- Home

- »

- Advanced Interior Materials

- »

-

Metal Li-based Battery Casing Market Size Report, 2030GVR Report cover

![Metal Li-based Battery Casing Market Size, Share & Trends Report]()

Metal Li-based Battery Casing Market Size, Share & Trends Analysis Report By Type (Primary, Rechargeable), By Application (Automotive, Consumer Electronics), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-480-7

- Number of Report Pages: 103

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

“2030 metal Li-based battery casing market value to reach USD 1.97 billion.”

Market Size & Trends

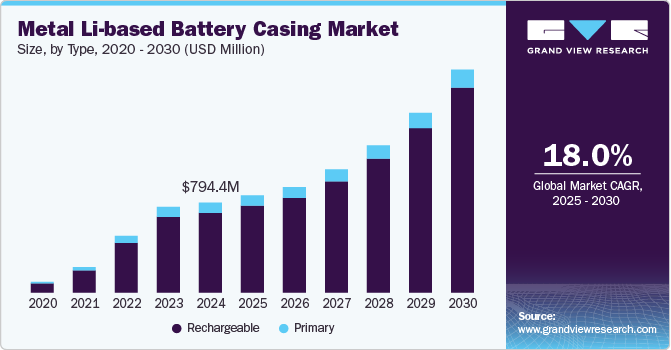

The global metal Li-based battery casing market size was estimated at USD 794.4 million in 2024 and is expected to grow at a CAGR of 18.0% from 2025 to 2030. The growth of fast-charging technologies for EVs drives the metal lithium-based battery casing market. With advancements in charging infrastructure, consumers increasingly demand faster charging times for their electric cars. Metal casings play a vital role in dissipating the heat generated during the charging process, preventing battery degradation, and ensuring long-term performance. As fast-charging technologies become more prevalent in the EVs market, the demand for metal casings that offer superior thermal management increases, contributing to the growth of the metal Li-ion battery casing market.

Additionally, government policies and incentives promoting the adoption of EVs are significantly influencing the growth of the metal Li-based battery casing market. Many countries are implementing stricter emissions regulations and offering subsidies for the production and purchase of EVs, creating a favorable environment for EV manufacturers.

This shift is boosting the demand for lithium-ion batteries and, consequently, the metal casings that protect these batteries. In regions and countries where EVs adoption is supported by government initiatives, such as the U.S., Europe, and China, the metal lithium-based battery casings market is experiencing accelerated growth as automakers ramp up EV production to meet regulatory requirements and consumer demand.

Drivers, Opportunities & Restraints

The development of autonomous electric vehicles (AEVs) contributes to the market growth. AEVs, which rely on advanced battery systems for extended operation and powering multiple sensors and AI-driven technologies, require highly efficient and reliable energy storage solutions. Metal battery casings are essential in these systems, offering protection against environmental stresses while maintaining performance in varying conditions.

Advancements in battery safety technologies drive the growth of the metal lithium-based battery casing market. Technological innovations include improved thermal management systems, enhanced protective circuits, and advanced battery management systems (BMS) to prevent overheating, overcharging, and thermal runaway. Metal housing plays a crucial role in these safety improvements by providing superior structural integrity and heat dissipation compared to other materials.

Integration of smart battery technology contributes to the growth of the metal lithium-based battery casing market. Smart battery technologies, including wireless monitoring and advanced diagnostics, are increasingly prevalent. These technologies allow for real-time tracking of battery health, performance, and charging status, enhancing overall efficiency and safety. Metal housings are essential, as they protect the sophisticated electronic components embedded in smart batteries. The growing adoption of smart batteries that require secure and durable housing to preserve sensitive components contributes to the demand for metal casings.

Tariffs And Subsidies

In May 2024, the U.S. government announced the implementation of Section 301 tariffs on approximately USD 18 billion worth of goods, including a 100% tariff on all electric vehicles imported from China. This measure extends to essential components of the EV supply chain, where China plays a significant role as a supplier. Key inputs affected by the tariffs encompass permanent magnets, lithium-ion batteries, and critical minerals, all vital for producing battery enclosures.

