Metal Injection Molding Market Summary

The global metal injection molding market size was estimated at USD 5,746.6 million in 2024 and is projected to reach USD 11,087.7 million by 2030, growing at a CAGR of 11.2% from 2025 to 2030. Manufacturers prefer the metal injection molding process on account of reduced material wastage, minimum finishing operations, and production of unlimited components with enhanced properties.

Key Market Trends & Insights

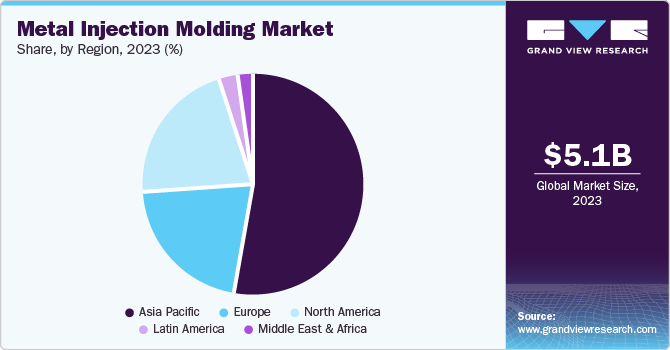

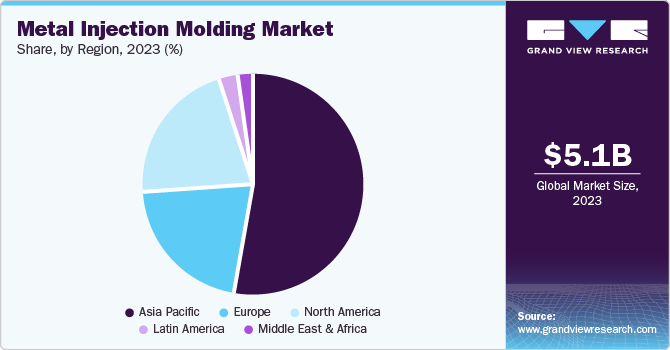

- North America dominated the global metal injection molding market with the largest revenue share of 20.7% in 2023.

- The metal injection molding market in the U.S. accounted for the largest revenue share in North America in 2023.

- By end use, the consumer product segment led the market with the largest revenue share of 30.8% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 5,746.6 Million

- 2030 Projected Market Size: USD 11,087.7 Million

- CAGR (2025-2030): 11.2%

- Asia Pacific: Largest market in 2023

Metal injection molding (MIM) is a relatively more cost-effective technology as compared to other conventional fabrication methods since it lowers raw material usage, workforce, and inventory costs.

The rising demand for lightweight components to enhance fuel efficiency and performance of vehicles is driving the metal injection molding market. The healthcare sector is embracing MIM to create complex surgery tools, medical implants, and dental parts due to its accuracy and compatibility with the human body. It helps to finish tasks at a lower cost while also decreasing production time and waste of raw materials when making feedstocks.

Technological advancements are positively influencing the MIM market. MIM is often more environmentally friendly than traditional metalworking processes due to its reduced material waste. Additionally, factors such as urbanization and industrialization are resulting in the growing adoption of MIM in emerging economies that are driving a positive market outlook.

End Use Insights

The consumer product segment dominated the market and accounted for the largest revenue share of 30.8% in 2023 owing to the high demand for products such as smartphones and other electronic devices. These products drive the growth for numerous components such as phone flip sliders, fiber-optic parts, and lightning connectors, which are manufactured with MIM machines. MIM allows for the development of intricate internal parts that enhance device functionality, such as cutting-edge camera components, wireless charging coils, and precise mechanical connections.

The medical segment is expected to grow at a significant CAGR over the forecast period. MIM's capabilities are in alignment with the trend toward smaller, more compact medical devices. The components of MIM can endure the demanding sterilization procedures utilized in the healthcare sector. It is used for dental implants, orthopaedic implants, and other internal devices. The precision instruments such as scalpels, forceps, and retractors is improved by MIM's accuracy.

Regional Insights

The North America metal injection molding market held a market share of 20.7% in 2023. The growing emphasis on fuel efficiency and vehicle performance has led to a higher need for lightweight but durable parts, resulting in high demand for MIM. The expansion of Advanced Driver Assistance Systems (ADAS) functions demands intricate and precise metal components, which MIM can effectively provide.

U.S. Metal Injection Molding Market Trends

The metal injection molding market in the U.S. experienced significant growth in 2023. The country leads the world in medical technology, creating a high demand for precision-engineered components that MIM specializes in manufacturing.

Asia Pacific Metal Injection Molding Market Trends

The Asia Pacific metal injection molding market dominated the global market with a share of 52.7% in 2023 due to lower labour cost in the region. The region has a well-developed supply chain for raw materials, resulting in the convenient and easy supply of MIM products. The rise in demand for electronic devices requires the manufacturing of small, intricate metal parts, which is a specialty of MIM.

The metal injection molding market in China is expected to grow significantly in the coming years due to the support and incentives offered by the government. The increasing disposable income is resulting in higher demand for consumer goods many of which include MIM components.Numerous countries in the Asia Pacific region have established themselves as key global manufacturing centres, exporting MIM products to various countries around the world.

Europe Metal Injection Molding Market Trends

Europe metal injection molding market is expected to grow at a CAGR of 9.4% over the forecast years. The huge investment in infrastructure enhances the business environment for MIM companies. The European automotive industry leads in the implementation of lightweight materials and components to improve fuel efficiency and decrease emissions.

The metal injection molding market in the UK is expected to grow significantly during the forecast period. The rising demand for EVs in the UK is creating opportunities for MIM in battery packs, electric motors, and drivetrain systems.

Key Metal Injection Molding Company Insights

Some of the key participants in the global metal injection molding market are Dynacast, GKN Automotive Limited, Optimim, and others. The companies in the sector are implementing strategic measures to enhance their competitive advantage, leading to an expected increase in investments and production capacity in the near future.

Key Metal Injection Molding Companies:

The following are the leading companies in the metal injection molding market. These companies collectively hold the largest market share and dictate industry trends.

- Dynacast

- GKN Automotive Limited

- Greene Group Industries, Inc. (Britt Manufacturing)

- Optimim

- Dean Group International

- Sintex

- CMG Technologies

- INDO-MIM

- Schunk Mobility

- Rockleigh Industries

Metal Injection Molding Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 6,522.4 million

|

|

Revenue forecast in 2030

|

USD 11,087.7 million

|

|

Growth rate

|

CAGR of 11.2% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Volume in kilotons, revenue in million/billion, and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

End use, region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, South Africa

|

|

Key companies profiled

|

Dynacast; GKN Automotive Limited; Greene Group Industries, Inc. (Britt Manufacturing); Optimim; Dean Group International; Sintex ; CMG Technologies; INDO-MIM; Schunk Mobility; Rockleigh Industries

|

|

Customization scope

|

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Metal Injection Molding Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyses the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global metal injection molding market report based on end use, and region:

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Consumer product

-

Medical

-

Industrial

-

Defense

-

Others

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)