- Home

- »

- Next Generation Technologies

- »

-

Building Information Modeling Market, Industry Report, 2033GVR Report cover

![Building Information Modeling Market Size, Share & Trends Report]()

Building Information Modeling Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment, By Project Lifecycle, By Application, By Building Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-676-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Building Information Modeling Market Summary

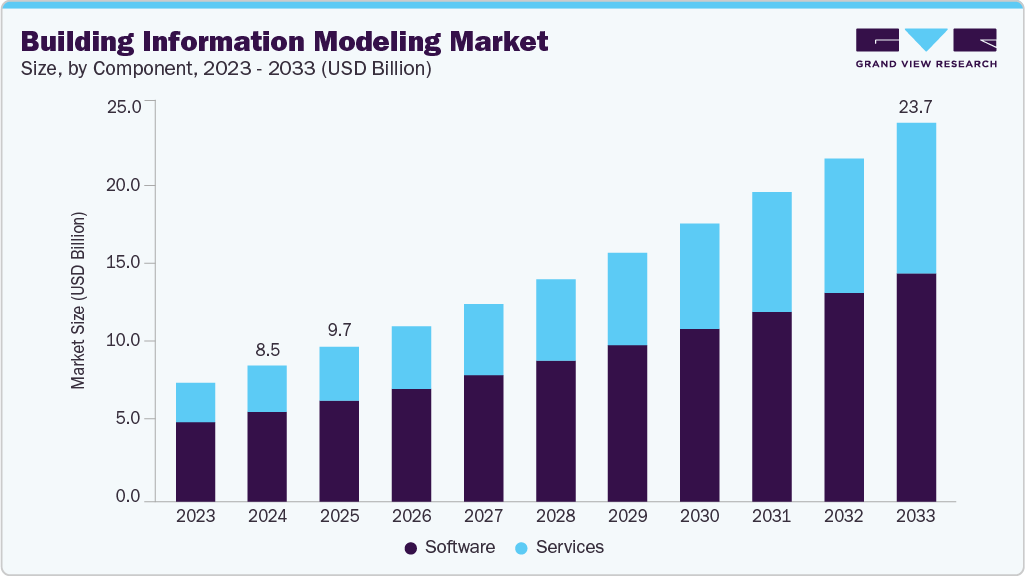

The global building information modeling market size was estimated at USD 8.53 billion in 2024 and is projected to reach USD 23.74 billion by 2033, growing at a CAGR of 11.8% from 2025 to 2033. The market growth is primarily driven by the integration of AI and machine learning, rising adoption of cloud-based BIM platforms, increased focus on sustainability and green building design, and expansion of BIM applications beyond design into asset management and operations.

Key Market Trends & Insights

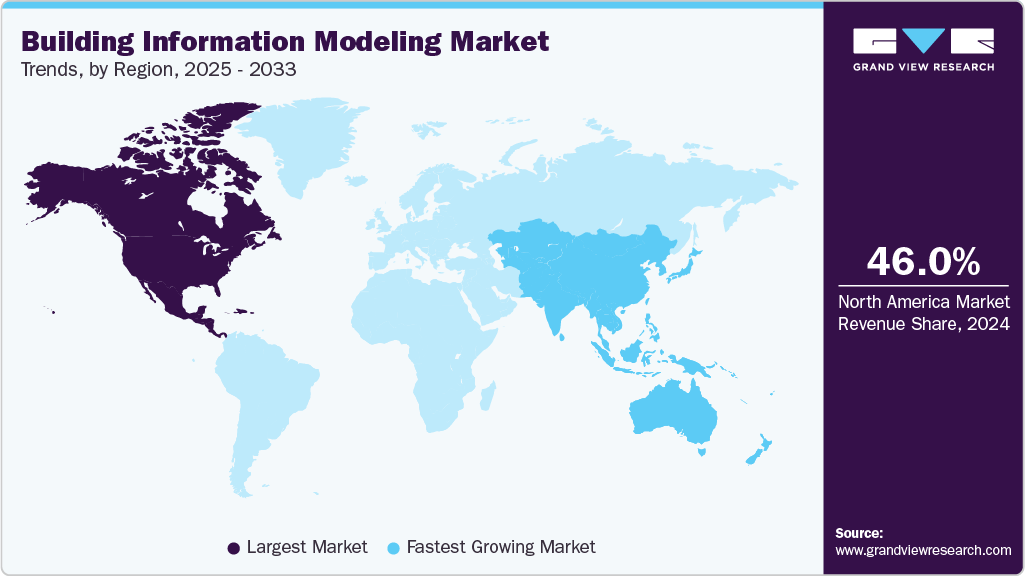

- North America dominated the global building information modeling market with the largest revenue share of 46.5% in 2024.

