- Home

- »

- Medical Devices

- »

-

Medical Equipment Maintenance Market, Industry Report, 2030GVR Report cover

![Medical Equipment Maintenance Market Size, Share & Trends Report]()

Medical Equipment Maintenance Market (2024 - 2030) Size, Share & Trends Analysis Report By Equipment (Imaging Equipment, Surgical Instruments), By Service (Preventive, Corrective), By Service Provider, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-308-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Equipment Maintenance Market Summary

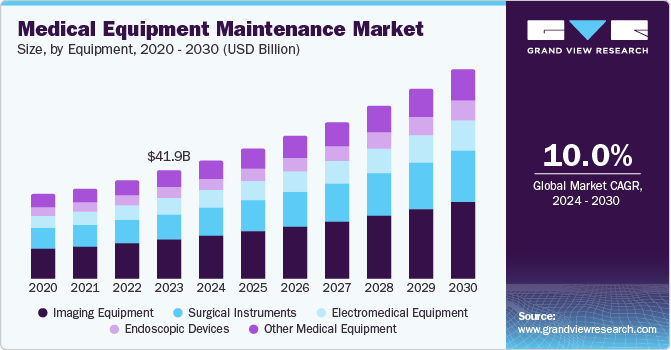

The global medical equipment maintenance market size was valued at USD 41.90 billion in 2023 and is projected to reach USD 81.32 billion by 2030, growing at a CAGR of 10.0% from 2024 to 2030. Increasing demand for medical devices globally, growing prevalence rate of life-threatening disorders requiring diagnosis, and rising demand for the refurbished medical equipment are projected to drive the medical device maintenance market growth during the forecast period.

Key Market Trends & Insights

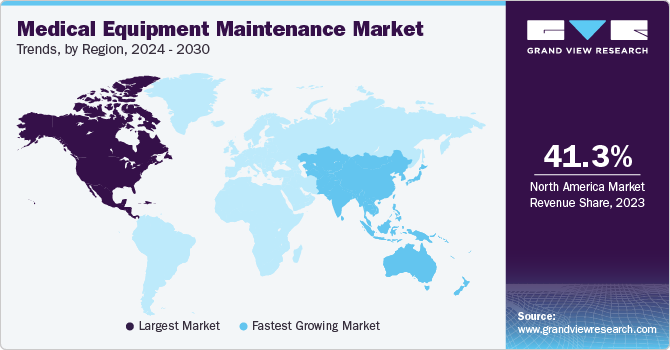

- North America medical equipment maintenance market dominated the global industry in 2023.

- The U.S. medical equipment maintenance market dominated the regional market in 2023 with the largest revenue share.

- Based on equipment, the imaging equipment segment dominated the market with a share of 36.1% in 2023.

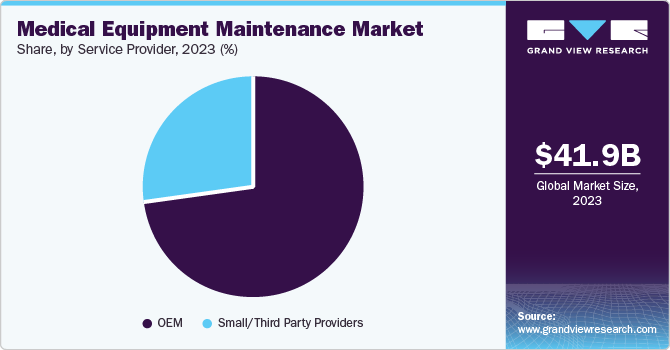

- By service, original equipment manufacturer (OEM) segment accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 41.90 Billion

- 2030 Projected Market Size: USD 81.32 Billion

- CAGR (2024-2030): 10.0%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

As medical equipment is extensively used in healthcare service provisions, the success rate of treatments is highly reliable on the accuracy and performance of this equipment. Currently, several devices such as electrocardiographs, syringe pumps, centrifuges, X-ray units, autoclaves, and ultrasound are available in the healthcare industry for diagnosis and treatment, which require maintenance due to the unceasing burden of continuous use, defects, malfunctions, and more.

