- Home

- »

- Renewable Chemicals

- »

-

Microcrystalline Cellulose Market Size, Industry Report, 2033GVR Report cover

![Microcrystalline Cellulose Market Size, Share & Trends Report]()

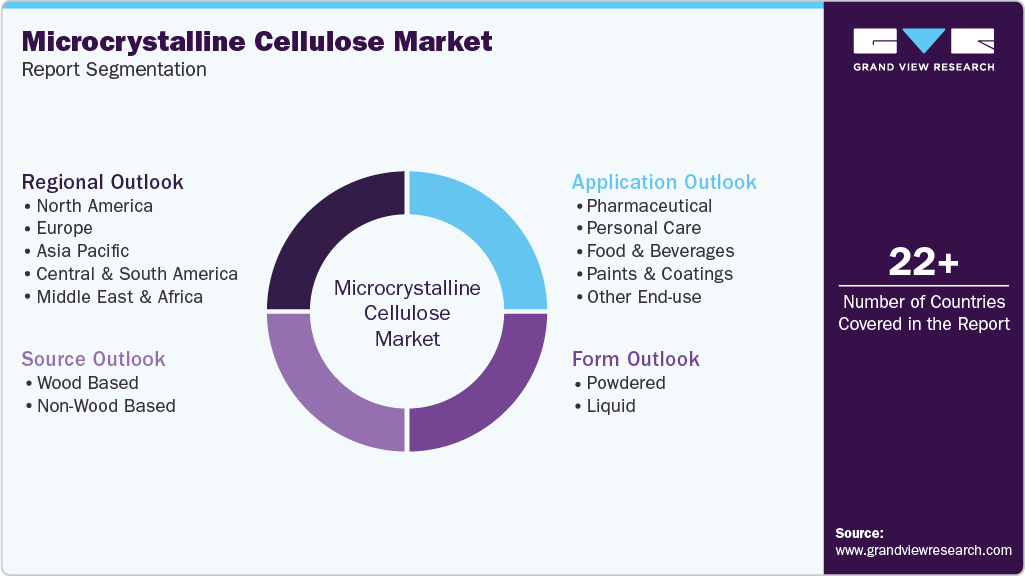

Microcrystalline Cellulose Market (2026 - 2033) Size, Share & Trends Analysis Report By Source (Wood Based, Non-Wood Based), By Form (Powdered, Liquid), By End-use (Pharmaceutical, Personal Care, Food & Beverages, Paints & Coatings), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-342-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Microcrystalline Cellulose Market Summary

