- Home

- »

- Advanced Interior Materials

- »

-

Metal Shredder Machine Market Size, Industry Report, 2033GVR Report cover

![Metal Shredder Machine Market Size, Share & Trends Report]()

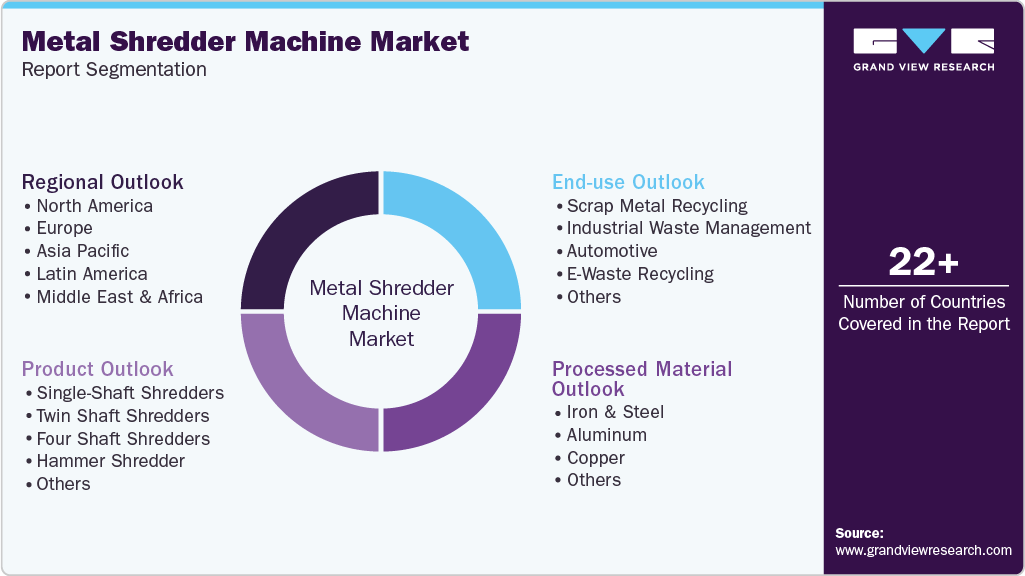

Metal Shredder Machine Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Single-Shaft Shredders, Twin Shaft Shredders), By Processed Material (Iron & Steel, Aluminum, Copper), By End-use (Scrap Metal Recycling, Automotive), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-821-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Metal Shredder Machine Market Summary

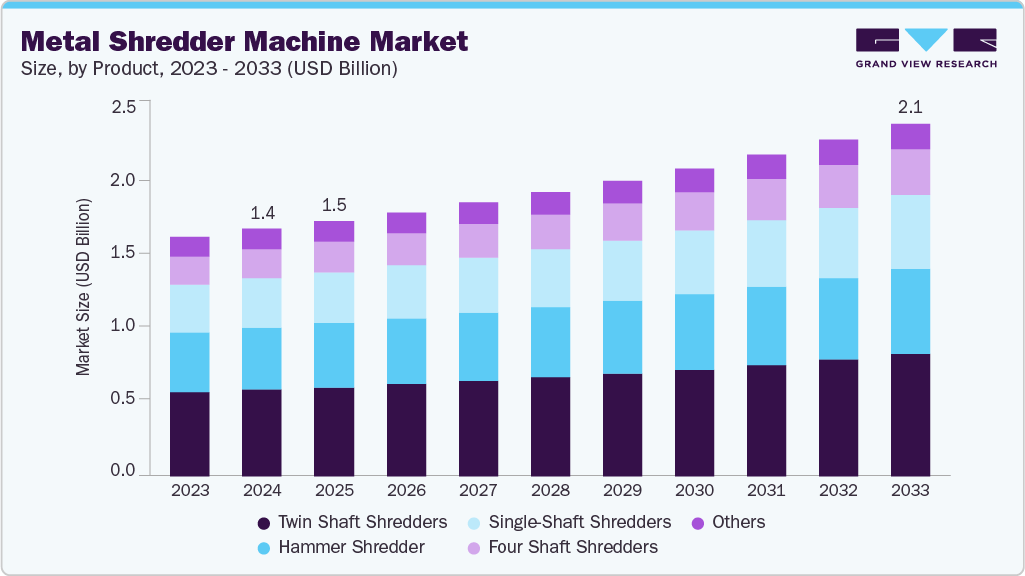

The global metal shredder machine market size was estimated at USD 1,408.4 million in 2024 and is projected to reach USD 2008.0 million by 2033, growing at a CAGR of 4.1% from 2025 to 2033. The market is driven by the rising volume of scrap generation across automotive, construction, and manufacturing industries.