In August 2022, the U.S. government announced the implementation of the Inflation Reduction Act (IRA) into law, one of the largest investments in the U.S. economy. The Inflation Reduction Act allocates over USD 1 trillion for clean energy subsidies, including significant tax credits for battery production in the U.S. The Act's Section 13502 offers production credits for domestically produced battery cells and modules, with the government estimating USD 30.6 billion in costs to taxpayers from 2022 to 2031.

Market Concentration & Characteristics

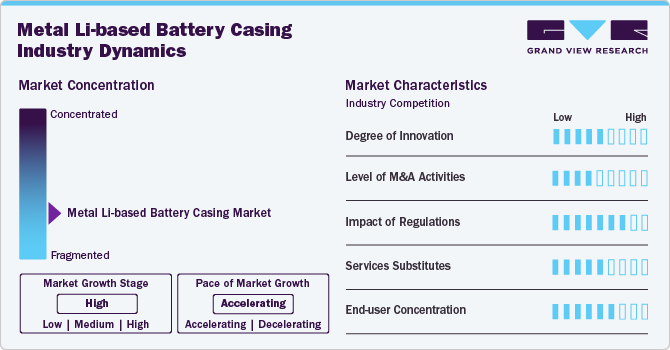

The worldwide market for Li-based battery casings made of metal exhibits a moderate level of fragmentation, comprising a variety of producers ranging from small to large scales, dispersed across various regions. This moderate level of fragmentation promotes a competitive landscape, as firms attempt to cater to the unique needs of regional markets.

Collaborations in the metal li-based battery casing market are becoming increasingly common as end users seek to mitigate risks associated with supply chain disruptions, price volatility, and regulatory compliance while supporting sustainability and innovation. For instance, in September 2024, the Fraunhofer Institute for Machine Tools and Forming Technology IWU, part of the Fraunhofer-Gesellschaft, collaborated with 15 partners to launch the COOLBat joint research project.

New product developments are also one of the strategies adopted by market players to sustain and gain a higher competitive share in the industry. For instance, in September 2022, AZL Aachen GmbH initiated a new development project to develop innovative battery enclosure concepts for cell-to-pack technology. This project emphasized the creation of structural components using diverse materials and design strategies.

Plastics, particularly advanced polymers, are increasingly adopted for battery casings, due to their cost-effectiveness, lightweight properties, and flexibility in design. Unlike metals, which can be relatively heavy and require complex manufacturing processes, plastics can be molded into various shapes and sizes with lower production costs.

Type Insights

“Primary held the revenue share of over 10% in 2024.”

Primary metal lithium batteries power equipment and sensors in remote or extreme conditions in industrial applications. The casings shield in the batteries prevents mechanical shocks, moisture, and other environmental challenges, ensuring that devices operate without interruption. For example, oil & gas exploration often relies on primary lithium batteries with robust casings to power monitoring systems in harsh conditions. This high level of protection increases battery life and reliability, reducing the need for frequent replacements and lowering operational risks.

In medical devices, primary metal lithium batteries are used in devices such as implantable defibrillators, where long-term, maintenance-free operation is essential. Battery casings must be highly reliable to avoid malfunctions and ensure the device continues functioning properly throughout its lifespan. The robust design of these casings not only extends battery longevity but also safeguards sensitive equipment from malfunctioning, due to environmental exposure or accidental damage, thus upholding patient safety and device reliability.

