- Home

- »

- Plastics, Polymers & Resins

- »

-

Microplastic Recycling Market Size, Industry Report, 2030GVR Report cover

![Microplastic Recycling Market Size, Share & Trends Report]()

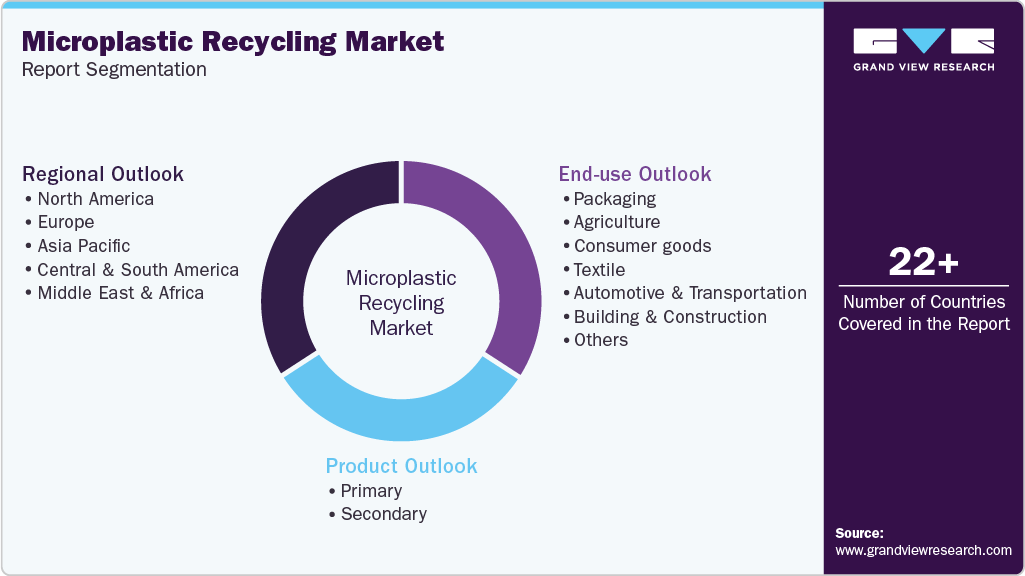

Microplastic Recycling Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Primary, Secondary), By Application (Packaging, Agriculture, Consumer Goods, Textile), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-082-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Microplastic Recycling Market Summary

