- Home

- »

- Advanced Interior Materials

- »

-

Metals In Electric Vehicle Charging Infrastructure Market, 2030GVR Report cover

![Metals In Electric Vehicle Charging Infrastructure Market Size, Share & Trends Report]()

Metals In Electric Vehicle Charging Infrastructure Market (2022 - 2030) Size, Share & Trends Analysis Report By Metals (Copper, Steel, Aluminum), By Charging Port, By End Use (Commercial, Private), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-912-5

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

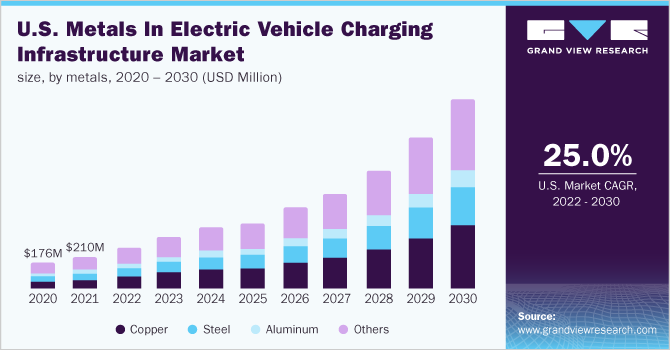

The global metals in electric vehicle charging infrastructure market size was valued at USD 1.4 billion in 2021 and are expected to expand at a compound annual growth rate (CAGR) of 28.2% from 2022 to 2030. An increase in the global demand for Electric Vehicles (EVs) and favorable government policies for developing EV charging infrastructure are driving the market. The requirement for charging stations is rising in order to normalize the utilization of EVs as any other fuel-driven vehicle. This in turn has augmented investments as the EV drivers should be safeguarded that charging stations are in close proximities. This in turn is expected to augment the consumption of metals that are crucial raw materials in the charging infrastructure for EVs.

The U.S. is among the leading consumers of the market for metals in electric vehicle charging infrastructure. The market growth is mainly attributable to the increase in the production of EVs in the country. In 2021, the U.S. President introduced a USD 2 trillion infrastructure bill in which he prioritized a national EV charging network, promising to install at least 500 thousand devices in the country by 2030. Furthermore, in December 2021, the National Electric Highway Coalition was formed by over 50 key electric companies in the U.S., which came together to develop a fast-charging network for EVs in the U.S. by end of 2023. These companies have invested over USD 3.0 billion in projects related to electric transportation and charging infrastructure.

Other economies such as Brazil and India are also expected to invite large investments. For example, Kazam, an IOT-based company plans to install 1 lakh charging stations in India by 2023. Furthermore, the EV charging infrastructure in Brazil received a push through numerous proposals from the Efficient Electric Mobility Solutions program. A charging station consists of housing, switch and fuses, a control and operating system, and an electricity meter. These components require metals, for example, the housings require aluminum or steel, and the electrical components make use of critical metals. As a result, growing investments in the EV industry across different economies are expected to accelerate the consumption of metals over the forecast period.

Metal Insights

Based on metals, the copper segment accounted for the largest revenue share of over 27.0% in 2021 and this trend is expected to continue over the forecast period. Around 3.5 kg of copper is used in making one charging station. Copper is used in cables, charging units, and wiring in electric panels. Steel was the second-largest segment of the market for metals in electric vehicle charging infrastructure in 2021. Due to its low cost and superior strength, steel is preferred over aluminum for housing charging infrastructure. The CHAdeMO charging system utilizes steel for housing and many EV manufacturers including Tesla and Nissan have invested heavily in CHAdeMO, thereby driving the demand for steel over the forecast period.

Other metals include precious metals like silver and other metal alloys. The consumption of precious metals like silver in EV chargers is expected to grow at a substantial rate over the forecast period owing to its high conductivity and corrosion resistance properties. Moreover, the establishments of silver solar charging stations are likely to further fuel segment growth over the forecast period.

End-use Insights

Based on end-use, the commercial segment accounted for the largest revenue share of over 79.0% in 2021. The segment is expected to follow the same trend across the forecast period. Rising efforts for developing stations in commercial places such as overnight charging at individual homes or residential complexes are anticipated not to be adequate for long-distance journeys. Moreover, initiatives by the government are facilitating the demand for metals. For instance, the central government of India is prioritizing the electrification of petrol pumps.

According to the Ministry of Power, “the setting-up of Public Charging Stations in India shall be a de-licensed activity.” The private end-use segment comprises stations, which can be installed at residential complexes, independent houses, and other private non-commercial properties. EV chargers for residential end-users have substantial growth potential as they cost less and are more convenient. The increase in global demand must be supported by strong infrastructures, resulting in the development of innovative chargers for the private segment.

