- Home

- »

- Healthcare IT

- »

-

Medical Reference Apps Market Size, Industry Report, 2030GVR Report cover

![Medical Reference Apps Market Size, Share & Trends Report]()

Medical Reference Apps Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Drug Information, Medical Condition & Symptoms Management, Medical Calculators), By Platform (Android, iOS), By Device, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-558-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Reference Apps Market Summary

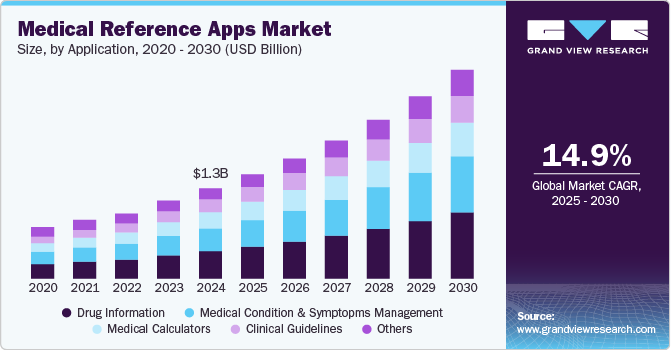

The global medical reference apps market size was estimated at USD 1.34 billion in 2024 and is projected to reach USD 3.10 billion by 2030, growing at a CAGR of 14.9% from 2025 to 2030. This growth is mainly driven by the increasing reliance on digital healthcare solutions, the expanding integration of IT within the healthcare industry, the rising demand for real-time mHealth information, and the growing penetration of smartphones among healthcare professionals and patients.

Key Market Trends & Insights

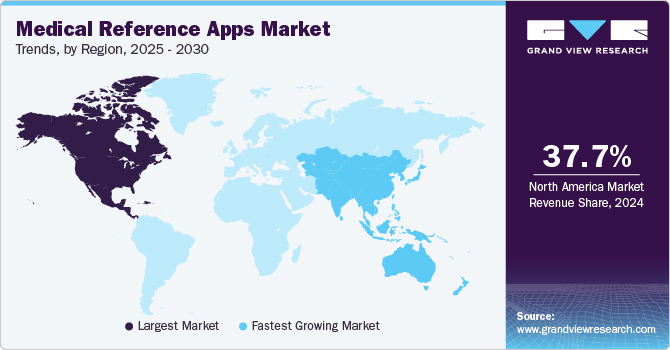

- In terms of region, North America was the largest revenue generating market in 2024.

- The U.S. dominated the medical reference apps industry in the North America region in 2024.

- Based on application, the drug information segment dominated the market with the largest revenue share of 30.48% in 2024.

- Based on platform, the iOS segment dominated the market with a revenue share of 51.04% in 2024.

- Based on device, the smartphones segment dominated the market with a revenue share of 65.97% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.34 Billion

- 2030 Projected Market Size: USD 3.10 Billion

- CAGR (2025-2030): 14.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Medical reference apps encourage the practice of evidence-based medicine and give providers and patients confidence in the chosen diagnosis and treatment plans. For example, Epic Systems' Haiku app for iPhones began allowing Doximity members to call patients with a single tap through the mobile EHR. This enables doctors to view health records and communicate with patients via mobile phones while keeping their personal phone numbers private.

Medical reference apps are essential for healthcare professionals, providing fast and reliable access to critical medical information. These apps support clinical decision-making by offering evidence-based guidelines, drug interaction checkers, and diagnostic tools. They ensure that healthcare providers, including doctors and nurses, can quickly find trusted resources such as treatment protocols, medical dictionaries, and clinical guidelines. With real-time updates on the latest research, these apps help reduce errors, improve patient outcomes, and streamline workflows in fast-paced clinical environments. Whether it's confirming a diagnosis or checking drug compatibility, medical reference apps are crucial in enhancing efficiency and accuracy in patient care.

Another factor expected to propel market growth is the growing adoption of 5G technology across the globe. According to a report published by GSMA in 2023, the global penetration of 5G is estimated to be 54% by 2030. In addition, the increased bandwidth and low latency of 5G are anticipated to facilitate the sharing of images and videos with higher resolution, improving the quality and value of virtual interaction. This is expected to reduce the need to visit a hospital or clinic and benefit remote patients who don’t have easy access to a medical facility or hospital.

