- Home

- »

- Advanced Interior Materials

- »

-

Micromachining Equipment Market, Industry Report, 2033GVR Report cover

![Micromachining Equipment Market Size, Share & Trends Report]()

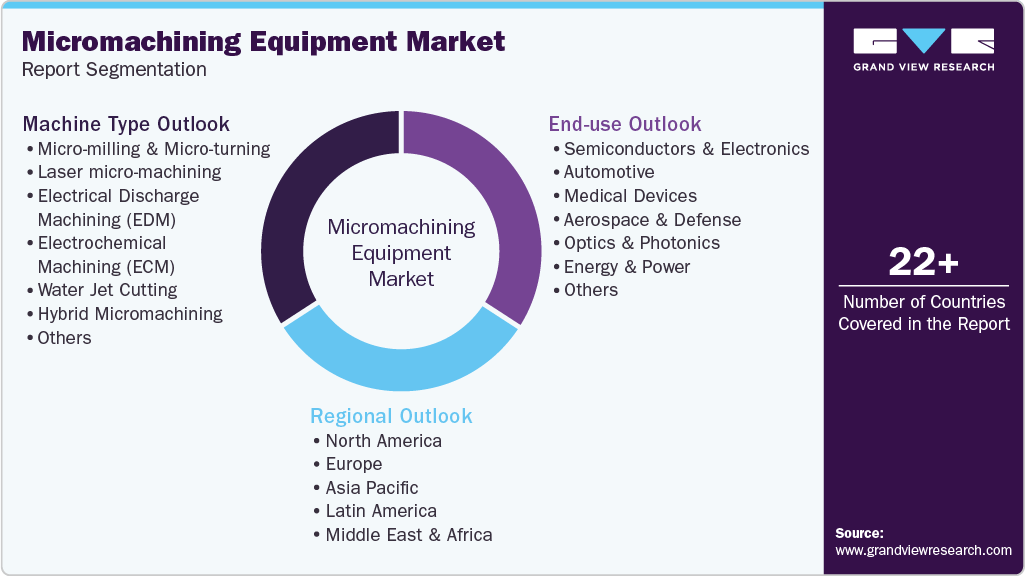

Micromachining Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Machine Type (Micro-milling & Micro-turning, Laser Micro-machining, Electrical Discharge Machining (EDM)), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-762-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Micromachining Equipment Market Summary

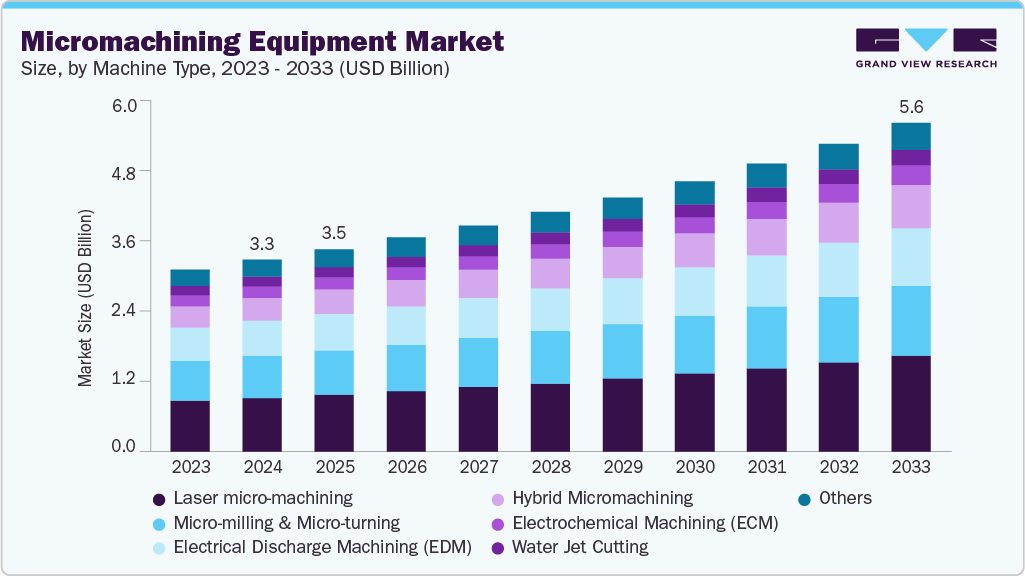

The global micromachining equipment market size was valued at USD 3,296.5 million in 2024 and is projected to reach USD 5,638.2 million by 2033, growing at a CAGR of 6.3% from 2025 to 2033. The growing need for smaller, high-performance electronic devices and medical implants is fueling demand for micromachining equipment.

