- Home

- »

- Advanced Interior Materials

- »

-

Membrane Separation Technology Market Size Report, 2033GVR Report cover

![Membrane Separation Technology Market Size, Share & Trends Report]()

Membrane Separation Technology Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Microfiltration, Ultrafiltration) By Application (Water & Wastewater Treatment, Industry Processing), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-503-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Membrane Separation Technology Market Summary

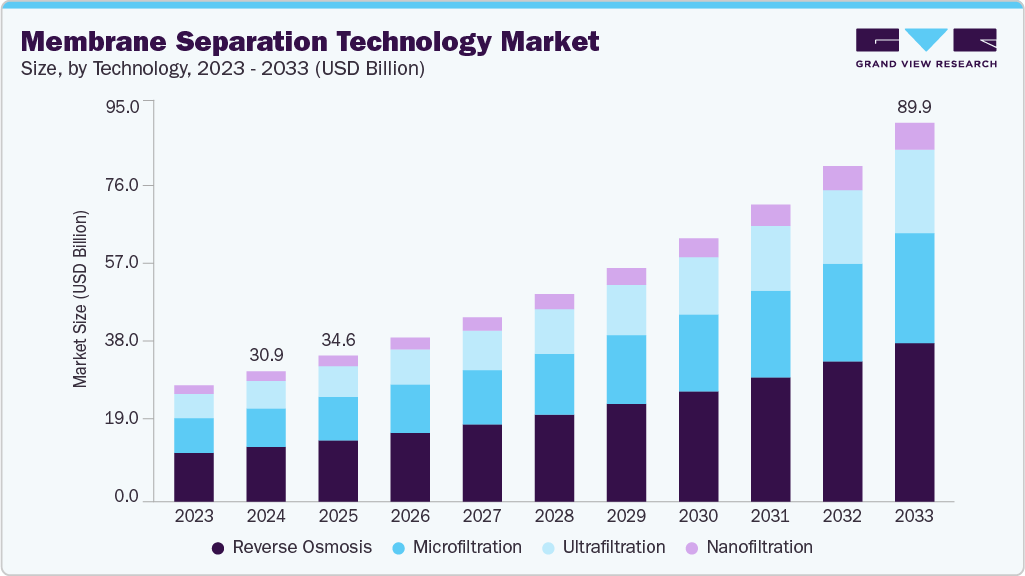

The global membrane separation technology market size was estimated at USD 30,900.5 million in 2024 and is projected to reach USD 89,879.5 million by 2033, growing at a CAGR of 12.7% from 2025 to 2033. The market is propelled by rising demand for water treatment and industrial gas separation, along with increasingly stringent environmental regulations.

