupled with the increasing frequency of cardiometabolic disorders including Deep Vein Thrombosis and Pulmonary Embolism. Moreover, the growing healthcare infrastructure and high adoption rate of advanced surgical treatments in the U.S. are predicted to fuel product demand during the forecast years.

The region’s dominance is also attributed to the presence of various healthcare facilities, including diagnostic centers, and high investments in healthcare R&D. Asia Pacific is anticipated to register the highest CAGR over the forecast period owing to the increasing demand for superior healthcare facilities and an increasing number of hospitals in the region. The increasing geriatric population and rising obesity cases, which can lead to a high probability of cardiac diseases, are likely to drive product demand in the coming years. The rising home healthcare market and ease in private health insurance will further boost industry growth.

Key Companies & Market Share Insights

The industry is fragmented owing to the presence of numerous small- and large-scale players. The companies seek to increase their market position by expanding their clientele. In addition, manufacturers are focused on new product development, distribution, contract manufacturing, technology licensing, mergers & acquisitions, and partnerships to gauge current and future demand from several applications. Major players are focusing on R&D of nanotechnology-based products and other coating technologies including waterborne and UV radiation-cured, due to the regulations regarding the emission of Volatile Organic Compounds (VOCs). For example, Covestro AG produces waterborne and biocompatible coatings for medical devices used in drug delivery and wound care. Some of the prominent players in the global medical device coating market include:

-

SurModics Inc.

-

Sono-Tek Corp.

-

DSM

-

Hydromer, Inc.

-

Covalon Technologies Ltd.

-

Infinita Biotech Private Ltd.

-

Materion Corp.

Medical Device Coating Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 13.97 billion

Revenue forecast in 2030

USD 23.85 billion

Growth rate

CAGR of 8.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; South Korea; ASEAN; Brazil; Argentina; Chile; South Africa; UAE

Key companies profiled

SurModics Inc.; Sono-Tek Corp.; DSM; Hydromer; Inc.; Covalon Technologies Ltd.; Infinita Biotech Pvt. Ltd., Materion Corp.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

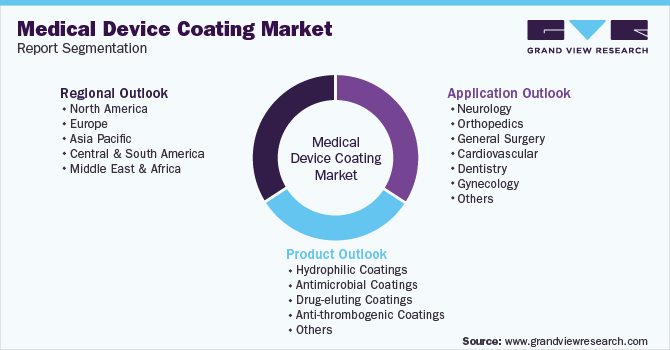

Global Medical Device Coating Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global medical device coating market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Hydrophilic Coatings

-

Antimicrobial Coatings

-

Drug-eluting Coatings

-

Anti-thrombogenic Coatings

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Neurology

-

Orthopedics

-

General surgery

-

Cardiovascular

-

Dentistry

-

Gynecology

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

ASEAN

-

-

Central & South America

-

Brazil

-

Argentina

-

Chile

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global medical device coating market size was estimated at USD 12.90 billion in 2022 and is expected to reach USD 13.97 billion in 2023.

b. The global medical device coating market is expected to grow at a compound annual growth rate of 8.0% from 2023 to 2030 to reach USD 23.85 billion by 2030.

b. North America dominated the medical device coating market with a share of 41.40% in 2022. This is attributable to rising healthcare awareness coupled with rising frequency of cardiometabolic disorders such as Pulmonary Embolism (PE) and Deep Vein Thrombosis (DVT) in the region.

b. Some key players operating in the medical device coating market include SurModics Inc., Sono-Tek Corporation, DSM, Hydromer, Inc., Covalon Technologies Ltd., Infinita Biotech Private Limited, Materion Corporation, and others.

b. Key factors that are driving the medical device coating market growth include the increasing demand for catheters, ventilators, catheters, cardiovascular devices, guide wires, sutures, syringes, mandrels, stents, and other devices used in the healthcare field due to rising government expenditures on healthcare facilities post covid globally.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."