- Home

- »

- Plastics, Polymers & Resins

- »

-

Middle East Flame Retardants Market, Industry Report, 2033GVR Report cover

![Middle East Flame Retardants Market Size, Share & Trends Report]()

Middle East Flame Retardants Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Halogenated, Non Halogenated), By Application (Polyolefins, Epoxy resins, UPE, PVC), By End-use (Construction, Transportation), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-738-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Flame Retardants Market Summary

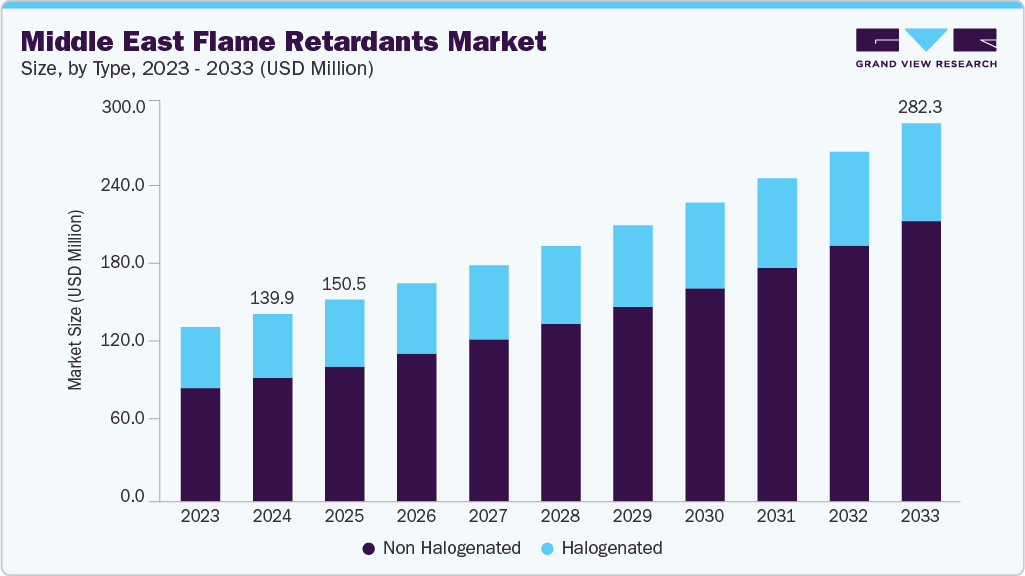

The Middle East flame retardants market size was estimated at USD 139.9 million in 2024 and is projected to reach USD 282.3 million by 2033, growing at a CAGR of 8.2% from 2025 to 2033. The market is driven by accelerating industrial applications and strengthening regulatory emphasis on fire safety.

Key Market Trends & Insights

- Saudi Arabia dominated the Middle East flame retardants market with the largest revenue share of 28.4% in 2024.

- By type, the non-halogenated segment dominated the market with a revenue share of 65.9% in 2024 and is expected to grow at the fastest CAGR over the forecast period.

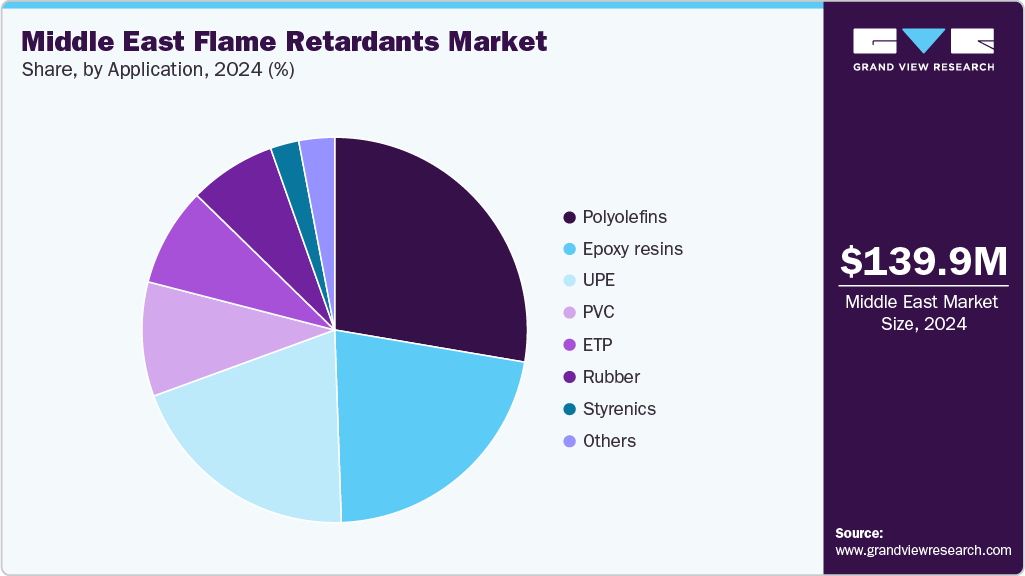

- By application, the polyolefins segment held the largest revenue share of 27.7% in 2024.