Furthermore, increasing global disposable income, rising medical device approvals, and growing adoption of new technologies in emerging countries are projected to further fuel the sales of medical devices, in turn, increasing the maintenance demand. Due to the growing geriatric population, higher expenditure is witnessed for remote patient monitoring devices. And these devices require higher maintenance, which is expected to propel the market growth over the forecast period.

Equipment Insights

The imaging equipment dominated the market and accounted for a share of 36.1% in 2023. Imaging equipment helps in visualizing the interior parts of the body and in conducting diagnosis of the same. The increasing rate of chronic diseases such as heart-related health issues are driving growth for this segment. According to the Centers for Disease Control and Prevention, an estimated 129 million people in the U.S. have at least one major chronic disease. X-rays, magnetic resonance imaging (MRI), computed tomography (CT) scans, and ultrasound are some of the commonly used types of imaging equipment.

The surgical instruments segment is expected to register the fastest CAGR of 10.3% during the forecast period. According to the World Health Organization, by the year 2030, one out of every six individuals globally will be 60 years old or older. The global population of individuals aged 60 and older is expected to reach 2.1 billion by the year 2050. The growing geriatric population necessitates the demand for surgeries which is driving the segment growth. Lifestyle disorders that lead to major surgeries, diseases such as cardiovascular conditions, and cancer-related surgeries are also some of the key drivers driving demand for the surgical instruments market.

Service Insights

The corrective maintenance segment accounted for the largest revenue share in 2023. This helps in repairing equipment when it malfunctions or fails, and maintenance takes place for breakdowns of instruments. It includes replacement and restoration of systems aiming to restore the equipment to its original operational condition. With the growing cases of equipment failure due to continuous use and unending application in modern healthcare facilities, this segment is most likely to attain rapid growth.

The preventive maintenance segment is anticipated to register the fastest CAGR from 2024 to 2030. It leads to an increase in the lifespan of assets and equipment by keeping them in good condition and an increase in efficiency by optimizing the performance and reliability of assets. Often, facilities and healthcare institutes undertake preventive maintenance drives once or twice a year to maintain quality service offerings and an uninterrupted flow of operations, which is expected to generate greater demand for the market in the coming years.

Service Providers Insights

The Original Equipment Manufacturer (OEM) segment accounted for the largest revenue share in 2023. The maintenance solutions offered by OEMs are highly specialized and tailored to meet the specific requirements of their products. OEMs have the opportunity to increase profits by providing maintenance and repair services after the warranty expires. This aids in developing enduring relationships with clients and promoting loyalty. It possesses extensive knowledge about the design, components, and operational characteristics of its equipment.

The small/third-party providers segment is anticipated to register the fastest CAGR during the forecast period. Numerous specialized small/third-party providers focus on the upkeep of certain types of medical equipment, providing extensive knowledge in the field. They can easily adjust to new technologies and maintenance needs. Smaller providers possess a solid grasp of local regulations, infrastructure, and market dynamics. The close vicinity to medical centers enables faster reaction times in case of urgent situations.

End Use Insights

The hospitals segment accounted for the largest revenue share in 2023. The increasing global population of elderly individuals is leading to a growth in chronic illnesses such as diabetes, heart disease, and cancer, necessitating more advanced diagnostic and treatment tools. Private healthcare facilities are putting money into advanced equipment to improve patient care and appeal to additional patients. Moreover, the rise in government investment in healthcare infrastructure and services fuels the need for more advanced medical equipment.

The ambulatory surgical centers segment is anticipated to register a significant CAGR during the forecast period. Patients can schedule procedures at times that are more convenient and experience shorter waiting periods in ASCs. The advancement of minimally invasive surgery has allowed numerous methods to be performed on an outpatient basis. Technological advancements such as robotic surgery units and cutting-edge imaging techniques, have boosted the potential of ASCs.

Regional Insights

North America medical equipment maintenance market dominated the global industry in 2023. Advances in medical infrastructure, rise in chronic diseases, growing expenses on healthcare, and availability of ambulatory surgical centers in the region are factors expected to drive growth for the market. North America has emerged as one of the developed markets for healthcare industry and medical tourism in recent years. This has developed a constant demand for uninterrupted availability of fully functioning medical equipment.

