- Home

- »

- Biotechnology

- »

-

Microbial Fermentation Technology Market Size Report, 2030GVR Report cover

![Microbial Fermentation Technology Market Size, Share & Trends Report]()

Microbial Fermentation Technology Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Antibiotics, Vaccines), By End-user (Biopharmaceutical Companies), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-983-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Microbial Fermentation Technology Market Summary

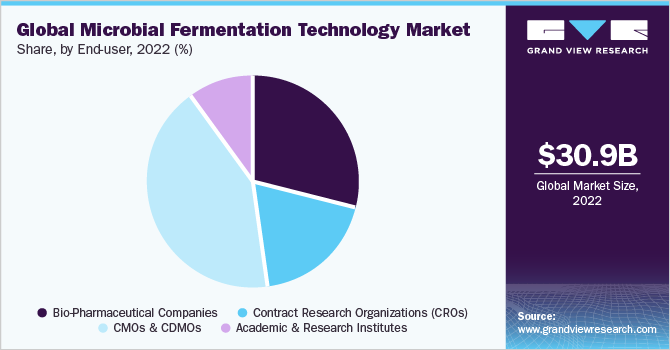

The global microbial fermentation technology market size was estimated at USD 30,964.1 million in 2022 and is projected to reach USD 49.39 billion by 2030, growing at a CAGR of 5.8% from 2023 to 2030. The factors such as increasing demand for biologics, development of innovative therapies based on smaller biologic drug substances, and advancements in microbial fermentation platforms/ technologies have driven the growth of the industry in recent years.

Key Market Trends & Insights

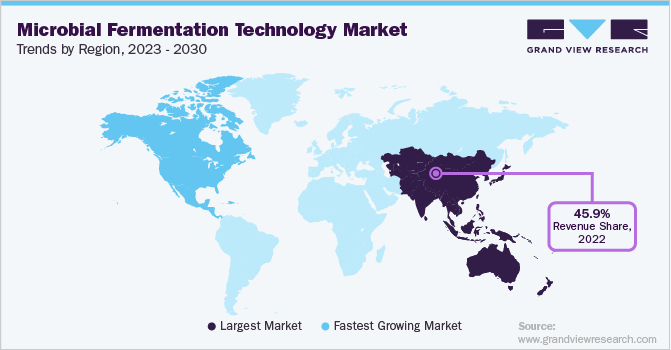

- Asia Pacific dominated the market and accounted for the highest revenue share of 45.9% in 2022.

- The U.S. is the key revenue contributor in the North America region.

- Based on application, the antibiotics segment captured the largest market share of 32.2% in 2022 and is expected to witness the fastest growth throughout the forecast period.

- Based on end-user, the CMOs and CDMOs segment dominated the market and accounted for the highest share of 42.2% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 30,964.1 Million

- 2030 Projected Market Size: USD 49.39 Billion

- CAGR (2023-2030): 5.8%

- Asia Pacific: Largest Market in 2022

- North America: Fastest growing market

In the past few years, the microbial fermentation space is witnessing an upsurge in demand owing to the exponential growth in the microbial biopharmaceutical industry. The advantages offered by microbial expression systems such as short-development timelines, higher expression levels, and less media cost as compared to mammalian cell culture have majorly contributed to the resurgence in interest in using microbial organisms in manufacturing processes. Overall, microbial fermentation technology offers higher yields, faster development, better scalability, reduced variation between batches along with lower production costs.

Amidst the COVID-19 pandemic, the microbial fermentation technology market was relatively less impacted. The surge in demand for various biologics resulted in growing attention toward microbial biotechnology. Market players involved in COVID-19 vaccine development and manufacturing have also relied on microbial expression systems for vaccine development. For instance, the Pfizer-BioNTech vaccine is based on bacterial fermentation for the production of DNA plasmids required for vaccine manufacturing.

Furthermore, increasing demand for microbial contract manufacturing services is anticipated to supplement the market growth. Currently, more than 115 industry participants are actively engaged in offering microbial fermentation services. Thus, the market is highly fragmented with the presence of well-established players such as AbbVie Contract Manufacturing, Lonza, and others. Such a high number of service providers in this market space are likely to spur market growth in the coming years.

Furthermore, yeasts are a commonly used eukaryotic host for the production of heterologous proteins and provide several advantages in the manufacturing of therapeutic recombinants. The use of yeast as a cell factory has various advantages, including simplicity of genetic manipulation, high cell density development, and post-translational modification possibilities. Thus, the rising focus of various research institutes and scientists on exploring the potential of yeast cells in therapeutic or clinical applications will expedite market growth in the near future.

Application Insights

The antibiotics segment captured the largest market share of 32.2% in 2022 and is expected to witness the fastest growth throughout the forecast period. The dominance of the segment can be attributed to the high demand for antibiotics across the globe, the increasing focus on microbial metabolite research, and the introduction of new antibiotics in the market. Microbial fermentation plays a crucial role in the development of antibiotics. For instance, several studies have stated that out of all discovered antibiotics 70-80% are produced from a single genus of bacteria.

At the same time, owing to the COVID-19 pandemic, the urgent need for the development of a vaccine against the SARS-CoV-2 virus resulted in the high usage of fermentation technology in research and development. For instance, in a study published in March 2021, a team of researchers used bacterial fermentation technology for the large-scale and inexpensive production of the COVID-19 vaccine. Such advancements are anticipated to increase the use of microbial fermentation in the coming years.