- By end-use, the electrical & electronics segment held the largest revenue share of 35.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 139.9 Million

- 2033 Projected Market Size: USD 282.3 Million

- CAGR (2025-2033): 8.2%

It is shaped primarily by regional government infrastructure initiatives and robust regulatory measures to enhance public safety and fire protection. A major driver for market growth in the Middle East is the increase in government spending on sustainable infrastructure, smart cities, and renewable-energy-capable buildings. Investments in mega-projects such as Saudi Arabia’s NEOM and an upsurge in smart urban infrastructure across the GCC necessitate adherence to the latest fire safety standards, fueling demand for modern flame-retardant technologies and solutions.

The NFPA and Aramco have signed a Memorandum of Understanding to develop fire, electrical, and life safety regulations in Saudi Arabia’s energy and petrochemicals sectors, emphasizing knowledge exchange, research, and the introduction of advanced fire-prevention technologies. Such initiatives accelerate the adoption of certified flame-retardant materials, strengthening compliance and creating growth opportunities for suppliers across the Middle East market. Government press releases and ministry websites frequently announce enhanced regulations mandating flame-retardant materials, especially in schools, hospitals, public transit, high-rise buildings, and critical infrastructure.

Product substitutes such as fire-resistant claddings, inherently flame-resistant polymers, and passive fire protection systems are gradually gaining traction in the Middle East. For instance, Fire-resistant (inherently non-combustible) cladding, made from materials such as mineral wool panels, fiber-cement boards (Euroclass A-rated), bricks, and concrete, does not ignite or lose structural integrity under fire, providing passive protection and reducing reliance on added flame retardants. However, while non-combustible, certain materials such as structural steel may lose significant strength at elevated temperatures unless adequately protected. In addition, bio-based halogen-free flame retardants developed for building applications, such as those creating protective char layers and releasing non-toxic gases under heat, point toward sustainable, regulatory-friendly alternatives.

Type Insights

The non-halogenated segment dominated the market with a revenue share of 65.9% in 2024 and is expected to grow at the fastest CAGR over the forecast period. This growth is driven by increasing regulatory and environmental pressure to reduce the use of halogenated compounds known for their persistence and toxicity. Non-halogenated flame retardants are favored for their superior ecological profile, lower smoke generation, and reduced toxicity, making them highly suitable for construction, electrical appliances, and transportation applications.

The halogenated segment is expected to grow at a CAGR of 4.9% during the forecast period. Despite increasing environmental concerns, halogenated flame retardants continue to be widely used due to their high efficiency in fire resistance and cost-effectiveness. The sustained demand for halogenated flame retardants is driven by their proven effectiveness in various industrial uses, the rising need for flame-resistant materials in automotive and electrical sectors, and ongoing investments in manufacturing industries across the Middle East.

Application Insights

The polyolefins segment dominated the market with a revenue share of 27.7% in 2024 and is expected to grow at the fastest CAGR over the forecast period. Polyolefins, including polyethylene and polypropylene, are widely used in various industries due to their versatility, cost-efficiency, and favorable mechanical properties. Their growing adoption in electrical insulation, automotive components, packaging, and construction materials underscores the demand for enhanced fire safety in these sectors. The rapid expansion of the electronics market and automotive industry in the Middle East, coupled with increasing urbanization and infrastructure development, drives the demand for flame-retardant polyolefins to ensure compliance with stringent fire safety regulations. The sustainable and recyclable attributes of polyolefins also align with regional green building initiatives, making this application segment a key growth area in the flame retardant market.

The epoxy resins segment is expected to grow at the second-fastest CAGR of 8.5% during the forecast. Due to their excellent mechanical strength, chemical resistance, and superior electrical insulating properties, epoxy resins are extensively used in coatings, adhesives, composites, and electrical laminates. Their increasing application in the electronics, automotive, and construction sectors in the Middle East is driving demand for flame-retardant epoxy resins. In addition, epoxy resins are preferred for their ability to enhance durability and safety in critical applications such as wind turbine blades, aerospace components, and electronic housings, further fueling market growth.

End-use Insights

The electrical & electronics segment dominated the market with a revenue share of 35.1% in 2024 and is expected to grow at the fastest CAGR over the forecast period. This growth is largely driven by the expanding electronics manufacturing and consumer electronics markets in the region, which demand high fire safety standards to protect delicate and valuable components. Flame retardants, particularly those used in epoxy resins, are critical in enhancing the fire resistance of circuit boards and connectors, ensuring device safety and reliability. Growing adoption of smart devices, increased use of electrical appliances in residential and commercial spaces and rising investments in industrial automation further boost this segment.