The U.S. medical equipment maintenance market dominated the regional market in 2023 with the largest revenue share. This is primarily due to the extensive applications of medical equipment in the healthcare industry of the country. The companies and facilities operate premium quality equipment to deliver enhanced services and treatments. In addition, the number of new cases and patients related to the disease where medical equipment are necessity is growing in the U.S., which has resulted in greater demand for the market.

Europe Medical Equipment Maintenance Market Trends

The Europe medical equipment maintenance market was identified as a lucrative in 2023. This is mainly due to the growing emphasis on early diagnosis of chronic diseases and the increasing adoption of imaging equipment in multiple healthcare treatments.

The medical equipment maintenance market in UK is expected to experience rapid growth and generate higher revenues during forecast period. This can be attributed to aspects such as enhancements in healthcare infrastructure, a growing number of healthcare industry participants, and a larger presence of independent service providers associated with medical equipment maintenance.

Asia Pacific Medical Equipment Maintenance Market Trends

The Asia Pacific medical equipment maintenance market is projected to grow at the fastest CAGR from 2024 to 2030. More than half the world’s population lives in this region with highly populated countries such as China and India. The demand for healthcare services in the region is expected to grow significantly over the years as demographics changes to a greater number of elderly individuals as compared to young, working people. Access to care, cost, and quality remain critical challenges for the healthcare system in the region. These aspects are developing rapid growth for the medical equipment maintenance market.

The medical equipment maintenance market in India is expected to experience lucrative growth in coming years owing to multiple factors such as increasing investments in healthcare infrastructure resulting in a growing number of facilities and users of medical equipment, and a rising need for refurbished medical equipment. period.

Key Medical Equipment Maintenance Company Insights

Some of the key companies in medical equipment maintenance market are GE Healthcare, Siemens Healthineers AG, Medtronic, Aramark and others. The prominent players have embraced strategies such as service differentiations, collaborations, long-term agreements and more, owing to rising competition and unceasing demand for maintenance services of advanced medical equipment,

-

GE HealthCare, one of the significant market participants in medical equipment and medical technology industry, offers wide range of medical equipment maintenance services and products such as planned maintenance kits, repair solutions, and technical support.

Key Medical Equipment Maintenance Companies:

The following are the leading companies in the medical equipment maintenance market. These companies collectively hold the largest market share and dictate industry trends.

- GE HealthCare

- Siemens Healthineers AG

- Medtronic

- Aramark

- Koninklijke Philips N.V.

- B. Braun SE

- AlphaSource Group

- Althea Group

Recent Developments

-

In March 2023, Advantus Health Partners and GE HealthCare announced that they entered into an agreement of upto USD 760 million over 10 years to provide GE’s Healthcare Technology Management (HTM) services to the clients of Advantus Health Partners.

-

In March 2023, Medipass Healthcare and Althea UK announced their merger of operations and that they have been rebranded as Ergéa. It covers endoscopy, radiology, cardiology, radiotherapy and surgical theatres. The company also offers vendor independent maintenance services for radiology, endoscopy, and biomed equipment in UK.

Medical Equipment Maintenance Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 45.95 billion

Revenue forecast in 2030

USD 81.32 billion

Growth Rate

CAGR of 10.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment, service, service provider, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Thailand, Australia, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

GE HealthCare;Siemens Healthineers AG; Medtronic; Aramark; Koninklijke Philips N.V.; B. Braun SE; AlphaSource Group; Althea Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Equipment Maintenance Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in industry and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global medical equipment maintenance market report on the basis of equipment, service, service providers, end use and region:

-

Equipment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Imaging Equipment

-

Surgical Instruments

-

Electromedical Equipment

-

Endoscopic Devices

-

Other Medical Equipment

-

CT

-

MRI

-

Digital X-Ray

-

Ultrasound

-

Others

-

Life Support Devices

-

Dental Equipment

-

-

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Preventive Maintenance

-

Corrective Maintenance

-

Operational Maintenance

-

-

Service Providers Outlook (Revenue, USD Billion, 2018 - 2030)

-

OEM

-

Small/Third Party Providers

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Diagnostic Imaging Centers

-

Dialysis Centers

-

Ambulatory Surgical Centers

-

Dental Clinics & Speciality Clinics

-

Other End Use

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.