- Home

- »

- Advanced Interior Materials

- »

-

Middle East Air Conditioning Systems Market Report, 2033GVR Report cover

![Middle East Air Conditioning Systems Market Size, Share & Trends Report]()

Middle East Air Conditioning Systems Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Package Air Conditioners, Ductless Mini-Split Systems), By Technology (Inverter, Non-Inverter), By End Use (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-704-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Air Conditioning Systems Market Summary

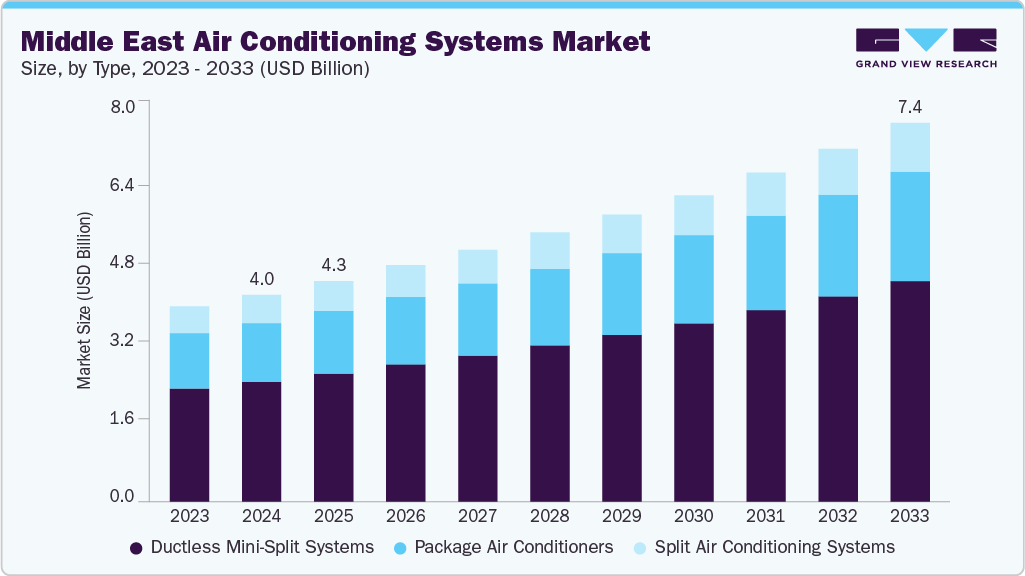

The Middle East air conditioning systems market size was estimated at USD 4,021.7 million in 2024 and is projected to reach USD 7,368.9 million by 2033, growing at a CAGR of 7.0% from 2025 to 2033. The Middle East's extreme climate, characterized by long, hot summers and soaring temperatures often above 45°C, drives high demand for air conditioning systems.

Key Market Trends & Insights

- The Middle East air conditioning systems market in Saudi Arabia is expected to grow at a substantial CAGR of 7.3% from 2025 to 2033.

- By type, the package air conditioners segment is expected to grow at a considerable CAGR of 7.2% from 2025 to 2033 in terms of revenue.

- By technology, the inverter waste segment is expected to grow at a considerable CAGR of 9.1% from 2025 to 2033 in terms of revenue.

- By end use, the residential segment is expected to grow at a considerable CAGR of 8.2% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 4,021.7 Million

- 2033 Projected Market Size: USD 7,368.9 Million

- CAGR (2025-2033): 7.0%

Urbanization and rising disposable incomes in countries like the UAE and Saudi Arabia are further supporting residential and commercial installations. The growing hospitality and tourism industry, particularly in Gulf countries, is also contributing to rising AC system requirements. Government-backed infrastructure projects and smart city initiatives add to this growth.

Additionally, energy efficiency regulations are pushing the adoption of inverter-based and smart air conditioning technologies. Governments in the region are investing in sustainable cooling solutions to manage power consumption and reduce emissions. The expansion of the real estate sector, including malls, airports, and luxury housing, further boosts HVAC system integration. Increasing foreign investment and diversification efforts away from oil economies also sustain long-term market demand.

