- Home

- »

- Advanced Interior Materials

- »

-

Middle East Cooling Tower Market, Industry Report, 2033GVR Report cover

![Middle East Cooling Tower Market Size, Share & Trends Report]()

Middle East Cooling Tower Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Open Circuit, Closed Circuit, Hybrid), By Material (FRP, Steel, Concrete, Wood), By Application (HVAC, Power Generation, Oil & Gas, Industrial), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-743-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Cooling Tower Market Trends

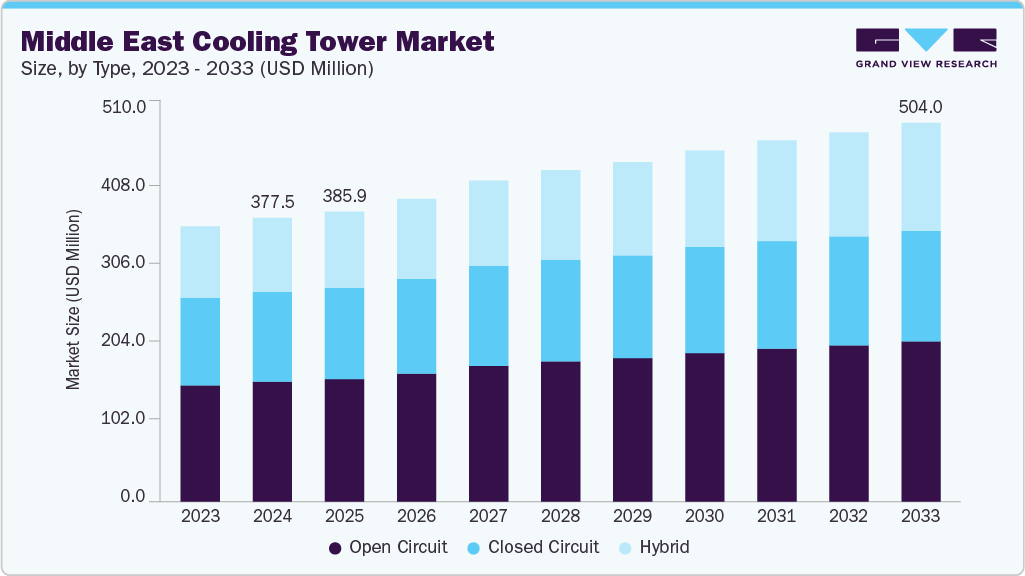

The Middle East cooling tower market size was estimated at USD 377.5 million in 2024 and is projected to reach USD 504.0 million by 2033, growing at a CAGR of 3.4% from 2025 to 2033. Rapid industrial expansion across petrochemicals, oil & gas processing, and large-scale power generation is a primary driver for cooling tower demand in the Middle East.

Key Market Trends & Insights

- Saudi Arabia dominated the cooling tower market with the largest revenue share of 51.5% in 2024.

- By type, the open circuit segment led the market with the largest revenue share of 42.3% in 2024.

- By material, the FRP segment led the market with the largest revenue share of 28.2% in 2024.

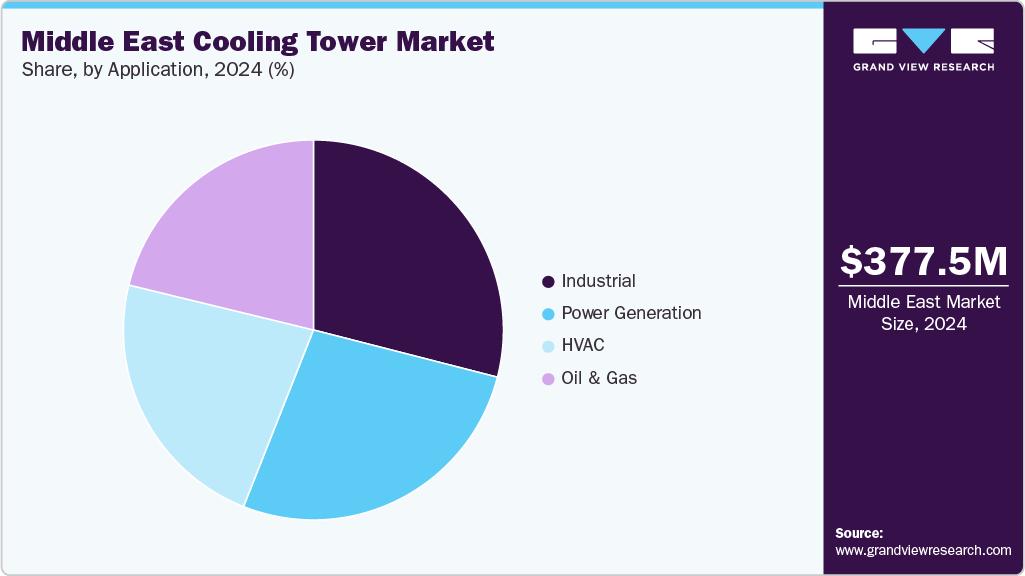

- By application, the industrial segment led the market with the largest revenue share of 29.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 377.5 Million

