- Home

- »

- Beauty & Personal Care

- »

-

Menstrual Cup Market Size And Share, Industry Report, 2030GVR Report cover

![Menstrual Cup Market Size, Share & Trends Report]()

Menstrual Cup Market (2025 - 2030) Size, Share & Trends Analysis Report By Material Type (Silicone, Thermoplastic Elastomer, Latex Rubber), By Type, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-541-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Menstrual Cup Market Summary

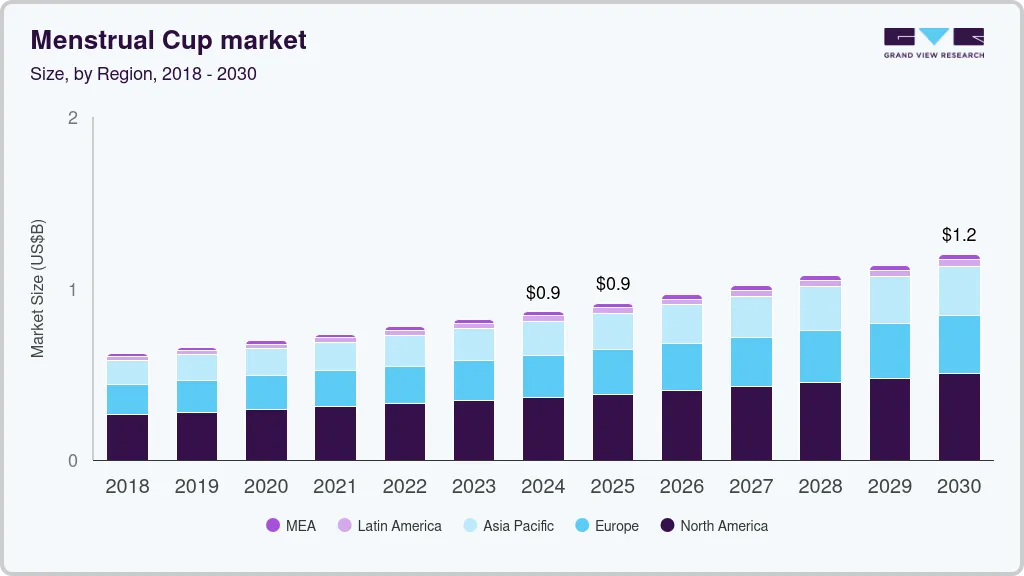

The global menstrual cup market size was estimated at USD 865.0 million in 2024 and is projected to reach USD 1,200.6 million by 2030, growing at a CAGR of 5.6% from 2025 to 2030. One of the primary reasons for the growth of the menstrual cup industry is the heightened environmental awareness.

Key Market Trends & Insights

- The North America menstrual cup market was valued at USD 364.34 million in 2024.

- The U.S. menstrual cup industry is expected to exceed USD 350 million by 2030.

- In terms of material type, silicone segment was the most significant material type in the market, with a revenue of USD 366.50 million in 2024.

- In terms of type, the reusable menstrual cup segment was the most popular type with a market share exceeding 80% in 2024.

- In terms of distribution, the online sale of menstrual cups segment is expected to grow at a CAGR of 5.8% from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 865.0 Million

- 2030 Projected Market Size: USD 1,200.6 Million

- CAGR (2025-2030): 5.6%

- North America: Largest market in 2024

Menstrual cups, made from eco-friendly materials such as medical-grade silicone, are reusable for up to 10 years, drastically reducing menstrual waste. This aligns with global efforts to promote sustainability and reduce environmental impact. Government policies and campaigns encouraging sustainable alternatives further bolster this trend.

Menstrual cups offer significant long-term cost savings compared to disposable products like tampons and pads. While the initial purchase cost of a menstrual cup may be higher, its reusability eliminates recurring monthly expenses. This economic advantage appeals to consumers globally, especially in regions where affordability is a concern. Additionally, online platforms have made these products more accessible and affordable by allowing consumers to compare prices and read reviews.

Growing concerns about the health risks associated with traditional menstrual products, such as exposure to chemicals and fragrances in pads and tampons, have driven consumers toward safer alternatives like menstrual cups. These products are free from harmful chemicals and have a lower risk of causing toxic shock syndrome (TSS). Endorsements from healthcare providers and health-focused media have further increased consumer trust in menstrual cups as a safer option.