With the increasing complexity of drug regimen, particularly for patients managing chronic conditions, there is a heightened emphasis on medication, safety, and compliance. Medical reference apps support this need by offering real-time access to comprehensive drug databases, including information on interactions, contraindications, dosage guidelines, and side effects. These tools help healthcare providers make more informed prescribing decisions, reducing the risk of medication errors. For patients, reminders, dosage trackers, and educational content improve adherence to treatment plans. In addition, the ability to flag and report adverse drug events (ADEs) contributes to more robust pharmacovigilance practices. These apps enhance medication safety, ensure compliance, and support better clinical outcomes.

Furthermore, technological advancements in healthcare IT provide opportunities to cut healthcare spending by improving care delivery and clinical outcomes. In addition, the rise in the launch of new and innovative medical reference apps boosts market growth. For instance, in July 2018, EMDEX Nigeria, in collaboration with ITmedicus, introduced a free EMDEX Drug Information App on the Google Play Store. It has the following features,

Case Study: Enhancing Shared Decision-Making with Medical Reference Apps

Background:

A primary care physician encountered a patient who was hesitant to receive the flu vaccine due to a history of egg allergy. The patient was considered high-risk for complications from influenza and pneumonia due to underlying health conditions.

Intervention:

During the consultation, the physician used a medical reference app that provides evidence-based information across multiple specialties. Integrated with the clinic’s electronic health record (EHR) system, the app allowed the physician to quickly access current studies and guidelines regarding vaccination safety for individuals with egg allergies.

Outcome:

Using the evidence retrieved from the app, the physician engaged the patient in a shared decision-making process. After discussing the latest data and safety recommendations, the patient agreed to receive both the flu and pneumonia vaccines-an important preventive step given their health risks.

Impact:

This case illustrates how medical reference apps support real-time, evidence-based clinical decisions. By integrating such tools into routine care, healthcare providers can enhance patient education, encourage informed decision-making, and improve health outcomes.

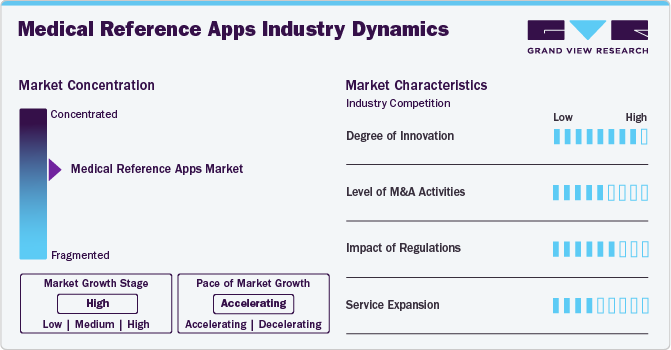

Market Concentration & Characteristics

The chart below illustrates the relationship among market concentration, market characteristics, and market participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various market characteristics, including degree of innovation, industry competition, service substitutes, and impact of regulations, level of mergers & acquisition activities, and market expansion. For instance, the medical reference apps market is moving towards concentration, with key players launching new products. The degree of innovation is high, the level of mergers & acquisition activities is medium, the impact of regulations on the market is medium, and the market expansion is low to medium.

The global medical reference apps market is characterized by a high degree of innovation, owing to the development of technologically advanced solutions driven by factors such as advancements in artificial intelligence (AI) functionalities. For instance, in June 2024, EASL introduced the EASL Guidelines App, which provides access to the most current and thorough clinical practice guidelines in hepatology. This app was developed to assist healthcare professionals by offering the latest insights and resources for managing liver diseases and improving efficiency and effectiveness in clinical environments.

The medical reference apps market is characterized by medium merger and acquisition activity, owing to several factors, including the desire to expand the business to cater to the growing demand for advanced solutions to maintain a competitive edge and to gain access to new technologies and advancements and the need to consolidate in a rapidly growing market.

The regulations governing the use of medical reference apps technologies vary across different countries and regions. However, having a well-structured regulatory framework positively impacts market accessibility, growth, and compliance. In Europe, the regulatory landscape for the mHealth services market is governed by a combination of EU directives and national regulations.

-

The EU Medical Device Regulation (MDR) establishes requirements for the safety and performance of medical devices, including mobile health apps and devices.