Key Market Trends & Insights

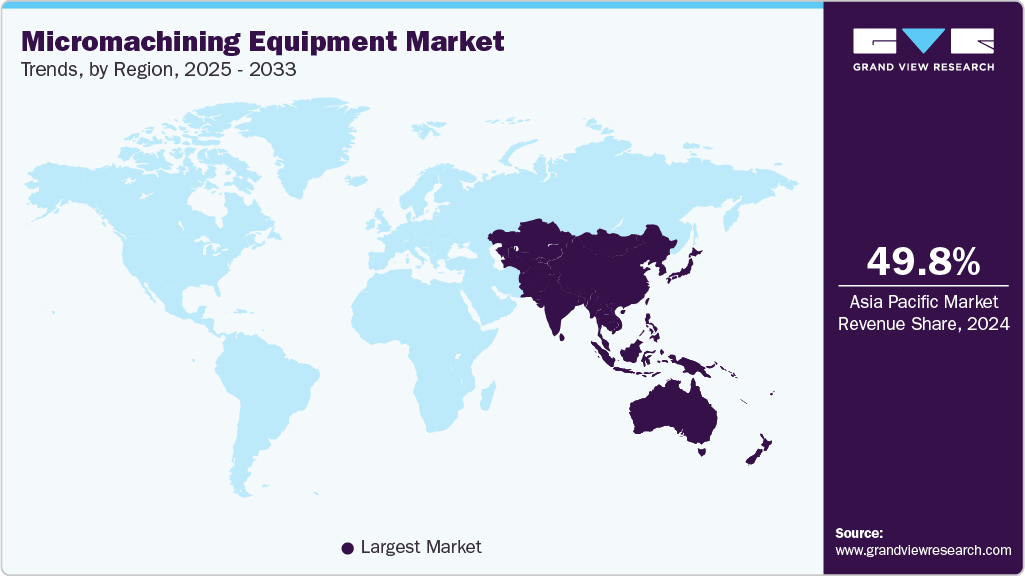

- Asia Pacific dominated the micromachining equipment market with the largest revenue share of 49.8% in 2024.

- The micromachining equipment market in the U.S. is expected to grow at a substantial CAGR of 6.7% from 2025 to 2033.

- By machine type, the hybrid micromachining segment is expected to grow at a considerable CAGR of 7.3% from 2025 to 2033 in terms of revenue.

- By end use, the semiconductors & electronics segment is expected to grow at a considerable CAGR of 6.9% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 3,296.5 Million

- 2033 Projected Market Size: USD 5,638.2 Million

- CAGR (2025-2033): 6.3%

- Asia Pacific: Largest market in 2024

Precision and accuracy at micro-scale levels are essential to meet these requirements. Industries such as semiconductors, aerospace, and automotive increasingly rely on micromachining to produce complex parts. Innovations in laser, ultrasonic, and micro-EDM machining are enhancing production efficiency and quality. Integration of automation and AI allows for faster, more precise manufacturing with minimal errors. These advancements reduce costs and improve scalability for mass production of micro components. As a result, companies are adopting modern micromachining equipment at a rapid pace.