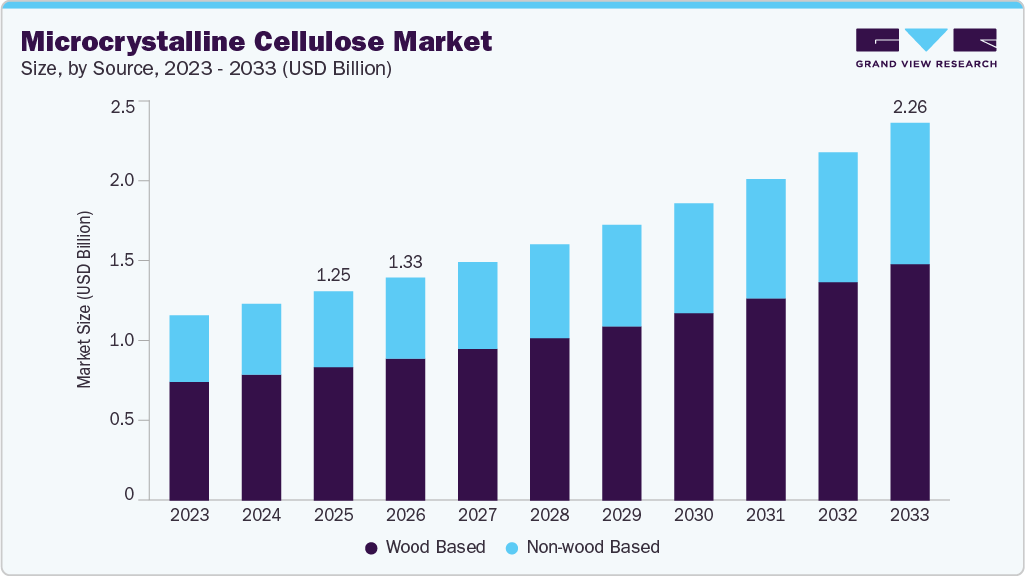

The global microcrystalline cellulose market size was estimated at USD 1,255.1 million in 2025 and is projected to reach USD 2,267.5 million by 2033, growing at a CAGR of 7.8% from 2026 to 2033. The microcrystalline cellulose (MCC) market represents a vital segment of the global excipient and specialty ingredient landscape, shaped by consistent demand from pharmaceuticals, food, and personal care industries.

Key Market Trends & Insights

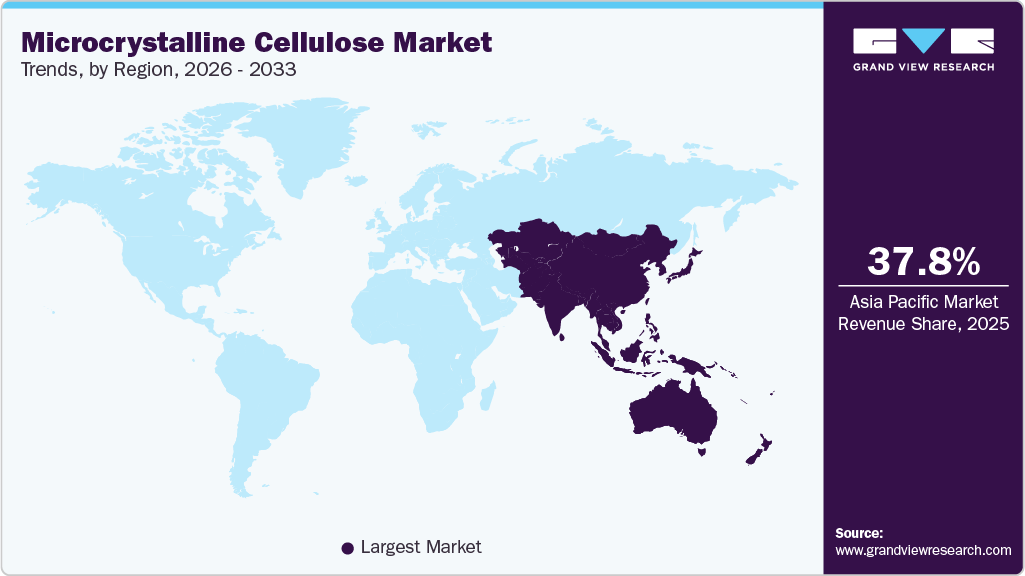

- The Asia Pacific microcrystalline cellulose industry led the global market in 2025, accounting for 37.8% of total revenue.

- China held over 43.9% revenue share of the Asia Pacific microcrystalline cellulose market.

- By source, the wood based source segment dominated the market in 2025, accounting for 63.9% of total revenue, due to its established reliability and broad industrial acceptance.

- By form, the powdered form segment held the leading position in the market in 2025, capturing 60.3% of total revenue, due to its wide applicability and ease of handling.