- The building information modeling industry in the U.S. led North America with the largest revenue share in 2024.

- By component, the software segment led the market, holding the largest revenue share of over 66.0% in 2024.

- By application, the designing segment held the dominant position with the largest revenue share of over 42.0% in 2024.

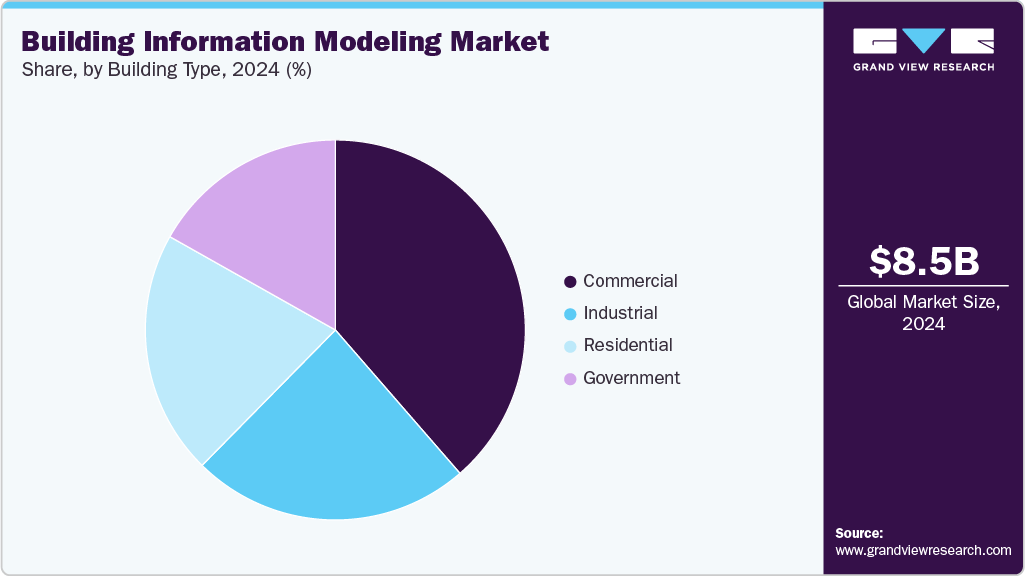

- By building type, the residential segment is expected to grow at the fastest CAGR of 13.6% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 8.53 Billion

- 2033 Projected Market Size: USD 23.74 Billion

- CAGR (2025-2033): 11.8%

- North America: Largest market in 2024

The building information modeling industry is increasingly integrating artificial intelligence (AI) and machine learning (ML) to automate routine tasks such as clash detection, predictive maintenance, and design optimization. These technologies enable smarter decision-making by analyzing vast datasets derived from building models. The adoption of AI in BIM is also helping project stakeholders reduce errors, cut down construction delays, and improve cost efficiency. As a result, the BIM industry is shifting toward more intelligent, data-driven construction management platforms.The building information modeling industry is witnessing a robust shift toward cloud-based platforms, enabling real-time collaboration among stakeholders across different geographies. Cloud BIM solutions offer centralized access to models, enhance data security, and allow version control throughout the project lifecycle. This trend is particularly gaining traction among firms aiming to reduce on-site IT infrastructure and enable remote work. Consequently, the BIM industry is embracing Software-as-a-Service (SaaS) models to drive agility, scalability, and faster project delivery.

Governments across the globe are mandating the use of BIM in public infrastructure projects, accelerating its adoption within the Building Information Modeling industry. These mandates aim to improve transparency, reduce project overruns, and ensure standardized documentation. For instance, countries like the UK, Singapore, and the UAE have already implemented BIM requirements for large-scale developments. The BIM industry is responding by aligning solutions with national digital construction strategies and compliance standards.

The increasing demand for time and cost integration is accelerating the adoption of 4D (scheduling) and 5D (cost estimation) functionalities in the Building Information Modeling industry. These capabilities offer greater project visibility, enabling better planning, resource allocation, and budget control. Project managers can simulate timelines and detect potential delays or cost overruns before construction begins. This trend is enhancing project predictability and reinforcing BIM's role in strategic construction management.

