- Home

- »

- Advanced Interior Materials

- »

-

Middle East Energy Efficient Windows Market Report, 2033GVR Report cover

![Middle East Energy Efficient Windows Market Size, Share & Trends Report]()

Middle East Energy Efficient Windows Market (2025 - 2033) Size, Share & Trends Analysis Report By Glazing (Double, Triple), By End-use (Residential, Non-residential), By Country (Saudi Arabia, UAE, Egypt, Qatar, Kuwait), And Segment Forecasts

- Report ID: GVR-4-68040-718-4

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Energy Efficient Windows Market Summary

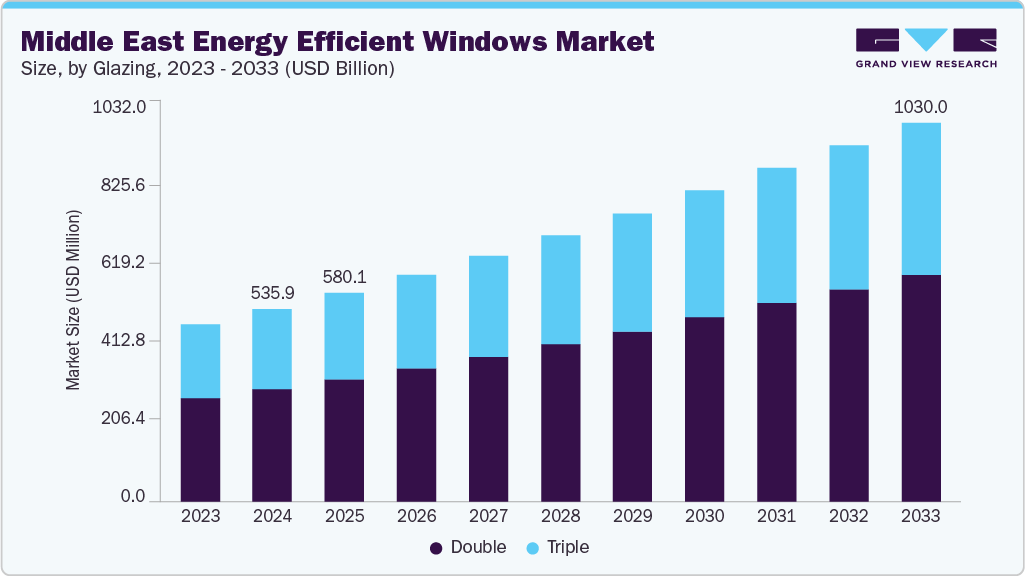

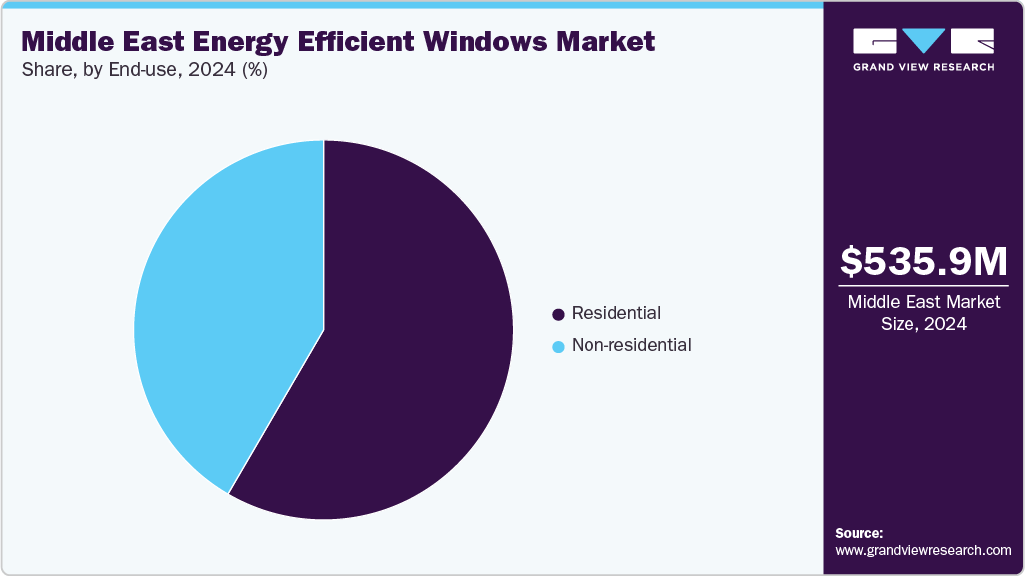

The Middle East energy efficient windows market size was estimated at USD 535.9 million in 2024 and is projected to reach USD 1,030.0 million by 2033, growing at a CAGR of 7.4% 2025 to 2033. The demand for energy-efficient windows in the Middle East is steadily rising due to increasing energy consumption in residential and commercial buildings.