The construction segment is expected to grow at the second-fastest CAGR of 8.4% during the forecast. This growth is driven by the ongoing infrastructure development and urbanization in the Middle East, characterized by large-scale projects such as smart city initiatives, commercial complexes, and residential high-rises. Flame retardants are essential in construction materials to meet stringent fire safety codes and reduce the risk of fire hazards in buildings. Government regulations and building codes across the region increasingly mandate the use of flame-retardant materials in insulation, panels, coatings, and wiring systems to enhance occupant safety.

Regional Insights

Saudi Arabia dominated the Middle East flame retardants market with the largest revenue share of 28.4% in 2024. Saudi Arabia has emerged as the leading market for flame retardants in the Middle East, largely supported by its Vision 2030 agenda to diversify the economy and upgrade infrastructure. The surge in construction, industrial manufacturing, and electronics creates strong demand for advanced flame-retardant solutions. Mega-projects such as NEOM, the Red Sea Development, and other smart city initiatives strongly emphasize fire safety, driving the use of certified flame-retardant materials in buildings, electrical systems, and transportation. At the same time, the government’s updated building and fire safety codes encourage the adoption of eco-friendly, high-performance products.

UAE Flame Retardants Market Trends

The UAE is expected to be the fastest-growing market for flame retardants over the forecast period. The country’s ambitious urban development fuels this growth, smart city projects like Dubai South and Masdar City, and heavy investments in infrastructure and renewable energy. Strict fire safety regulations and rigorous building codes further strengthen demand for certified, high-performance flame-retardant materials, particularly in the construction, electrical, and automotive industries.

Key Middle East Flame Retardants Company Insights

Key players operating in the market include Albemarle Corporation, ICL, LANXESS, and CLARIANT.

- ICL is a global specialty chemicals and minerals company headquartered in Israel. It offers a wide range of flame retardants, including brominated, phosphorus-based, and inorganic solutions for automotive, electronics, textiles, and construction industries.

Key Middle East Flame Retardants Companies:

- Albemarle Corporation.

- ICL

- LANXESS

- CLARIANT

- Italmatch Chemicals S.p.A

- BASF

Recent Developments

-

In March 2024, Italmatch announced the inauguration of its new Middle East headquarters office in Dammam City, Saudi Arabia. This opening represents a significant milestone in Italmatch’s journey in the KSA and marks a strategic move to strengthen the company’s presence and growth opportunities across the Middle East region.

Middle East Flame Retardants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 150.5 million

Revenue forecast in 2033

USD 282.3 million

Growth rate

CAGR of 8.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, country

Regional scope

Middle East

Country scope

Oman; Kuwait; Saudi Arabia; UAE; Qatar; Bahrain; Israel

Key companies profiled

Albemarle Corporation; ICL; LANXESS; CLARIANT; Italmatch Chemicals S.p.A; BASF

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Flame Retardants Market Report Segmentation

This report forecasts revenue growth at, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the Middle East flame retardants market report based on type, application, end-use and country:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Halogenated

-

Brominated

-

Chlorinated Phosphates

-

Antimony Trioxide

-

Others

-

-

Non Halogenated

-

Aluminum Hydroxide

-

Magnesium Dihydroxide

-

Phosphorus Based

-

Others

-

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Polyolefins

-

Epoxy resins

-

UPE

-

PVC

-

ETP

-

Rubber

-

Styrenics

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Construction

-

Transportation

-

Electrical & Electronics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Middle East

-

Saudi Arabia

-

Oman

-

Kuwait

-

UAE

-

Qatar

-

Bahrain

-

Israel

-

RoME

-

-

Frequently Asked Questions About This Report

b. The Middle East flame retardants market size was estimated at USD 139.9 million in 2024 and is expected to reach USD 150.5 million in 2025.

b. The Middle East flame retardants market is expected to grow at a compound annual growth rate of 8.2% from 2025 to 2033 to reach USD 282.3 million by 2033.

b. Saudi Arabia dominated the Middle East flame retardants market with a share of 28.4% in 2024. The surge in construction, industrial manufacturing, and electronics creates strong demand for advanced flame-retardant solutions. Mega-projects like NEOM, the Red Sea Development, and other smart city initiatives strongly emphasize fire safety, driving the use of certified flame-retardant materials in buildings, electrical systems, and transportation.

b. Some key players operating in the Middle East flame retardants market include Albemarle Corporation, ICL, LANXESS, CLARIANT, Italmatch Chemicals S.p.A, and BASF.

b. Key factors that are driving the market growth include increasing accelerating industrial applications and strengthening regulatory emphasis on fire safety. It is shaped primarily by regional government infrastructure initiatives and robust regulatory measures to enhance public safety and fire protection.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.