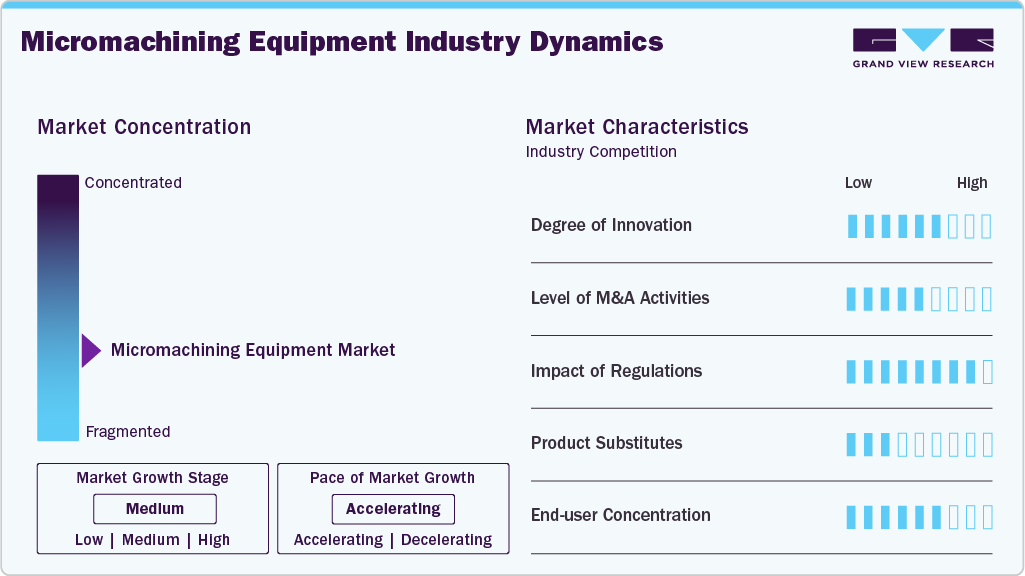

Market Concentration & Characteristics

The micro-machining equipment market is highly fragmented, with numerous players operating across different regions and technologies. While a few global companies hold significant technological expertise, many small and medium-sized manufacturers cater to niche applications. The market’s diversity in end use industries, from medical devices to aerospace, contributes to this fragmentation. This structure fosters competition and continuous innovation among market participants.

The micromachining equipment industry is highly innovation-driven, with companies constantly developing new technologies to improve precision and efficiency. Advancements in laser, ultrasonic, and micro-EDM processes enable the production of increasingly complex micro components. Continuous R&D is essential to meet the growing demands of electronics, medical, and aerospace sectors. This focus on innovation gives manufacturers a competitive edge in the global market.

M&A activity in the micromachining market is moderate, as companies aim to expand technological capabilities and enter new regional markets. Acquisitions often focus on niche technology providers or startups with specialized expertise. Such consolidation helps firms strengthen their product portfolio and enhance market reach. Strategic partnerships also play a key role in driving growth and competitiveness.

Regulatory standards influence product quality, safety, and environmental compliance in micromachining operations. Strict guidelines in medical, aerospace, and electronics industries require precision and certification adherence. Companies must invest in compliance to avoid legal penalties and maintain customer trust. Overall, regulations shape manufacturing practices and encourage adoption of advanced, safe technologies.

Drivers, Opportunities & Restraints

The increasing demand for miniaturized and high-precision components in electronics, medical devices, and aerospace is driving market growth. Advanced micromachining technologies such as laser and micro-EDM enhance accuracy and production efficiency. Rising adoption of automation and AI in manufacturing further supports expansion. Growing industrial applications across multiple sectors continue to fuel equipment demand.

Emerging applications in wearable electronics, MEMS, and microfluidics offer significant growth potential. Integration of smart manufacturing and Industry 4.0 solutions can improve productivity and reduce costs. Expansion into developing regions with growing industrial bases presents new market avenues. Technological advancements in multi-material micromachining open up innovative product possibilities.

High initial investment and maintenance costs of micromachining equipment can limit adoption, especially among smaller manufacturers. Technical complexity and requirement for skilled operators pose operational challenges. Regulatory compliance in sensitive industries increases production constraints. Market growth may also be affected by competition from alternative manufacturing technologies.

Machine Type Insights

Laser micromachining leads the market and accounted for a 27.9% share in 2024, due to its high precision, versatility, and ability to work with a wide range of materials. It enables the production of intricate microstructures with minimal material waste. Industries such as electronics, medical devices, and aerospace rely heavily on this technology. Its efficiency and reliability make it the preferred choice for large-scale and specialized applications.