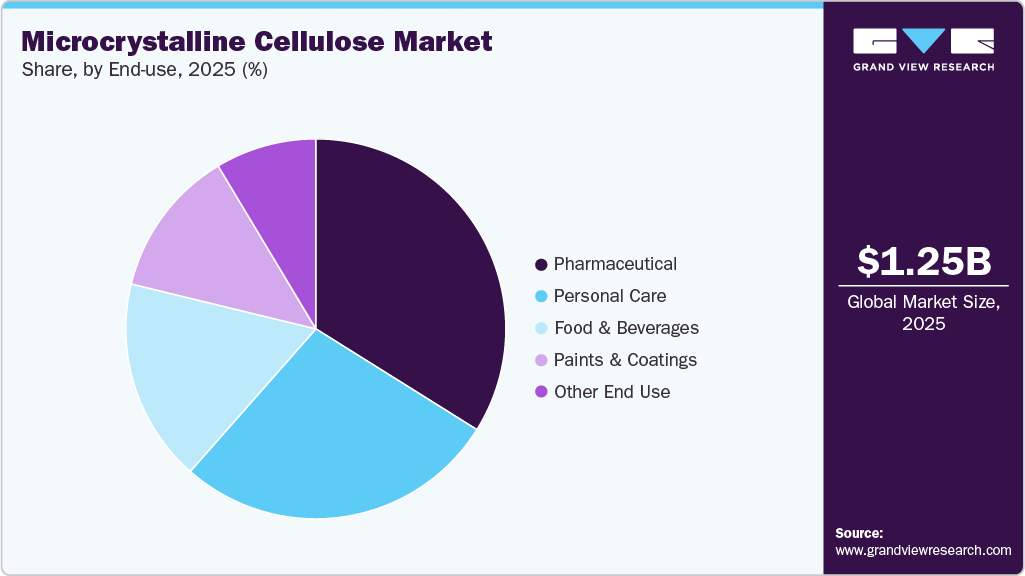

- By end-use, the pharmaceutical segment dominated the market with the largest revenue share of 33.9% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 1,255.1 Million

- 2033 Projected Market Size: USD 2,267.5 Million

- CAGR (2026-2033): 7.8%

- Asia Pacific: Largest market in 2025

Its importance lies in functional versatility, regulatory acceptance, and reliability, making it a foundational material across diverse formulations worldwide today and long term. The market continues to expand as industries increasingly prioritize performance consistency, safety, and formulation efficiency. In pharmaceutical manufacturing, microcrystalline cellulose excipient market is widely used for its binding, disintegration, and compressibility properties, which support high volume solid dosage production. Growth in generic drug manufacturing, rising healthcare access, and increasing regulatory emphasis on quality excipients reinforce demand. In food and beverage applications, the food additives microcrystalline cellulose market benefits from its role in texture control, calorie reduction, and stability, aligning well with clean label preferences and plant based ingredient adoption. Personal care and cosmetics also contribute through its role as a stabilizer and sensory modifier, further strengthening overall consumption patterns. Additionally, emerging industrial uses, including niche applications associated with the microcrystalline cellulose motors market, contribute incremental volumes and broaden the material’s application base.

Supply stability depends on pulp quality and sustainable sourcing practices since microcrystalline cellulose is derived from natural cellulose sources. Regulatory approvals from authorities such as pharmacopeias and food safety agencies strongly shape supplier credibility and market entry. Pricing sensitivity is moderated by the critical functional role the product plays in formulations, which limits substitution risks. Regional production expansion in Asia, combined with established manufacturing bases in Europe and North America, has also improved supply chain resilience and competitive balance.

