- Home

- »

- Next Generation Technologies

- »

-

Microgreens Market Size, Share And Analysis Report, 2030GVR Report cover

![Microgreens Market Size, Share & Trends Report]()

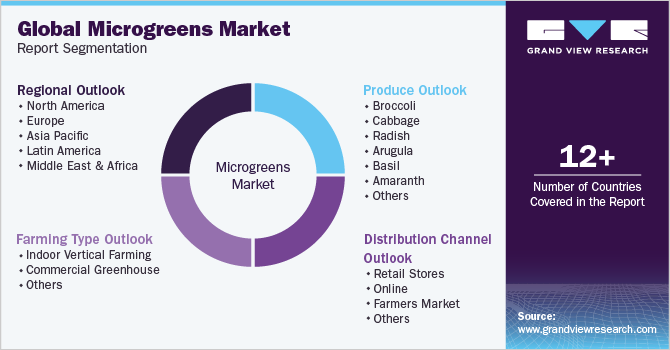

Microgreens Market (2023 - 2030) Size, Share & Trends Analysis Report By Produce (Basil, Broccoli, Radish), By Farming Type (Commercial Greenhouse, Indoor Vertical Farming), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-106-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Microgreens Market Summary

The global microgreens market size was estimated at USD 2.59 billion in 2022 and is projected to reach USD 6.12 billion by 2030, growing at a CAGR of 11.9% from 2023 to 2030. The market is witnessing significant growth driven by several key factors, such as the rise in consumer spending on premium food products has become a significant driver for the market.

Key Market Trends & Insights

- Europe dominated the overall market in 2022 with a share of 36.5%.

- By farming, the commercial greenhouse segment dominated the industry with a revenue share of 44.1% in 2022.

- By distribution channel, the retail stores segment dominated the market and accounted for a revenue share of 40.3% in 2022.

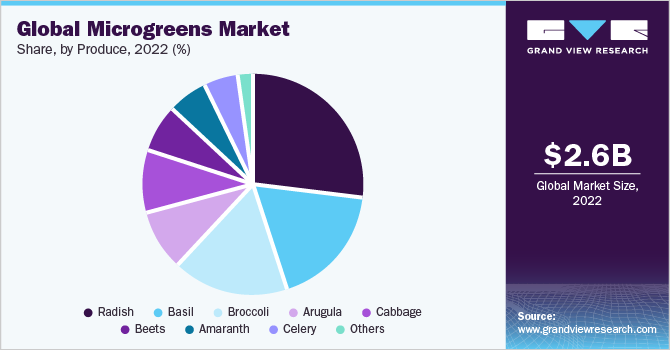

- By produce, the radish segment held the maximum market share of 26.8% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 2.59 Billion

- 2030 Projected Market Size: USD 6.12 Billion

- CAGR (2023-2030): 11.9%

- Europe: Largest market in 2022

- Asia Pacific: Fastest growing market

As more consumers prioritize healthier and nutrient-rich options in their diets, the demand for microgreens has increased. These delicate and flavorful greens are a popular choice for health-conscious individuals and have also found favor among culinary enthusiasts and chefs due to their vibrant colors and unique taste profiles. The increasing trend of seeking premium and high-quality ingredients has opened up new opportunities for microgreens growers and suppliers. As the focus on premium food products continues to grow, the market is poised for further expansion, catering to the evolving preferences of discerning consumers.

The market also benefits from the growing cosmetics and personal care industry. The demand for microgreens-based oils and ingredients is rising, particularly for producing consumer items, such as shampoos and skincare products. Microgreens' potent nutritional and antioxidant properties make them appealing additions to these products, aligning with the increasing consumer preference for natural and beneficial skincare solutions. An increase in consumer spending on premium food products, a rising demand for healthy functional & nutritional food options, and a growing adoption of indoor vertical & greenhouse farming techniques also support market growth. Their short growth cycle translates to lower water consumption compared to traditional crops. This sustainable feature resonates with eco-conscious consumers and aligns with corporate social responsibility initiatives.

Entrepreneurs who prioritize sustainability can leverage microgreens as a compelling selling point for their products, attracting environmentally conscious customers and potential business partners. Another factor driving the market growth is the resurging popularity of home gardening and do-it-yourself (DIY) food production. With microgreens' rapid growth, minimal space requirements, and easy cultivation process, they have emerged as an ideal choice for home gardeners. By cultivating microgreens at home, individuals can enjoy a constant supply of fresh and nutrient-rich greens, aligning with the rising trend of health-conscious consumers seeking sustainable and locally sourced food options. This increasing interest in home-grown microgreens contributes significantly to the overall growth and expansion of the market.

COVID-19 Impact on the Microgreens Market

The COVID-19 pandemic had a mixed impact on the market. On one hand, the closure of restaurants, hotels, and other food service establishments led to a significant decrease in demand during the initial phases of the outbreak. This disruption in the food service sector resulted in excess inventory and financial challenges for microgreens growers and suppliers. However, as the pandemic progressed, consumer behavior shifted toward health-focused choices, driving an increase in the demand for nutrient-dense foods like microgreens. This growing health consciousness, coupled with an emphasis on immunity-boosting foods, bolstered the market growth. Moreover, the lockdown and restriction on movement led to a surge in home gardening and indoor farming as people sought to grow their own fresh produce at home.