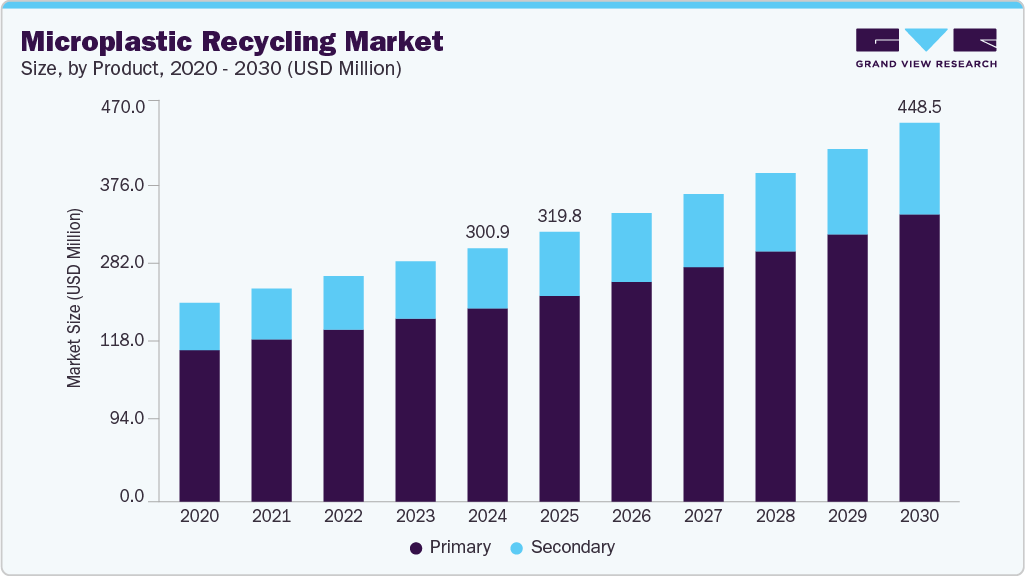

The global microplastic recycling market size was valued at USD 300.9 million in 2024 and is projected to reach USD 448.5 million by 2030, growing at a CAGR of 9.6% from 2025 to 2030. The market is expected to grow in the coming years owing to increasing government regulations, environmental concerns, technological advancements, consumer awareness, and the increasing use of microplastics in different industries.

Key Market Trends & Insights

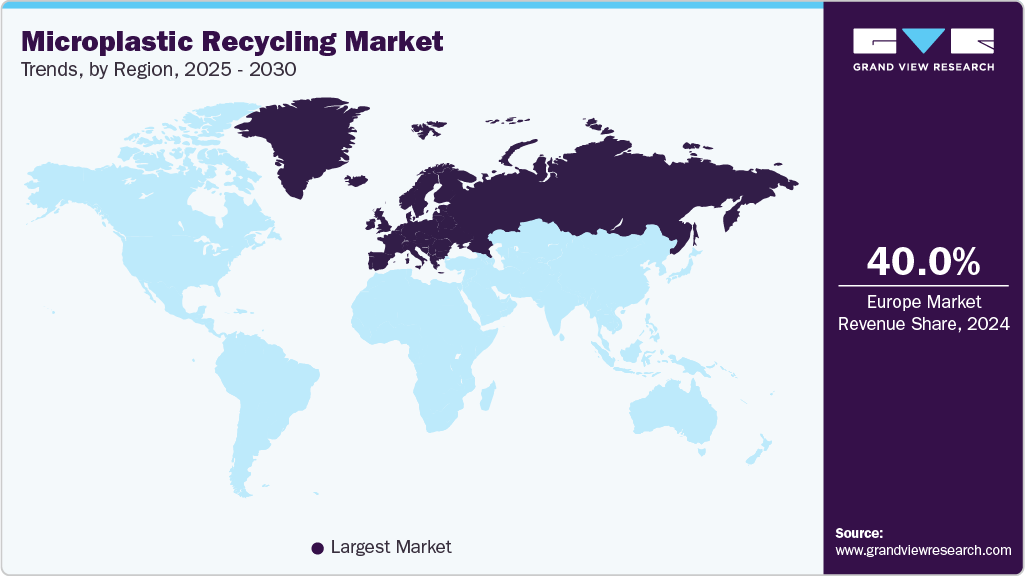

- Europe held the largest market share, accounting for over 40.0% in 2024.

- Germany commands the largest market share in Europe’s microplastic recycling sector, driven by its well-established recycling infrastructure.

- Based on the product, The secondary product segment led the market and accounted for more than 76.0% of the global revenue share in 2024.

- By end-use, packaging dominated the market and accounted for more than 60.0% of the global revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 300.9 Million

- 2030 Projected Market Size: USD 448.5 Million

- CAGR (2025-2030): 9.6%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Significant research and development in the U.S. regarding microplastic recycling is expected to be a major market driver in the country. Manufacturers are engaged in developing new technologies and processes for the efficient and cost-effective recycling of microplastics. Manufacturers in the country have set sustainability goals, which have increased demand for recycled plastics, including microplastics.Different governments across the globe are implementing regulations to reduce plastic waste, which in turn is expected to drive the demand for microplastic recycling. In addition, increasing consumer awareness regarding the environmental impact of their actions and are seeking out sustainable products and services. This has led to increased demand for products made from recycled materials, including microplastics.

Microplastic recycling generates revenue for businesses and reduces production costs in the recycling industry. It also reduces the amount of plastic waste that ends up in landfills or oceans, thereby minimizing the impact on the environment. Furthermore, increasing demand from end-use industries, including automotive and transportation, packaging, consumer goods, textiles, and others, is creating lucrative opportunities for microplastic recycling.