Key Market Trends & Insights

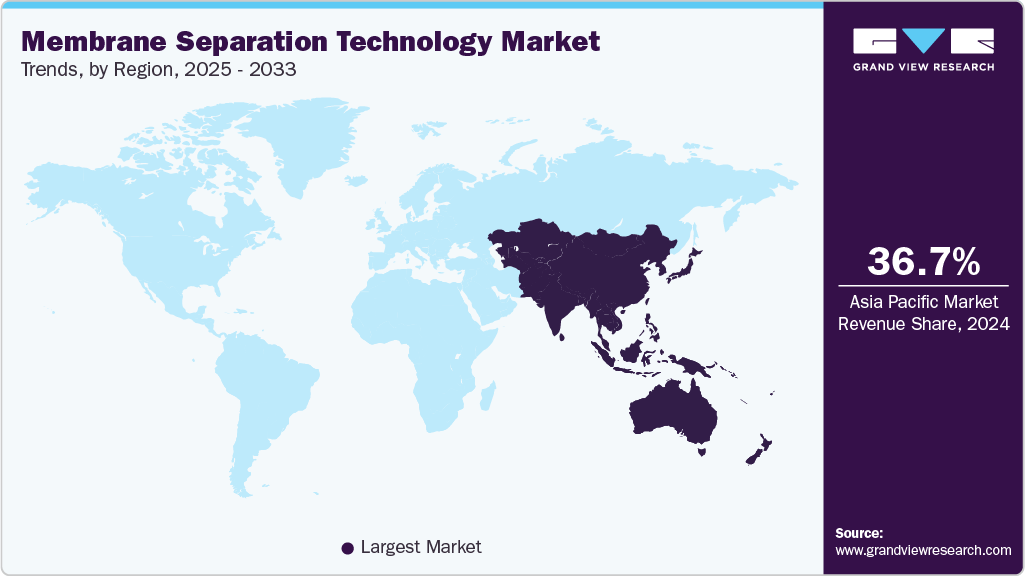

- Asia Pacific dominated the membrane separation technology market with the largest revenue share of 36.7% in 2024.

- The membrane separation technology market in the U.S. is expected to grow at a CAGR of 10.5% from 2025 to 2033.

- By technology, reverse osmosis segment is expected to grow at a considerable CAGR of 12.6 % from 2025 to 2033 in terms of revenue.

- By application, water & wastewater treatment segment is expected to grow at a considerable CAGR of 12.2% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 30,900.5 Million

- 2033 Projected Market Size: USD 89,879.5 Million

- CAGR (2025-2033): 12.7%

- Asia Pacific: Largest market in 2024

Technological advancements in membrane materials and a growing focus on energy-efficient separation processes further accelerate market expansion and innovation across key industries. In addition, the growing adoption of membrane separation technology in the dairy processing and beverage industry is expected to drive significant market growth. As demand for efficient filtration methods increases, membrane technology helps improve product quality, extend shelf life, and reduce energy consumption. Its applications in separating proteins, fats, and water in dairy and beverage production will further accelerate market expansion over the forecast period.

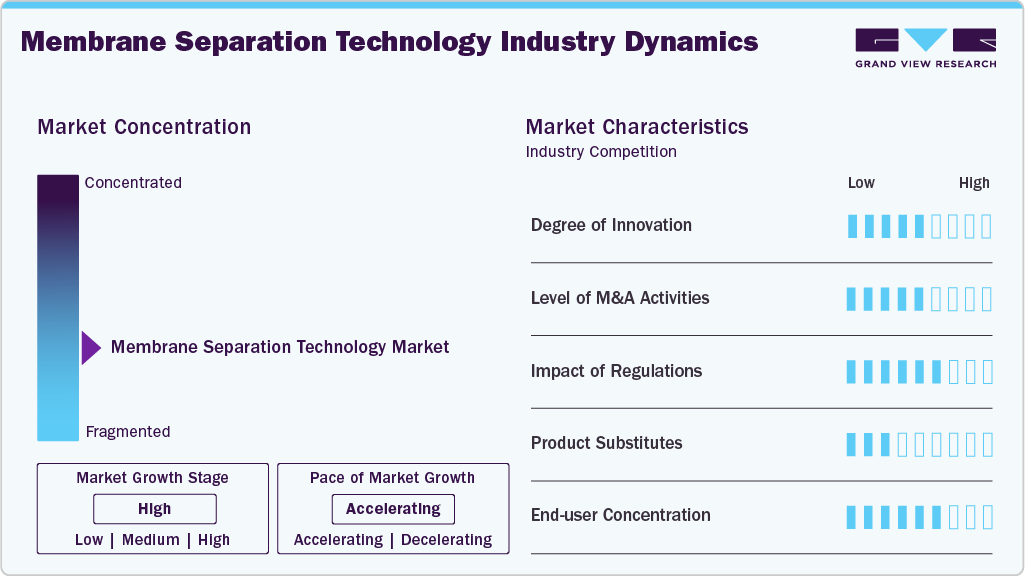

Market Concentration & Characteristics

The global membrane separation technology industry is moderately fragmented, with numerous companies offering a variety of solutions across different industries. While large multinational corporations dominate in high-capital sectors like water treatment and desalination, smaller players often focus on niche applications like food and beverage processing. Market diversity in product types, materials, and industries leads to a competitive landscape, where innovation and regional preferences influence growth, preventing dominance by a few major players.

