- Home

- »

- Automotive & Transportation

- »

-

Battery Management System Market, Industry Report, 2030GVR Report cover

![Battery Management System Market Size, Share & Trends Report]()

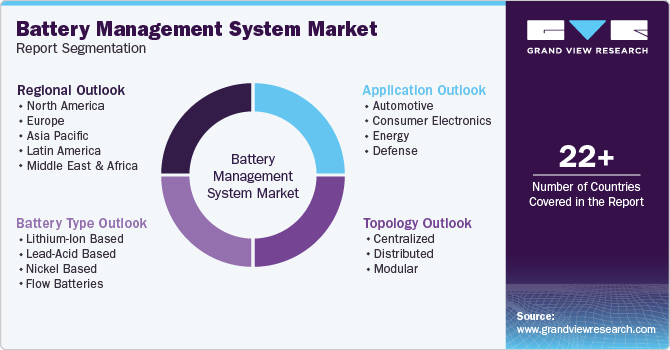

Battery Management System Market (2025 - 2030) Size, Share & Trends Analysis Report By Battery Type (Lithium-ion Based, Lead-acid Based, Nickel Based, Flow Batteries), By Topology, By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-747-6

- Number of Report Pages: 114

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Battery Management System Market Summary

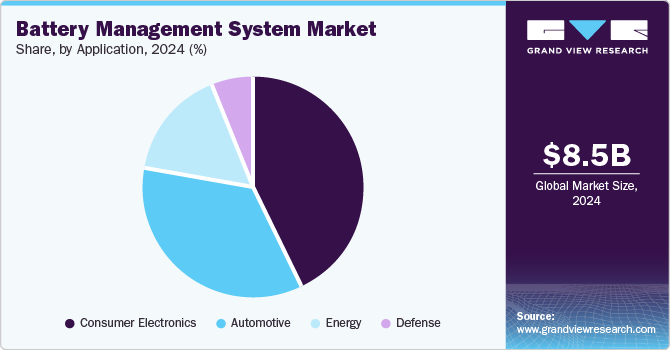

The global battery management system market size was estimated at USD 8.49 billion in 2024 and is projected to reach USD 31.27 billion by 2030, growing at a CAGR of 25.2% from 2025 to 2030. Battery management systems are widely used in rechargeable batteries mounted in electric vehicles.

Key Market Trends & Insights

- The Asia Pacific battery management system industry is anticipated to grow at a CAGR of 29.2%.

- The U.S. battery management system industry held a dominant position in 2024.

- By battery type, the lead-acid based segment accounted for the largest market share of 49.0% in 2024.

- By topology, the centralized segment held the largest market share in 2024.

- By application, the consumer electronics segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.49 Billion

- 2030 Projected Market Size: USD 31.27 Billion

- CAGR (2025-2030): 25.2%

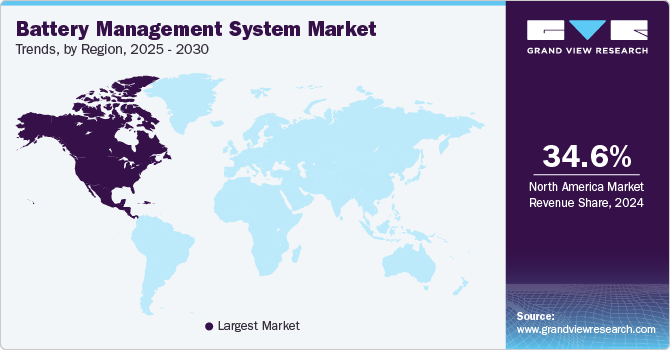

- North America: Largest market in 2024

The growth of the battery management systems industry can be attributed to the increasing adoption of Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs) across the globe, owing to stringent policies, such as the Kyoto protocol, implemented to curb Greenhouse Gas (GHG) emissions. In addition, the growing demand for renewable energy sources, such as solar and wind power, also fuels the demand for battery management systems to manage the batteries used in energy storage systems. Moreover, the rising need for efficient battery performance and extended battery life is also contributing to the growth of the battery management system.

A battery management system (BMS) offers several benefits for various applications, including electric vehicles, energy storage systems, and consumer electronics. Some of the key benefits of BMS include enhanced battery performance, improved safety, increased efficiency, remote monitoring and control, and enhanced user experience. For instance, BMS enables remote monitoring and control of battery performance, which is essential for applications such as energy storage systems and electric vehicles. This feature allows operators to monitor battery status, identify potential issues, and adjust remotely, improving overall efficiency and reducing maintenance costs.

Advancements in rechargeable battery technology, such as solid-state batteries, lithium-sulfur batteries, and flow batteries, are expected to drive the demand for battery management systems. These new battery technologies offer higher energy density, faster-charging rates, and longer life than traditional batteries, but they also have different charging and discharging characteristics, which require specialized BMSs for optimal performance and safety. Governments worldwide are implementing regulations to reduce greenhouse gas emissions. As a result, the demand for rechargeable batteries, which are equipped with BMS technology and are more environmentally friendly than disposable batteries, is expected to increase. Furthermore, the growing demand for consumer electronics devices such as smartphones, laptops, tablets, and wearable devices with rechargeable batteries is expected to fuel the growth of the battery management system industry.