The rise in educational initiatives about menstrual health has played a pivotal role in market growth. Governments, NGOs, and corporations are actively promoting awareness about menstrual hygiene through campaigns targeting schools, communities, and online platforms. These efforts not only educate women about the benefits of menstrual cups but also help break cultural taboos surrounding menstruation. Policies such as tax exemptions on menstrual products or free distribution in schools have also contributed to wider adoption.

Continuous innovation in menstrual cup design has enhanced comfort and usability, making them more appealing to a broader audience. Manufacturers are focusing on customization by offering various sizes and shapes to suit individual needs. The use of advanced materials like medical-grade silicone ensures durability and safety while improving user experience. Such innovations have expanded the market by addressing consumer concerns about comfort and ease of use.

Government initiatives aimed at improving access to feminine hygiene products have significantly influenced market growth. For example, regulatory efforts like the Menstrual Equity for All Act in the U.S. promote access to reusable options like menstrual cups. Additionally, collaborations between manufacturers and governments or educational institutions help expand the reach of these products into untapped markets, especially in developing regions where cultural stigmas still exist.

One of the most significant challenges is the lack of awareness and education regarding menstrual cups, particularly in developing countries. Many women are unfamiliar with how to use menstrual cups or their benefits compared to traditional products like pads and tampons. This lack of knowledge often leads to misconceptions about safety and hygiene, which can deter potential users from making the switch. Educational campaigns are crucial but have been hampered by social distancing measures during the COVID-19 pandemic, limiting outreach efforts to inform women about menstrual health and hygiene.

The market for menstrual hygiene products is highly competitive, with various alternatives such as reusable cloth pads and period underwear gaining popularity. These alternatives often appeal to consumers who may find them easier to use or more comfortable than menstrual cups. As a result, the presence of these competing products can limit the market penetration of menstrual cups, particularly among those who are hesitant to try something new.

Material Type Insights

Silicone was the most significant material type in the market, with a revenue of USD 366.50 million in 2024. Silicone is the most commonly used material for menstrual cups due to its durability, hypoallergenic properties, and reusability. Medical-grade silicone ensures safety for prolonged mucous membrane contact and can last up to 10 years, making it highly cost-effective. Silicone cups are dimensionally stable, resilient, and easy to clean, which appeals to environmentally conscious consumers seeking long-term solutions. The growth of silicone-based cups is driven by their widespread regulatory approval and compatibility with various jurisdictions requiring medical-grade materials. The growth of silicone-based menstrual cups is largely attributed to their safety profile and regulatory acceptance. Medical-grade silicone meets stringent standards for hygiene and biocompatibility, making it the preferred choice among manufacturers and consumers alike. Its long lifespan reduces waste and recurring costs, aligning with the increasing demand for sustainable menstrual products.

Thermoplastic elastomer (TPE) is another material used in menstrual cups are is expected to grow at a CAGR of 5.9% from 2025 to 2030. These plastics are heat-moldable and elastomeric, providing flexibility and comfort during use. TPE cups are often marketed in jurisdictions allowing food-grade materials rather than medical-grade ones, making them more affordable. Their adaptability to different regulatory environments has contributed to their growth in regions with fewer restrictions on medical-grade standards. TPE-based menstrual cups have gained traction due to their affordability and flexibility in manufacturing processes. They cater to markets where cost is a primary concern or where regulations permit food-grade materials instead of medical-grade ones. Their ability to adapt to diverse consumer needs has supported their growth in regions with varying economic conditions

Type Insights

The reusable menstrual cup was the most popular type with a market share exceeding 80% in 2024. Reusable menstrual cups are made from durable materials like medical-grade silicone, latex, or rubber and can last for up to 10 years with proper care. Their growth is primarily driven by environmental sustainability, cost-effectiveness, and health benefits. Reusable cups significantly reduce menstrual waste compared to disposable options, as they generate only about 0.4% of the plastic waste produced by pads and 6% of that from tampons. Additionally, they are budget-friendly over time; while the initial cost is higher, their long lifespan eliminates the need for recurring purchases. Health-conscious consumers also prefer reusable cups because they are free from harmful chemicals such as dioxins found in some disposable products. Reusable menstrual cups currently dominate the menstrual cup market, accounting for an estimated 85–90% share, as they align with global sustainability goals and consumer demand for eco-friendly solutions.