- 2033 Projected Market Size: USD 504.0 Million

- CAGR (2025-2033): 3.4%

Large thermal loads from refineries, LNG trains, and combined-cycle power plants require dependable heat rejection systems, making cooling towers central to plant design and ongoing capacity expansions. Moreover, parallel growth in desalination capacity often sited alongside power plants, adds persistent baseline demand for both new-build towers and lifecycle replacements.

Project owners increasingly prioritize towers that deliver low water consumption, proven thermal performance, and minimal downtime to protect complex upstream and midstream operations. As projects become larger and more integrated, specification standards increasingly favor engineered packaged towers and custom field-erected solutions to meet site-specific thermal and water-quality challenges.

Market Concentration & Characteristics

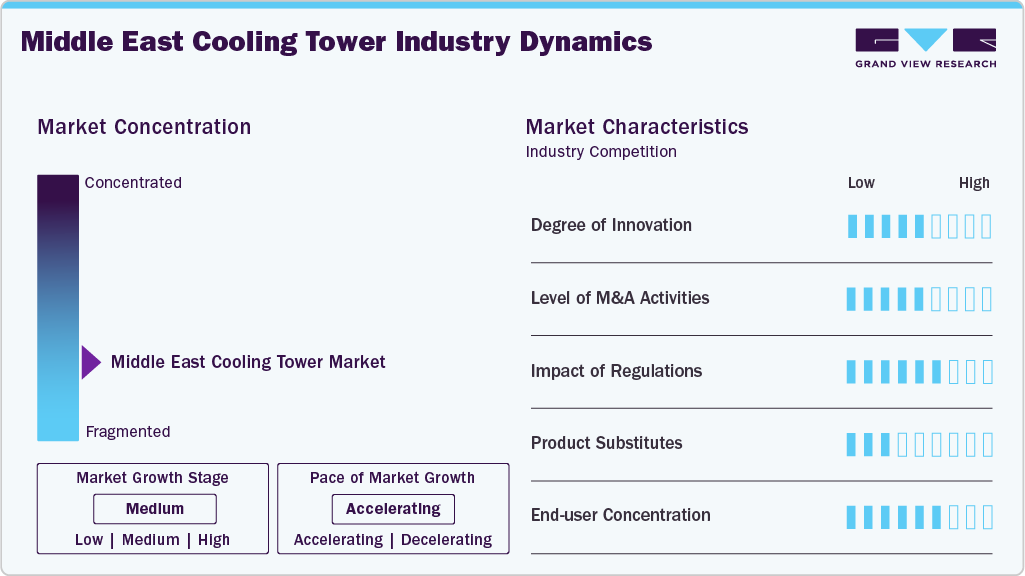

The Middle East cooling tower industry is moderately concentrated around a mix of global engineering firms and specialized regional fabricators. International OEMs with proven thermal designs, global references, and extended service networks command preference for large industrial and utility-scale projects, while regional manufacturers and EPC subcontractors supply standard packaged towers and competitively priced replacements. This split creates mid-to-high entry barriers for bespoke engineered projects but permits localized competition on commodity, packaged, and retrofit jobs where cost and lead time dominate decisions.

Innovation is iterative and application-focused rather than disruptive; advances center on materials that resist saline corrosion, improved fill geometries for thermal efficiency, reduced water drift, and integration with water-treatment systems and digital monitoring. M&A activity has been selective, usually aimed at expanding geographic footprint or adding aftermarket services and water-treatment capabilities rather than radical product redefinition. Regulations on water use, environmental discharge, and occupational safety influence vendor selection by increasing switching costs for non-compliant hardware, while service substitutes such as closed-loop dry coolers and hybrid systems are gaining traction in niche applications where water scarcity or plume abatement is critical. End-user concentration is high in the petrochemical, power, and desalination sectors, giving a relatively small number of large buyers substantial negotiating leverage.