The global membrane separation technology industry exhibits a high degree of innovation, driven by advancements in membrane materials, such as nanocomposites and polymer blends. Continuous R&D aims to improve efficiency, selectivity, and durability. Innovation also focuses on reducing energy consumption and expanding applications in biotechnology, pharmaceuticals, and wastewater treatment.

Mergers and acquisitions in the membrane separation technology industry have increased to expand service capabilities, geographic reach, and technology portfolios over the years. Key players are acquiring smaller, specialized firms to strengthen their position in water treatment, food processing, and pharmaceuticals. They also foster innovation and increase competitiveness in a rapidly evolving industry landscape. For instance, in March 2025, True North Venture Partners merged Nanostone Water and Solecta to form Acuriant Technologies, aiming to solve complex separation challenges across industries like dairy, life sciences, and water treatment. Acuriant combines polymeric and ceramic membrane technologies, offering a broad, advanced membrane portfolio with tailored solutions and single-point accountability for filtration and separation processes.

Regulations play a crucial role in shaping the membrane separation technology industry by setting strict standards for water quality, industrial emissions, and food safety. Compliance requirements drive demand for advanced, efficient membrane systems in wastewater treatment, pharmaceuticals, and food processing, encouraging innovation and ensuring sustainable and environmentally responsible operations.

Drivers, Opportunities & Restraints

Increasing demand for clean and safe water is significantly driving the market globally. Increasing global water scarcity and stringent environmental regulations are pushing industries and municipalities to adopt advanced membrane technologies for wastewater treatment, desalination, and water purification, fueling consistent market growth.

The expanding use of membrane separation in the pharmaceutical and biotechnology sectors is creating an emerging opportunity in the market. These industries require precise and efficient filtration processes for drug production and research. As biologics and personalized medicine grow, so does the demand for advanced membrane systems capable of high-purity separation and contamination control.

A major challenge in the membrane separation market is membrane fouling, which leads to reduced efficiency and higher maintenance costs. Frequent cleaning, replacement needs, and operational downtime can hinder adoption, especially in cost-sensitive sectors. Addressing this issue requires continued innovation in anti-fouling materials and membrane cleaning technologies to improve long-term performance.

Technology Insights

Reverse osmosis dominated the market in 2024, accounting for the highest revenue share at 42.0%. Its position as the leading technology segment is attributed to its broad use across residential and industrial sectors. In addition, its increasing adoption as a more efficient alternative to thermal desalination is anticipated to drive further growth.

The ultrafiltration technology segment is expected to grow significantly during the forecast period due to rising demand for high-quality water in industries like food processing, pharmaceuticals, and municipal treatment. Its ability to effectively remove bacteria, viruses, and suspended solids while maintaining energy efficiency makes it increasingly popular. Advancements in membrane materials and modular system designs also contribute to its growing adoption.