Key Market Trends & Insights

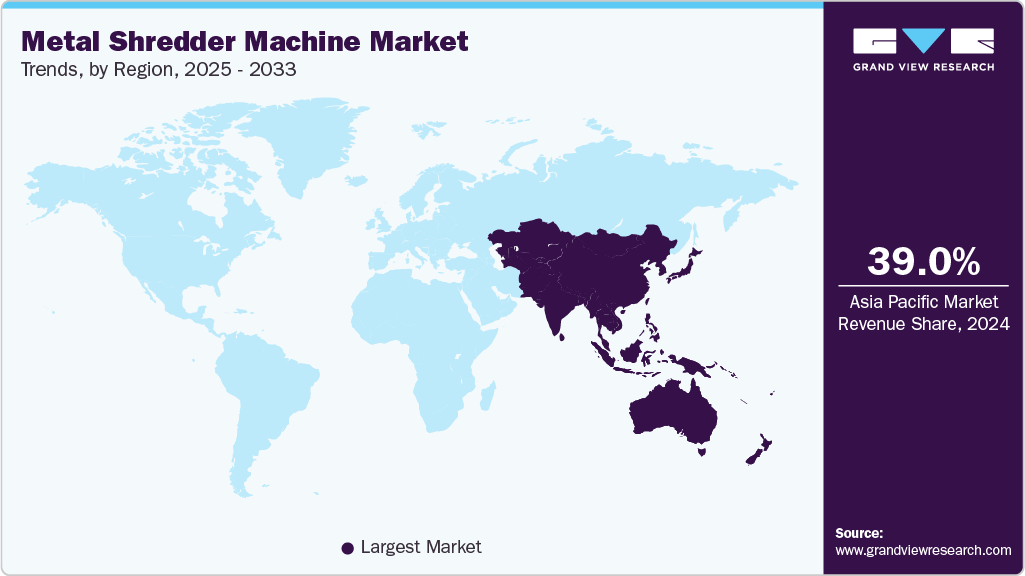

- Asia Pacific dominated the global metal shredder machine industry with the largest revenue share of 39.0% in 2024.

- China metal shredder machine industry dominated the Asia Pacific market due to its massive scrap generation from manufacturing, automotive, and construction industries.

- By product, the twin shaft shredders dominated the market with a revenue share of 35.0% in 2024.

- By processed material, the iron and steel dominated the market with a share of 59.9% in 2024.

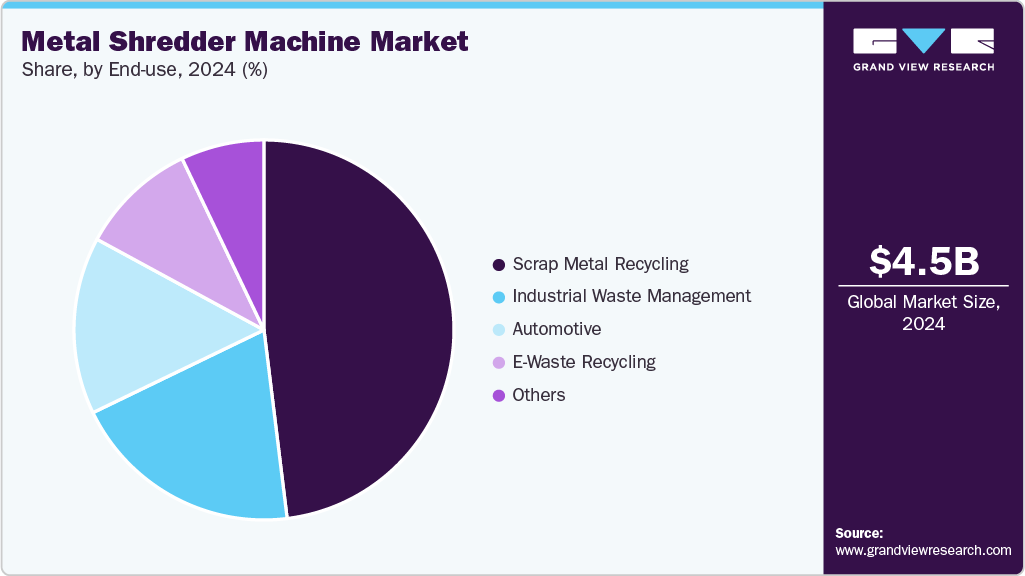

- By end-use, the scrap metal recycling dominated the market and held a share of 48.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,408.4 Million

