- Home

- »

- Medical Devices

- »

-

Menopause Market Size, Share And Trends Report, 2030GVR Report cover

![Menopause Market Size, Share & Trends Report]()

Menopause Market Size, Share & Trends Analysis Report By Treatment (Dietary Supplements, OTC Pharma Products), By Region (North America, Europe, Latin America), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-434-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Menopause Market Size & Trends

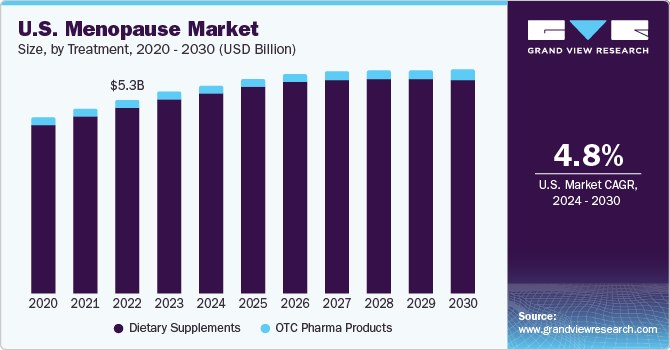

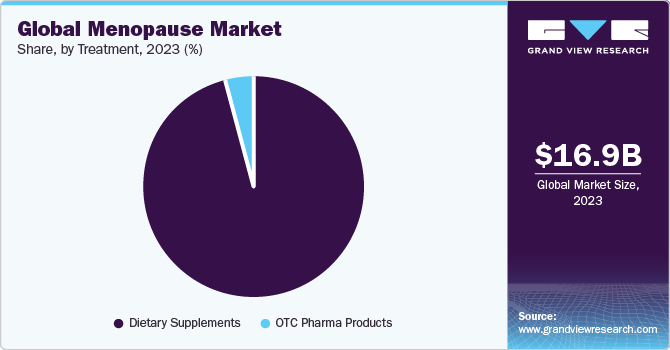

The global menopause market size was estimated at USD 16.93 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.37 % from 2024 to 2030. Increasing prevalence of postmenopausal symptoms owing to a shift towards a sedentary lifestyle is expected to drive market growth. According to the North American Menopause Society, approximately 6,000 women in the U.S. reach menopause every day, and around 2 million women per year. As per the UN data, an estimated 985 million women aged 50 years and above in 2020. This number is expected to reach 1.65 billion by 2050.

Rising prevalence of vasomotor and menopausal symptoms such as night sweats and hot flashes among women during menopausal transition is projected to propel the market growth. In addition, issues such as mood swings, difficulty concentrating, and depression are linked to menopause. As per a study published in the International Journal of Applied & Basic Medical Research, around 36.7% of women reported hot flashes among 87.7% of women reporting menopausal symptoms. The major symptom reported was anxiety, which accounted for 80%, and sleep issues accounted for 61.2%.

Hormone replacement therapy is first-line treatment for menopausal symptoms, especially vasomotor symptoms. However, there may be adverse effects, such as vaginal bleeding, hip, and vertebral fractures, dementia, urinary incontinence, breast cancer, heart attack, blood clots, stroke, and colorectal cancer. Owing to these side effects, patients are seeking safer treatments such as plant-based products and dietary supplements.

The pandemic had adversely impacted mental health of women leading to hormonal imbalance and subsequent exaggeration of vasomotor symptoms. Although market was negatively impacted, the sales of OTC pharma products and dietary supplements surged in the third and fourth quarters of 2020. In August 2020, according to the results of a study conducted by the Council for Responsible Nutrition (CRN), a trade association for the functional food and dietary supplement industry, dietary supplement usage increased during the pandemic. Furthermore, a surge in the demand for dietary supplements is expected due to a shift in consumer preference for nature-based substitutes in place of synthetic pharmaceutical products.

COVID-19 menopause market impact: 4.9% growth from 2020 to 2021

Pandemic Impact

Post COVID Outlook

The COVID-19 pandemic negatively impacted the market in the first quarter of 2020 owing to the supply chain disruptions and a temporary shutdown of manufacturing facilities. It had adversely impacted the mental health of the women leading to the hormonal imbalance and subsequent exaggeration of the vasomotor symptoms.

The market is growing rapidly due to the ongoing demand for products for the treatment of menopause symptoms. Companies are launching various products to meet the demand. For instance, in September 2021, Theramex received approval for the body-identical HRT, Bijuva. It will aid in the deficiency of estrogen in post-menopausal women.

Although the market was negatively impacted, the sales of the OTC pharma products and dietary supplements surged in the third and fourth quarters of 2020. In August 2020, according to the results of a study conducted by the Council for Responsible Nutrition (CRN), a trade association for the functional food and dietary supplement industry, dietary supplement usage increased during the pandemic.