Application Insights

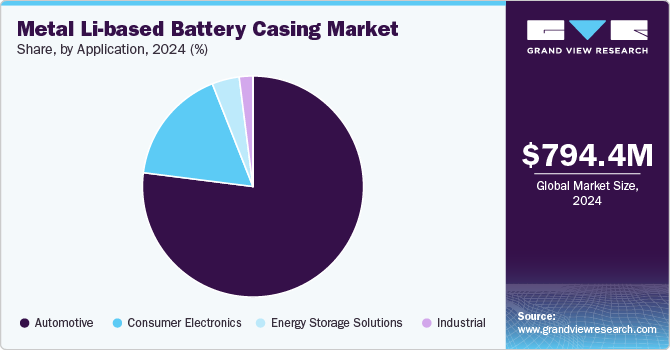

“Energy storage solutions segment is anticipated to register a revenue CAGR of 23.7% over the forecast period.”

The need for metal casings for batteries in energy storage solutions is gaining traction due to the rising demand for efficient and durable energy storage in renewable energy grids. These casings, often made from aluminum or steel, provide robust protection against mechanical impacts and thermal instability, essential for large-scale energy storage systems. Energy storage applications, such as grid balancing and renewable energy backup, require casings that can withstand prolonged exposure to harsh environmental conditions, ensuring longevity and consistent performance of lithium-ion batteries.

Metal casing is a crucial component for safeguarding lithium-ion batteries used in the automotive industry. Recent innovations in the metal casing for lithium-ion batteries focus on reducing weight while enhancing safety. For instance, companies have developed thinner yet more resilient casings that increase battery energy density without sacrificing protection. In EVs and aerospace applications, where weight is critical, these casings allow better performance and longer battery life. Some manufacturers have also integrated thermal management features into the casing design to dissipate heat more efficiently, further improving safety in high-performance applications.

Regional Insights

“China held over 92% revenue share of the overall Asia Pacific metal Li-based battery casing market.”

Asia Pacific Metal Li-based Battery Casing Market Trends

Increasing investments in power grid infrastructure, rising renewable energy generation, and growing electricity consumption are driving the demand for metal lithium-based battery casings in the Asia Pacific region. The surge in energy consumption necessitates the development of new distribution networks, which directly impacts the requirement for high-quality battery casings essential for the safety and efficiency of energy storage systems.

China metal li-based battery casing market is anticipated to progress due to rising investments in power infrastructure. China is a leader in renewable energy production, and thus, the industry's battery requirement aids the country's demand for metal casings.

North America Metal Li-based Battery Casing Market Trends

North America is significantly influenced by the high consumption of consumer goods, with a large portion of the population relying on gadgets such as smartphones, tablets, and laptops for communication. This reliance is expected to drive the demand for lithium batteries, supporting the growth of the battery casing market.

U.S, Metal Li-based Battery Casing Market Trends

The U.S. economy is a major consumer of metal lithium-based battery casings in North America. Its economic growth is fueled by consumer spending on automobiles, electronics, and government initiatives to develop EV infrastructure.

Europe Metal Li-based Battery Casing Market Trends

Europe is the world's largest consumer of EVs. The demand for EVs is anticipated to increase in the upcoming years as the continent struggles with the energy crisis due to Russia's invasion of Ukraine. This invasion has driven up power prices and sparked widespread support for accelerating the energy transition away from fossil fuels.

Central & South America Metal Li-based Battery Casing Market Trends

The growing demand for lithium-ion batteries in the Central & South American region, driven by applications such as battery storage systems for renewable energy and emergency power supply systems, is fueling the demand for metal casings.

Middle East & Africa Metal Li-based Battery Casing Market Trends

Middle East & Africa region is emerging as a key player in the global transition to the adoption of clean energy and EVs. The demand for lithium-ion batteries is rising rapidly as countries in the region push to implement sustainable energy solutions.

Key Metal Li-based Battery Casing Company Insights

Some of the key players operating in the market include GF Casting Solutions, Nemak, and Magna International Inc.

-

GF Casting Solutions is a division of Georg Fischer (GF), a Swiss-based industrial group. The company specializes in lightweight casing technologies and high-precision components for the automotive, aerospace, and industrial sectors.

-

Magna International Inc. is a global automotive supplier with a diverse portfolio that spans the entire vehicle, including body exteriors and structures, power and vision technologies, seating systems, and complete vehicle engineering and assembly services.