Hybrid Micromachining segment is expected to grow at a considerable CAGR of 7.3% from 2025 to 2033 in terms of revenue. Hybrid micromachining is witnessing rapid growth as it combines multiple techniques, offering enhanced flexibility and performance. It allows manufacturers to achieve superior accuracy and process complex geometries efficiently. Rising demand in advanced electronics, MEMS, and automotive components fuels its adoption. The ability to handle diverse materials and reduce processing time drives its expanding market share.

End-use Insights

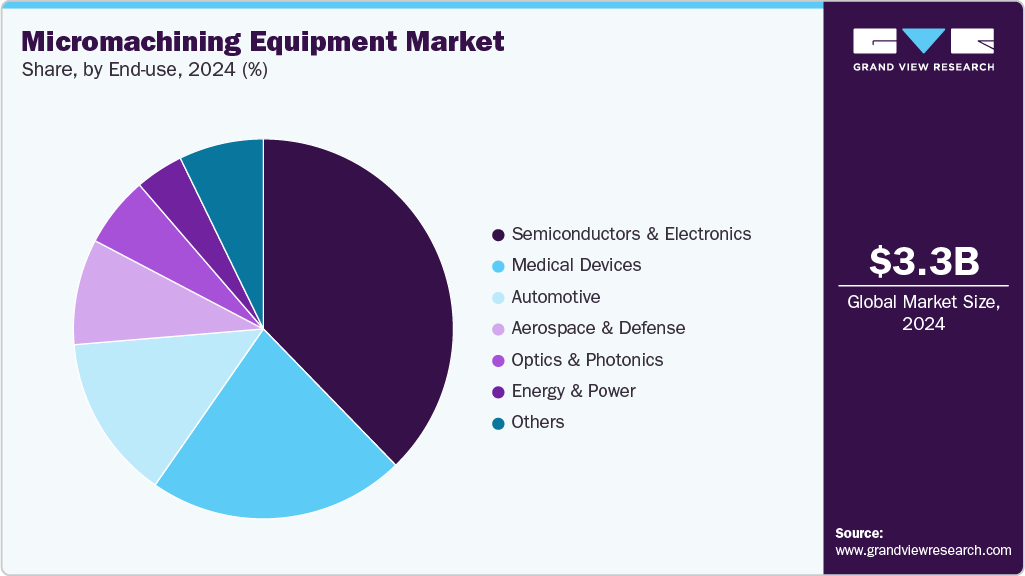

The semiconductors and electronics sector dominates the micromachining equipment market and accounted for a 37.7% share in 2024, due to the need for highly precise micro-components. Rapid miniaturization of devices and complex circuitry drives demand for advanced machining solutions. Manufacturers rely on laser and micro-EDM technologies to meet strict tolerance requirements. This sector’s continuous innovation sustains a strong demand for micro-machining equipment.

The medical devices segment is expected to grow at a significant CAGR of 6.6% from 2025 to 2033 in terms of revenue, as micromachining enables the production of implants, surgical tools, and microfluidic devices. Precision and reliability are critical for patient safety and regulatory compliance. Increasing adoption of minimally invasive procedures boosts demand for micro-scale components. Technological advancements and rising healthcare investments further accelerate market expansion in this segment.

Regional Insights

North America micromachining equipment market is witnessing steady growth at CAGR of 6.5%, driven by technological advancements and high adoption of automation in manufacturing. The presence of leading medical device and aerospace companies fuels demand for micromachining equipment. Continuous R&D activities enhance precision and efficiency in production processes. Government support for innovation and manufacturing initiatives contributes to market expansion.

U.S. Micromachining Equipment Market Trends

The U.S. dominates the North American micro-machining equipment industry due to its advanced electronics, aerospace, and medical device industries. High investment in R&D and adoption of cutting-edge technologies drive equipment demand. Strong presence of leading micromachining manufacturers reinforces market leadership. Continuous innovation and government support for high-precision manufacturing sustain growth.

The Mexico micromachining equipment market is experiencing growth as industrial automation and electronics manufacturing expand in the region. The country benefits from foreign investments and proximity to U.S. supply chains. Increasing demand for automotive and medical components supports the adoption of micromachining equipment. Emerging industrial hubs and skilled labor availability further boost market potential.