- 2033 Projected Market Size: USD 2,008.0 Million

- CAGR (2025-2033): 4.1%

- Asia Pacific: Largest market in 2024

Growing emphasis on metal recycling to reduce environmental impact and conserve resources further boosts equipment demand. Governments worldwide are strengthening recycling regulations, creating a favorable landscape for advanced shredding solutions.

Surging demand for efficient waste management systems is pushing industries to invest in modern metal shredding technologies. Shredders enable cost-effective material recovery, helping companies optimize operations and reduce disposal expenses. Technological advancements such as energy-efficient drives, smart monitoring systems, and wear-resistant components are enhancing machine performance. Expansion of e-waste recycling and sustainable production practices also accelerates market growth.

Market Concentration & Characteristics

The global metal shredder machine industry remains moderately fragmented, with a mix of established manufacturers and several regional players competing across different capacity ranges. While large companies dominate high-volume shredders used in heavy scrap recycling, smaller firms actively supply customized and mid-capacity machines, preventing strong consolidation. Continuous innovation in automation, rotor design, and energy-efficient systems further broadens competitive dynamics. Overall, the market’s structure encourages technological differentiation rather than dominance by a few players.

Innovation in the metal shredder machine industry is steadily rising as manufacturers integrate smart sensors, automated controls, and predictive maintenance features to improve efficiency. New rotor designs, wear-resistant materials, and noise-reduction technologies are improving machine durability and performance. Energy-efficient motors and hybrid drive systems are also gaining traction to lower operating costs. Overall, innovation is driven by the need for faster processing, higher throughput, and improved safety.

Environmental regulations on waste management, recycling efficiency, and emissions have a strong influence on machine design and adoption. Governments are increasingly pushing for strict compliance in scrap handling, which encourages industries to invest in advanced shredders with dust control and safer processing features. Incentives for circular economy initiatives further support market growth. As regulatory standards tighten across regions, companies must upgrade equipment to remain compliant.

End user demand is relatively diversified, though scrap metal recycling remains the dominant segment driving bulk equipment purchases. Industrial waste processors, automotive dismantlers, and e-waste recyclers add steady demand across medium and high-capacity shredder categories. Emerging sectors such as municipal waste and construction recyclers are expanding their investments gradually. This spread of end users reduces market dependency on a single sector and supports stable long-term growth.

Drivers, Opportunities & Restraints

The market is driven by rising global scrap generation and the growing shift toward circular economy practices, which increase demand for efficient metal processing equipment. Industries are investing in high-capacity shredders to reduce disposal costs and recover valuable metals. Technological advances such as automated control systems, improved rotor designs, and energy-efficient motors boost adoption across recycling facilities. In addition, stricter waste management regulations are pushing companies to upgrade to compliant, high-performance shredding solutions.

The expansion of e-waste recycling and the surge in lightweight metal usage, particularly aluminum, are creating new opportunities for specialized shredding systems. Emerging economies are rapidly building recycling infrastructure, opening growth avenues for mid-capacity and modular shredders. There is increasing potential in customized solutions tailored for defense, municipal waste, and construction debris processing. Adoption of IoT-based monitoring and predictive maintenance also provides opportunities for value-added service models.

High initial investment costs remain a key barrier, especially for small and mid-sized recycling firms with limited capital. Maintenance expenses and downtime associated with heavy-duty shredders can further restrict adoption. Variability in scrap quality and inconsistent metal supply chains often affect operational efficiency at end user facilities. In addition, noise, dust, and safety concerns may limit installations in urban or regulated industrial zones, slowing market penetration.