Leading suppliers in the battery market are utilizing the most advanced technologies, such as BMS, to improve the durability and lifespan of batteries during usage. BMS prevents overcharging and over-discharging by regulating the charging and discharging process, thereby improving the durability of the battery system. In addition, BMS monitors the temperature of the battery system, preventing overheating, which can cause thermal runaway and lead to battery failure. Moreover, to prevent thermal runaway, temperature monitoring can also help identify potential issues with the battery system. For example, if a particular cell in the battery pack is consistently running at a higher temperature than other cells, it may indicate a problem with the cell or the BMS itself. Early detection of such issues can prevent further damage to the battery system and improve its durability.

Although BMS offers numerous benefits, such as improved battery performance and enhanced safety, its use can also increase the final cost of a product or application. This added cost may discourage manufacturers from adopting BMS, especially in price-sensitive markets. As a result, this can lead to reduced demand for BMS solutions. In addition, in several emerging economies, the lack of skilled labor capable of implementing or testing BMSs may further hinder the growth of the battery management system industry.

Battery Type Insights

The lead-acid based segment accounted for the largest market share of 49.0% in 2024. Lead-acid batteries are a commonly used type of rechargeable battery with a substantial Topology, making them an attractive option for various applications. They are known for their reliability and low cost per watt, making them highly popular among different industries. The cost-effectiveness of lead-acid batteries is unparalleled when a large Topology is required, making them an excellent choice for applications that need high energy storage at a lower cost. Due to their cost-effectiveness and high Topology, lead-acid batteries find widespread use in electric vehicles and automobiles.

The lithium-ion based segment is expected to grow at the fastest CAGR during the forecast period, owing to the rising usage of portable devices, such as tablets, mobile phones, and Bluetooth devices. In addition, these batteries provide multiple benefits, including lightweight, high adaptability for different applications, can withstand a significant number of charge/discharge cycles, are easy to maintain, and have a longer life span. These benefits are driving the adoption of lithium-ion batteries in several applications. On the other hand, the nickel-based battery segment is also anticipated to witness significant growth in the coming years. These batteries are charged with less stress and at high speed and offer an extended shelf life. They perform well under rigorous working conditions and are low in cost. They are used in professional cameras, power tools, two-way radios, and emergency medical equipment.

Topology Insights

The centralized segment held the largest market share in 2024. The centralized BMS functions as a single pack controller that monitors, balances, and manages all cells in the battery pack. Designing and building a centralized BMS is simpler and more cost-effective compared to other topologies. A centralized BMS is primarily used in medium-power applications such as e-bikes, portable medical equipment, portable devices, home appliances, and many other applications.

The distributed segment is expected to register the fastest CAGR of 26.8% during the forecast period. In a distributed BMS topology, the battery cells in the system are managed by multiple control units. One of the significant benefits of utilizing a distributed BMS is its resilience, as it can continue to function effectively even in the event of one or more control unit failures. In addition, compared to other BMS topologies, a distributed BMS is growing in popularity due to its distinctive design. A distributed BMS features electronics that are housed on cell boards, which are placed directly on the cells being measured. Instead of numerous tap wires running between the cells and electronics, a distributed BMS only requires a few communication wires between the cell boards and a BMS controller that performs computation and communication functions. Thus, the abovementioned benefits of the distributed BMS are propelling the segment’s growth.

Application Insights

The consumer electronics segment dominated the market in 2024. The increasing adoption of battery management systems in consumer electronics applications is boosting the segment’s growth. They are widely used in portable electronics, with a high-energy density, low self-discharge, and tiny memory effect. In consumer electronics, BMSs are typically used to ensure the safe and efficient use of lithium-ion batteries, which are commonly used in these devices due to their high energy density and long cycle life.

The automotive segment is anticipated to grow rapidly during the forecast period. Strategic initiatives undertaken by key market players to launch BMS for EVs are fueling the segment’s growth. In January 2025, LG Energy Solution Ltd (LGES) introduced its new advanced battery management system, built on a system-on-chip platform and equipped with diagnostic solutions, aimed at enhancing battery safety in electric vehicles. Furthermore, the growing popularity of electric two-wheelers across developing countries is expected to drive demand for BMS in the automotive sector.

Regional Insights

The North America battery management system industry was identified as a lucrative region in 2024. The growth can be attributed to advances in battery technology, which have led to the development of more efficient and long-lasting batteries. The increasing support from both the federal government and various state governments is also encouraging the adoption of EVs, thereby driving the demand for battery management systems.

