- Home

- »

- Medical Devices

- »

-

Medical Laser Systems Market Size, Industry Report, 2033GVR Report cover

![Medical Laser Systems Market Size, Share & Trends Report]()

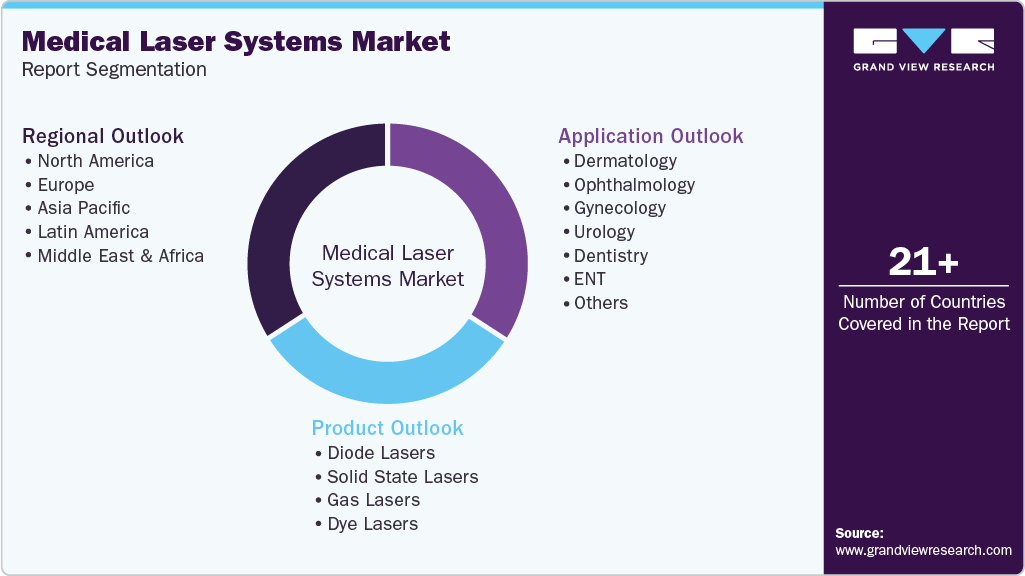

Medical Laser Systems Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Diode Lasers, Solid State Lasers, Gas Lasers, Dye Lasers), By Application (Dermatology, Ophthalmology, Gynecology, Urology), By Region, And Segment Forecasts

- Report ID: 978-1-68038-574-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Laser Systems Market Summary