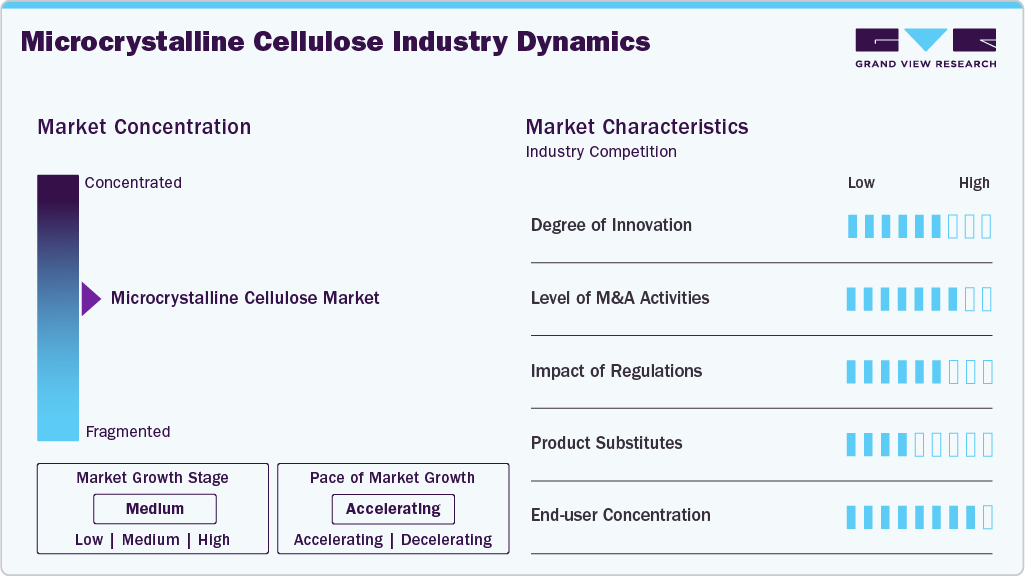

Market Concentration & Characteristics

The microcrystalline cellulose industry shows a moderately concentrated structure, shaped by the presence of established global manufacturers alongside a growing number of regional producers. Leading companies benefit from long standing customer relationships, regulatory approvals, and broad product portfolios that support multiple end use industries. At the same time, smaller manufacturers remain active by focusing on cost efficiency, regional supply, or specific application requirements, which sustains competitive pressure across the market.

Market characteristics are defined by high quality expectations, process consistency, and strong emphasis on compliance. Buyers prioritize reliability, traceability, and performance stability over frequent supplier switching, resulting in long term supply agreements. Product differentiation is based more on functionality and application fit than on branding alone. The market favors manufacturers with technical expertise, robust quality systems, and the ability to support customers through formulation guidance and dependable supply continuity.

Source Insights

The wood based source segment dominated the market in 2025, accounting for 63.9% of total revenue, due to its established reliability and broad industrial acceptance. Wood pulp provides consistent cellulose quality, predictable processing behavior, and strong compatibility with pharmaceutical and food formulations. Mature production infrastructure and long term regulatory recognition continue to reinforce its leading position across high volume and quality sensitive applications.

The non-wood based source segment is expected to expand at the fastest pace, registering a CAGR of 8.4% from 2026 to 2033, supported by growing demand for alternative cellulose sources. Agricultural residues and plant based fibers offer diversification advantages and improved sustainability perception. Advancements in purification methods are improving functional performance, enabling wider adoption across nutraceutical, food, and specialty formulation uses.

Form Insights

The powdered form segment held the leading position in the market in 2025, capturing 60.3% of total revenue, due to its wide applicability and ease of handling. Powdered microcrystalline cellulose is favored for its excellent compressibility, uniform particle distribution, and compatibility with dry blending processes. Its long shelf life and cost efficiency further support strong adoption across pharmaceutical, food, and nutraceutical manufacturing.

The liquid form segment is projected to grow at the fastest CAGR of 8.3% from 2026 to 2033, as demand rises for ready to use and dispersion friendly formulations. Liquid microcrystalline cellulose supports improved processing efficiency, especially in beverages, coatings, and personal care products. Its ability to enhance stability and texture is encouraging broader uptake across formulation driven industries.

End-use Insights

The pharmaceutical segment led the microcrystalline cellulose industry in 2025, accounting for 33.9% of total revenue, reflecting its essential role in solid dosage manufacturing. Microcrystalline cellulose is widely relied upon for its binding, disintegration, and flow properties, which support consistent tablet quality and large scale production. Growing demand for generic medicines and expanding pharmaceutical manufacturing capacity continue to reinforce its dominant position.

