- Home

- »

- Power Generation & Storage

- »

-

Middle East Energy As A Service Market Size Report, 2033GVR Report cover

![Middle East Energy As A Service Market Size, Share & Trends Report]()

Middle East Energy As A Service Market (2025 - 2033) Size, Share & Trends Analysis Report By Service Type (Supply Services, Demand Services), By End Use (Industrial, Commercial), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-722-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Energy As A Service Market Summary

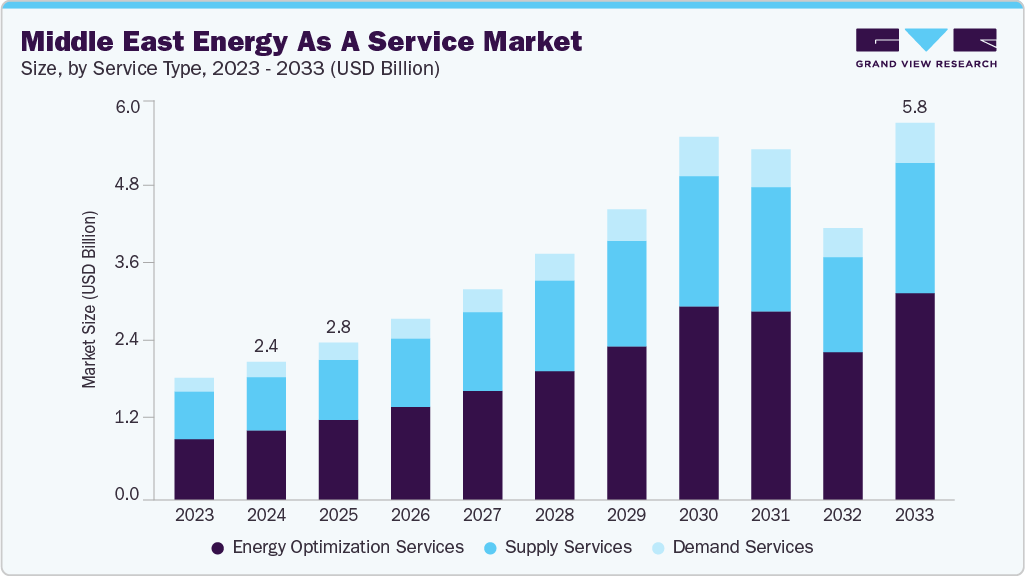

The Middle East energy as a service market was estimated at USD 2.44 billion in 2024 and is projected to reach USD 5.83 billion by 2033, growing at a CAGR of 9.4% from 2025 to 2033. EaaS is rapidly gaining momentum in the region as businesses, governments, and utilities seek cost-effective, flexible, and sustainable energy solutions without the burden of upfront capital investments.

Key Market Trends & Insights

- Saudi Arabia dominated the energy as a service market with the largest revenue share of 35.76 % in 2024.

- The energy as a service market in the Middle East is expected to grow at a significant CAGR over the forecast period.

