Medical Kiosk Market Summary

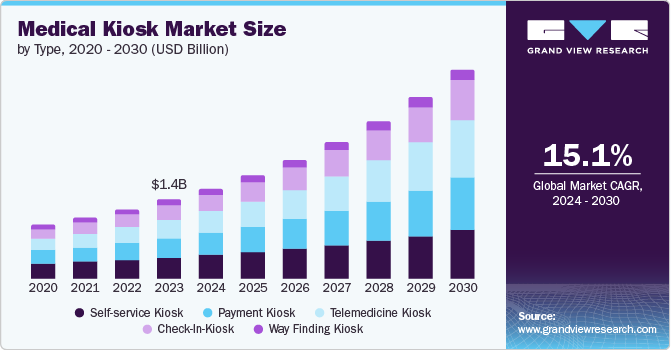

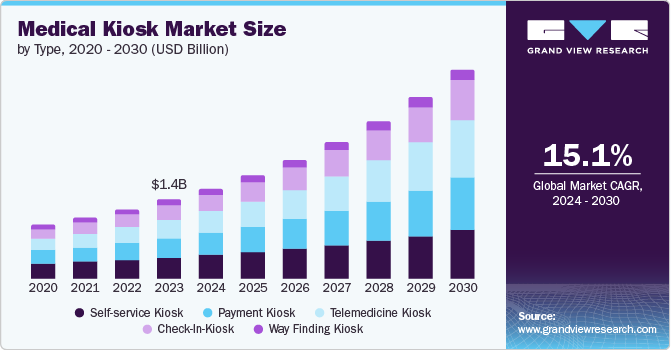

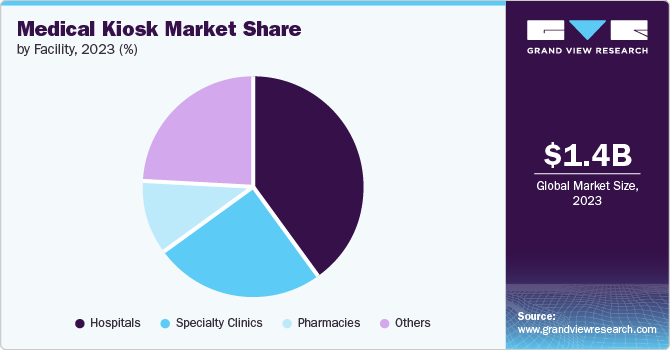

The global medical kiosk market size was valued at USD 1.42 billion in 2023 and is projected to grow at a CAGR of 15.1% from 2024 to 2030. As AI-enabled kiosks become more common in the healthcare sector, the industry is expanding.

Key Market Trends & Insights

- North America held the largest share of 54.5% in 2023.

- By type, the self-service kiosk segment held the dominant revenue share of 27.9% in 2023.

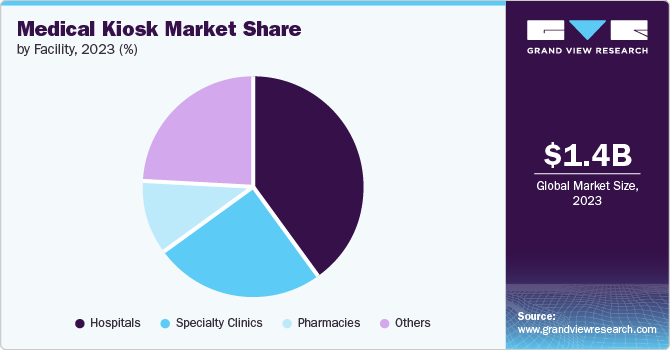

- By facility, the hospital segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.42 Billion

- 2030 Projected Market Size: USD 3.76 Billion

- CAGR (2024-2030): 15.1%

- North America: Largest market in 2023

In July 2021, imageHOLDERS launched the first touchless medical kiosk, which uses hand-tracking technology to allow patients to interact with the screen without touching it.

The installation of health ATMs in medical facilities can lower operating costs. Self-check-ins reliefs the hospital from having paper records, file forms to find a patient's record. It also enables nurses to spend more time caring for patients rather than handling paperwork.

The present healthcare workforce is being burdened by the increased prevalence of chronic diseases and the physician shortage. Implementing telemedicine solutions can assist in addressing these issues.

Type Insights

The self-service kiosk segment held the dominant revenue share of 27.9% in 2023. This is attributable to the increasing need for online and instant services as a result of touch screen technology's widespread adoption across numerous industries. In addition, the increasing number of patients, especially those with primary care needs and chronic diseases, requires simplified check-in, online appointment booking, and easy payment solutions. Kiosks are useful for reducing the burden that is placed on health care workers who are already overworked as well as for shifting the responsibility of patients’ management to the patients themselves.

The telemedicine kiosk segment is anticipated to register the fastest CAGR during the forecast period. In the upcoming years, they should become a crucial component of healthcare systems and initiatives. It enables medical practitioners to treat patients remotely by using communication technologies. They can reduce the price of patient care as well as hospital stays and waiting periods. In addition, the rise in chronic diseases will need frequent check-ups as well as follow-up appointments. They are convenient means for these routine interactions hence enhancing the management of patient care and reduction of unnecessary admissions.

Facility Insights

The hospital segment dominated the market in 2023. This is attributable to the high patient volumes and the growing need to optimise workflow and reducing waiting period. Additionally, the industry is growing as a result of hospitals investing more in digital health technologies. Hospital managers have discovered that patient satisfaction is a key aspect that needs improvement. Kiosks also enable patients to be in control of processes such as check-ins, appointments, and even billing, thus eliminating the time and irritation caused by the process. The emphasis on patient care along with the operational aspects is anticipated to drive the market growth.