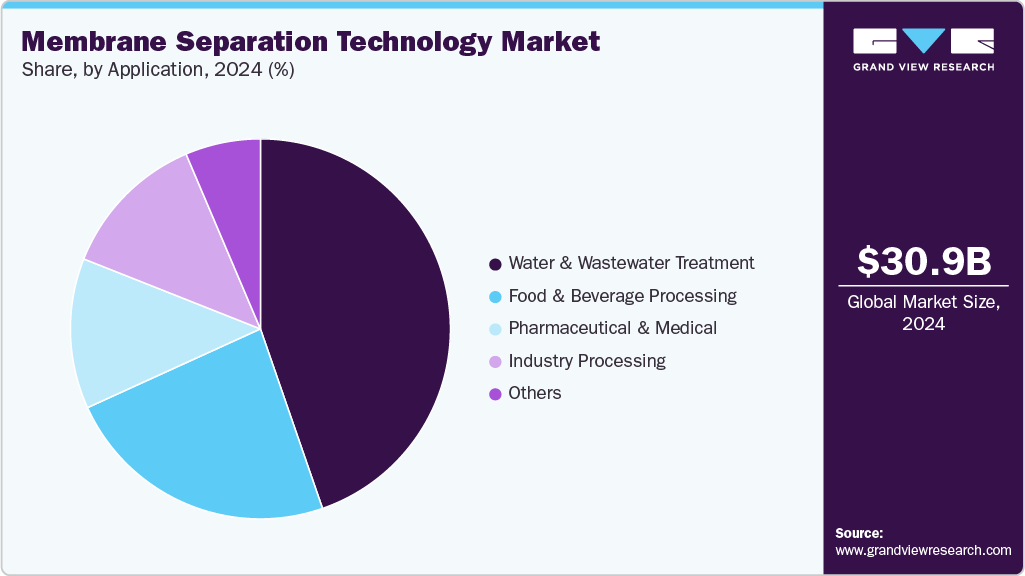

Application Insights

The water and wastewater treatment segment dominated the market in 2024, holding the largest revenue share at 44.7%. Governments and regulatory agencies worldwide have introduced strict water treatment and disposal guidelines. These regulations drive industries to adopt eco-friendly wastewater treatment methods, boosting global demand for membrane separation technologies.

The pharmaceutical and medical segment is expected to grow fastest due to rising demand for high-purity filtration processes. Membrane systems are widely used for drug manufacturing, protein separation, and sterile filtration. Regulatory requirements for clean production environments and the expansion of biopharmaceuticals further support the segment's growth.

Regional Insights

North America is expected to grow at a 10.2% CAGR during the forecast period, due to rising investments in water infrastructure, strict environmental regulations, and increasing adoption in pharmaceuticals, food processing, and energy industries. Technological advancements and government initiatives supporting sustainable water treatment also contribute to expanding membrane technology applications in the region.

U.S. Membrane Separation Technology Market Trends

The membrane separation technology market in the U.S. is expected to grow at a CAGR of 10.5% from 2025 to 2033. U.S. is poised for strong growth due to strong demand in water reuse, industrial wastewater treatment, and advanced pharmaceutical processes. Federal and state regulations on clean water, with R&D investments and a well-established industrial base, support rapid adoption of innovative membrane solutions across sectors.

Mexico membrane separation technology market is anticipated to experience growing demand due to increasing concerns over water scarcity and pollution. Rising industrialization, urbanization, and supportive government programs for clean water access drive investment in membrane-based water treatment and desalination, particularly in regions facing drought and infrastructure challenges.

Europe Membrane Separation Technology Market Trends

The membrane separation technology market in Europe is witnessing strong growth, driven by stringent environmental regulations, strong sustainability goals, and increasing adoption in water reuse, food processing, and pharmaceuticals. EU directives promoting circular water use and energy-efficient solutions encourage industries to invest in advanced membrane systems across member countries.

Germany membrane separation technology market is growing rapidly, supported by its advanced manufacturing base and focus on environmental compliance. The country’s leadership in industrial water treatment, biopharmaceutical production, and food processing drives demand for high-performance membranes. Government emphasis on green technologies further accelerates adoption in municipal and industrial applications.

The membrane separation technology market in the UK is fueled by water management needs, pharmaceutical production, and post-Brexit regulatory shifts. Investments in sustainable infrastructure and rising concerns over water pollution encourage using membrane systems. Innovation in biotech and food sectors also supports broader adoption of efficient and compact separation technologies.

Asia Pacific Membrane Separation Technology Market Trends

The membrane separation technology market in the Asia Pacific dominated the global market over the forecast period, accounting for 36.7% of the market share in 2024, due to rising urbanization, industrial expansion, and growing water treatment needs. Government initiatives supporting clean water access, healthcare, and food processing investments drive adoption. Increasing environmental awareness and technology transfer from Western markets also contribute to regional demand.