The personal care segment is expected to experience the fastest expansion, registering a CAGR of 8.2% from 2026 to 2033, driven by increasing use in cosmetics and hygiene products. Microcrystalline cellulose enhances texture, stability, and sensory performance in formulations such as creams, lotions, and powders. Rising preference for plant derived and functional ingredients is accelerating adoption across premium and mass market personal care products.

Regional Insights

The Asia Pacific microcrystalline cellulose industry led the global market in 2025, accounting for 37.8% of total revenue, supported by strong pharmaceutical manufacturing activity and expanding food processing industries. The region benefits from cost effective production, increasing healthcare demand, and a large consumer base. Growing investments in excipient manufacturing and rising adoption of processed and packaged foods continue to strengthen its dominant market position.

China Microcrystalline Cellulose Market Trends

China held over 43.9% revenue share of the Asia Pacific microcrystalline cellulose market. China microcrystalline cellulose industry is supported by rapid expansion of pharmaceutical production and increasing domestic consumption of processed foods and healthcare products. The country’s strong manufacturing base and growing focus on self-sufficiency in excipients enhance local demand. Rising quality standards and export oriented pharmaceutical production are encouraging wider adoption of compliant cellulose based excipients across industrial applications.

North America Microcrystalline Cellulose Market Trends

The North America microcrystalline cellulose market is driven by a well-established pharmaceutical industry and strong demand for high quality excipients. Advanced drug development activities, widespread use of solid dosage forms, and strict regulatory oversight support consistent consumption. The region also shows steady demand from food and nutraceutical sectors, where formulation stability and clean label compatibility are highly valued, reinforcing sustained market presence.

The U.S. microcrystalline cellulose market benefits from large scale pharmaceutical manufacturing, extensive generic drug production, and continuous formulation innovation. Microcrystalline cellulose remains essential due to its proven performance and regulatory acceptance across dosage forms. Strong investment in dietary supplements and functional foods further supports demand. Domestic emphasis on quality compliance and supply reliability continues to shape stable consumption patterns within the country.

Europe Microcrystalline Cellulose Market Trends

Europe microcrystalline cellulosemarketis projected to record the fastest growth in the market, registering a CAGR of 7.8% from 2026 to 2033, driven by strict quality standards and innovation focused industries. Pharmaceutical, nutraceutical, and personal care manufacturers in the region emphasize high performance and compliant excipients. Increasing focus on sustainable sourcing and advanced formulation development is supporting accelerated regional market expansion.

Latin America Microcrystalline Cellulose Market Trends

The Latin America microcrystalline cellulose industry is influenced by expanding pharmaceutical manufacturing capacity and improving access to healthcare across emerging economies. Growth in generic drug production and increasing use of packaged foods are strengthening demand for functional excipients. Regional manufacturers and importers benefit from rising formulation standardization, while cost sensitivity continues to shape sourcing decisions and application focus.

Middle East & Africa Microcrystalline Cellulose Market Trends

The Middle East and Africa microcrystalline cellulose industry is gradually expanding due to increasing pharmaceutical imports, local drug manufacturing initiatives, and growing food processing activity. Demand is supported by healthcare infrastructure development and rising consumption of personal care products. While reliance on imports remains high, investments in local formulation capabilities and regulatory alignment are improving long term market prospects.

Key Microcrystalline Cellulose Company Insights

The two key dominant manufacturers in the market are JRS Pharma and Asahi Kasei Corporation.

-

JRS Pharma is widely recognized for its strong focus on cellulose based excipients and its deep technical expertise in formulation performance. The company has built a reputation for consistent quality, application driven innovation, and close alignment with pharmaceutical and food formulation needs. Its manufacturing approach emphasizes controlled particle characteristics, functional reliability, and compliance with global quality expectations. Continuous development of specialized grades supports diverse dosage forms and processing requirements. JRS Pharma’s long standing industry presence and emphasis on scientific collaboration reinforce its position as a benchmark manufacturer in the microcrystalline cellulose industry.