Drivers, Opportunities & Restraints

Urbanization and construction activity across the GCC and Egypt support significant cooling tower demand for district cooling, commercial real estate, and large institutional HVAC systems. District cooling schemes in dense urban developments and high-end real estate projects rely on central chilled-water plants with large induced-draft or crossflow towers for efficient heat rejection. The trend toward large mixed-use developments, data centers, and tourism infrastructure (hotels, malls) drives procurement of towers with low acoustic footprint and high thermal efficiency. Contractors and building owners often favor vendors offering integrated MEP solutions, service contracts, and bundled maintenance to ensure continuous, warranty-backed performance in urban settings.

The Middle East cooling tower industry is restrained primarily by chronic water stress and tightening environmental regulations: operators face rising costs and operational constraints as authorities and customers push for lower water consumption, blowdown, and chemical use, which penalizes traditional wet cooling systems. High upfront capital and lifecycle maintenance costs for large, corrosion-resistant towers (plus the need for trained maintenance teams) slow new purchases and favor life-extension of existing assets instead of full replacements. Harsh climatic extremes in parts of the region also reduce system efficiency and increase materials and parts wear. At the same time, supply-chain and logistics costs for large, fabricated components raise project lead times and installed costs.

Strong regional demand for district cooling, expanding hyperscale data centers, desalination, and new power/industrial projects creates a steady pipeline for both new cooling-tower installations and retrofit/upgrade business (hybrid and dry technologies, advanced fill media, and corrosion-resistant materials). Fast-growing sustainability and water-efficiency mandates open market share for hybrid/wet-dry and air-cooled solutions, water-recovery and zero-liquid-discharge integrations, and digitalization (condition monitoring, predictive maintenance) that reduce OPEX and extend asset life.

Type Insights

The open circuit segment led the market with the largest revenue share of 42.3% in 2024. Open-circuit cooling towers grow because they are the most thermally efficient and cost-effective solution for large evaporative heat rejection needs, especially in power plants, petrochemical, and industrial process applications. Their relative simplicity, proven technology base, and lower capital cost per unit of heat rejected make them the default choice where water availability is adequate and plume/drift can be managed.

The hybrid segment is expected to grow at the fastest CAGR of 4.5% from 2025 to 2033. Hybrid cooling systems gain traction as a compromise solution combining evaporative efficiency with dry or closed-circuit performance to address plume, water-use, and noise constraints simultaneously. Hybrids are increasingly specified on coastal urban projects, near airports, or in water-stressed regions where regulatory constraints limit purely evaporative solutions.

Material Insights

The FRP segment led the market with the largest revenue share of 28.2% in 2024, driven by the material’s superior corrosion resistance and light weight, which reduces lifecycle maintenance costs in saline and reclaimed-water environments common across the Middle East. Faster fabrication and modular factory-built cells shorten lead times versus cast-in-place alternatives, supporting rapid project schedules. FRP’s lower installation weight and improved thermal performance per unit volume also make it attractive for rooftop and retrofit applications where structural limits matter.

The HDPE segment is expected to grow at the fastest CAGR of 4.4% from 2025 to 2033. HDPE cooling towers are gaining traction for small-to-medium duty applications because of excellent chemical resistance, near-zero corrosion risk, and very low maintenance requirements. Their lightweight nature and modular factory manufacture simplify transportation and fast installation, making HDPE suitable for remote sites and temporary installations where ease of deployment is critical.

Application Insights

The industrial segment led the market with the largest revenue share of 29.0% in 2024. General industrial cooling-tower demand grows with diversification of manufacturing, mining, and heavy industry investments, where process cooling supports compressors, heat exchangers, and production lines. Cost-sensitive industries often opt for packaged towers that balance initial capex with manageable O&M. At the same time, specialized plants (chemical, steel, pulp & paper) require engineered towers with enhanced materials and water-treatment integration. Growth is additionally supported by aftermarket replacement cycles, digital monitoring for predictive maintenance, and localized fabrication capacity that shortens lead times.

The HVAC applications segment is expected to grow at the fastest CAGR of 4.4% from 2025 to 2033. In HVAC applications, growth is driven by urban expansion, increased demand for district cooling, and rising standards for indoor comfort in commercial and hospitality developments. Large mixed-use complexes, data centers, and premium real-estate projects demand towers with low acoustic signatures, compact footprints, and high thermal efficiency to integrate with central chilled-water plants.

Country Insights

Saudi Arabia Middle East Cooling Tower Market Trends

Saudi Arabia dominated the market with the largest revenue share of 51.5% in 2024. Saudi Arabia’s market is primarily driven by mega energy and petrochemical projects under national diversification plans and Vision 2030 initiatives. Large refinery expansions, new petrochemical complexes, and growing desalination capacity create demand for both large field-erected towers and packaged replacements.