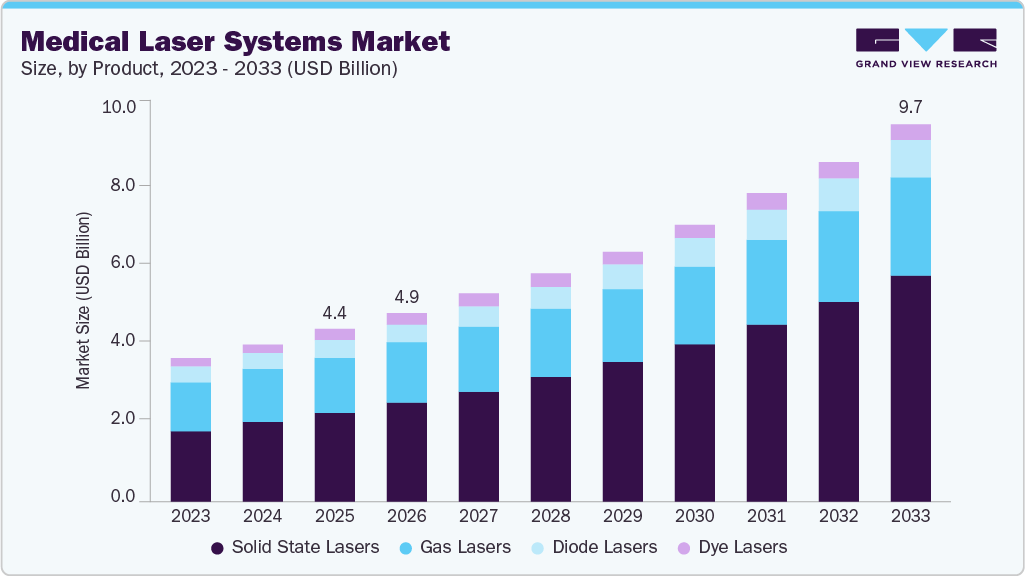

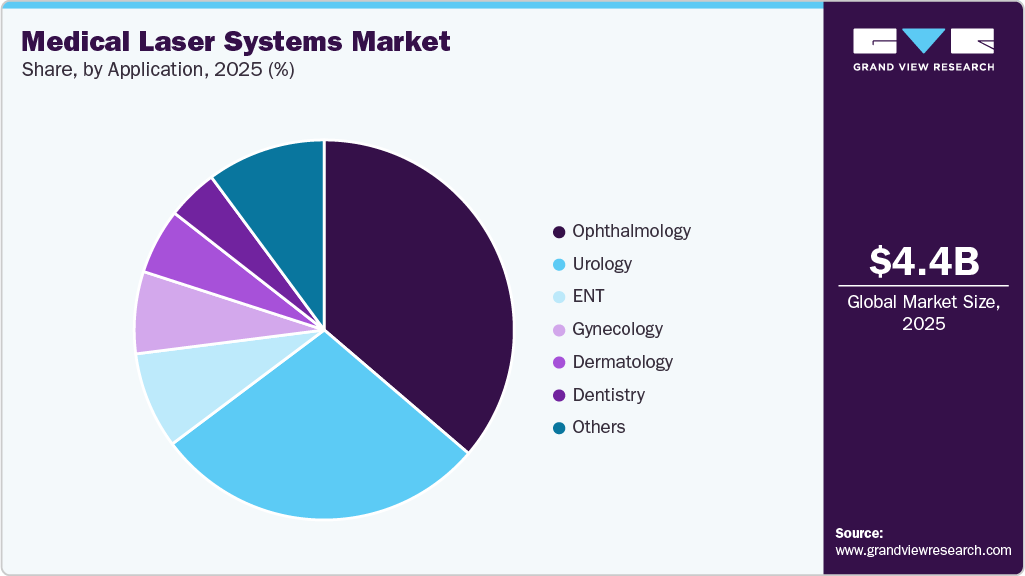

The global medical laser systems market size was estimated at USD 4.44 billion in 2025 and is projected to reach USD 9.72 billion by 2033, growing at a CAGR of 10.38% from 2026 to 2033. The market growth is driven by the rising demand for minimally invasive procedures across various specialties, including ophthalmology, urology, dermatology, dentistry, and oncology, where precision and reduced recovery times are critical.

Key Market Trends & Insights

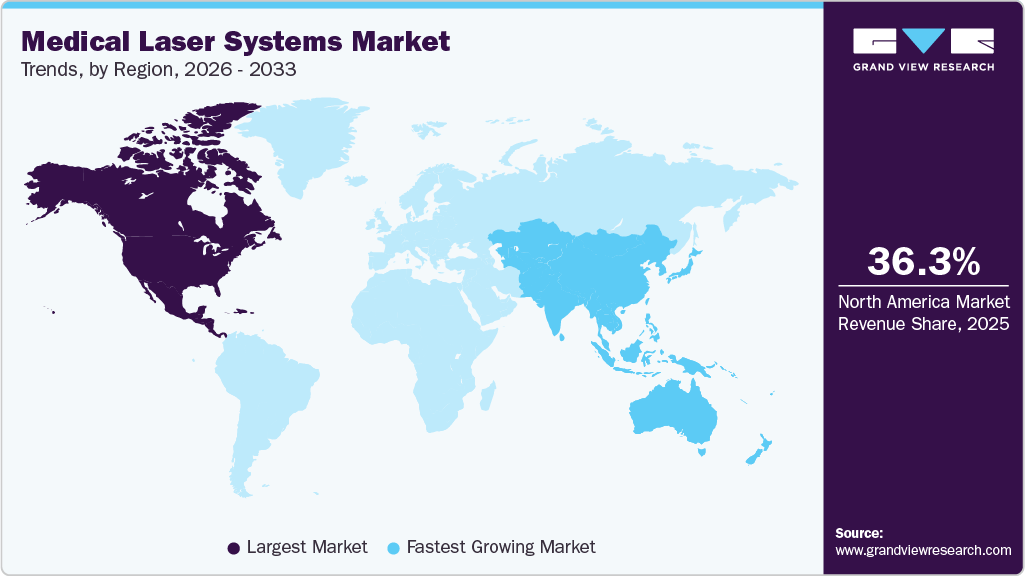

- North America dominated the medical laser systems market with the largest revenue share of 36.33% in 2025.

- The medical laser systems industry in the U.S. accounted for the largest revenue share in North America in 2025.

- By product, the solid-state lasers segment led the market with the largest revenue share in 2025.

- By application, the ophthalmology segment led the market with the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 4.44 Billion

- 2033 Projected Market Size: USD 9.72 Billion

- CAGR (2026-2033): 10.38%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The rising prevalence of chronic diseases and age-related conditions, combined with continuous technological advancements in laser platforms, is further accelerating adoption across hospitals and specialty clinics. According to the American Society of Plastic Surgeons’ 2024 Procedural Statistics Report, minimally invasive injectable treatments increased by 3% in 2024, outpacing surgical cosmetic procedures by a significant margin. This growth was driven by lower costs and shorter recovery times, resulting in more than 28.5 million minimally invasive procedures performed during the year.

The growing preference for minimally invasive treatments is a key driver of the medical laser systems industry, as both patients and clinicians seek procedures that reduce trauma, discomfort, and recovery time. Medical lasers offer high precision while minimizing damage to surrounding tissue, resulting in fewer complications and quicker healing times compared to traditional surgery. This shift toward safer, outpatient-based care is boosting the use of laser technologies across dermatology, ophthalmology, dentistry, and various surgical applications.