Key Market Trends & Insights

- Saudi Arabia dominated the Middle East energy efficient windows market with the largest revenue share of 32.4% in 2024.

- By glazing, the double segment is expected to grow at the fastest CAGR of 8.0% from 2025 to 2033.

- By end use, the residential segment is expected to grow at the fastest CAGR of 8.1% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 535.9 Million

- 2033 Projected Market Size: USD 1,030.0 Million

- CAGR (2025-2033): 7.4%

- Saudi Arabia: Largest Market in 2024

- Egypt: Fastest growing market

With high dependence on air conditioning in hot climates, energy-efficient windows help reduce cooling costs and improve thermal comfort. The rising urbanization and infrastructure development across Saudi Arabia, the UAE, Qatar, and Kuwait are driving replacement and new installation demand. Growing consumer awareness about sustainability, coupled with increasing energy tariffs, is pushing adoption.

The key drivers of demand in the Middle East energy efficient windows industry include rising electricity costs, stricter building codes, and growing adoption of sustainable construction practices. Large-scale urban development projects, including Saudi Vision 2030, the UAE’s Net Zero 2050 strategy, and Qatar’s sustainable infrastructure push, are fueling demand for energy-efficient building materials. The hospitality and commercial real estate sector, which seeks to reduce operational costs, is increasingly incorporating such solutions. Technological advancements in glazing, frames, and coatings are making energy-efficient windows more accessible.

The market is witnessing innovations such as triple glazing, low-emissivity (Low-E) coatings, and advanced frame materials that enhance thermal insulation. Smart windows with tint-adjustable glass and integrated sensors are gaining traction in luxury projects. Local manufacturers are partnering with international players to bring in advanced technology while reducing costs. Retrofitting older buildings with energy-efficient windows is an emerging trend, especially in urban centers like Riyadh and Dubai. Furthermore, sustainable materials like recycled aluminum frames are being used in window manufacturing. Digital construction practices such as Building Information Modeling (BIM) are helping in precise design and energy efficiency assessments. These innovations align with regional sustainability goals and consumer preferences.

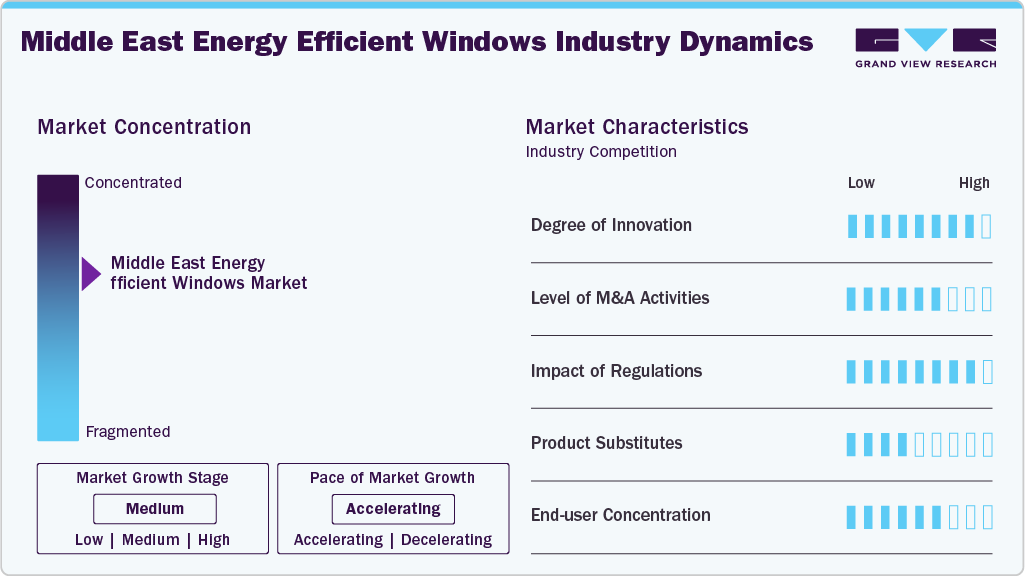

Market Concentration & Characteristics

The Middle East energy-efficient windows market is moderately concentrated, with a mix of regional manufacturers and global players. International brands dominate premium segments, while local producers cater to cost-sensitive buyers. Strategic partnerships, joint ventures, and distributor networks are common, helping international players expand across the region. The construction boom and large government-backed projects create opportunities for both established and new entrants. Competition is intensifying as energy efficiency regulations become stricter, pushing all players to innovate. Large-scale developers often prefer international brands, while small residential projects rely more on local suppliers.

