- Home

- »

- Plastics, Polymers & Resins

- »

-

Medical Fluoropolymers Market Size, Industry Report, 2033GVR Report cover

![Medical Fluoropolymers Market Size, Share & Trends Report]()

Medical Fluoropolymers Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (ETFE, PTFE, PVDF, Fluoroelastomers), By Application (Medical Tubing, Catheters, Medical Bags, Drug Delivery Device), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-958-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Fluoropolymers Market Summary

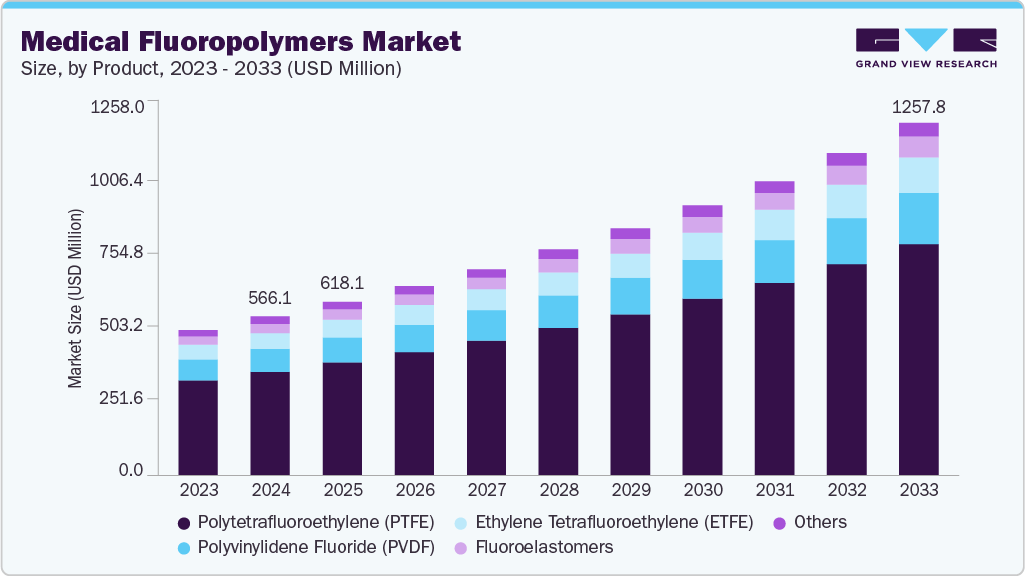

The global medical fluoropolymers market size was valued at USD 566.08 million in 2024 and is projected to reach USD 1,257.79 million by 2033, growing at a CAGR of 9.3% from 2025 to 2033. Increasing demand for advanced medical technology and devices, and growing healthcare investments in emerging economies, are expected to drive the demand for medical fluoropolymers over the forecast period.

Key Market Trends & Insights

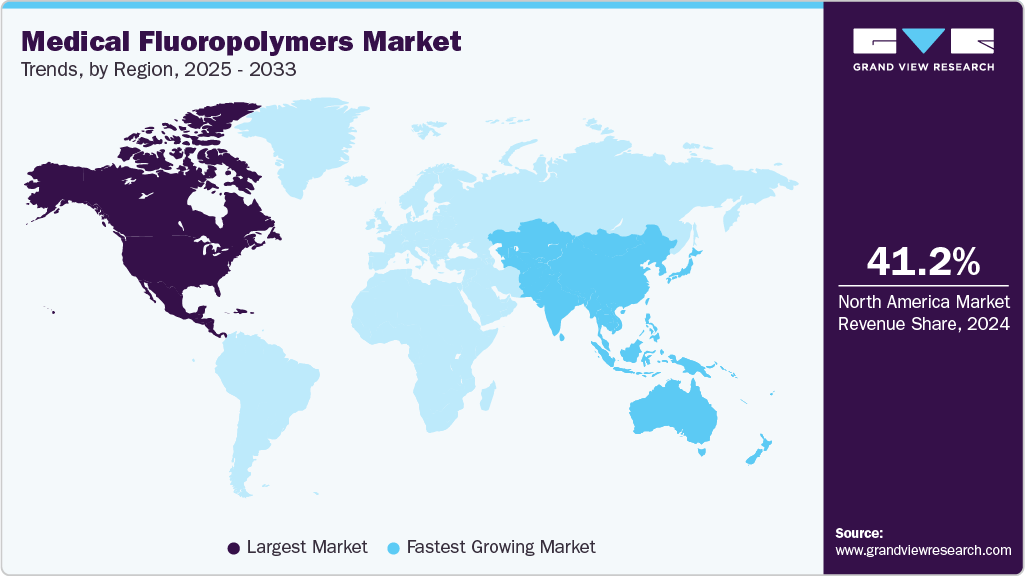

- North America dominated the medical fluoropolymers market with the largest revenue share of 41.23% in 2024.