Minimally invasive procedure performed in 2023 and 2022

Procedure

2023 Procedures

2022 Procedures

% Change 2023 vs 2022

Lip augmentation (with injectable materials)

1,439,291

1,378,631

4%

Noninvasive fat reduction

745,967

682,932

9%

Noninvasive skin tightening

438,211

408,970

7%

Skin resurfacing

3,501,696

3,322,292

5%

Skin treatment (combination lasers)

3,101,772

2,915,199

6%

Total Procedures

9,226,937

8,708,024

7%

Source: Plastic Surgery Statistics

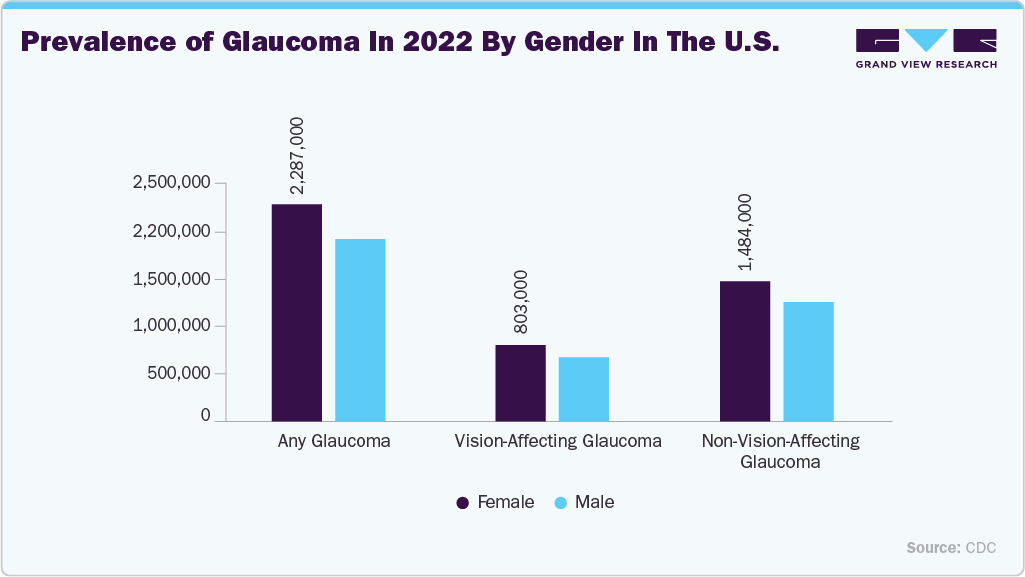

The growing incidence of age-related eye diseases is a key factor driving demand for medical laser systems, especially in ophthalmology. Disorders such as cataracts, glaucoma, diabetic retinopathy, and age-related macular degeneration are increasing as global populations age. Medical lasers enable precise diagnosis and treatment with minimal tissue damage, leading to better visual outcomes and quicker recovery, which continues to support wider adoption of laser-based eye care solutions.

According to a research study published in JAMA Ophthalmology, approximately 4.22 million adults in the U.S. were living with glaucoma in 2022, including about 1.49 million cases of vision-affecting glaucoma, with notable differences in prevalence across regions and demographic groups.

“Up-to-date estimates of how many people have glaucoma in a certain area are vital for addressing the problem,” said Joshua Ehrlich, MD, MPH, lead author of the study and associate professor of ophthalmology and visual sciences at Michigan Medicine. “This kind of information is important for formulating evidence-based policy and public health solutions.”

The widening use of medical lasers across multiple specialties is another driver of market growth, as these technologies are applied beyond traditional areas into gynecology, urology, dentistry, cardiology, orthopedics, and oncology. Their ability to deliver precise treatment with minimal tissue damage and a faster recovery makes lasers well-suited for a diverse range of diagnostic and therapeutic procedures. As a result, adoption is rising across hospitals, specialty clinics, and ambulatory surgical centers, supporting sustained expansion of the market.