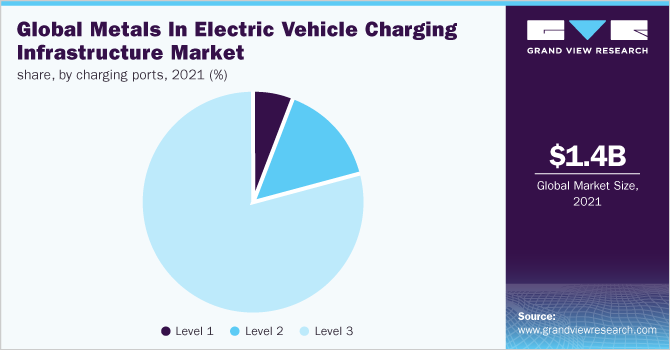

Charging Port Insights

The level 3 segment dominated the metals in the electric vehicle charging infrastructure market and accounted for the largest revenue share of over 79.0% in 2021. The segment is expected to continue its dominance over the forecast period. Level 3 chargers are also known as DC fast chargers (DCFC). These can rapidly charge EVs in lesser time than traditional AC chargers. Increasing R&D initiatives and rising investments in developing fast-charging networks are expected to propel segment growth.

The increased adoption of EVs and the preference of vehicle owners to charge vehicles at their homes are the factors leading to the increase in demand for level 1 chargers. Level 2 chargers are mostly used for daily charging purposes, and they are usually installed at workplaces, residential complexes, and other establishments. The increased adoption of EVs and the lack of commercial stations are anticipated to drive the requirement for level 1 and 2 chargers over the forecast period.

Regional Insights

The Asia Pacific dominated the market for metals in electric vehicle charging infrastructure and held the largest revenue share of over 55.0% in 2021. Growing demand for EVs in this region is anticipated to benefit market growth. Moreover, countries like India are ramping up their facilities to facilitate the adoption of EVs in the country through schemes like the Faster Adoption and Manufacturing of Electric Vehicles, thereby enhancing the growth of the market over the forecast period. In North America, the market for metals in electric vehicle charging infrastructure is anticipated to register a CAGR of 22.1%, in terms of revenue, over the forecast period.

With the presence of well-established automobile manufacturers such as Tesla, Nissan, and Ford and suitable infrastructure for producing EVs, market growth is expected from this region. Furthermore, efforts towards gaining control over the supply chain of the EV industry are likely to benefit metals demand over the forecast period. In Europe, the market accounted for the second-largest revenue share in 2021, which is attributable to the widespread adoption of EVs in the region. Moreover, leading automakers across Europe, including Bayerische Motoren Werke AG (BMW), Daimler AG, Groupe Renault, and Volkswagen have collaborated to set up a series of fast electric vehicle chargers in the region, which is further anticipated to augment metals demand over the coming years.

Key Companies & Market Share Insights

The market for metals in electric vehicle charging infrastructure is competitive in nature due to the presence of various established players with a global presence. Strategies adopted by companies usually include new product development, technological innovations, and distribution network expansion. Furthermore, manufacturers are engaged in acquisitions to expand their geographical presence, increase production capacity, and ink long-term metal supply deals. For instance, in November 2021, Modison Metals Limited announced expanding itself into EV charging infrastructure and BESS in India. The company will sign an MoU with RENERA and LDrive LLC (L-Charge), which are Russia-based battery storage firms and EV charger manufacturers, respectively. Some of the prominent players in the metals in electric vehicle charging infrastructure market include:

-

Alcoa Corporation

-

CODELCO

-

Emirates Global Aluminum (EGA)

-

First Quantum Minerals Ltd.

-

Glencore

-

JSW

-

KGHM

-

Norsk Hydro ASA

-

Rio Tinto

-

Rusal

Metals In Electric Vehicle Charging Infrastructure Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1.8 billion

Revenue forecast in 2030

USD 12.7 billion

Growth Rate

CAGR of 28.2% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Metals, charging ports, end use, region

Regional Scope

North America; Europe; Asia Pacific; Latin America, Middle East & Africa

Country scope

U.S., Canada, U.K., Germany, France, Russia, China, India, Japan, South Korea, Brazil, Mexico, GCC

Key companies profiled

Alcoa Corporation; CODELCO; Emirates Global Aluminum (EGA); First Quantum Minerals Ltd.; Glencore; JSW; KGHM; Norsk Hydro ASA; Rio Tinto; Rusal

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global metals in electric vehicle charging infrastructure market report on the basis of metals, charging port, end use, and region:

-

Metals Outlook (Revenue, USD Million, 2017 - 2030)

-

Copper

-

Steel

-

Aluminum

-

Others

-

-

Charging Port Outlook (Revenue, USD Million, 2017 - 2030)

-

Level 1

-

Level 2

-

DC Fast Charger (Level 3)

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Commercial

-

Private

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

GCC

-

-

Frequently Asked Questions About This Report

b. The metals in electric vehicle charging infrastructure market size was estimated at USD 1.4 billion in 2021 and is expected to reach USD 1.8 billion in 2022.

b. The metals in electric vehicle charging infrastructure market is expected to grow at a compound annual growth rate of 28.2% from 2022 to 2030 to reach USD 12.7 billion by 2030.

b. Based on the metals segment, other metals held the largest revenue share of more than 30.0% in 2021 as precious metals such as silver is used in the production of EV chargers owing to their high conductivity and corrosion resistance properties.

b. The key players operating in the metals in the electric vehicle charging infrastructure market include Rio Tinto, Alcoa Corporation, Glencore, KGHM, and JSW.

b. An increase in the global demand for electric vehicles and favorable government policies for developing electric vehicle charging infrastructure are key driving factors for market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.