- Home

- »

- Medical Imaging

- »

-

Medical Imaging Workstations Market Size Report, 2030GVR Report cover

![Medical Imaging Workstations Market Size, Share & Trends Report]()

Medical Imaging Workstations Market (2024 - 2030) Size, Share & Trends Analysis Report By Usage Mode (Thick, Thin), By Application (Conventional, Advanced), By Component, By Modality, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-984-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Imaging Workstations Market Trends

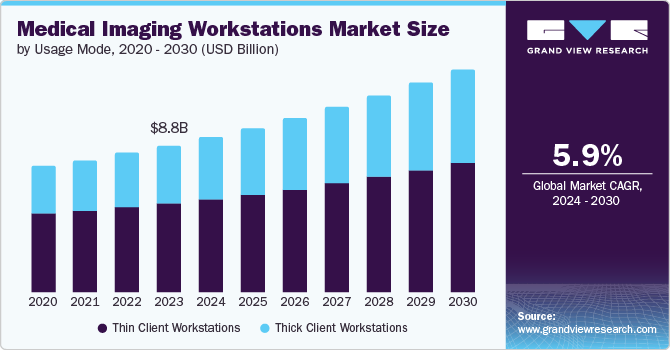

The global medical imaging workstations market size was valued at USD 8.84 billion in 2023 and is projected to grow at a CAGR of 5.9% from 2024 to 2030. The global medical imaging workstations market is driven by the growing incidence of lifestyle-related diseases such as cardiac failure and chronic kidney disease, which increases the demand for advanced diagnostic solutions. Technological innovations and increased R&D investments are also key growth factors. Moreover, factors such as improved healthcare infrastructure, rising disposable income, and affordable insurance policies are fueling demand for medical imaging workstations.

The global market for medical imaging workstations is driven by the rising demand for surgical procedures, including laparoscopic surgeries. Technological advancements have led to the development of radiofrequency and ultrasonic equipment, which improve accuracy and minimize tissue damage. The growing geriatric population, with its associated diseases and illnesses, also fuels the need for electro-surgery equipment.

The scientific imaging computer market is experiencing a surge in demand due to the need for efficient diagnostic solutions. Advancements in clinical imaging technologies, such as MRI, CT scans, and ultrasound, require sophisticated workstations to analyze and interpret complex imaging data accurately. These workstations feature multi-modality image viewing, 3D reconstruction, and post-processing tools, enabling clinicians to make informed decisions about patient care.

The growing prevalence of chronic diseases and the aging population drives the demand for medical imaging workstations. Diseases such as cancer, cardiovascular diseases, and neurological disorders require precise and timely diagnoses for effective treatment planning. Medical imaging workstations play a crucial role in facilitating faster image analysis, reducing interpretation errors, and enhancing workflow performance in healthcare settings. As a result, the market for these workstations is expected to continue its growth.

Usage Mode Insights

The thin client workstations segment dominated the medical imaging workstations market with a revenue share of 60.3% in 2023. The demand for thin-client workstations is increasing due to their cost-effectiveness, with reduced IT support fees, upfront purchase costs, and capital expenses. Small imaging centers and ambulatory facilities are driving this demand, as they prioritize timely and accurate patient analysis and remote, multimodal patient tracking capabilities.

The thick client workstation segment is expected to register the fastest CAGR of 7.1% during the forecast period. Thick client workstations offer offline access to medical imaging data, ensuring healthcare professionals can access critical information in areas with unreliable or no internet connectivity. This ensures timely decision-making. With superior security features, thick clients provide a secure solution for sensitive medical imaging data, a top priority for healthcare providers seeking to safeguard patient information.

Application Insights

The advanced imaging segment dominated the medical imaging workstations market with a revenue share of 55.8% in 2023. Cloud-based advanced imaging systems enhance image accessibility, reducing duplication and radiation exposure. With personalized medicine on the rise, advanced modalities are crucial for tailored treatment plans. Advanced imaging workstations enable healthcare organizations to analyze complex patient scan data, personalize interventions, and improve patient outcomes.