Market Concentration & Characteristics

The microplastic recycling market's growth is medium and accelerating. The market is characterized by a moderate degree of innovation, driven by a combination of health-conscious consumer behavior, technological advancements in production, and a shift towards ethical and sustainable practices. These drivers are reshaping the industry, developing new products and production methods that align with evolving consumer preferences and global sustainability goals.

The microplastic recycling market is experiencing moderate mergers and acquisitions (M&A) activity, indicating a strategic consolidation trend among key industry players, driven by market expansion, product portfolio diversification, and technological advancements. These strategic mergers and acquisitions are reshaping the microplastic recycling market, enabling companies to enhance their capabilities, expand their market reach, and meet the evolving demands of consumers.

The end-use concentration in the microplastics recycling market is notably high, with a significant share of demand originating from a few dominant sectors such as packaging, automotive & transportation, consumer goods, and textiles. These industries increasingly integrate recycled microplastics to meet environmental regulations and corporate sustainability goals. For instance, automotive manufacturers are utilizing recycled polymers for interior components to reduce vehicle weight and improve fuel efficiency, while the textile sector is adopting recycled microfibers in garments to respond to growing consumer demand for eco-friendly fashion. This concentration underscores a targeted yet expanding application scope across industries with high plastic consumption.

Product Insights

Based on the product, the market is segmented into primary and secondary sub-segments. The secondary product segment led the market and accounted for more than 76.0% of the global revenue share in 2024. Secondary microplastics recycling refers to the process of recovering microplastics that have already been used and discarded, such as plastic bottles, packaging, and other waste. Recycling secondary microplastics can help minimize the amount of plastic waste in landfills, oceans, and other natural environments. In addition, secondary microplastics recycling can be cost-effective, as recycled materials are less expensive than virgin materials.

Microbeads are easily available from the personal care industry, a significant feedstock for the microplastic recycling market. Owing to technological advancements in recycling, microbeads can be recovered from waste streams and transformed into high-quality recycled materials. Also, using recycled microbeads can give manufacturers a competitive edge in meeting consumer demand for sustainable products.

End-Use Insights

Packaging dominated the market and accounted for more than 60.0% of the global revenue in 2024. The packaging industry is gradually shifting towards sustainable and eco-friendly packaging solutions owing to government regulations and growing consumer awareness. The use of recycled plastics, including microplastics, is seen as an effective way to reduce the environmental impact of packaging.

The automotive and transportation industry is expected to register the fastest CAGR over the forecast period 2025-2030. It is increasingly using recycled plastics and exploring the use of microplastics in various applications.

The incremental use of microplastics is driven by environmental concerns and a desire for lighter, more fuel-efficient vehicles. This includes using recycled plastics for interior components, seat covers, and even innovative materials like plastic roads. While microplastics are a concern due to potential environmental impact, they are also being investigated for their potential as lightweight materials in specific applications, particularly in interior components.

Regional Insights

North America held a considerable share in 2024. This is attributed to the region’s mature recycling infrastructure and regulatory environment, particularly in the U.S. and Canada. The presence of major recycling firms, coupled with strong government policies like the U.S. Microbead-Free Waters Act (2015) and increasing state-level bans on single-use plastics, is fostering steady growth. Moreover, North America is a hub for technological innovation, with advancements in filtration systems, chemical recycling, and microplastic capture from wastewater contributing to market sustainability. Increasing corporate sustainability initiatives and investments in circular economy models further reinforce North America’s position as a global leader in microplastic recycling.

U.S. Microplastic Recycling Market Trends

The U.S. microplastic recycling market is experiencing significant growth, driven by environmental concerns, government regulations, and technological advancements. The country has demonstrated considerable progress in developing and deploying innovative recycling solutions, including chemical recycling, pyrolysis, and advanced filtration systems to capture microplastics from wastewater and industrial discharge.