The primary substitutes for energy-efficient windows include traditional double-glass windows, thermal insulation films, and shading systems such as blinds and external facades. However, these alternatives generally provide partial energy savings compared to high-performance windows. While cheaper options may appeal to budget-conscious buyers, growing awareness of long-term savings from energy-efficient windows limits substitution risk. Green building mandates also restrict the use of low-performing substitutes. Thus, while substitutes exist, their adoption is weaker in large-scale sustainable construction projects.

Glazing Insights

The double glazing segment held the highest revenue share of 49.7% in 2024, due to its balance of cost-effectiveness, thermal insulation, and wide availability. Many commercial and residential projects across the region continue to prefer double glazing as it provides significant energy savings by reducing heat transfer while remaining more affordable compared to advanced glazing systems. Builders and developers often adopt double glazing as the standard solution, especially in urban housing and mid-scale projects, where compliance with energy efficiency standards can be achieved without excessive cost escalation. This dominance is further reinforced by established supply chains and consumer familiarity with double-glazed solutions.

The triple glazing segment is expected to grow significantly at a CAGR of 7.3% over the forecast period, driven by rising demand for higher thermal insulation, noise reduction, and enhanced sustainability. With extreme climatic conditions and government initiatives pushing for green building certifications, triple glazing is increasingly being adopted in premium residential complexes, high-end commercial buildings, and smart city projects. Although its initial cost is higher, the long-term benefits in terms of energy efficiency and reduced HVAC expenses are driving its acceptance. Moreover, international manufacturers entering the region and local players expanding advanced product offerings are accelerating this trend, making triple glazing one of the fastest-growing segments in the regional energy-efficient windows market.

End-use Insights

The residential segment led the energy efficient windows market in Middle East with the highest revenue share of 58.4% in 2024, as rising urbanization, population growth, and increasing demand for modern housing have fueled adoption. Government-led housing projects, coupled with stricter energy efficiency regulations in the residential sector, have accelerated the use of double-glazed and low-emission windows to reduce electricity consumption from cooling systems. Homeowners and developers prefer energy-efficient windows not only for their thermal insulation but also for their noise reduction and security benefits, making them standard in urban apartments, villas, and gated communities. This dominance is expected to continue as residential construction remains a key focus across the region.

The non-residential segment is expected to grow at a significant CAGR of 6.5% over the forecast period, supported by expanding commercial, industrial, and institutional infrastructure. Large-scale investments in smart cities, office complexes, airports, and educational facilities are driving the demand for advanced glazing technologies that offer superior insulation and sustainability. Green building certifications, such as LEED and Estidama, are encouraging developers to integrate high-performance windows in non-residential projects. Additionally, increasing adoption of modern architectural designs with larger glass facades in the commercial sector is fueling the need for energy-efficient window solutions, positioning non-residential applications as one of the fastest-growing segments in the Middle East energy efficient windows industry.

Country Insights

The Middle East energy-efficient windows market is gaining traction as countries push toward sustainable development. Harsh climatic conditions across the region make advanced glazing technologies crucial for reducing cooling loads. Mega urban projects and smart city initiatives are integrating efficient windows as part of sustainability goals. Demand spans residential, commercial, and hospitality sectors, with premium adoption in high-rise projects. Global players are partnering with regional firms to strengthen their presence. Rising consumer awareness of energy conservation is further driving market growth.

Saudi Arabia Energy Efficient Windows Market Trends

Saudi Arabia represents the largest market for energy-efficient windows due to Vision 2030-driven infrastructure growth. Projects like NEOM, Red Sea Development, and Qiddiya prioritize green construction, creating high demand. The government enforces stricter building insulation codes, making efficient glazing essential. Rising urbanization and housing demand are further fueling installations. Both luxury and mass housing projects integrate such solutions for energy savings. Growing private sector involvement is also boosting the supply side.

UAE Energy Efficient Windows Market Trends

The UAE is a leader in sustainable construction adoption across the Middle East. Regulations such as Estidama Pearl Rating and Dubai Green Building Codes mandate energy-efficient windows in new projects. Luxury real estate, offices, and hospitality dominate demand in cities like Dubai and Abu Dhabi. Government initiatives toward Net Zero 2050 are encouraging widespread adoption. Ongoing infrastructure and residential projects continue to create opportunities for suppliers. International brands dominate premium projects, while local firms cater to mid-range demand.

Egypt Energy Efficient Windows Market Trends

Egypt is witnessing strong demand growth, driven by rapid urbanization and green city initiatives. Rising energy costs are pushing developers and consumers toward efficiency-focused construction materials. Mega projects like the New Administrative Capital integrate energy-efficient windows for sustainability. Residential housing projects also adopt efficient glazing to reduce long-term costs. Government efforts to promote sustainable practices are enhancing awareness. The market is expected to expand further as more projects seek certification.