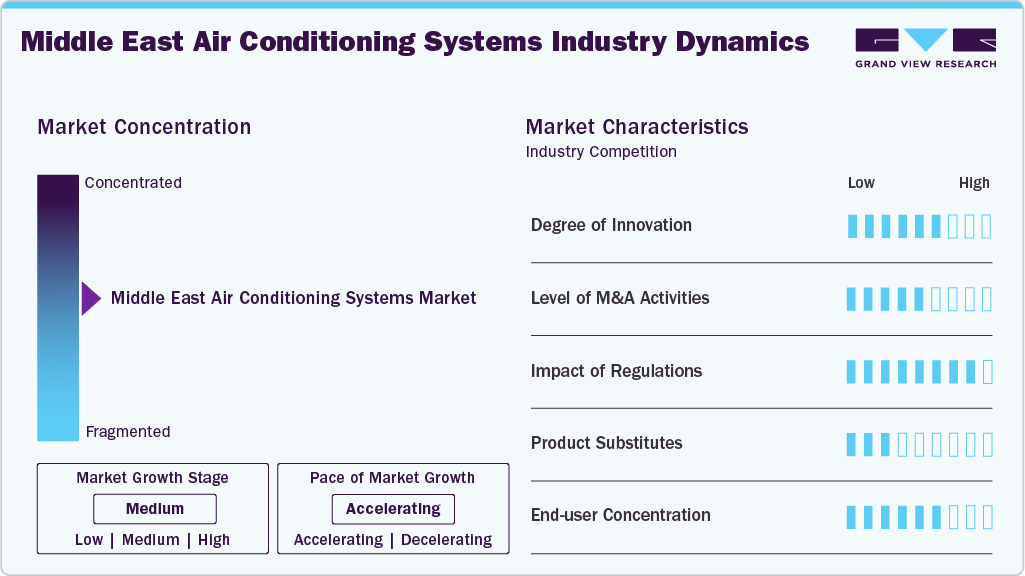

Market Concentration & Characteristics

The Middle East air conditioning systems market is moderately concentrated, with a few major players dominating in terms of market share and regional presence. Global brands such as LG, Daikin, and Samsung have strong distribution networks and brand recognition across GCC countries. However, the presence of several local and regional manufacturers offering cost-effective solutions adds a degree of fragmentation. The market continues to see consolidation through partnerships and product innovation to meet energy efficiency norms.

The need for energy-efficient and sustainable cooling solutions drives innovation in the Middle East air conditioning systems industry. Companies are introducing smart AC systems with IoT, AI-based controls, and inverter technology to meet climate demands. Solar-powered air conditioners are also gaining traction in response to regional energy goals. Continuous R&D investments focus on improving performance in high-temperature environments.

Mergers and acquisitions in the region are moderate, primarily driven by global players seeking to expand their footprint in the GCC market. Strategic collaborations with local distributors and HVAC service providers are common. M&A activity is often aimed at accessing upcoming smart city and infrastructure projects. The market is witnessing gradual consolidation as players seek a competitive advantage.

Government regulations play a key role, particularly those focused on energy efficiency and environmental sustainability. Countries like the UAE and Saudi Arabia have introduced mandatory efficiency labeling and refrigerant phase-out plans. These policies are pushing manufacturers to upgrade technologies and align with green building codes. Compliance with regional standards significantly shapes product development and market entry strategies.

Drivers, Opportunities & Restraints

The Middle East's harsh climate and high cooling demand are primary drivers for air conditioning system adoption. Rapid urbanization, population growth, and rising disposable incomes fuel residential and commercial installations. Mega infrastructure projects, including NEOM and Expo-linked developments, further accelerate HVAC demand. Additionally, a growing focus on indoor air quality enhances AC system integration across sectors.

There is a rising demand for energy-efficient and eco-friendly air conditioning systems due to regional sustainability goals. Government incentives and green building initiatives offer significant growth opportunities for advanced HVAC solutions. The expansion of sectors like tourism, healthcare, and data centers boosts long-term prospects. Emerging smart city projects create scope for IoT-enabled and solar-powered cooling technologies.

High installation and maintenance costs of advanced air conditioning systems can limit adoption among small-scale users. Power consumption concerns and pressure on regional electricity grids pose challenges for large-scale cooling deployment. Regulatory compliance costs related to refrigerant standards can burden manufacturers. Additionally, economic volatility and project delays in some countries may impact consistent market growth.

Type Insights

Package air conditioners segment is expected to grow at the fastest CAGR of 7.2% from 2025 to 2033 in terms of revenue. Ductless mini-split systems lead the Middle East Middle East air conditioning systems market and accounted for a 57.9% share in 2024, due to their energy efficiency and flexibility in installation. They are ideal for retrofitting in older buildings and provide zone-specific cooling, which suits residential and small commercial spaces. The absence of ductwork reduces energy losses and overall operating costs. Their popularity is further supported by the rising demand in villas and low-rise apartments.