Europe Micromachining Equipment Market Trends

Europe shows growth owing to strong industrial bases in Germany, France, and the UK, focusing on automotive, aerospace, and electronics sectors. High standards for quality and precision in manufacturing encourage adoption of advanced micromachining technologies. Investments in research and innovation further boost the market. Sustainability and compliance with regulatory frameworks also drive regional demand.

The Germany micromachining equipment marketdominates the European micromachining equipment market due to its strong automotive, aerospace, and precision engineering industries. Advanced manufacturing technologies and high demand for micro-scale components drive market growth. The country’s focus on quality and innovation attracts global investments. Continuous R&D and skilled workforce strengthen Germany’s leadership in the region.

The UK micromachining equipment market is growing as the aerospace, medical devices, and electronics sectors increasingly adopt micromachining solutions. Government initiatives and support for high-tech manufacturing promote advanced equipment use. Rising demand for precision components in healthcare and industrial applications fuels expansion. Investment in research and automation further accelerates market growth.

Asia Pacific Micromachining Equipment Market Trends

Asia Pacific leads the micro-machining equipment market and accounted for 49.8% share, due to the presence of major electronics, semiconductor, and automotive manufacturing hubs. Countries like China, Japan, and South Korea drive high demand for precision micro-components. Rapid industrialization and investments in advanced manufacturing technologies support market growth. The region’s strong supply chain and skilled workforce further reinforce its dominance.

The China micromachining equipment market dominates Asia Pacific market due to its massive electronics, semiconductor, and automotive manufacturing base. Strong government support and heavy investment in advanced manufacturing technologies drive demand. The country’s large-scale production capabilities enable rapid adoption of precision equipment. Continuous innovation and skilled labor availability further reinforce China’s market leadership.

The India micromachining equipment market is witnessing growth as its electronics, medical devices, and automotive sectors expand rapidly. Increasing industrial automation and foreign investments fuel the adoption of micromachining equipment. Rising demand for micro-scale components and precision manufacturing supports market development. Government initiatives to promote advanced manufacturing and innovation enhance growth opportunities.

Latin America Micromachining Equipment Market Trends

Latin America is gradually expanding as industries adopt modern manufacturing technologies to improve product quality and efficiency. Brazil and Argentina lead the market with increasing investments in electronics and automotive sectors. Rising demand for precision components in medical devices and electronics supports growth. Emerging infrastructure and industrial modernization projects create new market opportunities.

The Brazil micromachining equipment market is witnessing growth in the micromachining equipment market driven by expanding electronics, automotive, and medical device industries. Investments in modern manufacturing technologies and industrial automation support precision component production. Rising demand for high-quality micro-scale parts fuels equipment adoption. Government initiatives to enhance industrial infrastructure further promote market development.

Middle East & Africa Micromachining Equipment Market Trends

The Middle East and Africa region is witnessing growth due to increasing industrial automation and aerospace manufacturing activities. Investments in high-tech industries and infrastructure development drive the need for precision micromachining. Countries like the UAE, Saudi Arabia, and South Africa are focusing on advanced manufacturing solutions. Market expansion is supported by government initiatives promoting industrial innovation.

The Saudi Arabia micromachining equipment marketis experiencing growth in the micromachining equipment market due to increased investments in aerospace, defense, and advanced manufacturing sectors. Government initiatives to diversify the economy and promote industrial automation drive demand. Rising adoption of high-precision components in medical and electronics industries supports market expansion. The country’s focus on technological innovation further boosts equipment deployment.

Key Micromachining Equipment Company Insights

Some of the key players operating in the market include TRUMPF GmbH + Co. KG, Coherent, Inc., IPG Photonics Corporation

-

TRUMPF specializes in advanced laser micromachining systems for precision manufacturing across electronics, automotive, and medical sectors. Their equipment enables high accuracy cutting, drilling, and structuring of micro-components. Continuous innovation in laser technologies strengthens their position in global micromachining markets. The company also integrates automation and software solutions to enhance productivity and efficiency.

