- Home

- »

- Plastics, Polymers & Resins

- »

-

Middle East Flexible Packaging Market Size Report, 2033GVR Report cover

![Middle East Flexible Packaging Market Size, Share & Trends Report]()

Middle East Flexible Packaging Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Plastics, Paper, Metal, Bioplastics), By Product (Bags, Pouches, Rollstock, Films & Wraps), By Application, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-742-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Flexible Packaging Market Summary

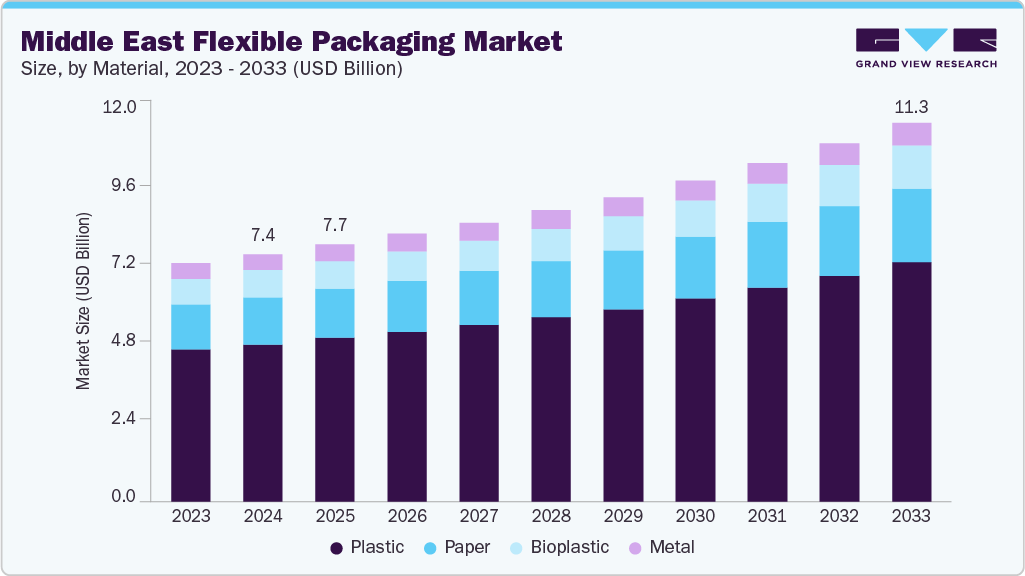

The Middle East flexible packaging market size was estimated at USD 7.36 billion in 2024 and is expected to reach USD 11.28 billion by 2033 and expand at a CAGR of 5.0% from 2025 to 2033. The market is driven by the rising demand for packaged food and beverages, supported by urbanization and changing consumer lifestyles.

Key Market Trends & Insights

- Saudi Arabia dominated the Middle East flexible packaging market with the largest revenue share of over 38.0% in 2024 and is expected to grow at a substantial CAGR of 5.3% from 2025 to 2033.

- By material, the bioplastic segment is expected to grow at a considerable CAGR of 5.6% from 2025 to 2033 in terms of revenue.

- By product, the pouches segment is expected to grow at a considerable CAGR of 5.5% from 2025 to 2033 in terms of revenue.

- By application, the pharmaceuticals & healthcare segment is expected to grow at a considerable CAGR of 5.9% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 7.36 Billion

- 2033 Projected Market Size: USD 11.28 Billion

- CAGR (2025-2033): 5.0%

- Saudi Arabia: Largest Market in 2024

In addition, growth in e-commerce, retail expansion, and increasing preference for sustainable, lightweight packaging solutions are fueling market adoption. The market is largely driven by the growth of the food and beverage (F&B) sector, which accounts for a significant share of packaging demand. With increasing urbanization, busy lifestyles, and a young population, there is growing consumption of ready-to-eat meals, snacks, and beverages that require convenient, lightweight, and cost-effective packaging solutions. For instance, the rising popularity of packaged dairy products in Saudi Arabia and the UAE, as well as the expansion of quick service restaurants (QSRs) across the Gulf Cooperation Council (GCC), is creating robust demand for pouches, films, and wraps. Flexible packaging offers longer shelf life, protection from contamination, and reduced transportation costs, making it ideal for the rapidly expanding processed food segment.

Sustainability has become a major driving factor, as regional governments and multinational FMCG brands are focusing on reducing plastic waste. Countries such as the UAE and Saudi Arabia have introduced restrictions on single-use plastics, pushing the packaging industry to adopt recyclable and bio-based materials. Flexible packaging formats such as mono-material films and recyclable polyethylene pouches are gaining traction as they align with the circular economy goals. For example, Unilever and Nestlé have launched recyclable flexible packaging for their food products in the region, catering to eco-conscious consumers. This sustainability push not only encourages innovation but also provides long-term growth opportunities for packaging converters.