- The medical fluoropolymers market in the U.S. is expected to grow at a substantial CAGR of 9.3% from 2025 to 2033.

- By product, the Ethylene Tetrafluoroethylene (ETFE) segment is expected to grow at a considerable CAGR of 9.7% from 2025 to 2033.

- By application, the medical tubing segment is expected to grow at a considerable CAGR of 9.6% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 566.08 Million

- 2033 Projected Market Size: USD 1,257.79 Million

- CAGR (2025-2033): 9.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The global market for medical fluoropolymers is witnessing consistent growth, fueled by their essential function in improving safety, performance, and dependability in healthcare applications. Medical-grade fluoropolymers, including PTFE, FEP, and PVDF, provide outstanding chemical resistance, biocompatibility, and thermal stability-making them suitable for catheters, surgical tools, tubing, and implantable devices. As healthcare systems around the globe grow and focus on minimally invasive techniques, infection control, and the integration of advanced materials, the demand for fluoropolymers continues to increase. Moreover, ongoing advancements in medical device manufacturing and heightened regulatory attention on material safety are promoting the use of fluoropolymers within the medical industry.

Drivers, Opportunities & Restraints

The main factor driving the global medical fluoropolymers market is the growing demand for high-performance, biocompatible materials used in advanced medical devices and equipment. Materials like PTFE, FEP, and PFA are commonly preferred due to their outstanding chemical inertness, low friction properties, and high thermal stability, which make them suitable for essential applications such as catheters, tubing, surgical tools, and implantable devices. Furthermore, the increasing popularity of minimally invasive procedures and the heightened focus on infection prevention and patient safety are boosting the utilization of components made from fluoropolymers. Compliance with regulations and continual advancements in medical material technologies also contribute to the market's growth.

Emerging markets offer significant growth potential for the medical fluoropolymers sector, driven by the enhancement of healthcare facilities, an increase in medical tourism, and greater access to advanced treatments. As these areas commit resources to updating hospitals and diagnostic centers, the need for high-performance, contamination-resistant materials such as fluoropolymers is on the rise. Additionally, the heightened focus on single-use medical devices and sustainability is promoting the use of recyclable, inert fluoropolymer options. Advancements in fluoropolymer processing, like enhanced extrusion methods, thinner-walled tubing, and radiation-resistant varieties, are also paving the way for broader applications in both traditional and next-generation medical devices.

Despite their many benefits, medical fluoropolymers encounter specific market limitations, such as elevated manufacturing costs and complicated processing requirements, which can impede widespread usage-particularly in budget-sensitive healthcare systems. Fluctuations in the prices of raw materials and disruptions in the supply chain add further challenges to market stability. Moreover, stringent regulatory approvals and protracted validation processes for medical-grade materials can delay product development and commercialization. Competition from alternative materials, including high-performance thermoplastics or silicone-based compounds, may also exert pressure on the adoption of fluoropolymers unless their superior performance or compliance advantages in critical applications can be demonstrated.