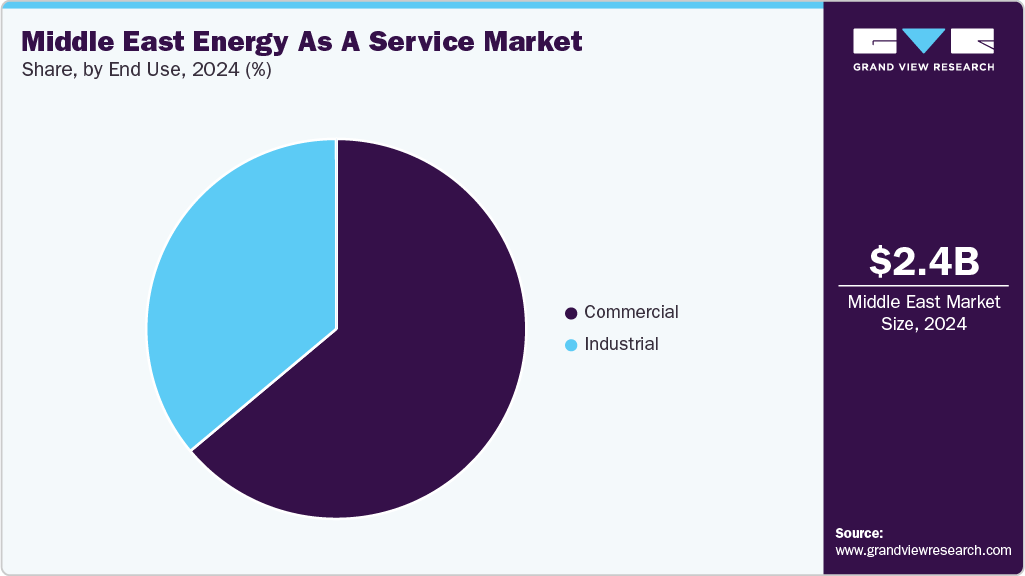

- By end use, the commercial segment led the market with the largest revenue share of 63.92% in 2024.

- Based on service type, the energy optimization services segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.44 Billion

- 2033 Projected Market Size: USD 5.83 Billion

- CAGR (2025-2033): 9.4%

- Saudi Arabia: Largest market in 2024

- Saudi Arabia: Fastest growing market

Under models such as energy supply, energy efficiency, and operational & maintenance services, EaaS providers are enabling enterprises to decarbonize operations, improve energy resilience, and align with sustainability goals. National strategies such as Saudi Vision 2030, the UAE's Energy Strategy 2050, and Qatar's National Vision 2030 create strong demand for innovative service-based models that integrate renewable power, distributed energy resources, and digital energy management platforms to drive operational efficiency and reduce carbon footprints.

Market growth is further supported by rising electricity demand, the acceleration of renewable integration, and the digital transformation of energy infrastructure across the GCC and wider Middle East. Commercial and industrial sectors increasingly adopt EaaS to optimize energy costs while mitigating risks from fluctuating tariffs and grid reliability concerns. Advanced technologies, including IoT-based energy management systems, AI-driven predictive analytics, and blockchain-enabled trading platforms, are expanding the scope of EaaS offerings in the region.

Moreover, public-private partnerships, green financing schemes, and corporate net-zero commitments fuel this model's investment. With key players such as ENGIE, Schneider Electric, Siemens, and Honeywell working alongside regional champions like Johnson Controls, Yellow Door Energy, and General Electric (GE), the Middle East energy as a service industry is positioned to emerge as a transformative driver of energy efficiency, sustainability, and innovation over the next decade.

Drivers, Opportunities & Restraints

The Middle East energy-as-a-service industry is primarily driven by rising demand for cost-effective and sustainable energy solutions, increasing electricity consumption, and ambitious national energy transition strategies. Governments in Saudi Arabia, the UAE, and Qatar are encouraging private sector participation in energy projects, creating favorable conditions for service-based models. EaaS adoption is also fueled by growing interest from commercial and industrial sectors seeking to reduce operational costs, hedge against volatile energy tariffs, and align with net-zero targets. Declining renewable energy generation costs and digitalization of energy infrastructure further enhance the appeal of EaaS models by enabling efficient, scalable, and performance-based solutions.

Opportunities in the market are expanding across utility-scale renewable integration, distributed energy solutions for commercial and industrial clients, and advanced energy efficiency services. Integrating IoT-enabled monitoring systems, AI-driven predictive analytics, and blockchain-based energy trading platforms opens new avenues for optimizing energy use and improving transparency. Hybrid EaaS models that combine solar PV, battery storage, and digital energy management systems are particularly well-suited to the Middle East’s energy-intensive industries and data center growth. In addition, innovative financing mechanisms, public-private partnerships, and corporate sustainability commitments are unlocking new investment flows. However, the market faces high initial service deployment costs, limited regulatory frameworks supporting third-party energy ownership, and fragmented policies across different countries. Challenges also include reliance on foreign technology providers and the need for robust cybersecurity measures to protect digital energy platforms, which could slow down large-scale EaaS adoption in the region.

Service Type Insights

The energy optimization services segment led the market with the largest revenue share of 51.25% in 2024. This dominance is attributed to the growing need for efficient energy management across regional commercial, industrial, and utility-scale facilities. Businesses increasingly use energy optimization solutions to reduce operational costs, improve system performance, and comply with national energy efficiency standards. With countries like Saudi Arabia, the UAE, and Qatar driving ambitious sustainability and diversification programs, energy optimization services play a pivotal role in balancing demand, reducing wastage, and maximizing the efficiency of renewable integration. Adopting smart meters, IoT-enabled sensors, and AI-driven analytics further strengthens this segment’s leadership by providing real-time monitoring, predictive maintenance, and performance-based contracting.