This trend provided an opportunity for individuals to cultivate microgreens, which are well-suited for small spaces and have a rapid growth cycle, ensuring a continuous supply of fresh greens. The e-commerce industry also played a pivotal role in sustaining the market during the pandemic. Many microgreens producers pivoted to online retail and doorstep delivery services, enabling them to reach consumers directly and maintain a steady market presence. As the world gradually recovered from the pandemic, the emphasis on health and wellness is likely to persist, further driving product demand. In addition, consumers' growing awareness of sustainable and locally sourced agriculture will support the growth. As a result, the market is poised for expansion, presenting promising opportunities for growers and businesses in this sector.

Farming Type Insights

The market is categorized into indoor vertical farms, commercial greenhouses, and others. The commercial greenhouse segment dominated the industry with a revenue share of 44.1% in 2022 and is expected to maintain its dominance. Commercial greenhouses are favored for growing microgreens due to their precise environmental control, providing optimal conditions for these delicate greens. They offer stability and protection from external factors, ensuring uninterrupted year-round production. This allows for a constant supply of fresh microgreens, meeting steady demand from restaurants, grocery stores, and consumers. Greenhouse cultivation also grants growers greater flexibility in selecting diverse microgreens varieties, enhancing their market competitiveness.

The indoor vertical farms segment is anticipated to grow at a significant CAGR of 12.5% over the forecast period. It is credited to indoor farming's space-efficient nature, which makes it an ideal solution for cultivation due to its small footprints, enabling growers to use limited space effectively and scale operations vertically for enhanced productivity and resource optimization. Moreover, this method reduces reliance on conventional agricultural practices, such as vast arable land and extensive water consumption. Utilizing hydroponic or aeroponic systems common in indoor microgreens farming substantially reduces water usage, promoting sustainable and eco-friendly practices.

Distribution Channel Insights

In terms of distribution channels, the market is classified into retail stores, online, farmers' markets, and others. The retail stores segment dominated the market and accounted for a revenue share of 40.3% in 2022. Retail stores are the preferred destination for purchasing microgreens due to their convenience, accessibility, and diverse selection. With the perishable nature of microgreens and their short shelf life, retail outlets offer quick access to fresh produce without the need for pre-ordering or waiting for deliveries. Customers can find a wide range of microgreens varieties in retail stores, catering to different culinary preferences and nutritional needs, enhancing the overall shopping experience. Reputable retailers prioritize food safety and quality control measures, ensuring that the microgreens on their shelves meet the highest standards, and providing reassurance to health-conscious consumers.

In addition, retail environments empower consumers with essential product information through packaging and labeling, facilitating informed purchasing decisions. Moreover, retailers' economies of scale and efficient distribution networks result in competitive pricing, making it more affordable and accessible to a broader customer base. In conclusion, retail stores serve as a convenient and reliable source for microgreens, offering convenience, variety, quality assurance, transparency, and cost-effectiveness to meet the increasing demand for these nutritious greens. The online segment is expected to grow at the fastest CAGR of 12.3% during the forecast period. The online mode of shopping is witnessing a significant increase due to several compelling factors. First and foremost, the user-friendly nature and widespread availability of online platforms make it considerably more convenient for consumers to purchase microgreens from the comfort of their homes.

With just a few clicks, customers can easily explore a diverse selection of product varieties, catering to various culinary preferences and health needs. Online stores provide in-depth product information, empowering shoppers to make well-informed decisions about their purchases. In addition, the direct sourcing of microgreens from growers or specialized suppliers ensures optimal freshness and quality, appealing to health-conscious consumers in search of nutrient-rich produce. Competitive pricing, exclusive deals, and doorstep delivery options further enhance the appeal of online microgreen shopping, contributing to the growing trend of choosing the virtual marketplace for procuring these nutritious greens.

Produce Insights

In terms of produce, the market is classified into broccoli, cabbage, radish, arugula, basil, amaranth, celery, beets, and others. The radish segment held the maximum market share of 26.8% in 2022. The rising demand for radish microgreens can be attributed to several key factors. Firstly, their unique peppery flavor and vibrant appearance make them a preferred choice among chefs and culinary enthusiasts, elevating the taste and visual appeal of various dishes. This culinary versatility has increased adoption in the food service industry and at-home cooking. In addition, radish greens garner attention for their exceptional nutritional profile, which is rich in essential vitamins, minerals, and antioxidants.

These include vitamins A, B, C, E, and K and vital minerals like calcium, iron, magnesium, phosphorus, potassium, and zinc. Moreover, they contain amino acids, carotene, chlorophyll, and protein, making them a powerhouse of health benefits in a compact and flavorful form. The growing emphasis on health and wellness has driven consumers to seek nutrient-dense food options, and radishes fit the bill perfectly. Furthermore, the rising popularity of plant-based diets and the ongoing trend of sustainable, locally sourced produce have fueled the demand for radish microgreens, as they offer a fresh and eco-friendly option for health-conscious consumers. The broccoli segment is anticipated to grow at a CAGR of 13.5% over the forecast period.