The conventional imaging segment is expected to register the fastest CAGR of 6.8% over the forecast period. Conventional imaging systems offer a cost-effective solution, making them accessible to a wider range of healthcare facilities, including smaller clinics and outpatient centers. With lower upfront costs, healthcare professionals can quickly deploy these systems, particularly in settings where timely results are essential. Ease of use, accessibility, and reliability drive market growth.

Component Insights

The visualization software segment dominated the medical imaging workstations market with a revenue share of 58.3% in 2023. The rapid growth of medical imaging data demands cutting-edge solutions to efficiently analyze and visualize complex images. Advanced visualization software offers sophisticated features such as 3D rendering, multi-planar reconstruction, and image fusion, enabling healthcare professionals to make accurate diagnoses and treatments. These capabilities are crucial for optimal patient care.

The hardware segment is expected to register the fastest CAGR of 4.7% during the forecast period due to continuous technological advancements in equipment, fueled by a demand for advanced hardware features within imaging workstations. As medical imaging technology becomes more sophisticated, the need for specialized hardware components to efficiently support these complex imaging modalities is increasing, driving innovation and growth.

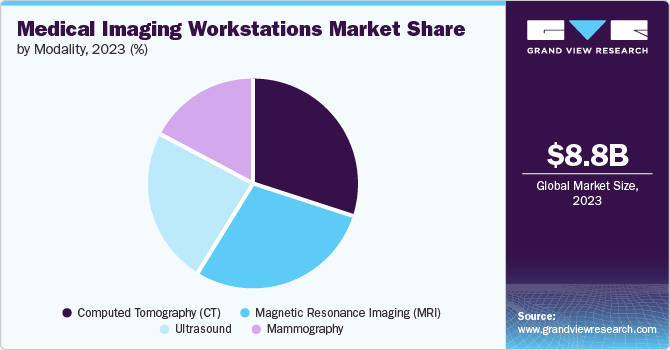

Modality Insights

The computed tomography (CT) segment dominated the medical imaging workstations market with a revenue share of 29.7% in 2023. The growing demand for CT scans is driven by their ability to provide precise internal anatomy imaging, enabling more accurate diagnosis and treatment planning. This leads to shorter hospital stays and improved patient comfort, making CT scans the preferred diagnostic tool. As a result, the market is dominated by CT treatment, driving growth and increasing patient satisfaction

The mammography segment is expected to register the fastest CAGR of 7.0% over the forecast period. The rising incidence of breast cancer worldwide is driving demand for advanced diagnostic equipment such as mammography workstations. Early detection through mammography is crucial for improving treatment outcomes and survival rates. The integration of AI and machine learning in mammography workstations has transformed image screening, enhancing diagnosis accuracy, reducing errors, and streamlining workflows, making AI-driven solutions a key competitive differentiator in the market.

Regional Insights

North America medical imaging workstations market dominated the global market with a revenue share of 36.4% in 2023. The North American industry is driven by a strong healthcare sector, abundant skilled specialists, cutting-edge technology, and widespread availability of imaging centers and prominent market players.

U.S. Medical Imaging Workstations Market Trends

The U.S. medical imaging workstations market dominated the North America medical imaging workstations market with a revenue share of 79.0% in 2023. This dominance is fueled by a robust healthcare infrastructure, significant investments in advanced technology, and a high prevalence of chronic conditions requiring frequent imaging services. The presence of major market players and favorable regulatory environments also drive growth in this region.

Europe Medical Imaging Workstations Market Trends

Europe medical imaging workstations market occupied a significant share worldwide in 2023. These encompass an increasing occurrence of persistent diseases, technological improvements in imaging strategies, developing investment in healthcare infrastructure, a rising drive for personalized healthcare solutions, and a competitive landscape that encourages innovation and reduces expenses.