UAE Middle East Cooling Tower Market Trends

The cooling tower market in the UAE is expected to expand with the fastest CAGR of 3.5% from 2025 to 2033. The UAE market benefits from a dense mix of commercial, hospitality, and industrial projects concentrated in Dubai and Abu Dhabi, stimulating significant demand for cooling towers in district cooling and central plant applications. High-rise commercial buildings, data centers, and integrated resorts require towers with low noise, plume control, and compact footprints compatible with urban regulations. Moreover, the availability of skilled contracting firms and an active rental and MEP market enables quicker turnkey deployments and retrofit campaigns.

Key Middle East Cooling Tower Company Insights

Some of the key players operating in the market include Baltimore Aircoil Company (BAC) and SPX Cooling Technologies.

-

SPX Cooling Technologies, part of SPX Corporation, headquartered in the U.S., global provider of thermal management solutions. The company’s Marley brand is particularly recognized in the cooling tower market, supplying induced-draft and crossflow designs for both packaged and field-erected applications. Its portfolio spans power generation, HVAC, and industrial process cooling, with a focus on proven thermal performance and reliability.

-

Baltimore Aircoil Company, a member of the Amsted Industries family, is an international leader in evaporative heat-transfer equipment with a strong reputation for innovation and efficiency. The company offers a wide portfolio of cooling towers, closed-circuit fluid coolers, and hybrid solutions tailored to both industrial and commercial environments. Its products emphasize reduced water and energy consumption, low acoustic output, and compliance with sustainability goals.

In recent years, companies active in the Middle East cooling tower industry have pursued a blend of strategic actions aimed at strengthening their competitive positions, improving technology offerings, and expanding regional presence. Many players are focusing on partnerships with contractors and industrial operators, selective capacity expansions, and product enhancements that emphasize durability and efficiency in harsh climates. There has also been a noticeable shift toward integrating smarter drive solutions, sustainable materials, and modular tower designs that can meet both industrial and HVAC needs.

Key Middle East Cooling Tower Companies:

- SPX Cooling Technologies

- Baltimore Aircoil Company (BAC)

- EVAPCO, Inc.

- GEA Group

- John Cockerill

- Thermax Limited

- Daikin Applied

- Tower Thermal

- HCTC Cooling Equipment Trading Company

- Delta Cooling Towers

Recent Developments

-

In July 2025, SPG Dry Cooling announced the opening of its new office in Dubai to serve the Middle East and Africa (MEA) region, expanding its global footprint to over 23 locations. The company aims to strengthen its presence across sectors such as power generation, gas, LNG, renewables, industrial facilities, and data centers. Biju Hari will lead MEA operations, focusing on delivering advanced cooling solutions and better local service.

Middle East Cooling Tower Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 385.9 million

Revenue forecast in 2033

USD 504.0 million

Growth rate

CAGR of 3.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, material, application, country

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Oman; Qatar

Key companies profiled

SPX Cooling Technologies; Baltimore Aircoil Company (BAC); EVAPCO, Inc.; GEA Group; John Cockerill; Thermax Limited; Daikin Applied; Tower Thermal; HCTC Cooling Equipment Trading Company; Delta Cooling Towers.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Cooling Tower Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East cooling tower market report based on type, material, application, and country:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Open Circuit

-

Closed Circuit

-

Hybrid

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

FRP

-

Steel

-

Wood

-

Concrete

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

HVAC

-

Power Generation

-

Oil & Gas

-

Industrial

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Saudi Arabia

-

Oman

-

UAE

-

Qatar

-

Frequently Asked Questions About This Report

b. The Middle East cooling tower market size was estimated at USD 377.5 million in 2024 and is expected to be USD 385.9 million in 2025.

b. The Middle East cooling tower market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.4% from 2025 to 2033 to reach USD 504.0 million by 2033.

b. The Saudi Arabia cooling tower market held the largest regional share of the market accounting for 51.5% in 2024 fueled by large-scale oil, gas, petrochemical, and infrastructure projects, along with expanding mining and construction activity. Preference for OEMs with local assembly, spare parts support, and strong aftermarket services further drives market growth.

b. Some of the key players operating in the Middle East cooling tower market include SPX Cooling Technologies, Baltimore Aircoil Company (BAC), EVAPCO, Inc., GEA Group, John Cockerill, Thermax Limited, Daikin Applied, Tower Thermal, HCTC Cooling Equipment Trading Company, and Delta Cooling Towers.

b. The Middle East cooling tower market is driven by rising demand from power generation, oil & gas, and industrial sectors, alongside expanding commercial and HVAC applications. Growing emphasis on energy efficiency, water conservation, and durable materials suited for harsh climates further supports market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.