The surge in the dietary supplements demand due to the shift in consumer trends for nature-based substitutes in place of synthetic pharmaceutical products is expected to drive the market in the coming years.

Initiatives to increase awareness of women’s health are expected to aid market growth. Prominent investments and startup ventures associated with well-known personalities have finally directed attention to women's healthcare. For instance, in January 2023, Actress Naomi Watts partnered with biotech company Amyris to launch Stripes, a beauty and wellness brand for menopause health.

Treatment Insights

Based on treatment, the market is segmented into dietary supplements, and OTC pharma products. Dietary supplements segment dominated the market and accounted for a revenue share of 95.26% in 2023. Growth of the segment can be attributed to the benefits associated with dietary supplements and risks associated with HRT. As per a study published in the Journal for Nutraceuticals, supplements such as primrose oil, black cohosh, soy isoflavones, and chasteberry showed a positive result in relief from hot flashes with sweating, depression, and sleep issues.

The dietary supplements are estimated to be the fastest-growing segment during the forecast period owing to the shift towards natural and herbal products, and innovative product launches by key companies operating in the market. For instance, in October 2022, PharmaLinea recently introduced an advanced menopause supplement that aims to benefit a woman's overall health. In addition to providing pain relief, the supplement also targets cardio-metabolic health, brain function, and bone health.

The OTC pharma products segment is expected to witness lucrative growth during the forecast period. This can be attributed to the shifting trend of pharmaceutical companies in developing OTC products for the treatment of menopausal symptoms. In August 2023, Sirio Europe has recently introduced two new soft gels that serve customers who desire to develop innovative products for consumer health. The company has introduced two ready-to-launch concepts, one for menopause and the other for eye health.

Regional Insights

North America accounted for the largest revenue share of 35.64% in 2023 owing to a high prevalence of post-menstrual syndrome, rising awareness regarding women’s health, and high healthcare expenditure. In addition, presence of global leaders in the region and developed healthcare infrastructure is expected to boost the market growth.

Awareness regarding women’s health is on the rise in the U.S. According to a survey conducted on female members between 60 years to 69 years of age by AARP, a U.S.-based nonprofit organization, around 72% of women revealed that menopausal symptoms affected their lives and 8% of them admitted the effects to be extreme. This coupled with increasing R&D investment is likely to favor the market expansion in the U.S.

Latin America is expected to witness the fastest growth over the forecast period owing to the increasing awareness regarding women’s health. The average age of women undergoing menopause transition is early in Latin America, as compared to Western nations. Although the prevalence of menopausal symptoms such as hot flashes is moderate in the region, change in lifestyle and food habits is contributing to growing adoption of dietary supplements to meet nutritional requirements.

Key Companies & Market Share Insights

The market is highly fragmented with the presence of various global and regional manufacturers. Mergers, acquisitions, new product launches, and product portfolio diversification are key strategies undertaken by key companies to strengthen their position. In June 2023, Aegis Ventures and Northwell Holdings collaborated to launch a new virtual menopause care startup called Upliv. The company has collaborated with employers to provide telehealth and individual care to employees who experience perimenopause or menopause symptoms.

Key Menopause Companies:

- Bayer AG

- Theramex

- AbbVie, Inc.

- Abbott

- Pure Encapsulations, LLC.

- Dr. Reddy’s Laboratories Ltd.

- Rainbow Light

- PADAGIS LLC

Menopause Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 17.8 billion

Revenue forecast in 2030

USD 24.4 billion

Growth rate

CAGR of 5.37% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Norway; Denmark; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Bayer AG; Theramex; AbbVie, Inc.; Abbott; Pure Encapsulations, LLC; Dr. Reddy’s Laboratories Ltd.; Rainbow Light; PADAGIS LLC

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Menopause Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global menopause market report based on treatment and region:

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Dietary Supplements

-

OTC Pharma Products

-

Hormonal

-

Non-hormonal

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global menopause market size was estimated at USD 16.93 billion in 2023 and is expected to reach USD 17.8 billion in 2024.

b. The global menopause market is expected to grow at a compound annual growth rate of 5.37% from 2024 to 2030 to reach USD 24.4 billion by 2030.

b. North America dominated the menopause market with a share of 35.6% in 2023. This is attributable to the high prevalence of menopausal symptoms such as hot flashes, and high healthcare expenditure.

b. Some key players operating in the menopause market include Swiss Precision Diagnostics GmbH; Proov; Easy@Home Fertility; Ro; Piramal Healthcare; Wondfo; Accuquik; Fairhaven Health; PREGMATE; runbio biotech co. ltd.

b. Key factors that are driving the menopause market growth include the high prevalence of vasomotor & other menopausal symptoms and increasing research supporting the advantages of dietary supplements.

b. The dietary supplements segment dominated the menopause market and accounted for a revenue share of more than 95.26% in 2023.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."