Germany medical imaging workstations market is experiencing a trend towards adoption of advanced technologies such as MRI and CT, which provide high-resolution images and enhanced diagnostic capabilities. This preference for cutting-edge technologies aligns with the global shift towards innovative and eco-friendly diagnostic solutions, driving growth and competitiveness in the market.

Asia Pacific Medical Imaging Workstations Market Trends

Asia Pacific medical imaging workstations market is expected to register the fastest growth in the global medical imaging workstations market at a CAGR of 6.5% over the forecast period. The region offers a lucrative market for medical imaging workstations, fueled by rapid urbanization, increasing healthcare expenditure, and a rapidly aging population. Countries in the region are witnessing significant growth in demand for imaging solutions due to advancements in healthcare infrastructure, a growing focus on early disease detection, and a large patient pool with unmet needs.

India medical imaging workstations market is expected to experience substantial growth over the forecast period, driven by the country’s efforts to upgrade its healthcare infrastructure and adopt advanced technologies such as medical imaging workstations. Government and private investments in healthcare centers have increased the availability and accessibility of diagnostic imaging solutions, creating opportunities for growth.

Key Medical Imaging Workstations Company Insights

Some key companies in the medical imaging workstations market include Accuray Incorporated; CANON MEDICAL SYSTEMS CORPORATION; Carestream Health; and others. Key players are developing advanced, affordable systems to drive growth. Novel radiation safety techniques and integration with predictive analytics will shape the competitive landscape.

-

Accuray Incorporated is an organization dedicated to advancing the scope of radiation therapy to enhance the lives of patients worldwide. The company specializes in developing innovative solutions for delivering radiation remedies, focusing on complicated instances and more common situations.

-

Carestream Health is a global corporation that specializes in offering high-value technology, products, and services in diverse business markets globally. The company is dedicated to turning in non-destructive testing products for capturing high-quality images used in applications consisting of aircraft inspection, assemblies, castings, and forensics.

Key Medical Imaging Workstations Companies:

The following are the leading companies in the medical imaging workstations market. These companies collectively hold the largest market share and dictate industry trends.

- Accuray Incorporated

- CANON MEDICAL SYSTEMS CORPORATION

- Carestream Health

- CARL ZEISS MEDITEC AG

- FUJIFILM Holdings Corporation

- GE HealthCare

- Koninklijke Philips N.V.

- NGI Group

- Siemens Healthineers AG

Recent Developments

-

In July 2024, Carestream Health upgraded its CARESTREAM DRX-Evolution Plus System and ImageView Software with new Smart Room Options, enhancing patient care through features such as patient-position monitoring and virtual imaging capabilities.

-

In June 2024, GE Healthcare and the Heart Hospital, New Mexico, at Lovelace Medical Center collaborated to install the first Allia IGS Pulse lab, offering superior image quality and enhanced diagnostics for precise cardiovascular disease treatment and management.

Medical Imaging Workstations Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.31 billion

Revenue forecast in 2030

USD 13.15 billion

Growth rate

CAGR of 5.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Usage mode, application, component, modality, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, UAE, South Africa, South Arabia, Kuwait

Key companies profiled

Accuray Incorporated; CANON MEDICAL SYSTEMS CORPORATION; Carestream Health; CARL ZEISS MEDITEC AG; FUJIFILM Holdings Corporation; GE HealthCare; Koninklijke Philips N.V.; NGI Group; Siemens Healthineers AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Imaging Workstations Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical imaging workstations market report based on usage mode, application, component, modality, and region:

-

Usage Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Thick Client Workstations

-

Thin Client Workstations

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional Imaging

-

Advanced Imaging

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Visualization Software

-

Hardware

-

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Computed Tomography (CT)

-

Magnetic Resonance Imaging (MRI)

-

Ultrasound

-

Mammography

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.