The rapid expansion of e-commerce and modern retail channels in the Middle East is fueling demand for durable and lightweight flexible packaging. Online shopping requires packaging that is cost-effective, tamper-evident, and capable of protecting products during transit. Flexible solutions such as mailer bags, stretch films, and resealable pouches are increasingly used by retailers and logistics providers. In addition, large-scale retail infrastructure developments, such as Carrefour and Lulu Group’s expansion in the UAE, Qatar, and Saudi Arabia, are boosting demand for packaged goods, thereby driving the need for efficient and attractive packaging solutions. Flexible packaging also offers better branding opportunities through high-quality printing, which appeals to regional consumers who prioritize aesthetics and product safety.

Cost competitiveness is another major driver of flexible packaging adoption in the Middle East. Compared to rigid packaging formats like glass and metal, flexible packaging uses fewer raw materials, reduces storage space, and lowers transportation costs. This makes it an attractive option for both local manufacturers and multinational players. In addition, technological advancements such as digital printing, barrier films, and smart packaging are enhancing product safety and shelf appeal. For instance, multilayer barrier films are widely used in packaging snacks, coffee, and pharmaceuticals in GCC countries, ensuring freshness in the region’s hot climate. The adoption of advanced printing technologies also allows companies to cater to short-run packaging demands and promotional campaigns, further stimulating market growth.

Market Concentration & Characteristics

The Middle East flexible packaging market reflects a dual characteristic: high cost sensitivity among small local businesses and a growing demand for premium, innovative packaging among multinational corporations. While cost efficiency remains a dominant factor, encouraging adoption of lightweight films and pouches, technological innovation such as barrier films, smart labels, and digital printing is gaining traction. This balance ensures that the industry continuously evolves to serve both mass-market affordability and high-end performance needs.

Government policies play a crucial role in shaping industry dynamics. With countries such as the UAE and Saudi Arabia implementing bans and restrictions on single-use plastics, packaging manufacturers are under increasing pressure to innovate with recyclable, biodegradable, and eco-friendly materials. This regulatory push has created an industry characteristic where sustainability is not just a trend but a necessity, driving R&D investments and collaboration between packaging companies and FMCG brands.

Material Insights

The plastic segment recorded the largest market revenue share of over 63.0% in 2024. Plastics dominate the flexible packaging industry in the Middle East due to their cost-effectiveness, durability, and ability to provide high barrier protection against moisture, oxygen, and contaminants. Materials such as polyethylene (PE) and polypropylene (PP) are widely used in food, beverage, personal care, and pharmaceutical packaging. Plastic films offer lightweight and versatile designs, making them the preferred choice for a broad range of packaging solutions. In addition, plastics’ cost efficiency compared to alternative materials makes them attractive for regional manufacturers who focus on high-volume packaging production.

Bioplastics are projected to register the fastest CAGR of 5.6% during the forecast period, driven by the rising adoption of materials such as polylactic acid (PLA), starch blends, and bio-based polyethylene. These materials offer comparable functionality to conventional plastics while being partially or entirely derived from renewable resources, aligning with the region’s sustainability agenda. Although still in the early stages of adoption, bioplastics are gaining momentum in applications such as food packaging and retail bags. Growth is further supported by increasing sustainability initiatives across the Middle East, particularly in the UAE, where bans and restrictions on single-use plastics are accelerating the shift toward bio-based alternatives.

Product Insights

The pouches segment recorded the largest market revenue share of over 40.0% in 2024 and is expected to grow at the fastest CAGR of 5.5% during the forecast period. Pouches are flexible packaging formats available in stand-up, flat, and spouted variants, widely used for packaging snacks, dairy, sauces, juices, and personal care items. Their lightweight structure, resealable features, and superior branding capabilities make them a preferred choice for consumer-facing products in the Middle East. The pouch segment is propelled by rising demand for convenience food and beverages, particularly driven by the young, urban population. Single-serve and on-the-go consumption trends are especially strong in the GCC region, fueling the uptake of spouted and stand-up pouches. Additionally, the increasing preference for sustainable multilayer pouches with recyclable materials is boosting growth.