Product Insights

The twin shaft shredders dominated the market with a revenue share of 35.0% in 2024, due to their ability to handle a wide range of ferrous and non-ferrous scrap with high torque and consistent throughput. Their robust blades and dual-shaft configuration make them ideal for heavy-duty recycling operations, especially in large scrap yards. Industries prefer these machines for their reliability, lower maintenance frequency, and efficient size reduction of bulky metals. Their versatility across automotive scrap, industrial waste, and mixed metals strengthens their leading position.

Four shaft shredders are expected to be the fastest-growing segment over the forecast period, as industries seek more controlled shredding, finer output, and higher precision in material separation. Their integrated screen system ensures uniform particle size, making them attractive for complex applications such as e-waste, defense materials, and sensitive data destruction. The growing demand for multi-stage processing within a single machine also supports its adoption. As recycling standards tighten, end users increasingly turn to four-shaft systems for cleaner, safer, and more efficient outcomes.

Processed Material Insights

Iron and steel dominated the market with a share of 59.9% in 2024, due to the massive volume of ferrous scrap generated by automotive, construction, heavy machinery, and industrial manufacturing sectors. These materials require high-strength shredders capable of handling dense, bulky feedstock, making them the primary focus for large recycling facilities. Strong global demand for recycled steel in electric arc furnaces also boosts processing activity. As steel recycling remains a cost-effective and energy-saving practice, it continues to anchor shredder utilization.

Aluminum is anticipated to be the fastest-growing processed material category over the forecast period, as industries accelerate the shift toward lightweight metals for automotive, aerospace, packaging, and electronics applications. Rising recycling rates for aluminum cans, extrusions, and mixed scrap are driving demand for specialized shredders that can process thinner yet high-volume material streams efficiently. The metal’s high recovery value further incentivizes recyclers to invest in advanced shredding systems. With sustainability targets tightening, aluminum recycling is expanding rapidly, fueling segment growth.

End-use Insights

Scrap metal recycling dominated the market and held a share of 48.1% in 2024, because it relies heavily on high-capacity shredders to process large volumes of ferrous and non-ferrous scrap efficiently. Rising global scrap generation from automotive dismantling, construction debris, and industrial offcuts strengthens demand for robust shredding equipment. Recycling companies prefer advanced shredders to improve metal recovery rates and meet stricter environmental standards. This consistent, large-scale operational need keeps the segment at the forefront of market demand.

Industrial waste management is the fastest-growing segment as manufacturers face increasing pressure to manage production waste responsibly and lower disposal costs. Shredders are being adopted to reduce waste volume, improve recyclability, and support in-house resource recovery programs. Sectors such as machinery, electronics, and metal fabrication are expanding investments in mid-capacity shredders to handle diverse waste streams. As regulatory requirements tighten, more industries are integrating shredding systems into their sustainability and waste-reduction strategies.

Regional Insights

Asia Pacific metal shredder machine industry dominated the global market with a 39.0% revenue share in 2024, due to large-scale metal recycling activity driven by China, India, Japan, and Southeast Asian countries. Rapid industrialization and expanding manufacturing output generate substantial scrap volumes that require advanced shredding systems. Governments in the region are also promoting recycling infrastructure to support circular economy initiatives. In addition, the presence of numerous local manufacturers offering cost-effective equipment strengthens regional leadership.

China metal shredder machine industry dominated the Asia Pacific market due to its massive scrap generation from manufacturing, automotive, and construction industries. The country’s large-scale recycling infrastructure and high-volume metal processing facilities drive strong demand for heavy-duty shredders. Government initiatives promoting circular economy practices further accelerate equipment adoption. In addition, the presence of numerous domestic manufacturers offering competitively priced machines reinforces China’s leadership.

India metal shredder machine industry is growing rapidly as expanding industrial activity and rising steel and aluminum consumption generate increasing scrap volumes. The country is strengthening its recycling ecosystem, prompting greater investment in modern shredding equipment. Government-backed sustainability programs and waste management regulations are also encouraging industries to upgrade their processing capabilities. Growing demand from automotive dismantling, infrastructure development, and metal fabrication sectors continues to support market expansion.

North America Metal Shredder Machine Market Trends

North America metal shredder machine industry is witnessing steady growth at a projected CAGR of 3.3% in the coming years, fueled by strong scrap recycling networks and high adoption of automated, high-capacity shredders. The U.S. and Canada are investing in modernizing recycling facilities to meet stricter environmental standards. Increasing demand for processed ferrous and non-ferrous metals in automotive and construction sectors supports expansion. Technological innovation and digital monitoring solutions further accelerate regional uptake.