China membrane separation technology market leads the Asia Pacific market due to strict environmental regulations, water scarcity concerns, and industrial modernization. Major investments in wastewater treatment, desalination, and pharmaceutical manufacturing boost membrane system demand. The government’s push for green technologies and clean production further accelerates membrane adoption across industrial and municipal sectors.

The membrane separation technology market in India is growing rapidly due to increasing focus on clean water access, pollution control, and Make-in-India initiatives. Rising demand from the food and beverage, pharmaceutical, and municipal sectors drives technology adoption. Supportive government schemes for wastewater treatment and industrial effluent regulation also enhance market potential.

Middle East & Africa Membrane Separation Technology Market Trends

The membrane separation technology market in the Middle East & Africa is poised for steady growth due to escalating water scarcity, high demand for desalination, and industrial development. Governments are investing heavily in water infrastructure and sustainable treatment technologies. Growing use in oil & gas, pharmaceuticals, and food industries is also boosting regional market expansion.

Saudi Arabia membrane separation technology market is anticipated to see strong growth in membrane separation technology due to its dependence on desalination for freshwater. Ongoing investment in water infrastructure, Vision 2030 initiatives promoting sustainability, and industrial diversification are driving adoption. The country's emphasis on reducing water stress and improving environmental performance fuels demand for advanced membrane-based solutions.

Central & South America Membrane Separation Technology Market Trends

The membrane separation technology market in Central & South America is growing steadily, driven by increasing industrialization and urbanization and the urgent need for clean water and wastewater treatment. Government regulations promoting environmental sustainability and investments in infrastructure projects are encouraging adoption.

Brazil membrane separation technology market is projected to experience significant growth due to rising water scarcity, industrial wastewater treatment needs, and regulatory pressure. Investments in municipal water treatment and agriculture, alongside expanding the food processing and pharmaceutical industries, are driving demand. Government initiatives focused on improving water quality and sustainable practices further support market growth.

Key Membrane Separation Technology Company Insights

Some key players operating in the market include SUEZ, Merck KGaA, Toray Industries Inc., and Pentair plc.

-

SUEZ is a global company specializing in water and waste management, providing water treatment, recycling, and resource recovery solutions. It offers membrane separation technologies for municipal and industrial water purification, helping clients meet environmental regulations and improve sustainability. SUEZ integrates digital tools to optimize water management and serves agriculture, energy, and manufacturing sectors.

-

Merck KGaA is a multinational company focused on healthcare, life sciences, and performance materials. It supplies membrane separation technologies in biopharmaceutical production, water treatment, and food processing. Merck develops ultrafiltration and microfiltration membranes to improve process efficiency and product quality. The company invests in research to innovate materials that meet industry requirements.

Key Membrane Separation Technology Companies:

The following are the leading companies in the membrane separation technology market. These companies collectively hold the largest market share and dictate industry trends.

- SUEZ

- Merck KGaA

- Toray Industries Inc.

- Pentair plc

- Hydranautics

- AXEON Water Technologies

- GEA Group Aktiengesellschaft

- Hyflux Ltd.

- Koch Membrane Systems, Inc.

- Corning Incorporated

- HUBER SE

- Pall Corporation

- 3M Company

- Asahi Kasei Corporation

- DuPont de Nemours, Inc.

Recent Developments

-

In March 2025, Memsift and Murugappa launched GOSEP ultrafiltration membranes designed for water treatment, sustainability, and industrial filtration applications. These membranes aim to enhance water purification efficiency while supporting eco-friendly processes.

-

In January 2025, Arkema and OOYOO LTD. partnered to develop advanced gas separation membrane technology. The collaboration was formalized through a memorandum of understanding (MOU), aiming to combine expertise and accelerate innovation in membrane solutions for efficient gas separation across various industrial applications.