End-user Insights

The CMOs and CDMOs segment dominated the market and accounted for the highest share of 42.2% in 2022. CMOs and CDMOs are rapidly becoming the favorable option for biotherapeutics manufacturers because most of the innovation in the bioprocess space is achieved by smaller firms that have a capacity constraint, lack of trained professionals, and resources for the commercialization of these products. Also, the constantly growing clinical pipeline of biologics is another contributing factor expected to increase this segment’s growth.

Outsourcing to contract manufacturing/research service providers can provide a faster market product penetration due to the competitive expertise and experience. Thermo Fisher Scientific and Lonza are a few of the many companies that provide contract services due to their commercial-scale production capabilities and wide geographical presence. According to an article published in March 2020, approximately 35% of the process is outsourced with traditional biologics and more than 65% of the manufacturing process for advanced therapies is outsourced.

Regional Insights

Asia Pacific dominated the market and accounted for the highest revenue share of 45.9% in 2022. This is due to the recognition of Asian countries as a hub for biopharmaceutical outsourcing. Asian companies, including domestic players and international giants, are estimated to build about 50% of the new bioprocessing facilities across the globe. For instance, several bioprocessing facilities are expected to be constructed in China to meet domestic demand. The confluence of the above-mentioned factors would increase the demand for microbial fermentation technology in the region.

On the other hand, North America is expected to witness significant growth in the coming years. This can be attributed to the growing engagement of companies in research and product development in biologics coupled with the presence of a substantial number of contract development organizations in the region. The strong regulatory framework is another key factor in shaping the North America market. The U.S. FDA continues to make attempts to improve guidelines regarding the promotion, development, approval, and legal practice surrounding biopharmaceutical products.

The U.S. is the key revenue contributor in the North America region. The evolving landscape of the manufacturing of biologics is a major driving factor for the U.S. market. In addition, increasing funding for biopharmaceutical research and development as well as the adoption of highly innovative manufacturing technologies for GMP manufacturing have contributed to market growth.

Key Companies & Market Share Insights

As the demand for biopharmaceutical products is rapidly growing, the market for microbial fermentation is also expected to witness substantial growth. To leverage this opportunity, the operating players are undertaking various strategic initiatives to strengthen their market presence. New product launches, mergers and acquisitions, and capacity expansion are some of the key strategies implemented by the key market participants.

For instance, in November 2021, Lonza invested around USD 1 billion to expand its microbial production capacity in Visp, Switzerland. With this investment, a 50-liter fermenter along with other equipment was installed at the site to boost the development services for Lonza’s microbial-derived proteins. Such initiatives are expected to supplement the market growth. Some of the prominent players in the global microbial fermentation technology market are:

-

Biocon Ltd.

-

BioVectra Inc.

-

Danone UK

-

F. Hoffmann-La Roche AG

-

Koninklijke DSM NV

-

Lonza

-

Novozymes A/S

-

TerraVia Holdings, Inc.

-

BIOZEEN

Microbial Fermentation Technology Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 33,363.3 million

Revenue forecast in 2030

USD 49.39 billion

Growth rate

CAGR of 5.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Biocon Ltd.; BioVectra Inc.; Danone UK; F. Hoffmann-La Roche Ltd.; Koninklijke DSM NV; Lonza; Novozymes A/S; TerraVia Holdings, Inc.;BIOZEEN

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Microbial Fermentation Technology Market Report Segmentation

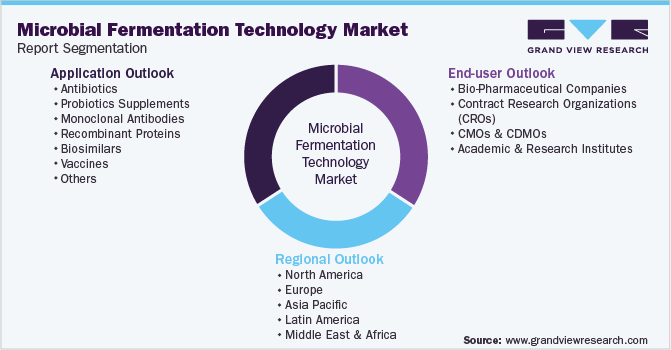

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the microbial fermentation technology market report based on application, end-user, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Antibiotics

-

Probiotics Supplements

-

Monoclonal Antibodies

-

Recombinant Proteins

-

Biosimilars

-

Vaccines

-

Enzymes

-

Small Molecules

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Bio-Pharmaceutical Companies

-

Contract Research Organizations (CROs)

-

CMOs & CDMOs

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global microbial fermentation technology market size was estimated at USD 30,964.1 million in 2022 and is expected to reach USD 33,363.3 million in 2023.

b. The global microbial fermentation technology market is expected to grow at a compound annual growth rate of 5.8% from 2023 to 2030 to reach USD 49.39 billion by 2030.

b. North America dominated the microbial fermentation technology market with a share of 24.90% in 2022. This is attributable to the growing engagement of companies in research and product development in biologics coupled with the presence of a substantial number of contract development organizations in the region.

b. Some key players operating in the microbial fermentation technology market include Biocon Ltd., BioVectra Inc., Danone UK, F. Hoffmann-La Roche Ltd, Lonza, Novozymes A/S, BIOZEEN, and TerraVia Holdings, Inc.

b. Key factors that are driving the market growth include growing demand for microbial contract manufacturing services, short-development time, higher expression levels, and high demand for antibiotics across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.