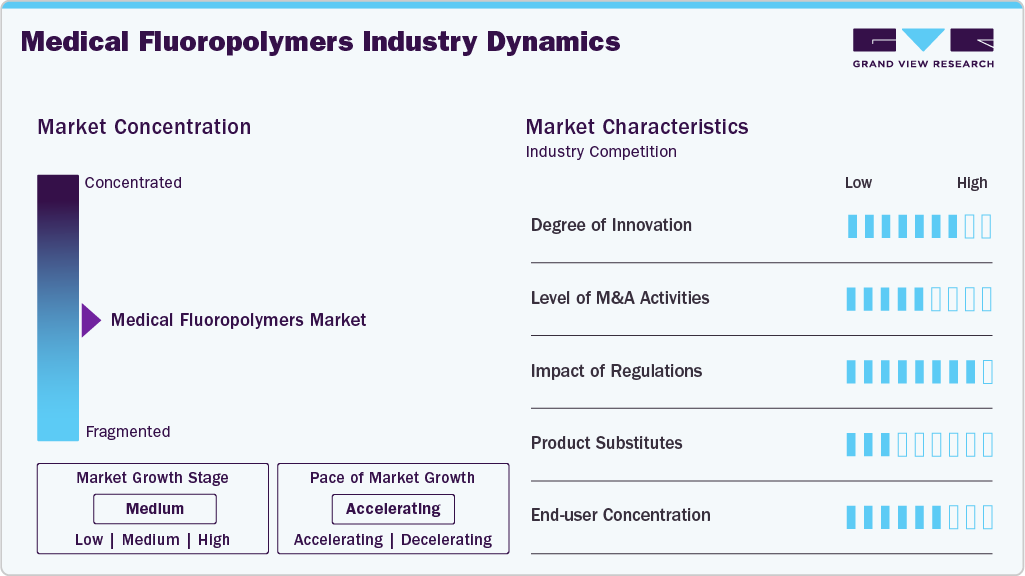

Market Concentration & Characteristics

The global market for medical fluoropolymers is currently undergoing steady growth, driven by an increasing need for sophisticated, biocompatible materials in medical devices and diagnostics. The market is somewhat consolidated, with several international players enhancing their development through innovation in materials, collaboration through strategic partnerships, and expertise in regulatory compliance. Leading companies such as The Chemours Company, Daikin Industries, Ltd., Solvay SA, 3M Company, W. L. Gore & Associates, Inc., Saint-Gobain, and Zeus Industrial Products, Inc. are instrumental in influencing the market. These organizations utilize their fluoropolymer technology, particularly in PTFE, FEP, and PFA, to create solutions that improve performance, safety, and durability in vital healthcare applications, which include catheter assemblies, surgical tubing, and implantable components.

Competition stems from alternative materials like high-performance thermoplastics (such as PEEK and PPSU) and medical-grade silicones. Thermoplastics are appreciated for their durability, ability to be sterilized, and lower pricing, making them appropriate for a variety of reusable and disposable medical devices. Conversely, silicones provide outstanding flexibility, biocompatibility, and ease of processing, which makes them well-suited for implants and soft-tissue interactions. Moreover, developments in bio-based polymers and materials sourced sustainably are gaining popularity, particularly in situations where environmental factors and cost-effectiveness are important, posing additional competitive challenges to the adoption of fluoropolymers.

Regulatory frameworks are essential in defining the market, especially given the stringent safety and performance requirements in the healthcare sector. In key markets like the U.S. and EU, medical components made from fluoropolymers must adhere to regulations set by organizations such as the U.S. FDA (21 CFR Part 820), the European Medical Device Regulation (MDR 2017/745), and relevant ISO standards like ISO 10993 for biocompatibility. These regulations affect everything from the composition of materials and sterilization processes to labeling and traceability. Moreover, the rising regulatory focus on PFAS substances is driving manufacturers to explore cleaner and compliant fluoropolymer chemistries, which are shaping their material choices and innovation approaches within the industry.

Product Insights

The polytetrafluoroethylene (PTFE) segment led the market and accounted for over 65.0% share of the global revenue in 2024. Polytetrafluoroethylene (PTFE) is a synthetic fluoropolymer of tetrafluoroethylene that has numerous applications. PTFE is mainly used for the manufacturing of gaskets, pump interiors, washers, and seals on account of exhibiting chemical resistance and inertness properties. PTFE is expected to increase its application in the manufacturing of chips and encapsulation devices for quartz heaters. The growth of PTFE can be attributed to its easy blending properties with numerous fillers such as carbon graphite, glass bead, and molybdenum disulfide for enhancing certain properties.

ETFE (Ethylene Tetrafluoroethylene) is a fluorine-based plastic with enhanced strength and corrosion resistance over a wide temperature range. Due to its unique chemical and physical properties, ETFE is widely used in the chemical, architectural, electrical/electronic, construction, automotive, and health care industries. ETFE offers the best wear resistance, impact toughness, and radiation resistance of any fluoropolymer. ETFE is a melt-processable material and has mechanical qualities comparable to completely fluorinated polymers.