-

On May 26th, 2021, the MDR came into effect, leading to an increased number of medical apps that qualify as medical devices. Manufacturers are required to adhere to the Medical Devices Regulation’s essential guidelines, including ISO 13485, ISO 17021, ISO 14971, and ISO/TS 82304-2.

-

The General Data Protection Regulation (GDPR) sets comprehensive rules for the protection of personal data, including health data processed by mHealth apps and devices.

Market players are expanding their business by entering new geographical regions and launching new tools to strengthen their market position and expand their product portfolio. For instance, in November 2021, Merck & Co., Inc., an American pharmaceutical company, launched Merck Manuals, a digital medical reference for healthcare specialists and consumers within Microsoft Teams. This free app, available on the Microsoft Teams app store and Microsoft AppSource, allows users of Microsoft Teams to access a common source for authoritative medical information.

Application Insights

The drug information segment dominated the market with the largest revenue share of 30.48% in 2024. Drug information apps are increasingly integrated into EHRs and clinical decision support systems (CDSS) to streamline prescribing and medication administration processes. These integrations allow for automatic alerts on drug contraindications, allergies, and dosing adjustments, particularly in high-risk settings such as intensive care units (ICUs) and oncology clinics. This integration enhances patient safety and clinical efficiency. Moreover, healthcare professionals rely heavily on drug information apps such as Lexicomp, Epocrates, and Drugs.com to safely manage these regimens, check for drug-drug interactions, and ensure accurate dosing.

The medical condition & symptoms management segment is anticipated to grow at the fastest CAGR over the forecast period. Governments and healthcare institutions increasingly recognize the value of mHealth tools, including medical condition and symptom management apps, in expanding healthcare access. For instance, in October 2023, the World Health Organization (WHO) introduced an updated version of its Skin NTDs App, a tool developed to help frontline health workers diagnose and manage skin-related neglected tropical diseases (skin NTDs). The updated app is free of charge for Android and iOS devices. Some of the key features of the updated app include logical, offline algorithm, multilingual support, learning resources, and cutting-edge ai integration (Beta).

Platform Insights

The iOS segment dominated the market with a revenue share of 51.04% in 2024, due to the high adoption of iOS devices is one of the major factors propelling growth and is expected to continue to boost the segment over the forecast period. For instance, according to the Demandsage report, as of 2023, there were 153 million iPhone users in the U.S. In addition, according to the Backlinko report, in 2023, Apple delivered 231.8 million iPhones across the globe. Moreover, the government's growing adoption of iOS-based medical reference apps in healthcare settings boosts market growth. For instance, in April 2024, the Indian Union Health Ministry introduced the myCGHS app for iOS devices to boost access to EHR, resources, and information for the beneficiaries of the Central Government Health Scheme (CGHS).

The android segment is anticipated to grow at the fastest CAGR over the forecast period. Moreover, the widespread adoption of Android smartphones globally is expected to drive segment growth over the forecast period. As per the Backlinko report, as of Q4 2023, Android smartphones represented 56% of global quarterly smartphone sales. Furthermore, the Android operating system has undergone continuous improvements. These include enhanced Application Programming Interface (API) integrations and machine learning capabilities. These enhancements strengthen the functionality and accuracy of medical reference apps.

Device Insights

The smartphones segment dominated the market with a revenue share of 65.97% in 2024. Growth in the segment is attributed to the increasing penetration of smartphones globally. According to an article in The Hindu, over 2 billion 5G smartphones were shipped worldwide in the last quarter of 2023, with China, the U.S., and Western Europe accounting for almost 70% of all 5G shipments. In addition, the cost & availability of 5G smartphones increased as the price difference between 5G and 4G chipsets narrowed, contributing to segment growth.

The tablets segment is expected to grow at the significant rate during the forecast period. One of the major drivers for tablets is their ability to run multiple apps simultaneously. Healthcare professionals can reference drug interaction tools, patient charts, and condition management guidelines all on a single device without the screen constraints of smartphones. This multi-window functionality supports real-time clinical decision-making, especially in high-pressure settings such as ICUs and surgery centers. Thus, such benefits offered by tablets drive their adoption rate and propel the market growth.