Bags are among the most widely used flexible packaging products in the Middle East, covering grocery bags, shopping bags, mailer bags, and specialty food packaging bags. Bags are preferred for carrying consumer goods, food products, and retail items, especially in supermarkets and hypermarkets that dominate the region’s retail sector. The demand for bags is driven by the growing retail industry, rapid urbanization, and the expansion of organized supermarkets and hypermarkets in countries such as the UAE and Saudi Arabia. In addition, government initiatives toward eco-friendly alternatives, such as biodegradable and recyclable bags, are pushing innovation and increasing adoption of sustainable bag formats.

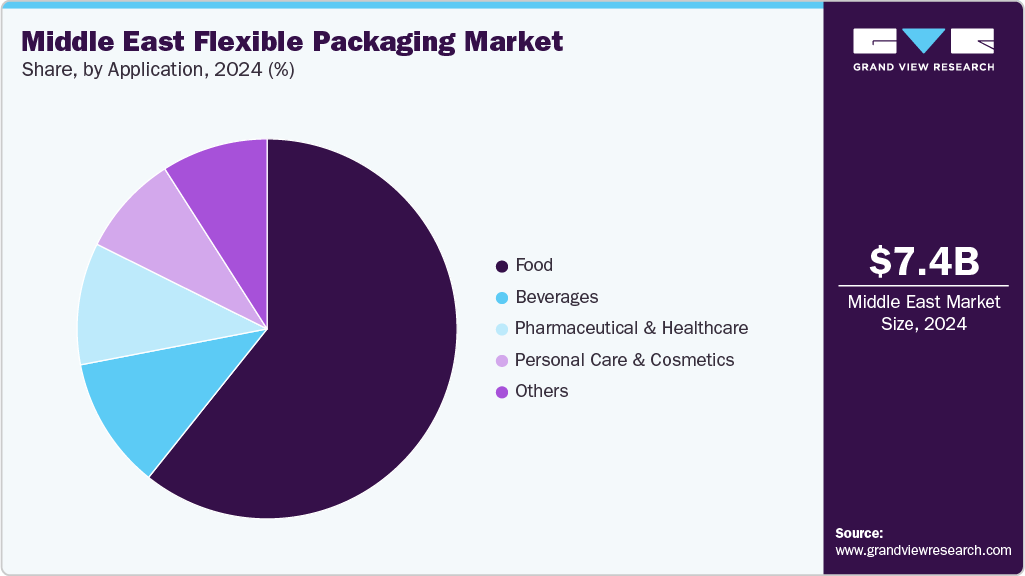

Application Insights

The food segment recorded the largest market share of over 60.0% in 2024 due to the rising demand for packaged and processed food products. Flexible packaging formats such as pouches, wraps, and films are widely used for bakery items, snacks, frozen food, dairy products, and ready-to-eat meals. These packaging solutions enhance shelf life, preserve freshness, and provide convenience for both manufacturers and consumers, making them a preferred choice in the regional food industry. The booming quick-service restaurant (QSR) and food delivery ecosystem across countries such as the UAE and Saudi Arabia is also fueling demand.

The pharmaceuticals & healthcare segment is projected to grow at the fastest CAGR of 5.9% during the forecast period. In the Middle East, the pharmaceutical & healthcare industry is increasingly adopting flexible packaging formats such as blister packs, sachets, and strip packaging for tablets, capsules, and medical devices. Flexible packaging ensures product safety, tamper resistance, and extended shelf life, which are critical for healthcare applications. The sector also requires compliance with stringent hygiene and regulatory standards, making high-barrier flexible packaging a preferred choice.

Country Insights

In 2024, Saudi Arabia led the market, accounting for over 38.0% of revenue, and is projected to register the fastest CAGR of 5.3% during the forecast period. This positive outlook is due to its large population, robust food and beverage industry, and government-backed industrial diversification programs under Vision 2030. The Kingdom is witnessing strong investment in both food manufacturing and retail sectors, which in turn is fueling demand for advanced packaging solutions.

The UAE has a well-developed packaging industry driven by its role as a regional trade hub and a diversified economy. With a strong retail sector, a booming e-commerce market, and a large expat population fueling demand for packaged food and beverages, the UAE has become one of the leading markets for flexible packaging in the Middle East. The government’s sustainability goals, including the ban on single-use plastics in 2024, are also reshaping the flexible packaging landscape.

Turkey has the most developed packaging industry in the Middle East, serving both domestic and export markets. It is a regional hub for packaging production with a large manufacturing base and cost advantages. The country exports packaging products to Europe, Africa, and the Middle East. Large-scale domestic demand for packaged food and beverages, strong export-oriented packaging production capacity, availability of raw materials, and growing e-commerce market fueling demand for flexible packaging solutions in the country.