The demand for disposable menstrual cups is expected to grow at a CAGR of 4.9% from 2025 to 2030. These cups are particularly appealing for individuals who may find cleaning reusable cups inconvenient or unhygienic in certain settings, such as public restrooms. Disposable cups also offer unique features, such as compatibility with penetrative intercourse during menstruation, which reusable options typically do not provide. However, their environmental impact is higher due to single-use plastic waste, limiting their appeal among eco-conscious consumers. Despite this drawback, disposable menstrual cups hold a smaller but growing market share of around 10–15%, driven by demand from users seeking hassle-free alternatives.

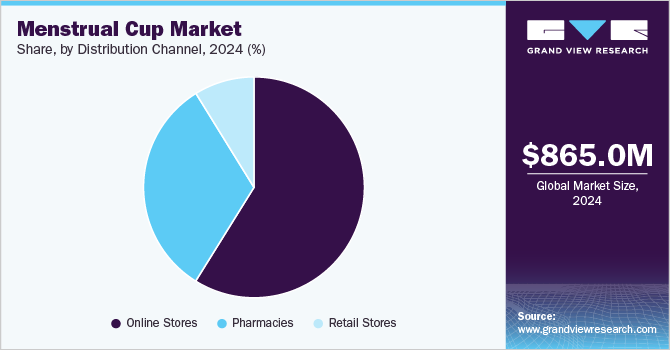

Distribution Insights

The online sale of menstrual cups is expected to grow at a CAGR of 5.8% from 2025 to 2030. E-commerce has emerged as the dominant distribution channel for menstrual cups, accounting for a significant share of sales due to its unparalleled convenience. Consumers appreciate the ability to browse a wide variety of products, read user reviews, and make purchases discreetly from home. This is particularly important for menstrual products, which some individuals prefer to buy without public scrutiny. The rise of digital literacy and increased internet penetration, especially in emerging markets, has expanded the consumer base for online purchases. Competitive pricing and frequent promotional offers on e-commerce platforms further attract cost-sensitive customers. As a result, e-commerce is projected to continue growing rapidly, reflecting changing consumer preferences towards online shopping.

Retail remain traditional yet vital distribution channels in the menstrual cup market. These venues benefit from high foot traffic and the opportunity for impulse buying. Consumers often prefer to purchase menstrual cups in-store where they can physically inspect products and receive immediate assistance if needed. However, the share of retail is increasingly challenged by the convenience and variety offered by online platforms. Despite this competition, supermarkets still play a crucial role in reaching consumers who may not be comfortable making purchases online or who require immediate access to products.

Pharmacy stores also contribute significantly to the distribution of menstrual cups, particularly for first-time buyers who may seek professional advice or reassurance about product safety. Pharmacies provide a trusted environment where consumers can ask questions about menstrual health and hygiene. This channel is particularly important for individuals with specific medical needs or allergies, as pharmacies often stock a range of products tailored to these requirements. While pharmacy stores hold a smaller market share compared to e-commerce, their role remains essential in educating consumers and providing immediate access.

Regional Insights

The North America menstrual cup market was valued at USD 364.34 million in 2024. The growth in this region is attributed to high levels of awareness about menstrual health and environmental sustainability. Robust marketing efforts by manufacturers, coupled with a strong emphasis on eco-friendly lifestyles, have normalized the use of menstrual cups among consumers. Additionally, the advanced retail infrastructure, including both online and offline channels, provides easy access to a variety of brands and products, supporting market expansion.

U.S. Menstrual Cup Market Trends

The U.S. menstrual cup industry is expected to exceed USD 350 million by 2030 and grow at a CAGR of 5.6% from 2025 to 2030. Government initiatives also play a crucial role in promoting menstrual hygiene products. For instance, legislative efforts such as the Menstrual Equity for All Act aim to improve access to menstrual products, including cups, thereby encouraging their use among women who may have previously faced barriers to accessing these products. Awareness campaigns led by both government and non-profit organizations have significantly increased public knowledge about menstrual health, contributing to a more informed consumer base. The availability of a diverse range of menstrual cup brands and products through various distribution channels, particularly e-commerce platforms, has also facilitated market growth. Consumers now have easier access to information and purchasing options, allowing them to make more informed choices regarding their menstrual health.