Qatar Energy Efficient Windows Market Trends

Qatar’s focus on sustainable development under Vision 2030 strongly supports the adoption of energy-efficient windows. Hosting the FIFA World Cup 2022 accelerated the construction of eco-friendly stadiums and urban infrastructure. Commercial real estate, luxury hotels, and housing are key demand sectors. Government-backed sustainability initiatives are creating long-term opportunities. Developers increasingly prefer advanced glazing technologies to optimize cooling efficiency. Partnerships with global suppliers are expanding product availability in the country.

Kuwait Energy Efficient Windows Market Trends

Kuwait is gradually embracing energy-efficient windows as part of its sustainability drive. High reliance on air conditioning makes efficient glazing a cost-saving necessity. Government-led initiatives for energy diversification encourage adoption in new construction. Residential demand is rising with growing consumer awareness of energy savings. Commercial and institutional projects are increasingly specifying such products. The market is expected to gain momentum with stronger regulatory enforcement in the coming years.

Key Middle East Energy Efficient Windows Company Insights

Some of the key players operating in the market include Gulf Glass Industries, Q-NAP.

-

Based in the UAE, Gulf Glass Industries is a leading regional supplier of high-performance glazing solutions. The company focuses on energy-efficient glass products designed to reduce cooling loads in buildings. Its offerings cater to both commercial and residential construction projects in line with sustainable building codes.

-

Q-NAP, headquartered in Qatar, specializes in advanced coated and laminated glass solutions that improve thermal performance. The company supports energy-efficient construction aligned with Qatar National Vision 2030. Its products are widely used in modern infrastructure and high-rise developments.

Guardian Glass and Global Glass Solutions are some of the emerging participants in the energy efficient windows market.

-

Guardian Glass has a strong presence in the Middle East, supplying advanced glazing technologies for energy efficiency. Known for its low-emissivity (Low-E) glass, it serves iconic architectural projects across Saudi Arabia, the UAE, and beyond. The company’s innovations support regional sustainability goals and green building compliance.

-

Operating from Abu Dhabi, Global Glass Solutions provides sustainable, climate-adapted glazing systems for residential, commercial, and industrial projects. The firm emphasizes customized solutions for Middle Eastern conditions, ensuring energy savings and improved building comfort. It is gaining prominence through partnerships with developers and contractors.

Key Middle East Energy Efficient Windows Companies:

- Gulf Glass Industries

- Emirates Glass LLC

- Guardian Glass

- Q-NAP

- Saudi American Glass (SAG)

- Glaverbel Middle East

- Global Glass Solutions

- Building Envelope Solutions Ltd.

- Saint-Gobain Glass

- Asahi Glass Company (AGC)

Recent Developments

- In February 2025, Saint-Gobain completes the acquisition of Fosroc, a leading global construction chemicals player with a strong geographic footprint in India, the Middle East, and Asia Pacific in particular.

Middle East Energy Efficient Windows Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 580.1 million

Revenue forecast in 2033

USD 1,030.0 million

Growth rate

CAGR of 7.4% from 2025 to 2033

Base year for estimation

2024

Actual estimates/Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Glazing, end-use, country

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Egypt; Qatar; Kuwait

Key companies profiled

Gulf Glass Industries; Emirates Glass LLC; Guardian Glass; Q-NAP; Saudi American Glass (SAG); Glaverbel Middle East; Global Glass Solutions; Building Envelope Solutions Ltd.; Saint-Gobain Glass; Asahi Glass Company (AGC)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Energy Efficient Windows Market Report Segmentation

This report forecasts revenue growth at the regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East energy efficient windows market report based on glazing, end-use, and country:

-

Glazing Outlook (Revenue, USD Million, 2021 - 2033)

-

Double

-

Triple

-

Other Glazing

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Non-residential

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Qatar

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The Middle East energy efficient windows market size was estimated at USD 535.9 million in 2024 and is expected to reach USD 580.1 million in 2025.

b. The Middle East energy efficient windows market is expected to grow at a compound annual growth rate of 7.4% from 2025 to 2033 to reach USD 1,030.0 million by 2033.

b. The double glazing segment held the highest revenue market share, 49.7%, in 2024 due to its balance of cost-effectiveness, thermal insulation, and wide availability.

b. Some of the key players operating in the Middle East energy efficient windows market include Gulf Glass Industries, Emirates Glass LLC, Guardian Glass, Q-NAP, Saudi American Glass (SAG), Glaverbel Middle East, Global Glass Solutions, Building Envelope Solutions Ltd., Saint-Gobain Glass, and Asahi Glass Company (AGC).

b. Rising urbanization, strict energy efficiency regulations, growing green building initiatives, and increasing demand for thermal comfort in extreme climates are key factors driving the Middle East energy-efficient windows market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.