-

Asahi Kasei Corporation holds a prominent position in the microcrystalline cellulose industry through its advanced materials science capabilities and precision manufacturing. The company integrates chemical engineering expertise with strict quality control to deliver products that meet demanding formulation standards. Its microcrystalline cellulose portfolio is designed to support high performance tablet production and processing efficiency. Strong research orientation and commitment to innovation allow Asahi Kasei to respond effectively to evolving pharmaceutical and food industry requirements, sustaining its leadership and long term relevance in the market.

Key Microcrystalline Cellulose Companies:

The following key companies have been profiled for this study on the pen and microcrystalline cellulose market.

- JRS Pharma

- FMC BioPolymer

- DFE Pharma GmbH & Co. KG

- Asahi Kasei Corporation

- Roquette Frères

- International Flavors & Fragrances Inc. (IFF)

- Mingtai Chemical Co., Ltd.

- Sigachi Industries Pvt. Ltd.

- Anhui Sunhere Pharmaceutical Excipients Co., Ltd.

- Accent Microcell Pvt. Ltd.

Recent Developments

-

In January 2024, Sigachi Industries strengthened its position in the microcrystalline cellulose industry by advancing quality benchmarks and commissioning a new active pharmaceutical ingredient facility. This development reflects capacity expansion and integration progress, supporting growth and innovation within the MCC market.

-

March 2025: Oji Holdings Corporation acquired a stake in India based Chemfield Cellulose, strengthening integration across the microcrystalline cellulose value chain. The move enhances pharmaceutical excipient capabilities and represents a strategic development supporting quality, traceability, and long term growth in the MCC market.

Microcrystalline Cellulose Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1,338.1 million

Revenue forecast in 2033

USD 2,267.5 million

Growth rate

CAGR of 7.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, form, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Brazil; Argentina; Germany; UK; Italy; Spain; France; China; Japan; South Korea; Saudi Arabia; South Africa

Key companies profiled

JRS Pharma; FMC BioPolymer; DFE Pharma GmbH & Co. KG; Asahi Kasei Corporation; Roquette Frères; International Flavors & Fragrances Inc. (IFF); Mingtai Chemical Co., Ltd.; Sigachi Industries Pvt. Ltd.; Anhui Sunhere Pharmaceutical Excipients Co., Ltd.; Accent Microcell Pvt. Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Microcrystalline Cellulose Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global microcrystalline cellulose market report based on source, form, end-use, and region:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Wood Based

-

Non-Wood Based

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Powdered

-

Liquid

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Pharmaceutical

-

Personal Care

-

Food & Beverages

-

Paints & Coatings

-

Other End-use

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global microcrystalline cellulose market size was estimated at USD 1,255.1 million in 2025 and is expected to reach USD 1,338.1 million in 2026.

b. The global microcrystalline cellulose market is expected to grow at a compound annual growth rate of 7.8% from 2026 to 2033, reaching USD 2,267.5 million by 2033.

b. The wood based source segment dominated the microcrystalline cellulose market in 2025, accounting for 63.9% of total revenue, due to its established reliability and broad industrial acceptance. Wood pulp provides consistent cellulose quality, predictable processing behavior, and strong compatibility with pharmaceutical and food formulations. Mature production infrastructure and long term regulatory recognition continue to reinforce its leading position across high volume and quality sensitive applications.

b. Some of the key players operating in the microcrystalline cellulose market include JRS Pharma, FMC BioPolymer, DFE Pharma GmbH & Co. KG, Asahi Kasei Corporation, Roquette Frères, International Flavors & Fragrances Inc. (IFF), Mingtai Chemical Co., Ltd., Sigachi Industries Pvt. Ltd., Anhui Sunhere Pharmaceutical Excipients Co., Ltd., Accent Microcell Pvt. Ltd.

b. The microcrystalline cellulose market represents a vital segment of the global excipient and specialty ingredient landscape, shaped by consistent demand from pharmaceuticals, food, and personal care industries. Its importance lies in functional versatility, regulatory acceptance, and reliability, making it a foundational material across diverse formulations worldwide today and long term.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.