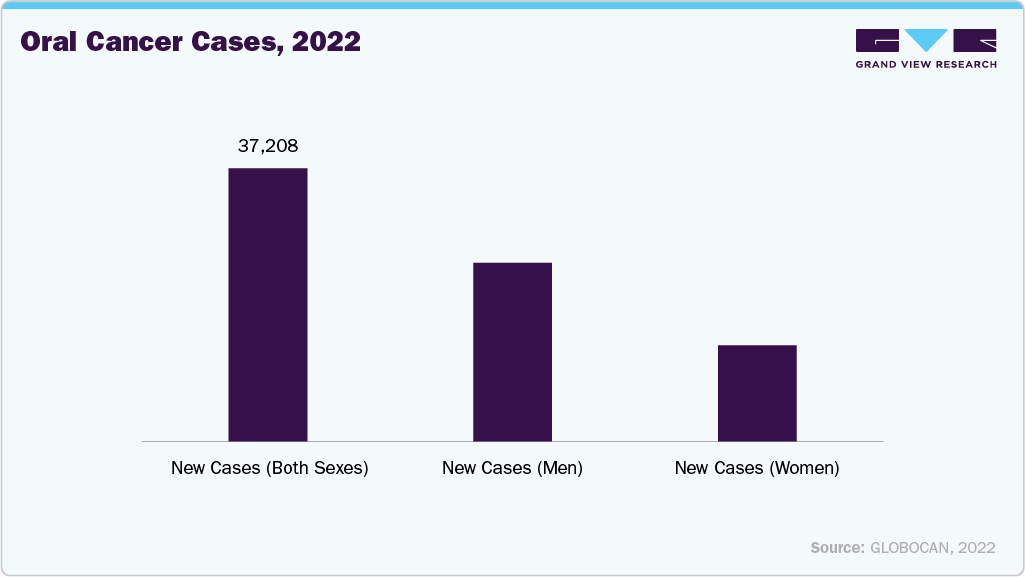

Dentistry is a key contributor to the medical laser systems market, driven by increasing adoption of minimally invasive and precision-focused dental procedures. Dental lasers are widely used for caries removal, periodontal therapy, soft-tissue surgery, and aesthetic treatments, as they reduce pain, bleeding, and recovery time. Rising awareness of oral health, a growing burden of dental conditions, and advances in diode and erbium laser technologies continue to support market expansion.

Oral Health Burden in India (2022)

Oral Health Condition

Number of Cases in India

Percentage of Global Cases (%)

Caries of Permanent Teeth

366,858,183

18.1

Severe Periodontal Disease

221,084,427

20.3

Caries of Deciduous Teeth

98,199,025

18.9

Edentulism

34,905,533

9.9

Lip and Oral Cavity Cancer

327,648

23.4

Source: Global Oral Health Status Report (GOHSR)

Gynecological cancers such as ovarian, endometrial, and cervical cancer are increasing the demand for medical lasers due to the need for precise, minimally invasive treatments. Lasers are commonly used for cervical lesion ablation, tumor removal, biopsy, and hemostasis, offering high accuracy with minimal tissue damage. Rising cancer incidence, preference for fertility-preserving and outpatient procedures, and advancements in CO₂ and diode laser technologies are supporting wider adoption across hospitals and gynecology clinics.

Incidence of Ovarian Cancer, Endometrial Cancer and Cervical Cancer in EU Countries in 2022

Population

Ovarian Cancer

Endometrial Cancer

Cervical Cancer

UK

9.2

14.8

7.5

Norway

9.2

14.9

10.9

Italy

9

14.4

5

Sweden

7.9

13.1

8.6

Spain

7.6

12.9

5.4

Denmark

7.2

14.3

9.7

France (metropolitan)

7.1

12.1

6.6

Germany

7

10.8

7.1

Source: World Go Day

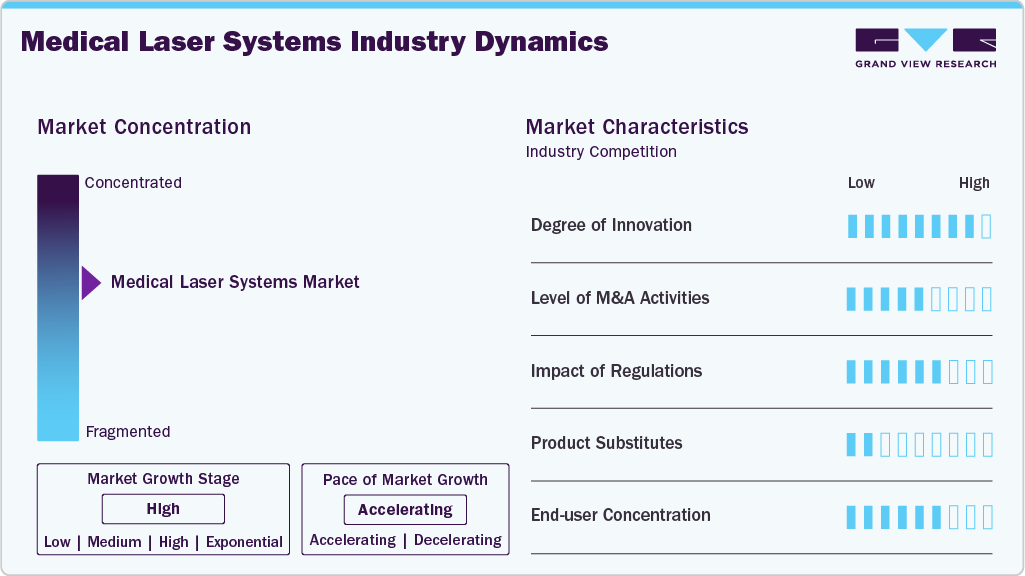

Market Concentration & Characteristics

The market exhibits a high degree of innovation, driven by continuous advancements in laser physics, digital integration, and the expansion of clinical applications. Manufacturers are focusing on developing multi-wavelength and multifunctional platforms that can treat a wider range of conditions with greater precision and safety. Innovation is also evident in improved energy control, compact system designs, enhanced cooling mechanisms, and integration with imaging, robotics, and AI-assisted guidance, which together improve clinical outcomes and workflow efficiency. Additionally, growing emphasis on minimally invasive procedures and outpatient care is accelerating innovation aimed at reducing recovery time, improving patient comfort, and expanding use across dermatology, ophthalmology, dentistry, urology, and oncology.