Broccoli offers a concentrated source of essential nutrients, including vitamins, minerals, and antioxidants, appealing to health-conscious consumers seeking nutrient-dense food options. Broccoli is gaining popularity among chefs and home cooks alike for its versatility in adding a mild, nutty flavor and a delicate crunch to a wide range of dishes, from salads and wraps to smoothies and sandwiches. Moreover, the growing interest in plant-based diets and the desire for sustainable, locally sourced produce have further boosted the appeal of broccoli microgreens. With their quick growth cycle and ease of cultivation, suppliers and growers are experiencing a surge in demand for broccoli microgreens. This makes them a sought-after and profitable choice in the flourishing market.

Regional Insights

Europe dominated the overall market in 2022 with a share of 36.5%. Europe has established itself as a prominent leader in the market driven by a combination of factors that have shaped its dominant position in the industry. One key driver is the region's unwavering emphasis on health and wellness. European consumers are aware of the importance of nutrition in maintaining overall well-being, leading to rising demand for nutrient-dense foods like microgreens. The region's robust and thriving food service industry has also played a significant role in propelling the product's popularity.

Renowned for their diverse culinary offerings and innovations, European restaurants and chefs have embraced microgreens as a way to elevate the visual and gustatory appeal of their dishes. For instance, Nok’s Kitchen, one of the most famous restaurants in the UK uses microgreens in their various recipes as food dressing. As consumers increasingly prioritize high protein intake and seek low-carb food options, there is a growing demand for such products. In response, vegetable growers are focusing on cultivating microgreens alongside traditional vegetables and expanding their area under protected cultivation. Asia Pacific is expected to register the fastest CAGR of 12.4% during the forecast period.

This growth can be attributed to various factors, such as a health-conscious consumer base and urbanization trends. In addition, the integration of microgreens into traditional cuisine is boosting their popularity. Furthermore, there is a growing interest in sustainability and agricultural advancements, contributing to the market's expansion. Notably, China plays a crucial role in this growth as the largest product exporter. The country's competitive pricing strategies, ability to meet diverse customer demands, highly efficient & technologically advanced agricultural sector enabling large-scale production & streamlined export processes all contribute to its dominant position in the global market.

Key Companies & Market Share Insights

The market is fragmented and has the presence of several key players. Key players are adopting strategies, such as partnerships and collaborations, to gain a competitive edge. For instance, in May 2023, AeroFarms established a strategic partnership with Amazon Fresh, extending its reach to both the online platform and all physical Amazon retail stores. This collaboration is expected to significantly boost AeroFarms' product promotion and market presence, leveraging the extensive customer base and distribution network of Amazon Fresh. Some of the key players in the global microgreens market are:

-

AeroFarms

-

Fresh Origins

-

Gotham Greens

-

Good Leaf Farms

-

Living Earth Farms

-

Farmbox Greens

-

Chef’s Garden

-

Bowery Farming

-

Teshuva Agricultural Projects Ltd.

-

Madar Farms

-

Metro Microgreens

Microgreens Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.79 billion

Revenue Forecast in 2030

USD 6.12 billion

Growth rate

CAGR of 11.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Farming type, distribution channel, produce, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

AeroFarms; Fresh Origins; Gotham Greens; Good Leaf Farms; Living Earth Farms; Farmbox Greens; Chef’s Garden; Bowery Farming; Teshuva Agricultural Projects Ltd.; Madar Farms; Metro Microgreens

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Microgreens Market Report Segmentation

This report forecasts revenue growth at global, regional, and at country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the microgreens market report based on farming type, distribution channel, produce, and region:

-

Farming Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Indoor Vertical Farming

-

Commercial Greenhouse

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail Stores

-

Online

-

Farmers Market

-

Others

-

-

Produce Outlook (Revenue, USD Million, 2017 - 2030)

-

Broccoli

-

Cabbage

-

Radish

-

Arugula

-

Basil

-

Amaranth

-

Celery

-

Beets

-

Ohers

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global microgreens market size was estimated at USD 2.59 billion in 2022 and is expected to reach USD 2.79 billion in 2023.

b. The global microgreens market is expected to grow at a compound annual growth rate of 11.9% from 2023 to 2030 to reach USD 6.12 billion by 2030

b. The commercial greenhouse segment dominated with a market share of 44.1% in 2022 and is expected to maintain its dominance. Commercial greenhouses are favored for growing microgreens due to their precise environmental control, providing optimal conditions for these delicate greens.

b. Some prominent players in the global microgreens market include AeroFarms, Fresh Origins, Gotham Greens, Good Leaf Farms, Living Earth Farms, Farmbox Greens, Chef's Garden, among others.

b. The rise in consumer spending on premium food products to adopt nutrient-rich options in their diets, increasing demand for microgreens-based oils and ingredients in the cosmetics and personal care industry, and the sustainable features of microgreens such as compact size and short growth cycle leading to lower water consumption are the factors attributing to the growth of the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.