Strong government mandates for energy efficiency audits, corporate sustainability commitments, and rising electricity costs are fueling demand for energy optimization services. Partnerships between regional utilities and global technology providers are accelerating the deployment of digital energy platforms that enable automated load management, demand response, and peak shaving. Moreover, the increasing penetration of distributed generation sources such as rooftop solar and battery storage enhances the need for optimization to ensure stable and cost-effective operations. While other EaaS service types, such as energy supply and analytics, are also gaining traction, energy optimization remains the backbone of the market, offering immediate cost savings and long-term sustainability benefits. This entrenched position ensures its continued dominance in the Middle East EaaS landscape over the forecast period.

End Use Insights

The commercial segment led the market with the largest revenue share of 63.92% in 2024 and is expected to grow at the fastest CAGR over the forecast period. The strong uptake in this segment is driven by the rapid expansion of commercial infrastructure, including shopping malls, hotels, airports, office complexes, and healthcare facilities across the region. These establishments face rising electricity costs, ambitious sustainability targets, and pressure to reduce carbon emissions, making EaaS solutions an attractive pathway to achieve both energy efficiency and financial savings. With advanced digital platforms and smart energy management tools, commercial users increasingly adopt energy optimization, demand response, and distributed generation solutions under flexible service-based models that eliminate the need for heavy upfront investments.

The commercial sector’s leadership is further reinforced by national diversification strategies, especially in Saudi Arabia, the UAE, and Qatar, which emphasize sustainable urban development and smart city initiatives. Service providers offer customized performance-based contracts that guarantee cost savings and operational efficiency, appealing to businesses seeking predictable energy expenses. Integration of rooftop solar PV, battery storage, and intelligent building management systems under EaaS frameworks is also gaining traction, enabling commercial entities to reduce grid dependency while improving resilience. As sustainability-linked financing grows in the region and corporate ESG commitments tighten, the commercial End Use segment is expected to remain the backbone of the Middle East EaaS market, offering economic and environmental advantages for a rapidly expanding service-based energy ecosystem.

Country Insights

Saudi Arabia dominated the Middle East energy as a service market with the largest revenue share of 35.76% in 2024, driven by rapid clean energy diversification and giga-projects under Vision 2030. The Kingdom is adopting EaaS models across commercial, industrial, and public sectors to enable cost-effective energy management, particularly for NEOM, The Line, and other mega-infrastructure projects. Service providers are integrating rooftop solar, efficiency upgrades, and distributed energy resources through performance-based contracts that minimize upfront capital risks. Backed by strong policy support, sovereign funding, and corporate ESG commitments, Saudi Arabia is positioned as the region's leading hub for energy service innovation.

The UAE energy as a service market accounted for the largest market revenue share of 34.85% in the Middle East EaaS market in 2024, ranking as a close second to Saudi Arabia. Its leadership stems from progressive policies under the UAE Energy Strategy 2050, prioritizing demand-side efficiency and service-based renewable integration. Dubai's Shams initiative and Abu Dhabi's smart grid modernization efforts encourage businesses to shift towards EaaS models to optimize consumption and reduce emissions. Commercial buildings, shopping complexes, and hospitality sectors are leading adopters, leveraging energy service contracts for solar deployment, HVAC upgrades, and advanced metering. With Expo City Dubai and Johnson Controls spearheading sustainable urban development, the UAE continues to drive strong EaaS uptake across the Gulf.

The energy as a service market in Israel is emerging as a frontrunner in distributed and digitally enabled EaaS adoption, supported by its advanced technology ecosystem. The country prioritizes solar-plus-service models for urban and commercial facilities, where land constraints and grid challenges demand efficient distributed solutions. Competitive tenders and regulatory frameworks encourage service providers to offer innovative contracts covering solar, storage, and efficiency solutions. Moreover, Israel's strong R&D capabilities fuel advancements in AI-driven energy management platforms, long-term service contracting, and grid optimization services. This positions Israel as a regional leader in innovation-driven EaaS growth, especially for the commercial and tech-driven sectors.