Component Insights

The software segment dominated the building information modeling market with a share of 66.0% in 2024, driven by the rising need for advanced design, planning, and simulation tools across the construction value chain. The increasing adoption of cloud-based BIM platforms is enabling real-time collaboration, remote access, and version control, especially for geographically dispersed project teams. Software providers are also integrating AI, machine learning, and analytics to enhance model intelligence, automate repetitive tasks, and improve decision-making accuracy. Additionally, demand is rising for 4D/5D BIM capabilities, linking models to project timelines and cost estimates, which is helping firms optimize project planning and reduce budget overruns.

The services segment is expected to register the fastest CAGR of over 13% from 2025 to 2033, owing to the rising complexity of construction projects and the growing need for digital transformation. Organizations are increasingly turning to specialized BIM service providers for consulting, integration, and training support to ensure seamless adoption and alignment with project goals. As regulatory requirements, sustainability mandates, and client expectations intensify, firms are seeking tailored services that go beyond software deployment to offer strategic guidance and process optimization. This is especially evident in large-scale infrastructure and public sector projects, where BIM implementation must meet stringent compliance and interoperability standards.

Deployment Insights

The on-premises segment dominated the building information modeling industry in 2024, primarily driven by the need for enhanced data security, regulatory compliance, and full control over IT infrastructure. This deployment model is particularly favored by large enterprises, defense contractors, and government agencies handling sensitive construction data. On-premises solutions allow for deeper customization, integration with legacy systems, and consistent performance in environments with limited internet connectivity. Despite the growing popularity of cloud-based BIM, the industry is still investing in robust on-premises offerings to serve clients with strict operational and security requirements.

The cloud segment is expected to grow at the fastest CAGR in the coming years, driven by the increasing need for remote collaboration, cost efficiency, and operational flexibility. Cloud-based BIM solutions enable seamless access and real-time updates to 3D models, allowing architects, engineers, and contractors to work together across locations without disruption. These platforms reduce reliance on internal IT systems while offering scalability, automatic backups, and secure data storage. As digital workflows become the norm in construction and infrastructure projects, the cloud segment is playing a central role in modernizing how Building Information Modeling is deployed and managed.

Project Lifecycle Insights

The pre-construction segment dominated the building information modeling market in 2024, driven by the increasing demand for early-stage project accuracy, cost control, and design coordination. BIM enables detailed visualization, clash detection, and simulation before actual construction begins, significantly reducing the likelihood of design errors and changing orders. Project teams are using BIM tools to improve stakeholder alignment, streamline approvals, and generate more reliable cost and time estimates. As developers and contractors prioritize efficiency and risk reduction, Building Information Modeling is becoming a critical asset in the pre-construction planning process.

The operation segment is expected to grow at the fastest CAGR in the coming years, driven by the increasing demand for lifecycle asset management, energy efficiency, and predictive maintenance. Building Information Modeling is being leveraged beyond construction to support facilities management by offering a centralized digital record of building systems, components, and performance data. Owners and operators use BIM to streamline maintenance schedules, optimize space utilization, and make data-driven decisions that extend the life of assets. As smart buildings and digital twins gain traction, BIM is becoming a valuable tool for managing complex infrastructure throughout its operational phase.

Application Insights

The designing segment led the building information modeling industry in 2024, driven by the growing need for precision, innovation, and real-time collaboration. The increasing emphasis on accurate planning, seamless coordination among stakeholders, and creative architectural solutions is propelling demand within this segment. Architects and engineers are using BIM to create detailed, data-rich 3D models that improve design accuracy, detect spatial conflicts early, and support seamless interdisciplinary coordination. As project complexity rises, Building Information Modeling is transforming the design process into a more dynamic, collaborative, and efficient workflow.

The asset management segment is expected to grow at the fastest CAGR in the coming years, owing to the growing demand for data-driven facilities management, operational efficiency, and long-term cost control. Building Information Modeling enables facility owners and operators to maintain a comprehensive digital record of building assets, including equipment specifications, maintenance histories, and spatial data. This centralized model supports preventive maintenance, lifecycle planning, and seamless integration with IoT and building automation systems. As infrastructure owners shift focus from just construction to total lifecycle value, BIM is becoming a key enabler of smart and sustainable asset management strategies.

Building Type Insights

The commercial segment dominated the market in 2024, driven by rising demand for complex, high-performance buildings with advanced functionalities. The use of building information modeling is accelerating in projects like office towers, retail hubs, and mixed-use developments to improve design precision, streamline collaboration, and optimize long-term performance. Commercial developers are using BIM to streamline the design and construction of office buildings, retail centers, hotels, and mixed-use developments, ensuring precision, efficiency, and compliance with sustainability standards. As commercial real estate projects become more ambitious and tech-integrated, Building Information Modeling is proving essential for managing complexity and delivering value across the project lifecycle.