Package air conditioners are witnessing the fastest growth due to their suitability for large commercial and industrial applications. These systems offer high cooling capacity and are commonly used in malls, hospitals, and temporary structures. Their compact design and ease of installation make them attractive for rapid infrastructure projects. Increased deployment in modular buildings and smart city developments also supports segment growth.

Technology Insights

The non-inverter segment is expected to grow at a moderate CAGR of 3.0% from 2025 to 2033 in terms of revenue. Inverter-based air conditioners segment held the largest share of the Middle East air conditioning systems industry with a share of 59.4% in 2024, owing to their ability to perform efficiently under extreme heat. Countries like the UAE and Saudi Arabia promote inverter-based systems through energy labeling programs and efficiency standards. These systems help reduce electricity bills, which is crucial given the region’s high cooling needs. Their growing use in residential and commercial buildings reflects a shift toward sustainable cooling.

Non-inverter AC systems in the Middle East are seeing moderate growth, mainly driven by cost-conscious buyers. They are commonly installed in older buildings, labor accommodations, and low-income housing units where upfront cost is a key factor. However, stricter government regulations on energy efficiency are limiting their widespread adoption. Despite this, they remain relevant in markets with minimal regulatory enforcement and short-term cooling needs.

End Use Insights

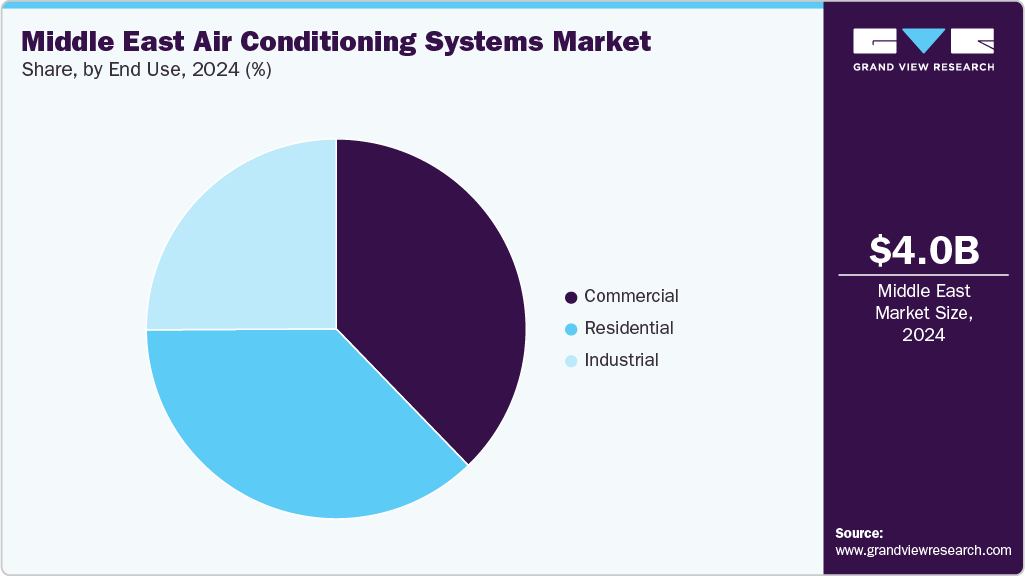

The residential segment is expected to grow at the fastest CAGR of 8.2% from 2025 to 2033 in terms of revenue. The commercial sector dominates the Middle East air conditioning systems market with a 37.8% share in 2024, due to large-scale infrastructure projects, including malls, airports, hotels, and office complexes. The expansion of tourism and hospitality sectors, especially in Dubai and Riyadh, accelerates commercial AC adoption. New business hubs and economic diversification initiatives create further demand. Increased focus on indoor air quality and thermal comfort enhances investment in advanced HVAC systems.

The residential sector is witnessing significant growth driven by high demand for cooling in homes and apartments amid extreme temperatures. Rapid urban development and rising middle-class income, especially in countries like Saudi Arabia and the UAE, fuel AC installations. Government housing projects and population growth further boost residential demand. Energy-efficient systems are gaining popularity in villas and high-rise apartments.

Country Insights

Saudi Arabia leads the Middle East air conditioning market due to its vast land area, extreme desert climate, and high population. Massive infrastructure projects like NEOM, along with growing urban centers, drive large-scale AC installations. Government initiatives promoting energy-efficient systems further support market dominance. Residential, commercial, and industrial sectors all contribute significantly to demand.

The UAE is a major contributor to the growth of theMiddle East air conditioning systems industry, driven by high-rise developments, luxury real estate, and a booming hospitality sector. Dubai and Abu Dhabi lead in smart city adoption, boosting demand for advanced HVAC solutions. Strong regulatory frameworks on energy efficiency encourage the use of inverters and eco-friendly systems. The country’s year-round heat and tourism inflow sustain high cooling needs.