Due to its chemical resistance, polyvinylidene fluoride (PVDF) is utilized in biomedical sciences as an artificial membrane in immunoblotting. PVDF membranes are also utilized as membrane filtration devices in the biomedical industry. PVDF coatings exhibit resistance to abrasion and weathering, have high dielectric strength, and can extinguish the product in case of fire.

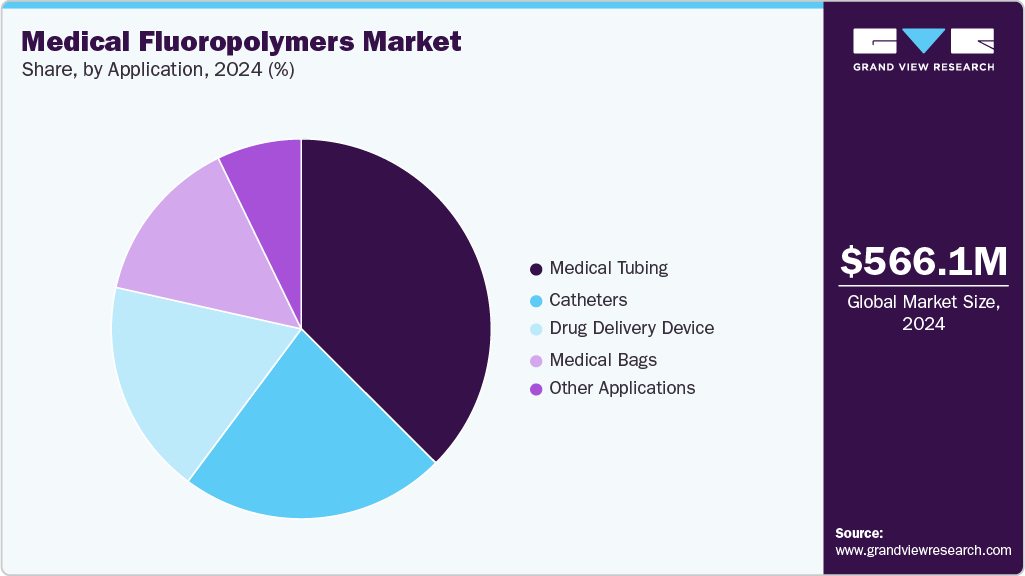

Applications Insights

The medical tubing segment led the market and accounted for 37.47% share of the global revenue in 2024. Medical tubing is designed for several applications, such as anesthesiology, respiratory equipment, peristaltic pumps, biopsy, check pump functions, and diagnosing congenital heart defects, to allow clinicians to administer fluids and devices or allow for gas flow. These are also used in diagnostic instruments and bio-processing fluid transfer.

The demand for medical fluoropolymers in catheters is dominated by polytetrafluoroethylene (PTFE) owing to its superior properties such as flexibility, clarity, firmness, and pliability. In addition, the enhanced mechanical and thermal properties offered by PTFE as compared to traditional materials such as rubber are expected to open up new avenues for market growth.

The implanted medical device with extended drug delivery has had a significant impact on the development of stand-alone reservoir-based delivery systems. Implant surgery is intrusive and might result in irritation or infection. The use of active therapies in conjunction with medical devices can help to lessen or eliminate the trauma of implantation.

Regional Insights

North America medical fluoropolymers market held the largest share of 41.23% of the global revenue in 2024. The medical fluoropolymers market in North America is projected to witness significant growth in the coming years, owing to the increased demand for medical fluoropolymers for developing drug delivery devices, medical tubing, catheters, medical bags, etc. The increase in health care infrastructure spending is one of the vital reasons fueling the growth of the medical fluoropolymers market in North America.

U.S. Medical Fluoropolymers Market Trends

The medical fluoropolymers market in the U.S. is experiencing consistent growth, fueled by the nation's advanced healthcare system, a high level of innovation in medical devices, and robust regulatory oversight. There is especially strong demand in areas such as catheter systems, surgical instruments, diagnostic devices, and implantable products, where biocompatibility and performance are essential. The U.S. FDA’s rigorous safety and performance standards for materials encourage the usage of high-quality fluoropolymers such as PTFE, FEP, and PFA. Furthermore, the rise in investment for minimally invasive procedures, the increasing healthcare needs of an aging population, and a focus on minimizing infection risks through single-use devices are driving the transition to fluoropolymer-based components. Additionally, the push to comply with changing PFAS regulations is motivating manufacturers to utilize cleaner and compliant formulations, further strengthening the market's long-term prospects.