-

Coherent, Inc. develops high-performance laser micromachining solutions for industrial and research applications. Their systems support ultra-precise microfabrication for semiconductors, medical devices, and electronics. Focus on innovation in laser sources and beam delivery enhances process accuracy. The company’s equipment is widely adopted for complex micro-scale manufacturing challenges worldwide.

Key Micromachining Equipment Companies:

The following are the leading companies in the micromachining equipment market. These companies collectively hold the largest market share and dictate industry trends.

- TRUMPF GmbH + Co. KG

- Coherent, Inc.

- IPG Photonics Corporation

- Makino Milling Machine Co., Ltd.

- Jenoptik AG

- AMADA WELD TECH

- Han’s Laser Technology Industry Group Co., Ltd.

- MKS Inc

- Synova SA

- Mitsubishi Heavy Industries, Ltd.

- Georg Fischer Ltd.

- Makino

- OpTek Ltd.

- Oxford Lasers

Recent Developments

-

In June 2025, Coherent launched the SES18-880A-190-10, an 18W, 880 nm single-emitter laser diode for high-performance DPSS systems. It delivers high brightness and efficiency for precision micromachining, material processing, and research applications. The compact design improves system reliability and lowers operational costs. This launch highlights Coherent’s focus on advancing industrial and scientific laser technologies.

-

In January 2025, IPG Photonics will showcase its latest fiber laser technologies at Photonics West 2025, highlighting applications in micromachining, cleaning, and research. The YLS-RI high-power platform offers improved performance and integration. Ultrafast lasers and high-brightness sources for biomedical and directed energy applications will also be featured. Specialized single-frequency lasers for quantum computing will be demonstrated.

Micromachining Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,469.5 million

Revenue forecast in 2033

USD 5,638.2 million

Growth rate

CAGR of 6.3% from 2025 to 2033

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Machine type, end-use, region

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Spain; UK; China; Japan; India; South Korea; Australia; Argentina; Brazil; Saudi Arabia; South Africa; UAE

Key companies profiled

TRUMPF GmbH + Co. KG; Coherent, Inc.; IPG Photonics Corporation; Makino Milling Machine Co., Ltd.; Jenoptik AG; AMADA WELD TECH; Han’s Laser Technology Industry Group Co., Ltd.; MKS Inc; Synova SA; Mitsubishi Heavy Industries, Ltd.; Georg Fischer Ltd.; Makino; OpTek Ltd.; Oxford Lasers

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Micromachining Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global micromachining equipment market report based on machine type, end-use, and region.

-

Machine Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Micro-milling & Micro-turning

-

Laser micro-machining

-

Electrical Discharge Machining (EDM)

-

Electrochemical Machining (ECM)

-

Water Jet Cutting

-

Hybrid Micromachining

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Semiconductors & Electronics

-

Automotive

-

Medical Devices

-

Aerospace & Defense

-

Optics & Photonics

-

Energy & Power

-

Others

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global micromachining equipment market size was estimated at USD 3,296.5 million in 2024 and is expected to be USD 3,469.5 million in 2025.

b. The global micromachining equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.3% from 2025 to 2033 to reach USD 5,638.2 million by 2033

b. The semiconductors and electronics sector dominates the micromachining equipment market and accounted for 37.7% share in 2024, due to the need for highly precise micro-components. Rapid miniaturization of devices and complex circuitry drives demand for advanced machining solutions. Manufacturers rely on laser and micro-EDM technologies to meet strict tolerance requirements.

b. Some of the key players operating in the micromachining equipment market include TRUMPF GmbH + Co. KG, Coherent, Inc., IPG Photonics Corporation, Makino Milling Machine Co., Ltd., Jenoptik AG, AMADA WELD TECH, Han’s Laser Technology Industry Group Co., Ltd., MKS Inc, Synova SA, Mitsubishi Heavy Industries, Ltd., Georg Fischer Ltd., Makino, OpTek Ltd., Oxford Lasers/\.

b. The micromachining equipment market is primarily driven by the increasing demand for miniaturized and high-precision components across electronics, medical devices, and aerospace industries. Technological advancements in laser, ultrasonic, and micro-EDM machining enhance efficiency and accuracy.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.