Membrane Separation Technology Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 34,653.4 million

Revenue forecast in 2033

USD 89,879.5 million

Growth rate

CAGR of 12.7% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; Russia; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

SUEZ; Merck KGaA; Toray Industries Inc.; Pentair plc; Hydranautics; AXEON Water Technologies; GEA Group Aktiengesellschaft; Hyflux Ltd.; Koch Membrane Systems, Inc.; Corning Incorporated; HUBER SE; Pall Corporation; 3M Company; Asahi Kasei Corporation; DuPont de Nemours, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Membrane Separation Technology Market Report Segmentation

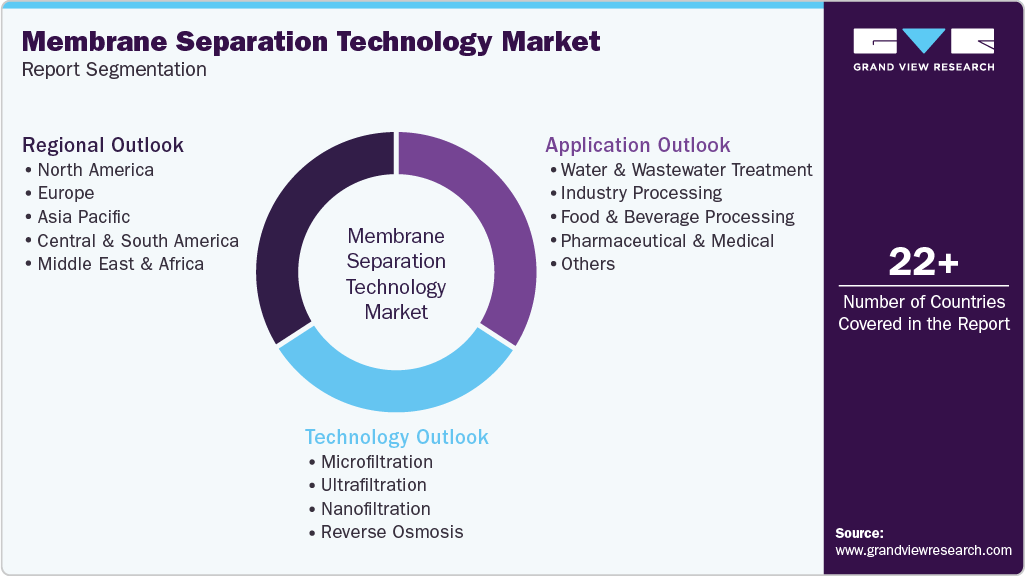

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global membrane separation technology market report based on technology, application, and region.

-

Technology Outlook (Revenue, USD Million,2021 - 2033)

-

Microfiltration

-

Ultrafiltration

-

Nanofiltration

-

Reverse Osmosis

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Water & Wastewater Treatment

-

Industry Processing

-

Food & Beverage Processing

-

Pharmaceutical & Medical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global membrane separation technology market size was estimated at USD 30,900.5 million in 2024 and is expected to be USD 34,653.4 million in 2025.

b. The global membrane separation technology market, in terms of revenue, is expected to grow at a compound annual growth rate of 12.7% from 2025 to 2033 to reach USD 89,879.5 million by 2033.

b. Reverse osmosis dominated the market in 2024, accounting for the highest revenue share at 42.0%. Its position as the leading technology segment is attributed to its broad use across residential and industrial sectors. Additionally, its increasing adoption as a more efficient alternative to thermal desalination is anticipated to drive further growth.

b. Some of the key players operating in the global membrane separation technology market include SUEZ, Merck KGaA, Toray Industries Inc., Pentair plc, Hydranautics, AXEON Water Technologies, GEA Group Aktiengesellschaft, Hyflux Ltd., Koch Membrane Systems, Inc., Corning Incorporated, HUBER SE, Pall Corporation, 3M Company, Asahi Kasei Corporation, DuPont de Nemours, Inc.

b. Key factors driving the global membrane separation technology market include increasing demand for clean water, stringent environmental regulations, rapid industrialization, and growing adoption in wastewater treatment. Advancements in membrane materials and rising awareness of sustainable water solutions further boost market growth across sectors like food, pharmaceuticals, and chemical processing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.