U.S. Metal Shredder Machine Market Trends

The U.S. metal shredder machine industry dominated the North America market due to its extensive scrap recycling infrastructure and high-volume ferrous and non-ferrous processing facilities. Strong demand from automotive dismantling, industrial manufacturing, and construction sectors drives continuous investment in advanced shredders. The country’s strict environmental regulations encourage upgrades to safer, energy-efficient, and high-capacity systems. In addition, strong adoption of automation and digital monitoring technologies reinforces its leading position.

Canada is experiencing steady growth as the country expands its recycling capabilities and modernizes waste management operations. Increasing metal scrap generation from construction, mining, and industrial fabrication sectors is boosting the need for efficient shredding solutions. Government-led sustainability programs and circular economy initiatives are encouraging adoption of high-performance shredder machines. Growing investments in regional recycling hubs further support market expansion across the country.

Europe Metal Shredder Machine Market Trends

Europe’s metal shredder machine industry growth is supported by stringent recycling and waste management regulations that encourage industries to upgrade shredding equipment. The region’s focus on reducing landfill use and advancing circular economy initiatives drives continuous investment in metal processing machinery. Strong demand for recycled metals in manufacturing and renewable energy sectors adds momentum. In addition, advanced engineering capabilities promote the adoption of high-efficiency shredder systems.

Germany metal shredder machine industry dominated the Europe region due to its advanced recycling infrastructure and strong engineering capabilities. High scrap generation from automotive manufacturing, machinery production, and industrial sectors drives consistent demand for heavy-duty shredders. The country’s strict recycling regulations push facilities to adopt efficient, low-emission equipment. Germany’s leadership in automation and precision machinery further reinforces its dominant position.

The UK metal shredder machine industry is experiencing steady growth as recycling facilities upgrade their equipment to meet tightening waste management and circular economy targets. Rising metal scrap from construction, vehicle dismantling, and consumer goods is boosting demand for reliable shredding systems. Investments in modern recycling plants and regional sustainability initiatives support market expansion. The increasing focus on efficient resource recovery is further accelerating shredder adoption across the country.

Middle East & Africa Metal Shredder Machine Market Trends

The Middle East and Africa metal shredder machine industry is experiencing rising demand as countries focus on strengthening waste management systems and diversifying their industrial base. Scrap generation from infrastructure development and metal fabrication industries is supporting the installation of new shredding facilities. Investments in recycling zones, especially in the Gulf region, are driving uptake of modern shredders. Increasing sustainability goals and resource recovery initiatives further support market expansion.

Saudi Arabia metal shredder machine industry is experiencing strong growth in the market as the country accelerates industrial diversification under national development programs. Expanding construction, metal fabrication, and automotive recycling activities are generating higher scrap volumes that require efficient shredding systems. Investments in modern waste management and dedicated recycling zones are supporting the adoption of advanced equipment. In addition, rising sustainability goals and resource recovery initiatives are driving industries to upgrade their processing capabilities.

Latin America Metal Shredder Machine Market Trends

Latin America metal shredder machine industry is gradually expanding its metal recycling capacity, driven by increasing urbanization and industrial activity in countries like Brazil and Argentina. Growing awareness of recycling’s economic benefits is encouraging both public and private investments in shredding equipment. The region’s evolving automotive and construction sectors generate substantial scrap that supports market growth. However, modernization of recycling infrastructure remains a key enabler for faster adoption.

Brazil metal shredder machine industry is witnessing steady growth in the Latin American market as rising industrial activity and urban development generate increasing volumes of scrap metal. The country’s expanding automotive, construction, and manufacturing sectors are driving the need for efficient shredding and recycling systems. Government focus on improving waste management practices is encouraging investment in modern, high-capacity machines. Strengthening recycling networks and growing interest in resource recovery are further supporting market adoption across Brazil.

Key Metal Shredder Machine Company Insights

Some of the key players operating in the market include WEIMA, UNTHA Shredding Technology GmbH, and SSI Shredding Systems.

-

WEIMA is recognized for its specialization in high-torque shredding systems built to handle diverse metal scrap streams with consistent output quality. The company focuses heavily on customizable rotor designs that support complex, mixed-metal applications. Its machines integrate advanced hydraulic drives that enhance throughput while reducing energy use. WEIMA also emphasizes longevity by engineering components for reduced wear in demanding environments. Its strong service ecosystem helps facilities optimize uptime and processing efficiency.