The residential segment is expected to grow at the fastest CAGR in the coming years, owing to the rising need for affordable, sustainable, and efficiently planned housing. BIM allows developers and architects to visualize designs in detail, optimize space usage, and identify potential issues before construction begins, reducing costly rework. It also enables better coordination among project stakeholders, accelerating timelines and improving overall construction quality. As residential construction adapts to rapid urbanization and evolving homeowner expectations, BIM is becoming a critical tool for delivering smart, cost-effective, and future-ready housing solutions.

Regional Insights

The North America building information modeling market held the leading revenue share of over 46% in 2024, driven by technological innovation and advanced construction practices. North America continues to experience steady growth in BIM adoption. The region benefits from a strong presence of leading software vendors and a mature AEC industry, which accelerates implementation across commercial and infrastructure projects. Additionally, government support for smart city initiatives is further propelling the use of BIM in public sector construction.

U.S. Building Information Modeling Market Trends

The U.S. building information modeling industry held the largest revenue share of over 66.0% in 2024, primarily driven by federal mandates for digital construction and the urgency to upgrade aging infrastructure. The U.S. market is witnessing steady growth. BIM is being widely adopted in large-scale transportation, healthcare, and education projects to enhance cost control and streamline project coordination. The country also leads in integrating BIM with advanced technologies like digital twins and artificial intelligence, further strengthening its position in the global market.

Europe Building Information Modeling Market Trends

The Europe building information modeling industry is expected to grow at a CAGR of over 10.0% from 2025 to 2033. the growing demand for digitalization in public infrastructure and transportation is driving rapid BIM adoption across Europe. Governments and local authorities are increasingly implementing BIM to modernize railways, road networks, and energy systems, aiming for improved asset management and lower lifecycle costs. As a result, BIM is expanding its influence beyond design and construction, playing a vital role in long-term operations and maintenance across the region.

The Germany building information modeling market is expected to grow at a significant rate in the coming years. the rising demand for efficient infrastructure development and high-quality engineering is accelerating BIM adoption in Germany. The national BIM roadmap is a key driver, promoting digital transformation within the construction sector, particularly in transport and energy initiatives. Strong collaboration between public institutions and private enterprises is further embedding BIM into large-scale development projects across the country.

The building information modeling market in the UK is expected to grow at a significant rate in the coming years. The push for greater project transparency and delivery efficiency is fueling BIM adoption in the UK. The government’s Level 2 BIM mandate has played a pivotal role by mandating digital workflows in public sector construction. With its advanced BIM maturity and ongoing innovation, the UK continues to set global standards that influence best practices worldwide.

Asia Pacific Building Information Modeling Market Trends

The Asia Pacific building information modeling industry is expected to grow at the fastest CAGR of over 16.0% from 2025 to 2033. The rising emphasis on sustainability and green building practices is emerging as a key driver of BIM adoption across Asia Pacific. Governments and developers are leveraging BIM to enhance energy modeling, reduce material waste, and ensure compliance with environmental standards. As ESG (Environmental, Social, and Governance) criteria become more central to construction planning, BIM is being increasingly used to support lifecycle assessments and sustainable design. This shift is reinforcing BIM’s role in creating eco-efficient infrastructure across the region.

The China building information modeling market is primarily fueled by large-scale infrastructure investments and ambitious smart city initiatives. China is rapidly becoming a key growth hub. The government mandates are promoting BIM adoption in public projects to drive standardization, minimize waste, and enhance asset lifecycle performance. Additionally, the domestic ecosystem is strengthening with the rise of homegrown BIM platforms and a growing pool of skilled professionals.

The building information modeling market in Japan is expected to grow, owing to a shrinking labor force and the growing need for construction automation. Japan is increasingly adopting measures to optimize project execution. Government initiatives are promoting BIM use in public infrastructure and urban redevelopment to improve efficiency and minimize reliance on manual labor. The country is also advancing the integration of BIM with robotics and prefabrication technologies, driving modernization across its construction industry.

Key Building Information Modeling Company Insights

Some of the key players operating in the market include Autodesk Inc. and Trimble Inc.

-

Autodesk Inc. is a global leader in the BIM market, known for its widely used solutions such as Revit, AutoCAD, and BIM 360. The company provides end-to-end BIM tools covering design, visualization, simulation, and project collaboration across architecture, engineering, and construction (AEC) sectors. Autodesk continues to lead the market through innovations in cloud-based BIM, AI integration, and sustainability features.