The medical laser systems market exhibits a moderate to high level of merger and acquisition activity, as established players pursue acquisitions to expand their technology portfolios, enter new clinical applications, and strengthen their geographic presence. Larger companies often acquire specialized or regional laser manufacturers to gain access to innovative platforms, proprietary wavelengths, or established distribution networks. These strategic moves help accelerate product development, enhance competitive positioning, and support consolidation in a market where scale, innovation, and regulatory expertise are important. For instance, in September 2025, BIOLASE announced a new chapter in its history following its acquisition by MegaGen Implant. This strategic transition signifies BIOLASE’s revitalization and renewed commitment to innovation, quality, and customer service under the leadership of its new CEO, Dr. Kwang Bum Park.

Regulations have a significant impact on the medical laser systems industry by ensuring patient safety, clinical effectiveness, and product quality through strict approval and compliance requirements. While regulatory standards increase development time and costs for manufacturers, they also build clinician confidence and support wider adoption of approved laser technologies in healthcare settings.

FDA Regulatory Classification of Medical Laser Devices

Device Name

Device Class

Laser for Gastro-Urology Use

Class II

Laser, Neurosurgical

Class III

Source: FDA

End user concentration in the medical laser systems market is relatively high, with hospitals, specialty clinics, and large outpatient centers accounting for a major share of demand. These settings benefit from higher procedure volumes, skilled professionals, and the financial capacity to invest in advanced laser technologies. In addition, consolidation among healthcare providers and the growth of multi-specialty clinic chains further concentrate purchasing power. Smaller clinics and ambulatory centers are gradually increasing adoption, mainly for targeted and cost-efficient laser applications.

Product Insights

The solid-state laser segment dominated the market in 2025 and is also expected to register the fastest CAGR over the forecast period. This dominance is driven by their high precision, stable performance, and wide range of clinical applications across ophthalmology, urology, dermatology, and oncology. Solid-state lasers, such as Nd:YAG and Ho:YAG, are extensively used in procedures that require deep tissue penetration and controlled energy delivery. Continuous technological advancements are improving efficiency, pulse control, and safety profiles, making these systems more attractive to clinicians. Their compatibility with minimally invasive and outpatient procedures further supports adoption. In addition, growing investment in advanced surgical technologies and rising procedure volumes globally are reinforcing strong demand. As healthcare providers prioritize reliable and versatile laser platforms, solid-state lasers are expected to maintain their leadership position while continuing to expand rapidly.

The diode laser segment is experiencing significant growth due to its versatility, compact design, and cost-effectiveness. Diode lasers are widely used across dermatology, dentistry, ophthalmology, and urology for both therapeutic and aesthetic procedures. Their ability to deliver precise energy with minimal thermal damage makes them suitable for minimally invasive treatments. Advances in power output, wavelength flexibility, and system portability are further expanding their clinical applications. In addition, lower maintenance requirements and ease of integration into outpatient and clinic-based settings are encouraging adoption. Growing demand from emerging markets and small to mid-sized healthcare facilities is also contributing to strong segment growth.

Application Insights

The ophthalmology segment dominated the medical laser systems industry in 2025, driven by the high volume and growing demand for laser-based eye procedures worldwide. Lasers are extensively used in vision correction, cataract treatment, glaucoma management, and retinal therapies, where precision and safety are critical. An aging global population and rising prevalence of eye disorders significantly increased procedural demand. In addition, continuous advancements in femtosecond and excimer laser technologies improved clinical outcomes, reinforcing ophthalmology’s leading position in the market.

Urology is expected to be the fastest-growing segment over the forecast period, driven by the rising prevalence of urological disorders such as kidney stones, benign prostatic hyperplasia, and urinary tract conditions. Laser-based procedures, including lithotripsy and prostate enucleation, are preferred due to their high precision, reduced bleeding, and shorter hospital stays. Growing adoption of minimally invasive surgical techniques in both hospitals and specialty urology centers is further accelerating demand. Technological advancements in holmium and thulium laser systems are improving procedural efficiency and clinical outcomes. Furthermore, an aging male population and increasing awareness of advanced urological treatments are driving sustained growth. As reimbursement coverage and surgeon training improve, laser-based urology procedures are expected to expand rapidly across developed and emerging markets.

Regional Insights

The medical laser systems market in North America held the largest revenue share of 36.33% in 2025. This can be attributed to the widespread adoption of cosmetic, ophthalmic, and surgical procedures, supported by advanced healthcare infrastructure and high acceptance of technology. Ongoing innovation in minimally invasive and versatile laser platforms is encouraging hospitals and clinics to replace or upgrade existing systems. At the same time, strong demand for non-invasive aesthetic treatments continues to drive usage in outpatient and specialty settings.

U.S. Medical Laser Systems Market Trends

The U.S. medical laser systems industry is evolving with increasing use of minimally invasive and aesthetic procedures that prioritize precision, safety, and faster patient recovery. High healthcare expenditure and a shift toward outpatient care are supporting steady adoption across dermatology, ophthalmology, and surgical specialties, while ongoing innovation in versatile and efficient laser platforms is encouraging providers to upgrade existing equipment.

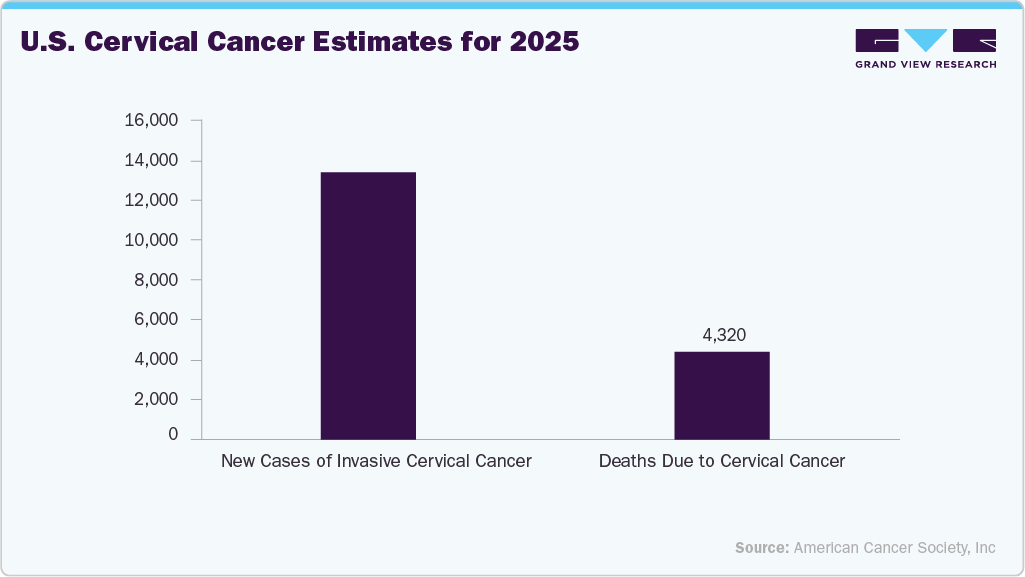

Cervical cancer plays an important role in driving the U.S. market’s growth, as minimally invasive laser-based therapies are used to treat precancerous lesions and early-stage disease. Techniques such as laser ablation and excision enable precise targeting of abnormal cervical tissue while preserving surrounding healthy areas, resulting in fewer complications and faster recovery than traditional surgery. Moreover, expanded screening initiatives, including Pap tests and HPV screening, support earlier diagnosis, which in turn boosts demand for outpatient laser procedures.

Europe Medical Laser Systems Market Trends

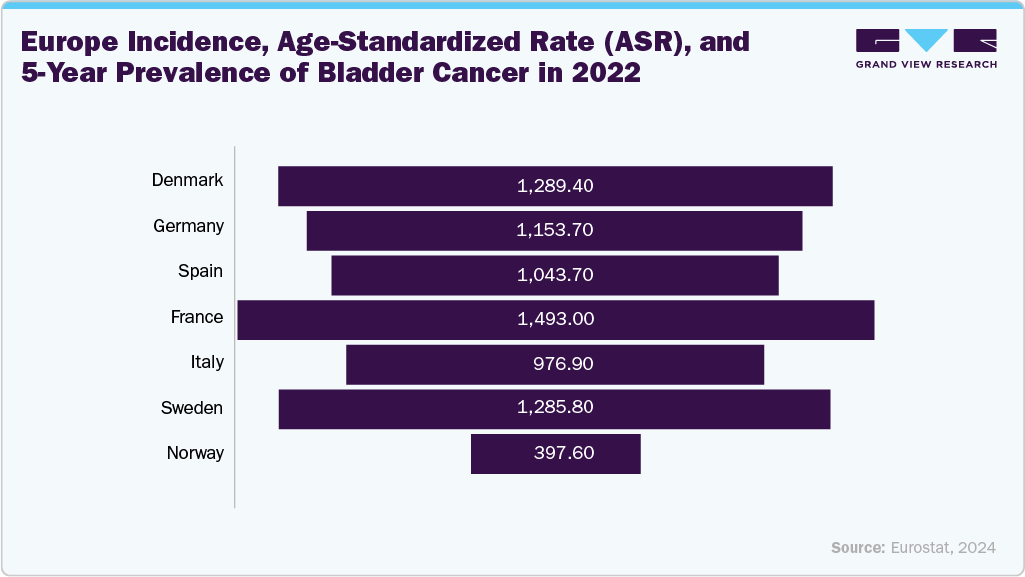

The growth of the Europe medical laser systems industry is driven by the increasing use of laser-based treatments in cosmetic, ophthalmic, and surgical care, reflecting a shift toward less invasive procedures with improved clinical outcomes. Well-developed healthcare systems, an aging population, and rising demand for aesthetic treatments support the adoption of these treatments, while ongoing technological improvements and a focus on cost efficiency are influencing purchasing decisions across the region.

The UK medical laser systems market is growing as hospitals and clinics adopt laser technologies for a wide range of therapeutic applications. In ophthalmology in particular, lasers are widely used for procedures such as LASIK, cataract treatment, and retinal surgery, where high precision and minimally invasive approaches are essential.

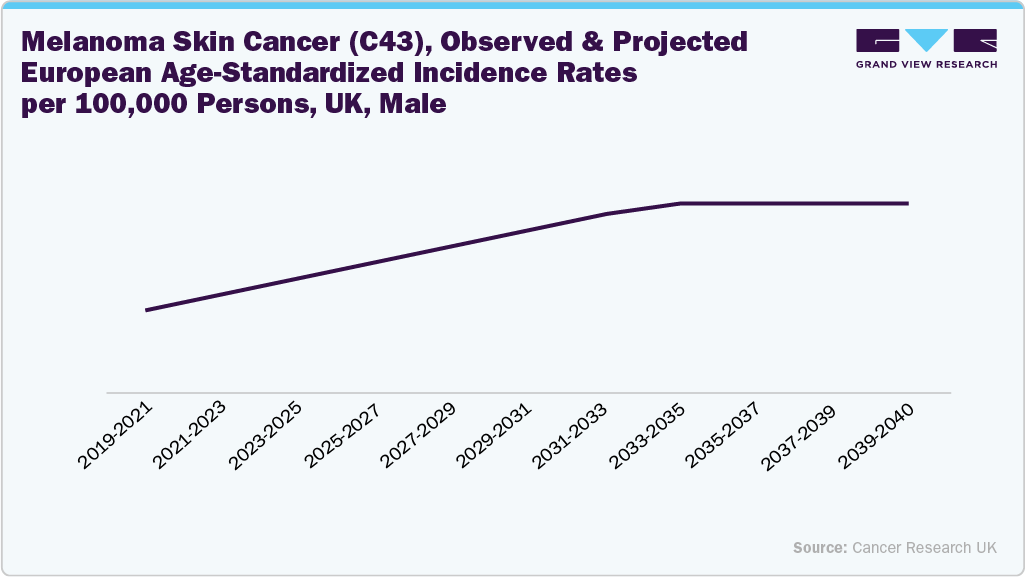

In the UK, rising cases of skin cancer, especially melanoma, are a key factor supporting the market growth. Hospitals and specialist oncology clinics are utilizing laser-based therapies, photodynamic treatments, and targeted ablation as less invasive options for the accurate removal of lesions compared to traditional surgery. Advanced lasers, such as CO₂, pulsed-dye, and Nd:YAG, enable the precise treatment of cancerous tissue while sparing healthy skin, thereby helping to shorten recovery time and improve clinical outcomes.

The medical laser systems market in France is supported by the healthcare, demographic trends, and technological advancements. A well-established healthcare infrastructure enables hospitals and private clinics to invest in advanced laser solutions. At the same time, the rising burden of chronic conditions such as skin cancers, eye disorders, and urological diseases drives demand for accurate, minimally invasive treatments. An aging population further contributes to growth, increasing the need for procedures related to cataracts, prostate conditions, and dermatological care. Supportive reimbursement frameworks, along with ongoing innovation in multi-wavelength and high-precision laser technologies, are improving clinical effectiveness and patient outcomes. In addition, growing patient awareness, preference for less invasive options, and expanded clinician training are accelerating adoption across multiple medical specialties.

Asia Pacific Medical Laser Systems Market Trends

The Asia Pacific medical laser systems industry is experiencing the fastest growth, driven by demographic shifts, rising disease prevalence, expanding healthcare infrastructure, and supportive government initiatives. Increasing cases of chronic diseases and cancers, such as ophthalmic, urological, cardiovascular, and head and neck conditions, are boosting demand for precise and minimally invasive laser-based treatments. Rapid population aging in countries such as Japan, South Korea, China, and Australia is further accelerating the adoption of procedures, as older patients benefit from shorter recovery times. In parallel, the growing hospital capacity, increased investment in advanced medical equipment, and government-led healthcare modernization and screening programs across emerging economies, such as India, China, and Thailand, are promoting the wider adoption of medical laser technologies.

China’s medical laser systems market is expanding due to a combination of demographic shifts, rising disease prevalence, higher healthcare spending, and ongoing technological progress. A large and rapidly aging population is contributing to more cases of chronic and complex conditions, including oral and other cancers, eye disorders, urological and cardiovascular diseases, where minimally invasive laser therapies are preferred. At the same time, strong government investment in healthcare infrastructure, such as the development of tertiary hospitals and specialized oncology centers under national reform initiatives, is supporting wider adoption of advanced medical technologies. Greater emphasis on early screening and timely treatment, particularly for cancer and ophthalmic conditions, is further increasing procedure volumes that depend on medical laser systems.

Latin America Medical Laser Systems Market Trends

The medical laser systems industry in Latin America is expanding, fueled by growing demand for minimally invasive procedures and aesthetic treatments, as patient preferences shift toward faster recovery and less downtime. Increasing investments in private healthcare facilities and rising awareness of advanced therapeutic options are encouraging wider adoption of laser technologies across dermatology, ophthalmology, and dentistry. Moreover, ongoing training programs for clinicians and the expansion of financing options are helping to overcome cost barriers, making medical lasers more accessible across major markets, such as Brazil and Argentina.

MEA Medical Laser Systems Market Trends

The MEA medical laser systems industry is growing due to the rising healthcare investments, expanding private hospital infrastructure, and increasing demand for advanced diagnostic and therapeutic procedures. Adoption is particularly strong in cosmetic and dermatology applications, driven by growing awareness of aesthetic treatments and a youthful population. In addition, improvements in healthcare insurance coverage and partnerships with global technology providers are encouraging wider use of laser systems in both urban and emerging regional centers, making the market more dynamic and competitive.

Key Medical Laser Systems Company Insights

The medical laser systems market is led by a few established players with broad product portfolios and strong global distribution, giving them a significant share of overall revenues. While top companies maintain dominance through innovation and clinical adoption, smaller and regional manufacturers are gradually gaining share in niche and cost-sensitive segments.

Key Medical Laser Systems Companies:

The following are the leading companies in the medical laser systems market. These companies collectively hold the largest market share and dictate industry trends.

- LumIR Laser

- Boston Scientific Corporation

- Candela Corporation

- Koninklijke Philips N.V.

- BIOLASE MG LLC. (MEGA’GEN IMPLANT CO.,LTD.)

- IRIDEX Corporation

- biolitec Holding GmbH & Co KG

- Olympus

- Cutera

- Alcon

- Carl Zeiss Meditec AG

- Bausch + Lomb

- El.En. Sp.A.

- Johnson & Johnson

- Fotona

Recent Developments

-

In September 2025, BIOLASE announced a new chapter in its history following its acquisition by MegaGen Implant. This strategic transition signifies BIOLASE’s revitalization and renewed commitment to innovation, quality, and customer service under the leadership of its new CEO, Dr. Kwang Bum Park.

-

In December 2024, Bausch + Lomb Corporation announced that an affiliate had acquired Elios Vision, Inc., the developer of the ELIOS procedure. The ELIOS procedure is the first clinically validated, minimally invasive glaucoma surgery (MIGS) technique utilizing an excimer laser. This acquisition presents new opportunities for effectively treating glaucoma in conjunction with cataract surgery, eliminating the need for implants, and strengthens Bausch + Lomb’s glaucoma portfolio, which encompasses both pharmaceutical and surgical approaches.

-

In June 2023, Candela Corporation announced that the Vbeam Family of Pulsed Dye Lasers (PDL) has expanded its FDA-cleared indications for the use of the 595 nm wavelength. The expanded indications now include treatment for the pediatric population (from birth to 21 years of age) for conditions such as cutaneous capillary malformations, also known as port wine stains (PWS), and infantile hemangiomas (IH) / congenital hemangiomas.

Medical Laser Systems Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 4.87 billion

Revenue forecast in 2033

USD 9.72 billion

Growth rate

CAGR of 10.38% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

LumIR Laser; Boston Scientific Corporation; Candela Corporation; Koninklijke Philips N.V.; BIOLASE MG LLC. (MEGA’GEN IMPLANT CO.,LTD.); IRIDEX Corporation; biolitec Holding GmbH & Co KG; Olympus; Cutera; Alcon; Carl Zeiss Meditec AG; Bausch + Lomb; El.En. Sp.A.; Johnson & Johnson; Fotona

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Laser Systems Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global medical laser systems market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Diode Lasers

-

Solid State Lasers

-

Holmium Yttrium Aluminum Garnet (Ho:YAG) lasers

-

Erbium Yttrium Aluminum Garnet (Er:YAG) lasers

-

Neodynium Yttrium Aluminum Garnet (Nd:YAG) lasers

-

Potassium Titanyl Phosphate (KTP)

-

Alexandrite lasers

-

Ruby lasers

-

-

Gas Lasers

-

Co2 laser

-

Argon laser

-

Krypton laser

-

Metal Vapor (Au & Cu) laser

-

Helium-Neon laser

-

Excimer laser

-

-

Dye Lasers

-

-

Application Outlook (Revenue, USD Million; 2021 - 2033)

-

Dermatology

-

Ophthalmology

-

Gynecology

-

Urology

-

Dentistry

-

ENT

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical laser systems market size was estimated at USD 4.44 billion in 2025 and is expected to reach USD 4.87 billion in 2026.

b. The global medical laser systems market is expected to grow at a compound annual growth rate of 10.38% from 2026 to 2033 to reach USD 9.72 billion by 2033.

b. North America dominated the medical laser systems market with a share of 36.33% in 2025. This is attributable to the rising adoption of cosmetic lift-ups and increasing demand for aesthetic surgeries along with high disposable income and increasing healthcare spending by patients.

b. Some of the key players operating in the medical laser systems market include LumIR Laser, Boston Scientific Corporation, Candela Corporation, Koninklijke Philips N.V., BIOLASE MG LLC. (MEGA’GEN IMPLANT CO.,LTD.), IRIDEX Corporation, biolitec Holding GmbH & Co KG, Olympus, Cutera, Alcon, Carl Zeiss Meditec AG, Bausch + Lomb, El.En. Sp.A., Johnson & Johnson, and Fotona.

b. Key factors that are driving the market growth include increasing demand for noninvasive cosmetic surgeries, growing awareness about the safety of these procedures, and technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.