- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Middle East & Africa Corrosion Protection Coating Market Report, 2030GVR Report cover

![Middle East & Africa Corrosion Protection Coating Market Size, Share & Trends Report]()

Middle East & Africa Corrosion Protection Coating Market Size, Share & Trends Analysis Report By Resin (Acrylic, Epoxy), By End-use (Civil, Marine), By Technology (Waterborne Coatings, Powder Coatings), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-030-9

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Report Overview

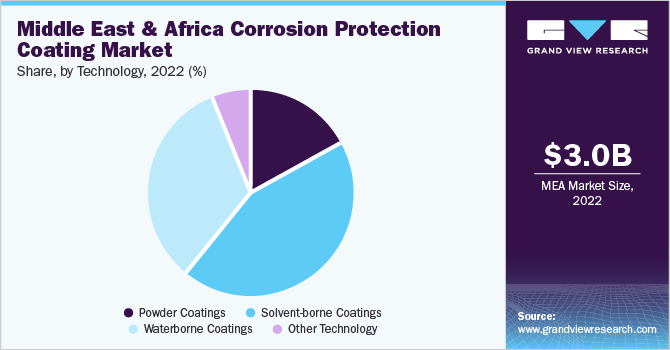

The Middle East & Africa corrosion protection coating market size was estimated at USD 3,025.3 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.7 % from 2023 to 2030. The growth of the product market is attributed to the rising investments in the construction industry as well as the development of manufacturing hubs in the region. Corrosion protection coatings (CPCs) play a crucial role in automotive production by protecting vehicles from corrosion and ensuring their durability and longevity. These coatings are applied to the body panels and structures of automobiles to prevent corrosion caused by exposure to moisture, road salt, chemicals, and other environmental hazards. The coatings act as a barrier, inhibiting the penetration of moisture and corrosive substances to the underlying metal surfaces.

Typically, a multi-layer coating system is used, which includes a pretreatment, primer, and topcoat. These coatings provide excellent adhesion, corrosion resistance, and aesthetic appeal to the automotive. The COVID-19 pandemic had a significant impact on various industries worldwide, including the corrosion protection coatings market in the Middle East and Africa. The pandemic led to disruptions in global supply chains, affecting the availability and transportation of raw materials used in manufacturing the product. The reduction in industrial activities had a direct impact on the demand for the product, as industries like oil and gas, construction, and manufacturing are major consumers of these coatings. However, the market appears to have rebounded in 2022 as production has resumed normally across all industries.

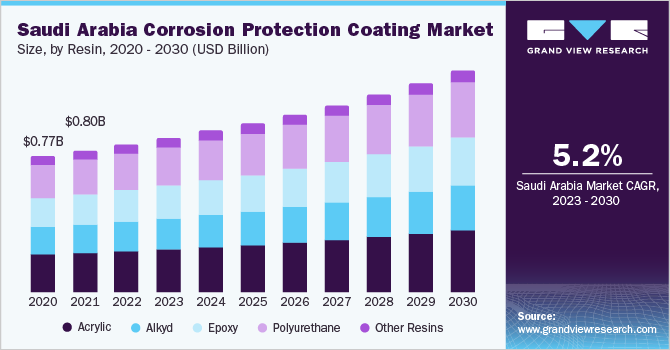

Saudi Arabia is the largest consumer of the product in the MEA region with a significant revenue share in 2022. The Middle East region with its extreme temperature, humidity, and saltwater corrosion, has seen a significant increase in the demand for CPCs. In 2020, the Kuwait Oil Company (KOC) selected International Paint, a subsidiary of AkzoNobel, to provide CPCs for its oil and gas assets. The CPCs were used to protect KOC's onshore and offshore facilities from corrosion caused by high temperatures, humidity, and harsh environmental conditions. This project showcased the importance of CPCs in the oil and gas industry in the Middle East, which is a major contributor to the region's economy.

Resin Insights

The acrylic resin segment dominated the market with a revenue share of 28.2% in 2022. This growth is attributed to the high demand for resins due to their excellent adhesion properties, durability, and weatherability. These coatings can also be used as a topcoat over another underlying coating, such as epoxy or polyurethane coatings, to provide enhanced corrosion protection. In such cases, acrylic coatings offer additional benefits, such as improved aesthetics, gloss retention, and anti-fading characteristics.

The alkyd segment is also anticipated to witness considerable growth over the period. Alkyd resins are obtained by combining polybasic alcohols and organic acids. They can be formulated to offer varied functionalities, such as improved adhesion, UV stability, and flexibility. Alkyd-based coatings are commonly used in various industries, including construction, automotive, marine, and industrial applications, because of the several benefits it offers such as good adhesion, affordability, high gloss retention, and excellent water resistance among others.

End-use Insights

The oil & gas in end-use segment dominated the market with a revenue share of 20.1% in 2022. This is attributed to the extensive use of CPCs in the oil & gas industry due to the harsh environmental conditions that corrosive substances encounter during the exploration, production, transportation, and processing of oil and gas. In addition, corrosion can cause equipment failures, pipeline leaks, and environmental disasters, resulting in significant safety hazards, production losses, and costly repairs. Thus, CPCs offer a cost-effective solution for preventing corrosion and maintaining the integrity of oil and gas infrastructure.

Construction is another segment anticipated to witness rapid growth over the period. The demand for CPCs from the construction industry is growing due to the increased use of metal structures such as steel for building construction, reinforcement bars, supports, bridges, and other infrastructure projects. Metal structures are susceptible to corrosion, which can reduce their longevity, leading to structural failure, and increase maintenance and replacement costs. Thus, the use of CPCs creates a barrier that blocks out moisture and oxygen, which are the primary causes of corrosion.