-

UNTHA is known for engineering precision-built shredders designed for heavy, continuous-duty metal processing. The company’s four-shaft and high-torque systems deliver controlled, uniform output, making them suitable for high-security and complex metal waste streams. UNTHA prioritizes noise reduction, safety, and clean operation through integrated technology upgrades. Their machines are optimized for minimal maintenance downtime, even under harsh industrial loads. The brand’s strong reputation in high-accuracy shredding drives adoption in sensitive recycling applications.

Key Metal Shredder Machine Companies:

The following are the leading companies in the metal shredder machine market. These companies collectively hold the largest market share and dictate industry trends.

- WEIMA

- UNTHA shredding technology GmbH

- SSI Shredding Systems

- Lindner

- LINDEMANN

- Hammermill

- Zato North America Corp.

- BCA Industries, Inc

- Ma’anshan Shengzhong Heavy Industry Machinery Co., Ltd.

- 3TEK

- Shred-Tech

- SUNY GROUP

- LEFORT

- Vaner Machinery Co.,Ltd

- Advance Hydrau Tech Pvt Ltd.

Recent Developments

-

In October 2025, UNTHA has partnered with Sun Earth Co., Ltd. to strengthen its presence in Japan, directly supporting rising demand for advanced metal shredding and recycling systems. The collaboration ensures better access to UNTHA’s high-torque shredders along with faster local service and technical support. As Japan expands its recycling and resource-recovery infrastructure, this partnership enables wider adoption of modern shredding solutions. Overall, it reinforces market growth by improving regional availability of efficient metal processing equipment.

-

In July 2025,WEIMA announced it will unveil its new W5.22 single-shaft shredder along with an upgraded C.200 Duo dewatering press at K 2025. The company is also introducing its WE.connect platform, enabling live machine insights and predictive maintenance. These launches highlight WEIMA’s push toward smarter, more efficient recycling technologies. The focus remains on boosting throughput, reliability, and sustainability for modern processing needs.

Metal Shredder Machine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,454.1 million

Revenue forecast in 2033

USD 2,008.0 million

Growth rate

CAGR of 4.1% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, processed material, end-use, region.

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

WEIMA; UNTHA Shredding Technology GmbH; SSI Shredding Systems; Lindner; LINDEMANN; Hammermill; Zato North America Corp.; BCA Industries, Inc.; Ma’anshan Shengzhong Heavy Industry Machinery Co., Ltd.; 3TEK; Shred-Tech; SUNY GROUP; LEFORT; Vaner Machinery Co., Ltd.; Advance Hydrau Tech Pvt Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Metal Shredder Machine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global metal shredder machine market report based on product,processed material, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Single-Shaft Shredders

-

Twin Shaft Shredders

-

Four Shaft Shredders

-

Hammer Shredder

-

Others

-

-

Processed Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Iron & Steel

-

Aluminum

-

Copper

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Scrap Metal Recycling

-

Industrial Waste Management

-

Automotive

-

E-Waste Recycling

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global metal shredder machine market size was estimated at USD 1,408.4 million in 2024 and is expected to be USD 1,454.1 million in 2025.

b. The global metal shredder machine market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.1% from 2025 to 2033 to reach USD 2,008.0 million by 2033.

b. Scrap metal recycling dominates the end-use segment and accounting for a share of 48.1% in 2024, because it relies heavily on high-capacity shredders to process large volumes of ferrous and non-ferrous scrap efficiently.

b. Some of the key players operating in the global metal shredder machine market include WEIMA; UNTHA Shredding Technology GmbH; SSI Shredding Systems; Lindner; LINDEMANN; Hammermill; Zato North America Corp.; BCA Industries, Inc.; Ma’anshan Shengzhong Heavy Industry Machinery Co., Ltd.; 3TEK; Shred-Tech; SUNY GROUP; LEFORT; Vaner Machinery Co., Ltd.; Advance Hydrau Tech Pvt Ltd.

b. The global metal shredder machine market is driven by rising scrap generation from automotive, construction, and industrial sectors, increasing the need for efficient metal processing. Strengthening recycling regulations and circular economy initiatives are pushing companies to adopt advanced shredding systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.