The Oman air conditioning systems market is steadily growing, fueled by increasing residential construction and government-led development plans. Rising temperatures and a growing urban population are driving greater demand for cooling systems. Energy efficiency programs under Oman Vision 2040 promote modern, sustainable HVAC technologies. While smaller on a scale, the market shows strong potential in both the public and private sectors.

Key Middle East Air Conditioning Systems Company Insights

Some of the key players operating in the market include DAIKIN INDUSTRIES, Ltd., Carrier, and Awal Gulf Manufacturing.

-

Daikin specializes in advanced air conditioning systems, with a strong focus on inverter and energy-saving technologies. The company leads in environmentally responsible solutions, particularly through its early adoption of R-32 refrigerants. It heavily invests in R&D to develop smart and AI-enabled HVAC products. Daikin has a robust manufacturing and distribution presence across Asia, Europe, and the Middle East. Its product strategy emphasizes performance, low environmental impact, and regulatory compliance.

-

Carrier is known for its high-efficiency HVAC systems tailored for both residential and large-scale commercial applications. The company emphasizes sustainable technologies, offering solutions with low-GWP refrigerants and energy optimization features. Its portfolio includes smart AC systems integrated with building automation platforms. Carrier is active in acquisitions to strengthen its digital and green HVAC offerings. The company leverages data-driven innovation to improve lifecycle performance and reduce carbon footprints.

Key Middle East Air Conditioning Systems Companies:

- DAIKIN INDUSTRIES, Ltd.

- Carrier.

- Awal Gulf Manufacturing

- Zamil Air Conditioners

- LG Electronics.

- GREE

- Samsung Electronics Co. Ltd.

- Panasonic Corporation

- Trane Technologies plc

- Blue Star

Recent Developments

-

In January 2025, Panasonic introduced its OASYS Residential Central AC System in the Saudi Arabia, combining mini-split AC, ventilators, and transfer fans. It reduces energy use by over 50% and ensures quiet, uniform airflow for well-insulated homes. The system helps prevent condensation and mold in hidden spaces.

-

In March 2024, Trane Technologies launched a new residential HVAC line featuring energy-efficient heat pumps and ACs with low-GWP refrigerants. The systems include smart controls and support reduced emissions. This upgrade aligns with the company’s sustainability goals.

Middle East Air Conditioning Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4,291.8 million

Revenue forecast in 2033

USD 7,368.9 million

Growth rate

CAGR of 7.0% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in thousand units, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, end use, country

Country scope

Saudi Arabia; UAE; Oman

Key companies profiled

DAIKIN INDUSTRIES, Ltd.; Carrier; Awal Gulf Manufacturing; Zamil Air Conditioners; LG Electronics; GREE; Samsung Electronics Co. Ltd.; Panasonic Corporation; Trane Technologies plc; Blue Star

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Air Conditioning Systems Market Report Segmentation

This report forecasts the volume & revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East air conditioning systems market report based on type, technology, end use, and region:

-

Type Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

Package Air Conditioners

-

Split Air Conditioning Systems

-

Ductless Mini-Split Systems

-

-

Technology Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

Inverter

-

Non-Inverter

-

-

End Use Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

Middle East

-

Saudi Arabia

-

UAE

-

Oman

-

-

Frequently Asked Questions About This Report

b. Inverter-based air conditioners segment held the largest share in the market and accounted for a share of 59.4% in 2024 owing to their ability to perform efficiently under extreme heat. Countries like the UAE and Saudi Arabia promote inverter-based systems through energy labeling programs and efficiency standards.

b. Some of the key players operating in the Middle East air conditioning systems market include DAIKIN INDUSTRIES, Ltd.; Carrier.; Awal Gulf Manufacturing; Zamil Air Conditioners; LG Electronics.; Midea; Samsung Electronics Co. Ltd.; Panasonic Corporation; Trane Technologies plc; Blue Star

b. Rising temperatures, population growth, and rapid urbanization are key drivers of the Middle East air conditioning systems market. Major infrastructure projects in Saudi Arabia and the UAE are fueling commercial demand. Additionally, energy efficiency regulations are accelerating the shift toward advanced HVAC technologies.

b. The Middle East air conditioning system’s market size was estimated at USD 4,021.7 million in 2024 and is expected to be USD 4,291.8 million in 2025.

b. The Middle East air conditioning systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.0% from 2025 to 2033 to reach USD 7,368.9 million by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.