Europe Microplastic Recycling Market Trends

Europe held the largest market share, accounting for over 40.0% in 2024. Europe continues to lead the global market due to its early adoption of environmental regulations, such as the EU Plastics Strategy and extended producer responsibility (EPR) policies. Countries like Germany and the UK have invested heavily in recycling infrastructure and innovation, making Europe a benchmark for sustainable practices. Europe’s focus on reducing microplastic leakage through green manufacturing and textile regulations continues to drive high-quality recycling outcomes.

Germany commands the largest market share in Europe’s microplastic recycling sector, driven by its well-established recycling infrastructure, strong regulatory framework, and leadership in environmental innovation.

Asia Pacific Microplastic Recycling Market Trends

The Asia Pacific microplastic recycling market is anticipated to grow at a CAGR of 10.3% during the forecast period. This growth is fueled by rising plastic consumption, expanding industrial activity, and increasing awareness of environmental degradation caused by microplastic pollution. Several countries in the Asia-Pacific region are making strategic investments in recycling infrastructure. Microplastic recycling is gaining traction in various sectors, including textiles, packaging, and wastewater treatment (microfiber and microbead filtration).

China’s microplastic recycling industry is experiencing rapid growth, driven by massive plastic consumption, a large-scale manufacturing base, and a growing emphasis on environmental sustainability. Increasing demand in the packaging and textile industry is also fueling the rapid popularity among consumers for the recycled market. Stringent government measures and policies have encouraged the development of advanced recycling infrastructure capable of processing various microplastic forms, including synthetic fibers from textiles, plastic pellets, and micro-residues from industrial processes.

Key Microplastic Recycling Company Insights

Some key microplastic recycling companies include PlanetCare, ECOFARIO, Carbios, PureCycle Technologies, Ioniqa, Ocean Diagnostics, Calyxia, and Polygonesystems. These organizations have been strategically implementing various initiatives, such as technology innovation in microplastic filtration and separation, advancements in chemical recycling, environmental monitoring solutions, and the development of closed-loop systems.

-

PlanetCare is a pioneer in microplastic filtration technology. It specifically targets microfibers released from washing machines, one of the largest sources of secondary microplastics. The company has developed patented microfiber filters for household and industrial laundry applications.

-

ECOFARIO is a technology-driven company specializing in removing microplastics from wastewater through its high-performance separation technology, which uses vortex-based water treatment systems.

Key Microplastic Recycling Companies:

The following are the leading companies in the microplastic recycling market. These companies collectively hold the largest market share and dictate industry trends.

- PlanetCare

- ECOFARIO GmbH

- Carbios

- PureCycle Technologies, Inc.

- Ioniqa Technologies B.V.

- Calyxia

- Ocean Diagnostics, Inc.

- OceanWorks International

- Matter.

Recent Developments

-

In August 2024, Carbios and SASA signed a Letter of Intent for a future licensing arrangement, with SASA potentially acquiring a license for Carbios' PET biorecycling technology.

-

In April 2023, Biffa announced the acquisition of North Yorkshire based Esterpet Ltd, a recycler of Polyethylene Terephthalate (PET) plastic. Esterpet converts 25,000 tons of plastic flakes each year, generated from recycled bottles, into high-purity plastic pellets.

Microplastic Recycling Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 319.8 million

Revenue forecast in 2030

USD 448.5 million

Growth Rate

CAGR of 9.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America, Europe, Asia Pacific, CSA and MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India and Brazil

Key companies profiled

Carbios; PureCycle Technologies, Inc.; Ioniqa Technologies B.V.; Calyxia; PlanetCare; ECOFARIO GmbH; Ocean Diagnostics, Inc.; OceanWorks International; Matter.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Microplastic Recycling Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the microplastics recycling industry report based on product, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Primary

-

Secondary

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Agriculture

-

Consumer goods

-

Textile

-

Automotive & Transportation

-

Building & Construction

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.