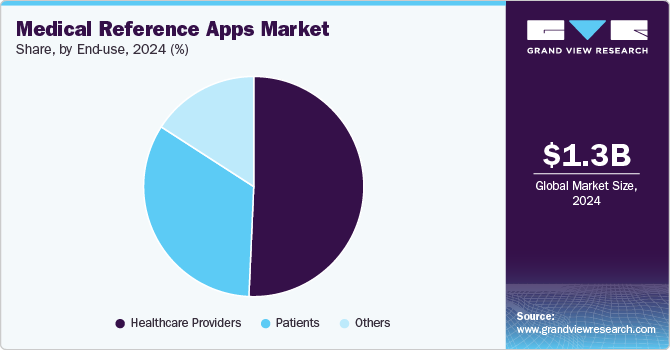

End-use Insights

The healthcare providers segment dominated the market with a revenue share of 50.70% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. Healthcare practitioners increasingly adopt medical reference apps to improve patient care and operational efficiency. For example, Asan Medical Center (AMC), one of South Korea's tertiary hospitals, has developed several in-house medical apps to support clinical practice, such as My Medication, which provides detailed drug information, including indications, dosages, interactions, and side effects. It was downloaded over 70,000 times in a single year, reflecting its widespread use among healthcare professionals.

In addition, modern healthcare demands streamlined workflows and reduced administrative burden. Many medical reference apps are integrated directly into electronic health record (EHR) systems, allowing providers to check drug interactions, lab value ranges, or clinical calculators without switching platforms. This seamless integration supports time savings, reduces decision fatigue, and minimizes disruptions in clinical care delivery. Thus, such advantages of medical reference apps boost their adoption among healthcare providers.

Regional Insights

North America medical reference apps market dominated the global market with a revenue share of 37.66% in 2024. Several factors, such as the high adoption rate of advanced healthcare technologies, the presence of a large number of healthcare professionals, and the presence of well-established healthcare infrastructure, coupled with the increasing focus on digital health and health solutions, have contributed to the widespread use of medical reference apps in this region. Furthermore, the growing penetration of smartphones is a key factor expected to boost the adoption of medical reference apps in this region. For instance, according to Business of Apps, over 30 million individuals have actively used smartphones in Canada each year since 2020, with 31.2 million users recorded in 2023.

U.S. Medical Reference Apps Market Trends

The U.S. dominated the medical reference apps industry in the North America region in 2024 due to advanced healthcare management, innovative software development, and numerous key players operating in the country. For instance, in November 2023, PatientPoint launched Impact Calculator, developed to efficiently support hospitals and health systems and quickly determine how the patient engagement platform drives growth within key service lines, procedures, and other strategic initiatives.

Europe Medical Reference Apps Market Trends

The medical reference apps industry in Europe is expected to grow significantly over the forecast period. This growth is attributed to the government's backing and equal adoption of digital health and mHealth technology by the National Health Services (NHS) and small physicians to improve access to healthcare. In addition, various technology companies are actively working with academic institutes, clinicians, and policymakers to develop solutions that meet patient and clinician needs.

The medical reference apps market in France is expected to grow significantly during the forecast period, as there is a significant expenditure on health. the increasing adoption of novel and advanced technologies in various sectors of the country, including healthcare, is one of the factors driving the adoption of digital health services. Moreover, France’s Health Minister Olivier Véran announced an investment plan of USD 707.1 million to speed up the national digital health strategy as part of the Health Innovation 2030 plan.

Asia Pacific Medical Reference Apps Market Trends

The Asia Pacific medical reference apps market is expected to register the fastest growth rate over the forecast period. The growing awareness and demand for convenient healthcare solutions among Asia Pacific consumers contribute to expanding the medical reference apps market. In addition, the widespread adoption of smartphones and improved Internet connectivity have made fitness apps more accessible to a broader audience. According to The Mobile Economy 2023 by GSMA, unique mobile subscriptions in Asia Pacific reached 1.73 billion by the end of 2022, estimated to reach 2.11 billion by 2023.

China medical reference apps market is anticipated to register considerable growth during the forecast period. The growing patient population and increasing internet penetration in China can spur the country’s market. According to data from the China Internet Network Information Center (CNNIC), as of December 2022, China has 1.067 billion Internet users, an increase of 35.49 million since December 2021. Internet penetration has increased by 2.6%, reaching 75.6%. Moreover, the increasing use of smartphones is expected to drive the adoption of mobile platforms for various healthcare services.