The other Segment is projected to grow at the fastest CAGR over the forecast period. The segment includes clinics such as cancer clinics and sexual health, where patients are referred from primary care and hospital department outpatient clinics. These clinics can provide self-service scheduling for convenient arrival times, reducing and providing the need for potentially awkward interactions with reception staff the patient experience has been faced. Additionally, these kiosks can provide educational information and appointment reminders, empowering patients to take an active role in managing their health.

Regional Insights

North America held the largest share of 54.5% in 2023. This is due to the presence of major players, technological advancements, and growing demand for digital health. According to the 2020 Kiosk Marketplace Census Report, more than 50% of Check-In-Kiosk manufacturers are based in the U.S. Because of its startup culture and the speed at which local players are adopting new technologies, North America is seen as the growth hub for innovative technology-driven enterprise business models.

U.S. Medical Kiosk Market Trends

The Medical Kiosk Market in the U.S. dominated the market with a share of 93% in 2023 due to focus on efficiency and patient involvement, strong adoption of digital health, prevalence of chronic diseases.

Europe Medical Kiosk Market Trends

Europe medical kiosk market was identified as a lucrative region in this industry. This is due to patients seek self-service options, mirroring the US trend. An aging population strains healthcare systems, and kiosks can automate tasks and improve patient flow. Government initiatives promoting digital health further fuel market growth.

Asia Pacific is anticipated to witness significant growth in the Medical Kiosk Market due to the region's growing number of digital health businesses and the government's increased investment in IT infrastructure.

Key Medical Kiosk Company Insights

The market is highly fragmented with the presence of various players. Some of the key strategies that major companies are implementing to increase their market position include new product launches, mergers and acquisitions, and the incorporation of the latest technologies.

-

imageHOLDERS is a global company specializing in self-service digital kiosks. They design and build kiosks for various industries, including healthcare, retail, and hospitality.

-

Kiosks4Business, also known as K4B, designs and manufactures touchscreen kiosks for various industries. They specialize in customer engagement solutions, with kiosks used for information display, self-service transactions, and even virtual consultations.

Key Medical Kiosk Companies:

The following are the leading companies in the medical kiosk market. These companies collectively hold the largest market share and dictate industry trends.

- Olea Kiosks Inc.

- Fabcon, Inc.

- Meridian Kiosks

- XIPHIAS Software Technologies

- RedyRef Interactive Kiosks

- imageHOLDERS

- KIOSK Information Systems

- Frank Mayer and Associates, Inc.

- Kiosks4business Ltd.

- DynaTouch Corporation

Recent Developments

-

In April 2024, DynaTouch, a kiosk solutions provider, acquired KioWare, a kiosk management software company. This acquisition is anticipated to allow DynaTouch to offer more comprehensive kiosk solutions and strengthen their market presence.

-

In March 2024, Olea Kiosks Inc introduced Virtual Reception and Self-Service Kiosks to overcome extreme labor challenges. Virtual reception uses technology to handle tasks such as answering calls and scheduling appointments, allowing businesses to operate cost-effectively with less staff.

Medical Kiosk Market Report Scope

|

Report Attribute

|

Details

|

|

The market size value in 2024

|

USD 1.62 billion

|

|

The revenue forecast in 2030

|

USD 3.76 billion

|

|

Growth rate

|

CAGR of 15.1% from 2024 to 2030

|

|

The base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2024 to 2030

|

|

Report Coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments Covered

|

Type, facility, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

|

|

Country scope

|

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

|

|

Key companies profiled

|

Olea Kiosks Inc.; Fabcon LLC; Meridian Kiosks; XIPHIAS Software Technologies Pvt. Ltd.; imageHOLDERS; KIOSK Information Systems; Kiosks4business; DynaTouch Corporation

|

|

Customization scope

|

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

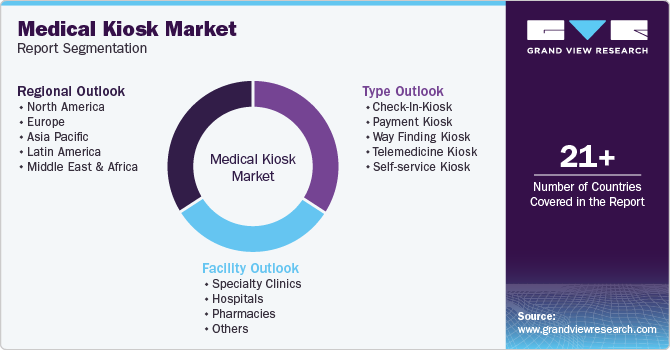

Global Medical Kiosk Market Report Segmentation

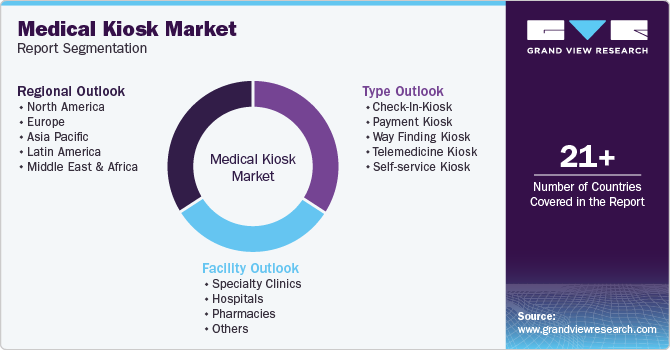

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical kiosk market report based on type, location, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Check-In-Kiosk

-

Payment Kiosk

-

Way Finding Kiosk

-

Telemedicine Kiosk

-

Self-service Kiosk

-

Facility Outlook (Revenue, USD Million, 2018 - 2030)

-

Specialty Clinics

-

Hospitals

-

Pharmacies

-

Others

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

Mexico

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

Latin America

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait