- Home

- »

- Plastics, Polymers & Resins

- »

-

Medical Polyetheretherketone Market Size Report, 2030GVR Report cover

![Medical Polyetheretherketone Market Size, Share & Trends Report]()

Medical Polyetheretherketone Market Size, Share & Trends Analysis Report By Application (Trauma Fixation, Cardiovascular, Orthopedic, Dental Implant & Fixtures), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-947-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Medical Polyetheretherketone Market Trends

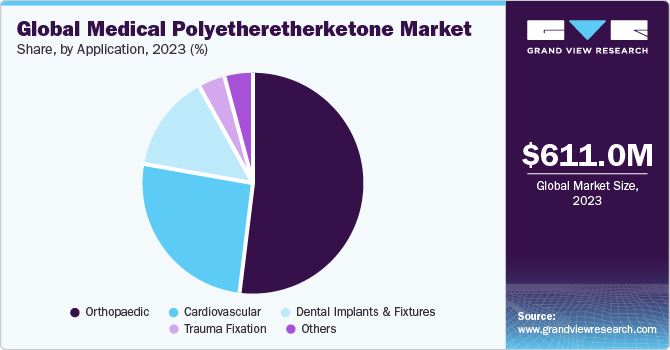

The global medical polyetheretherketone market size was estimated at USD 611.0 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.4% from 2024 to 2030, driven by the ascending demand for lightweight and high-strength materials in medical applications. This demand can be attributed to the increasing adoption of medical polyetheretherketone (PEEK) for use in medical implants such as knee & hip implants, vascular medical devices, spinal implants, and dental fixtures. The market is expected to register growth due to the high adoption of the product on account of its superior chemical inertness, heat and superior fatigue resistance. However, the high cost of the polyetheretherketone compared to other plastics may hinder the market growth over the forecast period.

The demand for knee & hip implants and spinal implants is expected to increase on account of the growing population in the U.S., which will further drive the use of medical PEEK in these implants. According to the latest U.S. census, 16.5% of the U.S. population, i.e., 54 million people, is over the age of 65. By 2030, this number is expected to rise to 74 million.

The number of people aged over 85, who need the most care, is growing even faster. According to the Centers for Disease Control and Prevention (CDC), an estimated population of nearly 78 million (26%) U.S. citizens aged 18 years or older are expected to have doctor-diagnosed arthritis by 2040.

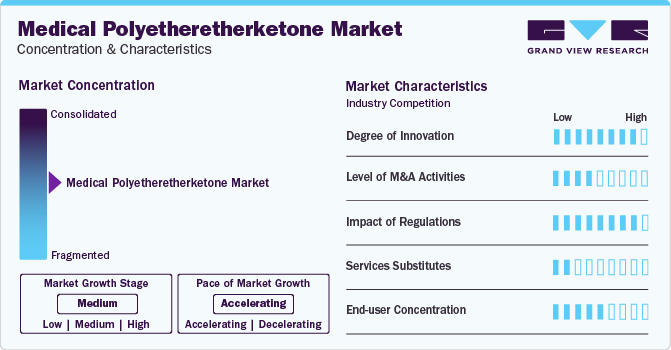

Market Concentration & Characteristics

Market growth stage is moderate owing to the fragmented market. Medical polyetheretherketone manufacturers are actively implementing challenging strategic initiatives such as mergers & acquisitions, new product launches, production expansion, among others.

For instance, in October 2023, Superior Polymers introduced medical-based polyetheretherketone (PEEK), namely, Magnolia Trinity. This polymer is a combination of three biomaterials including hydroxyapatite, carbon fiber, and polyether ether ketone, designed for medical devices such as surgical instruments and orthopedic implants.

Application Insights

Orthopedic dominated application segmentation for 2023 in terms of revenue share above 51.0%. Owing to its biocompatibility and reduced stress shielding, it integrates efficiently with human tissue, minimizing the risks of rejection and adverse reactions. Furthermore, radiolucency and imagine compatibility are another set of advantages offered by PEEK, allowing clear visualization of bones and implants during post-surgical follow-ups, eliminating the need for invasive procedures such as bone scans and simplified diagnosis and treatment monitoring.

Followed by cardiovascular amounting to a revenue share of above 25.0% in 2023. Polyetheretherketone (PEEK) has good flexural modulus, radiopacity, high temperature, and electrical resistance, biocompatibility, and ease of sterilization. It can be extruded into small diameter tubes for vascular catheters through melt processing. Compared to other medical polymers like polyimides, polyetheretherketone (PEEK) is increasingly being used in vascular medical devices and is preferred for making tubes and catheters. Polyetheretherketone (PEEK) is used in stent placement, transfemoral heart valve implantation, ablation catheters, and minimally invasive ventricular enhancement.

Regional Insights

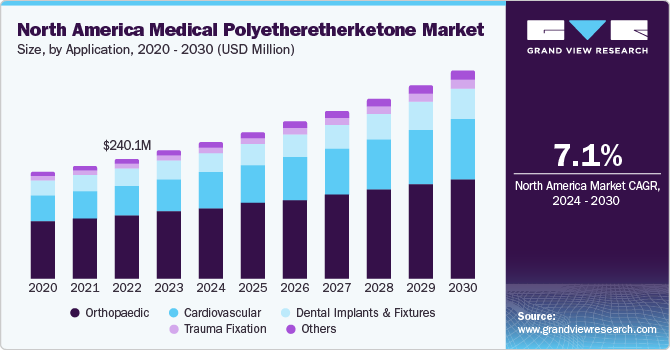

In 2023, North America dominated global medical polyetheretherketone market with a market share of above 41.0%. The increasing geriatric population in the U.S and Canada and increasing per capita healthcare spending in the form of health insurance in the U.S. have been among the major trends impacting the market growth in North America. This is expected to augment the demand for medical devices over the coming years, thereby driving the growth of the North American market over the forecast period.

Increasing incidences of lifestyle-related disorders and diseases in the region, including diabetes and cardiac arrests, have resulted in increased spending on healthcare by the population. This is expected to boost the demand for medical devices, generic drugs, and healthcare services, thereby, driving the market growth over the forecast period.

The demand for medical devices in the U.S. is increasing as a result of improving healthcare infrastructure and rising healthcare expenditure. Among all the countries in the region, Canada is expected to witness the highest growth in healthcare spending in the coming years. The increasing proportion of the elderly population (aged above 65 years) in the country can be regarded as one of the major factors affecting this trend.

Key Companies & Market Share Insights

Most of key players operating in market have integrated their raw material and distribution operations to maintain additive quality and expand their regional presence. This provides companies a competitive advantage in form of cost benefits, thus increasing profit margins. Companies are undertaking research and development activities to develop new industrial plastics to sustain market competition and changing end-user requirements.

Research activities focused on development of new materials, which combine several properties, are projected to gain wide acceptance in this industry in coming years. Furthermore, active players implement strategic initiatives for maintaining competitive environmental.

Key Medical Polyetheretherketone Companies:

- Superior Polymers

- Evonik Industries AG

- Invibio Ltd.

- Solvay

- Medtronic

- Victrex plc

- Ensinger

- Boedeker Plastics, Inc.

- Röchling

- PEEKCHINA

Medical Polyetheretherketone Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 654.53 million

Revenue forecast in 2030

USD 1,003.25 million

Growth rate

CAGR of 7.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Netherlands; Spain; China; India; Japan; South Korea; Malaysia; Thailand; Vietnam; Australia; Brazil; Argentina; Saudi Arabia; United Arab Emirates (UAE); South Africa

Key companies profiled

Superior Polymers; Evonik Industries AG; Invibio Ltd.; Solvay; Medtronic; Victrex plc; Ensinger; Boedeker Plastics, Inc.; Röchling; PEEKCHINA

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Polyetheretherketone Market Report Segmentation

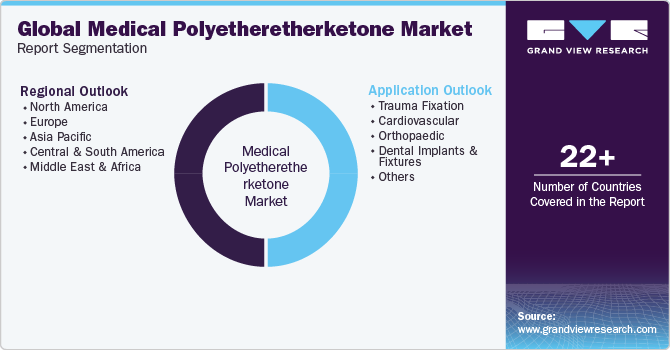

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of latest industry trends in each of sub-segments from 2018 to 2030. For purpose of this study, Grand View Research has segmented the global medical polyetheretherketone market report on basis of application, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Trauma Fixation

-

Cardiovascular

-

Orthopaedic

-

Spine Implantation

-

Knee & Hip Implantation

-

-

Dental Implants & Fixtures

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Netherlands

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Malaysia

-

Thailand

-

Vietnam

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates (UAE)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global medical polyetheretherketone market size was estimated at USD 611.0 million in 2023 and is expected to reach USD 654.53 million in 2024.

b. The global medical polyetheretherketone market is expected to grow at a compound annual growth rate of 7.4% from 2024 to 2030 to reach USD 1,003.2 million by 2030.

b. North America dominated the medical polyetheretherketone market with a share of 41.0% in 2023. The region is comprised of robust healthcare and is characterized by technologically advanced companies manufacturing Medical Polyetheretherketone (PEEK), thereby contributing significantly in the global Medical Polyetheretherketone (PEEK) market.

b. Some of the key players operating in the medical polyetheretherketone market include Invibio Ltd, Evonik Industries A.G., Solvay, Medtronic, and Superior Polymers

b. Key factors driving the medical polyetheretherketone market growth include the growing replacement of stainless steel and titanium with Polyetheretherketone (PEEK) in medical devices and implants and the increasing geriatric population in developed countries like the U.S, Japan, and Italy.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."