-

Trimble Inc. offers BIM-enabled hardware and software solutions, including Tekla Structures and SketchUp, along with field positioning systems. It connects the office and the jobsite through real-time collaboration and precision data capture, enhancing constructability and efficiency. Trimble’s strength lies in merging BIM with construction automation, laser scanning, and site control.

Asite Solutions Ltd. and Bimeye Inc. are some of the emerging market participants in the building information modeling market.

-

Bimeye Inc. provides cloud-based BIM data management platforms that bridge the gap between model information and project stakeholders. It enhances data collaboration, visualization, and coordination across architecture and construction teams. Bimeye is particularly valuable in model-to-field workflows, offering real-time data accessibility throughout the project.

-

Asite Solutions Ltd. offers a collaborative BIM platform that supports data sharing, common data environments (CDE), and full lifecycle asset management. The company focuses on streamlining communication and documentation across complex infrastructure and building projects. Asite’s scalable cloud platform is making it a rising player, especially in global, multi-stakeholder environments.

Key Building Information Modeling Companies:

The following are the leading companies in the building information modeling market. These companies collectively hold the largest market share and dictate industry trends.

- Autodesk Inc.

- Bentley Systems

- Trimble Inc.

- Dassault Systèmes

- Nemetschek Group

- Hexagon AB

- Topcon Positioning Systems Inc.

- AVEVA Group PLC

- Asite Solutions Ltd.

- Beck Technology

- Bimeye Inc.

- ACCA Software

Recent Developments

-

In April 2025, Conch Group partnered with the China Building Materials Federation and Huawei to launch an AI model tailored for the cement industry. The model applies Huawei’s Cloud Pangu AI to optimize processes like clinker strength prediction, coal usage reduction, and real-time anomaly detection. Over 200 use cases were identified across mining, production, safety, and logistics. This innovation aims to enhance operational efficiency, resource utilization, and accelerate digital transformation in the cement sector.

-

In March 2025, IFMA and Autodesk launched the Building Lifecycle Management Initiative (BLMI) to transform how building data is managed across its lifecycle. The initiative brings together stakeholders like facility managers, AEC professionals, and tech providers to align open standards and data interoperability. It promotes the use of tools such as BIM, digital twins, and AI to improve decision-making and operational efficiency. The goal is to extend asset life, reduce costs, support decarbonization, and enhance outcomes for tenants and investors.

-

In March 2025, Motif launched a cloud-based collaboration platform to advance the practical adoption of Building Information Modeling (BIM). The platform integrates 2D and 3D workflows into a unified environment with real-time model streaming from tools like Revit and Rhino. It enables live sketching, markups, and synced feedback, streamlining collaboration across design teams. Motif 1.0 aims to reduce friction in BIM processes and empower more connected, creative, and intelligent design workflows.

Building Information Modeling Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.70 billion

Revenue forecast in 2033

USD 23.74 billion

Growth rate

CAGR of 11.8% from 2025 to 2033

Base year of estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, project lifecycle, application, building type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Autodesk Inc.; Bentley Systems; Trimble Inc.; Dassault Systèmes; Nemetschek Group; Hexagon AB; Topcon Positioning Systems Inc.; AVEVA Group PLC; Asite Solutions Ltd.; Beck Technology; Bimeye Inc.; ACCA Software.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Building Information Modeling Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global building information modeling market report based on component, deployment, project lifecycle, application, building type, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

On-Premises

-

Cloud

-

-

Project Lifecycle Outlook (Revenue, USD Million, 2021 - 2033)

-

Pre-construction

-

Construction

-

Operation

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Designing

-

Planning and Modeling

-

Asset Management

-

Others

-

-

Building Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial

-

Industrial

-

Residential

-

Government

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

- Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global building information modeling market size was estimated at USD 8.53 billion in 2024 and is expected to reach USD 9.70 billion in 2025.

b. The global building information modeling market is expected to grow at a compound annual growth rate of 11.8% from 2025 to 2033 to reach USD 23.74 billion by 2033.

b. North America dominated the building information modeling market with a share of over 46% in 2024, owing to strong government mandates, early adoption of digital technologies, and a mature construction ecosystem. Continued investments in cloud-based BIM platforms and integration with digital twins are further accelerating growth across the region.

b. Some key players operating in the building information modeling market include Autodesk Inc., Bentley Systems, Trimble Inc., Dassault Systèmes, Nemetschek Group, Hexagon AB, Topcon Positioning Systems Inc., AVEVA Group PLC, Asite Solutions Ltd., Beck Technology, Bimeye Inc., and ACCA Software.

b. Key factors that are driving the market growth include driven by rising government mandates, increasing adoption of cloud-based solutions, and growing demand for sustainable construction practices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.