U.S. Battery Management System Market Trends

The U.S. battery management system industry held a dominant position in 2024. The growth is fueled by advancements in battery technology, which have led to the development of more efficient and longer-lasting batteries. In addition, increasing support from the federal and state governments has encouraged the adoption of EVs and their rechargeable batteries, further driving the demand for battery management systems.

Europe Battery Management System Market Trends

Europe battery management system industry is expected to register a moderate CAGR from 2025 to 2030.The proliferation of electric mobility is reshaping the European automotive industry, and BMS is at the forefront of this transformation. The rising popularity of electric vehicles is pushing manufacturers to invest in advanced BMS technology to enhance battery efficiency, extend range, and ensure the safety of EVs. In addition, data analytics and predictive maintenance capabilities are becoming integral to BMS solutions in Europe. These advancements enable real-time monitoring of battery health and performance, allowing for proactive maintenance and minimizing downtime, thereby contributing to the growth of the regional market.

The U.K. battery management system market is expected to grow at a notable CAGR from 2025 to 2030.The increasing demand for BMS in the energy sector and the development of advanced BMS systems for applications such as energy storage systems are boosting the growth of the U.K. BMS market.

The battery management system market in Germany held a substantial market share in 2024. Increasing strategic initiatives in the BMS industry and the growing efforts of market players in the country to achieve technological advancements in BMS components, such as battery sensors, resistors, and wireless cell monitoring boards, are driving the market growth.

Asia Pacific Battery Management System Market Trends

The Asia Pacific battery management system industry is anticipated to grow at a CAGR of 29.2% during the forecast period. The regional market has experienced significant growth in recent years, driven by the increasing demand for EVs and renewable energy systems in the region. Countries such as China, Japan, and South Korea have emerged as major markets for BMS technology, with several domestic and international companies investing in the development of advanced BMS solutions.

India’s battery management system market is expected to grow at the fastest CAGR during the forecast period. The market in India has been gaining traction in recent years. The Indian government is promoting the adoption of EVs as a part of its goal to reduce its dependence on fossil fuels and decrease emissions. In addition, state governments are implementing policies to complement these efforts and further promote the use of EVs powered by rechargeable batteries.

The battery management system market in China held a substantial revenue share in 2024. China has been a pioneer in the battery management system industry for consumer electronic products and electric vehicles, and has emerged as a leader in this sector. The increasing adoption of electronic products such as smartphones, portable computers, and tablets is boosting market growth.

Key Battery Management System Company Insights

Some of the key companies in the battery management system industry include NXP Semiconductor N.V., Analog Devices, Inc., and Johnson Matthey. Organizations are prioritizing the integration of advanced technologies to enhance their offerings and maintain a competitive edge. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, business expansions, new product launches, and partnerships, among others.

-

NXP Semiconductor N.V. provides fully automotive-qualified battery cell controllers, communication ICs, chargers, and sensors for vehicle battery management. The company is investing in R&D and product development as part of the efforts to defend its market share.

-

Analog Devices, Inc. provides a wide range of high-performance battery management IC devices, including companion battery charge controllers, battery chargers, and battery backup managers. The company has been leading the charge in new product development and strategic partnerships, and collaborations.

Key Battery Management System Companies:

The following are the leading companies in the battery management system market. These companies collectively hold the largest market share and dictate industry trends.

- Elithion, Inc.

- Johnson Matthey

- Analog Devices, Inc.

- Lithium Balance A/S

- NXP Semiconductor N.V.

- Nuvation

- Texas Instruments Incorporated

- Leclanché SA

- Eberspaecher Vecture Inc.

- Infineon Technologies AG

Recent Developments

-

In December 2024, at the 2024 CTI Symposium in Berlin, Marelli unveiled a groundbreaking innovation in Battery Management Systems for automotive applications, featuring a system based on Electrochemical Impedance Spectroscopy. This advancement is expected to raise the benchmark for battery cell management by enabling optimal operation and improved performance of battery packs.

-

In July 2023, Analog Devices, Inc. and Hon Hai Technology Group (Foxconn), a technology service provider, announced the signing of a Memorandum of Understanding (MoU) to develop a high-performance battery management system and the next-generation digital car cockpit.

Battery Management System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.17 billion

Revenue forecast in 2030

USD 31.27 billion

Growth rate

CAGR of 25.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

April 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Battery type, topology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Netherlands; Norway; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Elithion, Inc.; Johnson Matthey; Analog Devices, Inc.; Lithium Balance A/S; NXP Semiconductor N.V.; Nuvation; Texas Instruments Incorporated; Leclanché SA; Eberspaecher Vecture Inc.; Infineon Technologies AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Battery Management System Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest Application trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global battery management system market report based on battery type, topology, application, and region

-

Battery Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Lithium-Ion Based

-

Lead-Acid Based

-

Nickel Based

-

Flow Batteries

-

-

Topology Outlook (Revenue, USD Million, 2018 - 2030)

-

Centralized

-

Distributed

-

Modular

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Consumer Electronics

-

Energy

-

Defense

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Netherlands

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.