Latin America Medical Reference Apps Market Trends

Medical reference apps industry in Latin America is anticipated to witness considerable growth over the forecast period. Healthcare providers such as hospitals, clinics, and medical professionals are increasingly recognizing the potential benefits of mHealth technologies. These technologies help streamline workflows, increase patient engagement, and provide more personalized care. Thus, the integration and acceptance of mHealth into the broader healthcare ecosystem are driving the market in Latin America.

Brazil medical reference apps market is anticipated to register considerable growth during the forecast period. The increasing adoption of digital technology and the growing healthcare sector are key factors facilitating Brazil's medical reference apps market growth. Furthermore, increasing collaborations between the government and private investors to promote the digitalization of healthcare services are expected to propel market growth in Brazil.

Middle East and Africa Medical Reference Apps Market Trends

The medical reference apps market in the Middle East and Africa is anticipated to witness considerable growth over the forecast period. mHealth solutions are transforming healthcare in the Middle East and Africa (MEA), driven by the expanding internet connectivity and government initiatives. In addition, the rising awareness regarding digital health among people has increased the potential for market growth.

UAE medical reference apps market is anticipated to register considerable growth during the forecast period. The UAE is one of the most favorable markets for mHealth and digital platforms. The medical reference apps market in South Africa is experiencing rapid growth due to the increasing smartphone penetration, improving internet connectivity, and government initiatives promoting mHealth adoption.

Key Medical Reference Apps Company Insights

Key participants in the medical reference apps industry are focusing on devising innovative business growth strategies, such as expanding their product portfolios, partnerships and collaborations, mergers and acquisitions, and expanding their business footprints.

Recent Developments

-

In March 2025, Elsevier, a health information and data analytics company, enhanced its ClinicalKey AI solution, a clinical decision support tool powered by generative AI. The latest updates and partnerships are designed to revolutionize how healthcare providers access and employ actionable insights, improving patient care and efficiency directly within clinicians' workflows.

-

In August 2024, nib New Zealand, a private health insurance provider, launched an AI-powered symptom checker to assist Kiwis in effectively navigating the healthcare system by guiding them to the right treatment options based on their specific needs.

Key Medical Reference Apps Companies:

The following are the leading companies in the medical reference apps market. These companies collectively hold the largest market share and dictate industry trends.

- Medscape

- Epocrates

- DynaMed Plus

- UpToDate Lexidrug (formerly Lexicomp)

- VisualDX

- Micromedex (Merative US L.P.)

- Figure 1

- QxMD Read

- Skyscape Medical Library

- MedlinePlus

Medical Reference Apps Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.55 billion

Revenue forecast in 2030

USD 3.10 billion

Growth rate

CAGR of 14.9% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, platform, device, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medscape; Epocrates; DynaMed Plus; UpToDate Lexidrug (formerly Lexicomp); VisualDX; Micromedex (Merative US L.P.); Figure 1; QxMD Read; Skyscape; Medical Library; MedlinePlus

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Reference Apps Market Report Segmentation

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global medical reference apps market report based on application, platform, device, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Information

-

Medical Condition & Symptoms Management

-

Medical Calculators

-

Clinical Guidelines

-

Others (Medical News, Articles & Educational Reference Materials)

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Android

-

iOS

-

Others

-

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Smartphones

-

Tablets

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare Providers

-

Patients

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical reference apps market size was estimated at USD 1.34 billion in 2024 and is expected to reach USD 1.55 billion in 2025.

b. The global medical reference apps market is expected to grow at a compound annual growth rate of 14.94% from 2025 to 2030 to reach USD 3.10 billion by 2030.

b. North America led the medical reference apps market in 2024 with a 37.66% revenue share, driven by advanced healthcare technology adoption, a large base of healthcare professionals, robust infrastructure, and a strong focus on digital health solutions

b. Some of the key players in the market include Medscape, Epocrates, DynaMed Plus, UpToDate, Lexidrug (formerly Lexicomp), VisualDX, Micromedex (Merative US L.P.), Figure 1, QxMD Read, Skyscape, Medical Library, and MedlinePlus, among others.

b. This growth of the medical reference apps market is primarily driven by the growing reliance on digital healthcare solutions, the rising integration of IT with the healthcare industry, the increasing demand for real-time mHealth information, and the increasing penetration of smartphones among healthcare professionals and patients.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.