-

Nemak is a global company in the automotive supply industry. It specializes in the production of lightweight aluminum components for vehicle powertrains, body structures, and other applications.

Key Metal Li-based Battery Casing Companies:

The following are the leading companies in the metal Li-based battery casing market. These companies collectively hold the largest market share and dictate industry trends.

- Constellium

- Gestamp

- GF Casting Solutions

- Gränges

- Magna International Inc.

- Minth Group Co., Ltd.

- Nemak

- Norsk Hydro ASA

- Novelis

- Targray

- thyssenkrupp AG

- UACJ Corporation

Recent Developments

-

In July 2024, the Government of Serbia and Minth Group Co., Ltd. signed a memorandum of understanding to set up a new manufacturing facility in Serbia. The investment, EUR 870 (USD 939.6) million, focuses primarily on battery housings for electric vehicles. This substantial investment in the automotive industry's electrification makes the company a key supplier of battery enclosures and body structure components.

-

In May 2024, Gränges announced an extension of its collaboration with Shandong Innovation Group (SIG), which aimed at accelerating growth in the Asian electrification market by focusing on the battery housing sector. As part of this new agreement, Gränges will own a highly efficient, cost-effective casing and hot-rolling facility in Shandong province, China. The agreement will provide Gränges access to scalable downstream operations, enabling efficient manufacturing and delivery of battery housings to support Electric Vehicle (EV) production. The partnership will also offer Gränges access to a nearby low-carbon and recycled aluminum supply.

Metal Li-based Battery Casing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 859.5 million

Revenue forecast in 2030

USD 1.97 billion

Growth rate

CAGR of 18.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in Kilotons, Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Germany; UK; Sweden; Poland; Hungary; China; Japan; South Korea; Australia

Key companies profiled

Constellium; Gestamp; GF Casting Solutions; Gränges; Magna International Inc.; Minth Group Co. Ltd.; Nemak; Norsk Hydro ASA; Novelis; Targray; thyssenkrupp AG; UACJ Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

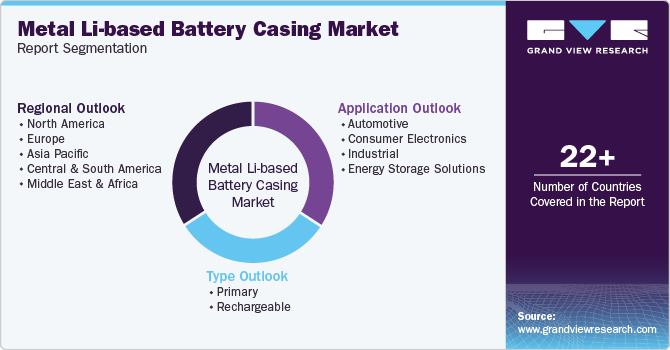

Global Metal Li-based Battery Casing Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global metal Li-based battery casing market report on the basis of type, application and region.

-

Type Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

Primary

-

Rechargeable

-

-

Application Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Consumer Electronics

-

Industrial

-

Energy Storage Solutions

-

-

Regional Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

Sweden

-

Poland

-

Hungary

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global metal Li-based battery casing market size was estimated at USD 794.4 million in 2024 and is expected to reach USD 859.5 million in 2025.

b. The global metal Li-based battery casing market is expected to grow at a compound annual growth rate of 18.0% from 2025 to 2030 to reach USD 1.97 billion by 2030.

b. Based on application segment, automotive held the largest revenue share of more than 86.0% in 2024 owing to rapid demand for electric vehicles

b. Some of the key vendors of the global metal Li-based battery casing market are Constellium, Gestamp, GF Casting Solutions, Gränges, Magna International Inc., Minth Group Co., Ltd., Nemak, Norsk Hydro ASA, Novelis, among others

b. The growing demand for lithium ion batteries in electric vehicles and energy storage solutions is the key driving factor for the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."