Europe Medical Fluoropolymers Market Trends

The medical fluoropolymers market in Europe is set for significant growth, fueled by the region's commitment to advancing technology in the healthcare industry. European governments are encouraging the enhancement of medical infrastructure through the integration of cutting-edge and high-performance materials, such as fluoropolymers, in next-generation medical devices. The regulatory backing from the EU, along with financial support for healthcare innovation and digital transformation, is hastening the expansion of the market. Europe boasts a robust base of medical device producers, along with an increasing network of health tech startups and strategic mergers and acquisitions, reinforcing the area’s leadership in the development of medical materials. Moreover, the rising demand for biocompatible, sterilizable, and PFAS-compliant materials is anticipated to further enhance the application of fluoropolymers in vital areas like diagnostics, surgical systems, and implantable devices.

Asia Pacific Medical Fluoropolymers Market Trends

The medical fluoropolymers market in Asia Pacific is anticipated to witness considerable growth in the coming years, owing to the increasing demand for medical fluoropolymers used for developing medical tubing, catheters, membranes, venous cannula, etc. The demand for the finest medical devices and components from hospitals in major economies of Asia Pacific, including China and India, is increasing owing to the rising healthcare expenditure of these countries. In addition, the improving service and safety standards in hospitals in Asia Pacific are expected to drive the growth of the medical fluoropolymers market in the region over the forecast period.

China medical fluoropolymers market is driven by the country's ongoing healthcare reforms, increased investment in medical facilities, and a heightened demand for advanced medical technologies. As China aims for self-reliance in the production of high-quality medical devices, the necessity for high-performance materials such as fluoropolymers is on the rise, particularly in areas like surgical tools, tubing, diagnostic equipment, and implantable devices. Government initiatives that promote local innovation, alongside regulatory enhancements that align with international standards (such as reforms from China’s National Medical Products Administration), are contributing to market expansion. Furthermore, the growth of private healthcare providers and the increasing healthcare demands of an aging population are boosting the need for biocompatible, chemically inert, and sterilization-compatible materials-key benefits of medical fluoropolymers in the Chinese market.

Key Medical Fluoropolymers Companies Insights

Key players operating in the medical fluoropolymers market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Medical Fluoropolymers Companies:

The following are the leading companies in the medical fluoropolymers market. These companies collectively hold the largest market share and dictate industry trends.

- Daikin Industries, Ltd.

- The Chemours Company

- Solvay SA

- Arkema

- Adtech Polymer Engineering Ltd.

- Dongyue Group Limited

- Saint-Gobain

- W. L. Gore & Associates, Inc.

- Hitachi, Ltd.

- Holscot Fluoropolymers Ltd.

Recent Developments

-

In June 2023, Arkema, a manufacturer of PVDF fluoropolymers, submitted feedback on the public consultation regarding the EU's restriction proposal put forth by five nations, which seeks to prohibit the production, utilization, and marketing of PFAS.

Medical Fluoropolymers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 618.06 million

Revenue forecast in 2033

USD 1,257.79 million

Growth rate

CAGR of 9.3% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; China; India; Japan; South Korea; Brazil; GCC Countries

Key companies profiled

Daikin Industries, Ltd.; The Chemours Company; Solvay SA; Arkema; Adtech Polymer Engineering Ltd.; Dongyue Group Limited; Saint-Gobain; W. L. Gore & Associates, Inc.; Hitachi, Ltd.; Holscot Fluoropolymers Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Fluoropolymers Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global medical fluoropolymers market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Ethylene Tetrafluoroethylene (ETFE)

-

Polytetrafluoroethylene (PTFE)

-

Polyvinylidene Fluoride (PVDF)

-

Fluoroelastomers

-

Others

-

-

Applications Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Medical Tubing

-

Catheters

-

Medical Bags

-

Drug Delivery Device

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

GCC Countries

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.