Technology Insights

The solvent-borne coatings technology segment dominated the market with a revenue share of 44.3% in 2022. Solvent-borne coatings are a reliable and steadfast solution for finishing metals like steel, aluminum, and copper. These coatings offer superior durability, producing an enduring protective layer that precisely adheres to the metallic substrate. The solvents within the coating vaporize upon the curing process, which results in a consistent and protective layer. Moreover, these coatings are designed to resist even the toughest environmental conditions, such as sharp changes in temperature, water exposure, and possible exposure to chemicals.

The powder coatings segment is also anticipated to witness significant growth over the period. These are a type of CPCs that are applied to various metal substrates through dry-powder spray application. They offer excellent protection, durability, end-use performance, & a high-quality finish and are often used as an alternative to traditional liquid paint coatings. In addition, using a powder coating for corrosion protection offers a longer-lasting, better-tolerated environmental exposure than that of liquid ones. Moreover, they provide exceptional resistance to chemicals, UV rays, and extreme temperatures, which makes them ideal for harsh operating environments.

Regional Insights

The Middle East region dominated the market with a revenue share of 63.8% in 2022. This is attributed to various factors, such as extreme temperature, humidity, and saltwater corrosion in the region. CPCs are used to prevent corrosion and increase the lifespan of assets, structures, and products in harsh environmental conditions. Africa is anticipated to witness lucrative growth over the forecast period. The demand for CPCs in Africa is due to harsh environmental conditions, such as high humidity, temperature fluctuations, and saltwater corrosion.

Thus, CPCs are now becoming an integral part of corrosion management in the region's end-use industries. Furthermore, African governments have been actively promoting the use of CPCs to protect national assets, which are crucial contributors to the economies. For instance, in 2021, the South African National Roads Agency (SANRAL) announced an investment of over R50 million (USD 3.4 million) in CPCs for its national road network. The investment is part of SANRAL's ongoing efforts to protect its national assets.

Key Companies & Market Share Insights

The market is highly competitive due to the presence of numerous manufacturers and suppliers owing to the huge demand for the product. These companies use various approaches to meet the growing demand and expand their reach globally, all while keeping distribution costs in check. To make the most of the opportunities presented by the global market, enterprises are resorting to mergers, acquisitions, joint ventures, and expansions, among others. Furthermore, technological advancements are being eagerly embraced by companies to stay ahead of the curve. For example, NIPPON collaborated with PETRONAS Technology Ventures Sdn Bhd (PTVSB) in June 2023 to enhance their range of advanced protective coatings applications. This collaboration will allow Nippon Paint to enrich its product portfolio by tapping into the latest technology advancements to deliver top-notch anti-corrosion and tank lining applications. Some of the prominent players in the Middle East & Africa corrosion protection coating market include:

-

AkzoNobel

-

Arkema SA

-

Axalta Coating Systems

-

Berger Paints

-

Carboline

-

Clariant AG

-

Eastman Chemical Company

-

Jotun A/S

-

Nippon Paint

-

PPG Industries

-

RPM International Inc.

-

Sherwin-Williams Company

-

Sika AG

-

Wacker Chemie AG

Middle East & Africa Corrosion Protection Coating Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3,146.7 million

Revenue forecast in 2030

USD 4,382.2 million

Growth rate

CAGR of 4.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Resin, technology, end-use, region

Regional scope

Middle East & Africa

Country scope

Oman; Saudi Arabia; UAE; Bahrain; Kuwait; Qatar; Algeria; Angola; Kenya; Libya; Morocco; Nigeria; South Africa

Key companies profiled

AkzoNobel; Arkema SA; Axalta Coating Systems; Berger Paints; Carboline; Clariant AG; Eastman Chemical Company; Jotun A/S; Nippon Paint; PPG Industries; RPM International Inc.; Sherwin-Williams Company; Sika AG; Wacker Chemie AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East & Africa Corrosion Protection Coating Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Middle East & Africa corrosion protection coating market report based on resin, technology, end-use, and region:

-

Resin Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Acrylic

-

Alkyd

-

Epoxy

-

Polyurethane

-

Other Resins

-

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Powder Coatings

-

Solvent-borne Coatings

-

Waterborne Coatings

-

Other Technology

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Civil

-

Construction

-

Energy

-

Marine

-

Municipal

-

Oil & Gas

-

Petrochemical

-

Other End-uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Middle East

-

Oman

-

Saudi Arabia

-

UAE

-

Bahrain

-

Kuwait

-

Qatar

-

-

Africa

-

Algeria

-

Angola

-

Kenya

-

Libya

-

Morocco

-

Nigeria

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The Middle East & Africa corrosion protection coating market size was estimated at USD 3,025.3 million in 2022 and is expected to reach USD 3,146.7 million in 2023.

b. The Middle East & Africa corrosion protection coating market is expected to grow at a compound annual growth rate of 4.7% from 2023 to 2030 to reach USD 4,382.2 million by 2030.

b. Oil and gas segment dominated the Middle East & Africa corrosion protection coating market with a share of 20.8% in 2019. This is attributable to the due to the harsh environmental conditions and corrosive substances encountered during the exploration, production, transportation, and processing of oil and gas

b. Some key players operating in the Middle East & Africa corrosion protection coating market include PPG Industries, Jotun A/S, The Sherwin William Company, Ashland LLC, Hempel A/S, International Marine Coatings, Steuler-Holding GmbH and BASF Coatings.

b. Key factors that are driving the market growth include rising urbanization & industrialization in the region, and growing investment in commercial sector such as business complexes, corporate offices, as well as luxury hotels especially in Saudi Arabia and UAE.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."