Europe Menstrual Cup Market Trends

Europe holds a notable share of the menstrual cup industry, with countries like the UK, Germany, and France leading the way. The growth in Europe is fueled by supportive government policies promoting sustainable menstrual products and widespread environmental consciousness among consumers. Educational initiatives aimed at raising awareness about menstrual health also contribute to the increasing adoption of menstrual cups in this region.

Asia Pacific Menstrual Cup Market Trends

The Asia Pacific menstrual cup industry is expected to grow at a CAGR of 6.1% from 2025 to 2030. This growth is driven by increasing urbanization, rising disposable incomes, and heightened awareness of menstrual health through educational campaigns. Countries like India and China are at the forefront, where government initiatives and non-profit organizations are promoting menstrual hygiene and sustainability. The region's large population and evolving consumer preferences towards eco-friendly products further bolster the adoption of menstrual cups.

Key Menstrual Cup Company Insights

The competitive landscape of the menstrual cup market is characterized by a diverse range of players and a growing emphasis on sustainability, product innovation, and consumer education. Key market participants include established brands such as Diva International Inc., Mooncup Ltd, Me Luna GmbH, The Flex Company, and Lena Cup LLC, among others. These companies are actively competing to capture market share by offering a variety of menstrual cup designs made from materials like medical-grade silicone, latex, and thermoplastic elastomers.

Key Menstrual Cup Companies:

The following are the leading companies in the menstrual cup market. These companies collectively hold the largest market share and dictate industry trends.

- Diva International Inc.

- Mooncup Ltd.

- Me Luna GmbH

- Lena Cup LLC

- The Flex Company

- LYV Life Inc. (Cora)

- LELOi AB (Intimina)

- Blossom Cup

- Fleurcup

- Lune Group Oy Ltd.

- Lunette Menstrual Cup (Peptonic Medical AB)

- Jaguara s.r.o. (LadyCup)

- YUUKI Company s.r.o.

- Ruby Cup

- Saalt

- The Keeper, Inc.

- Sirona Hygiene Private Limited

- SochGreen

- Redcliffe Hygiene Private Limited

- Procter & Gamble

Menstrual Cup Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 913.44 million

Revenue forecast in 2030

USD 1,200.60 million

Growth rate

CAGR of 5.6% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material type, type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; UAE

Key companies profiled

Diva International Inc.; Mooncup Ltd.; Me Luna GmbH; Lena Cup LLC; The Flex Company; LYV Life Inc. (Cora); LELOi AB (Intimina); Blossom Cup; Fleurcup; Lune Group Oy Ltd.; Lunette Menstrual Cup (Peptonic Medical AB); Jaguara s.r.o. (LadyCup); YUUKI Company s.r.o.; Ruby Cup; Saalt; The Keeper, Inc.; Sirona Hygiene Private Limited; SochGreen; Redcliffe Hygiene Private Limited; Procter & Gamble

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Menstrual Cup Market Report Segmentation

This report forecasts revenue growth globally, regionally, and country-wide and analyzes the latest industry trends and opportunities in each sub-segment from 2018 to 2030. Grand View Research has segmented the global menstrual cup market report by material type, type, distribution channel, and region:

-

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Silicone

-

Thermoplastic

-

Latex

-

Rubber

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Reusable

-

Disposable

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online Stores

-

Pharmacies

-

Retail Stores

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The menstrual cup market in North America accounted for over 42.12% of the global market revenue in 2024. This region's growth is attributed to high levels of awareness about menstrual health and environmental sustainability.

b. Some key players operating in the menstrual cup market include Diva International Inc.; Mooncup Ltd.; Me Luna GmbH; Lena Cup LLC; The Flex Company; LYV Life Inc. (Cora); LELOi AB (Intimina); Blossom Cup; Fleurcup; Lune Group Oy Ltd.; Lunette Menstrual Cup (Peptonic Medical AB); Jaguara s.r.o. (LadyCup); YUUKI Company s.r.o.; Ruby Cup; Saalt; The Keeper, Inc.

b. One of the primary reasons for the growth of the menstrual cup market is heightened environmental awareness. Traditional menstrual products like pads and tampons contribute significantly to non-biodegradable waste.

b. The global menstrual cup market size was estimated at USD 865.00 million in 2024 and is expected to reach USD 913.44 million in 2025.

b. The global menstrual cup market is expected to grow at a compound annual growth rate of 5.6% from 2025 to 2030, reaching USD 1,200.0 million by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.