Key Middle East Flexible Packaging Company Insights

The competitive environment of the Middle East flexible packaging industry is moderately fragmented, characterized by the presence of both global leaders such as Huhtamaki, UFlex, Mondi, and regional players such as Napco National, ENPI Group, and Hotpack Packaging Industries. Competition is primarily driven by cost efficiency, product innovation, and the ability to provide sustainable, customizable solutions to cater to the rising demand from food & beverage, personal care, and pharmaceutical sectors.

Increasing consumer preference for lightweight, eco-friendly, and recyclable packaging is driving companies to invest in advanced materials and green technologies as a means of differentiation. However, intense price competition, volatile raw material costs, and dependence on polymer imports pose significant challenges for smaller regional players. As a result, many are pursuing strategic partnerships, mergers, and capacity expansions to enhance their competitiveness and solidify their market presence across the Gulf and the wider Middle East region.

-

In August 2025, Napco National, through its Dubai-based subsidiary Napco Investment LLC, acquired Arabian Flexible Packaging, a well-established flexible packaging manufacturer known for its rotogravure printing and diverse substrate expertise including polypropylene, polyester, nylon, polyethylene, foil, and paper. This acquisition aims to strengthen Napco National’s manufacturing footprint, broaden its packaging portfolio, and support regional expansion aligned with the UAE's In-Country Value localization framework.

-

In May 2024, Huhtamaki consolidated its three flexible packaging manufacturing sites in the UAE by keeping one factory in Jebel Ali and expanding its factory in Ras Al Khaimah. The consolidation aims to optimize the manufacturing footprint, improve competitiveness, and strengthen the foundation for future growth in the region.

Key Middle East Flexible Packaging Companies:

- Huhtamaki

- Mondi

- Napco National

- ENPI Group

- Flex Films UAE

- Hotpack Packaging Industries LLC

- Silver Corner Packaging

- Bony Packaging

- ZamZam Packaging Mat. Ind. LLC

- Universal Carton Industries LLC

- RAK PACKAGING COMPANY LTD

- Takamul Industrial Company

Middle East Flexible Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.65 billion

Revenue forecast in 2033

USD 11.28 billion

Growth rate

CAGR of 5.0% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, product, application, and country

Country scope

UAE; Saudi Arabia; Oman; Kuwait; Qatar; Bahrain; Israel; Turkey

Key companies profiled

Huhtamaki; Mondi; Napco National; ENPI Group; Flex Films UAE; Hotpack Packaging Industries LLC; Silver Corner Packaging; Bony Packaging; ZamZam Packaging Mat. Ind. LLC; Universal Carton Industries LLC; RAK PACKAGING COMPANY LTD; Takamul Industrial Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Flexible Packaging Market Segmentation

This report forecasts revenue growth at a regional level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East flexible packaging market report based on material, product, application, and country:

-

Material Outlook (Revenue, USD Million 2021 - 2033)

-

Plastics

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyamide (PA)

-

Polyvinyl Chloride (PVC)

-

Polystyrene (PS)

-

Others

-

-

Paper

-

Metal

-

Bioplastics

-

-

Product Outlook (Revenue, USD Million 2021 - 2033)

-

Bags

-

Pouches

-

Retort Pouches

-

Refill Pouches

-

-

Rollstock

-

Films & Wraps

-

Others

-

-

Application Outlook (Revenue, USD Million 2021 - 2033)

-

Food

-

Beverages

-

Pharmaceutical & Healthcare

-

Personal Care & Cosmetics

-

Others

-

-

Country Outlook (Revenue, USD Million 2021 - 2033)

-

UAE

-

Saudi Arabia

-

Oman

-

Kuwait

-

Qatar

-

Bahrain

-

Israel

-

Turkey

-

Frequently Asked Questions About This Report

b. The Middle East flexible packaging market was estimated at around USD 7.36 billion in the year 2024 and is expected to reach around USD 7.65 billion in 2025.

b. The Middle East flexible packaging market is expected to grow at a compound annual growth rate of 5.0% from 2025 to 2033 to reach around USD 11.28 billion by 2033.

b. Food segment emerged as the dominating application segment in the Middle East flexible packaging market due to the region’s high consumption of packaged and processed foods.

b. The key players in the Middle East flexible packaging market include Huhtamaki; Mondi; Napco National; ENPI Group; Flex Films UAE; Hotpack Packaging Industries LLC; Silver Corner Packaging; Bony Packaging; ZamZam Packaging Mat. Ind. LLC; Universal Carton Industries LLC; RAK PACKAGING COMPANY LTD; and Takamul Industrial Company.

b. The market is driven by growth in e-commerce, retail expansion, and increasing preference for sustainable, lightweight packaging solutions in the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.