The Oman energy as a service market is steadily expanding its market in alignment with Vision 2040 and ongoing renewable initiatives. Energy-as-a-service models are being deployed to manage consumption in commercial establishments, industrial parks, and remote infrastructure, reducing reliance on costly grid extensions. Hybrid service contracts integrating solar, wind, and battery storage are particularly gaining traction in the Dhofar and Al Wusta regions. Moreover, Oman's Hydrogen Oman (Hydrom) initiative creates opportunities for service providers to structure long-term energy supply agreements for hydrogen-linked projects. While regulatory reforms are evolving, rising private participation and international partnerships are expected to accelerate Oman's EaaS adoption in the coming decade.

The energy as a service market in Qatar is gradually growing, supported by its clean energy vision under the Qatar National Vision 2030. The country is integrating EaaS models into commercial and institutional sectors, particularly through solar-powered initiatives such as the Al Kharsaah project. Service-based solutions enable organizations to reduce carbon footprints while maintaining operational efficiency, particularly by preparing for sustainability-linked global events and corporate reporting standards. Though natural gas continues dominating Qatar's energy mix, the government encourages diversification through EaaS-driven efficiency, demand-side management, and digital smart energy systems. This creates opportunities for steady adoption across both commercial and industrial facilities.

Key Middle East Energy as a Service Company Insights

Some of the key players operating in the Middle East energy as a service industry include Schneider Electric, Siemens, Johnson Controls, Honeywell International Inc., General Electric (GE), Ameresco, The National Energy Services Company (Tarshid), Yellow Door Energy, Enerwhere Sustainable Energy DMCC, and Enviromena Power Systems, among others. These companies are driving the adoption of energy efficiency solutions, distributed renewable energy, and demand-side management services across the region, catering to diverse end uses from commercial establishments to industrial hubs.

Key Middle East Energy as a Service Companies:

- Schneider Electric

- Siemens

- Ameresco

- General Electric (GE)

- Honeywell International Inc.

- Johnson Controls

- The National Energy Services Company (Tarshid)

- Yellow Door Energy

- Enerwhere Sustainable Energy DMCC

- Enviromena Power Systems

Recent Developments

- In March 2025, Ameresco strengthened its footprint in the Middle East Energy as a Service (EaaS) market by securing a landmark contract to supply 7.8 GWh of battery energy storage systems (BESS) to Saudi Electricity Company (SEC) and Al Gihaz Holding. This agreement represents one of the largest storage deals in the region to date and underscores Ameresco’s growing role in enabling Saudi Arabia’s clean energy transition under Vision 2030.

Middle East Energy as a Service Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.84 billion

Revenue forecast in 2033

USD 5.83 billion

Growth rate

CAGR of 9.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Service type, end use, country

Regional scope

Middle East

Country scope

UAE; Saudi Arabia; Israel; Oman; Qatar

Key companies profiled

Schneider Electric; Siemens; Ameresco; General Electric (GE); Honeywell International Inc.; Johnson Controls; The National Energy Services Company (Tarshid); Yellow Door Energy; Enerwhere Sustainable Energy DMCC; Enviromena Power Systems

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Energy As A Service Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East energy as a service market report based on the service type, end use, and country:

-

Service Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Supply services

-

Demand services

-

Energy optimization services

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Industrial

-

Commercial

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Middle East

-

UAE

-

Saudi Arabia

-

Israel

-

Oman

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The Middle East Energy as a service market was estimated at USD 2.44 billion in 2024 and is expected to reach USD 2.84 billion in 2025.

b. The Middle East Energy as a service market is expected to grow at a compound annual growth rate of 9.4% from 2025 to 2033 to reach USD 5.83 billion by 2033.

b. Based on the end-user segment, the commercial sector held the largest revenue share in the Middle East Energy as a Service (EaaS) market in 2024, supported by rising demand from shopping malls, business districts, hotels, data centers, and other large-scale facilities.

b. Some of the key vendors operating in the Middle East Energy as a service market include Schneider Electric, Siemens, Ameresco, General Electric (GE), Honeywell International Inc., Johnson Controls, The National Energy Services Company (Tarshid), Yellow Door Energy, Enerwhere Sustainable Energy DMCC, and Enviromena Power Systems, among others.

b. The key factors driving the Middle East Energy as a Service (EaaS) market include the region’s accelerating integration of renewable energy, ambitious government-led decarbonization strategies, and the urgent need for reliable grid stability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.