- Home

- »

- Advanced Interior Materials

- »

-

Middle East Hydraulic Workover Unit Market Report, 2033GVR Report cover

![Middle East Hydraulic Workover Unit Market Size, Share & Trends Report]()

Middle East Hydraulic Workover Unit Market (2025 - 2033) Size, Share & Trends Analysis Report By Service (Workover, Snubbing), By Installation (Skid Mounted, Trailer Mounted), By Capacity (151 - 200 Tons, Above 200 Tons), By Application, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-733-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Hydraulic Workover Unit Market Summary

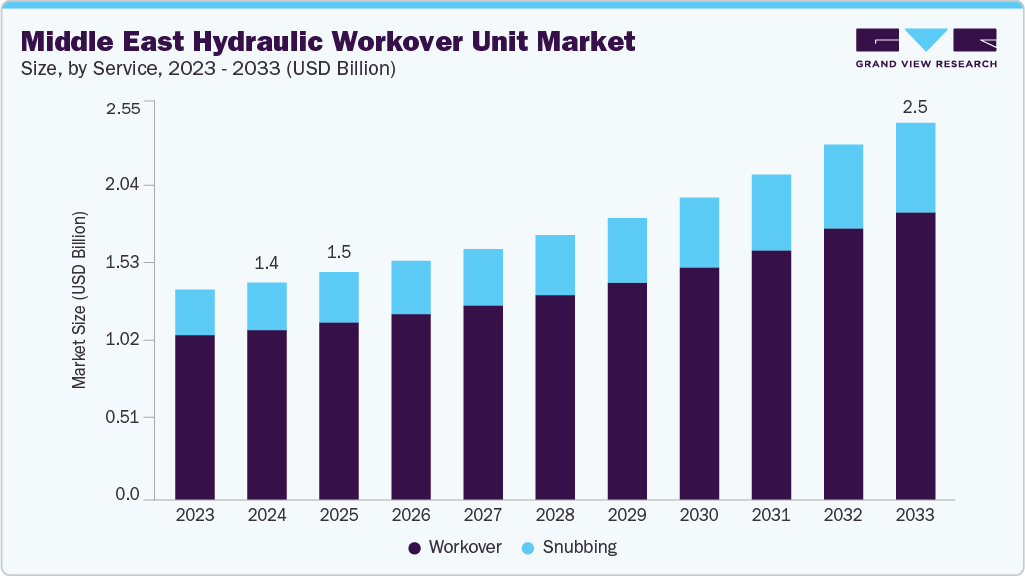

The Middle East hydraulic workover unit market size was estimated at USD 1,431.1 million in 2024 and is projected to reach USD 2,549.5 million by 2033, growing at a CAGR of 6.8% from 2025 to 2033. The hydraulic workover unit (HWU) market in the Middle East is growing due to increasing oilfield development and maintenance activities across Saudi Arabia, the UAE, and other Gulf countries.

Key Market Trends & Insights

- The Saudi Arabia hydraulic workover unit industry is expected to grow at a significant CAGR of 7.2% from 2025 to 2033.

- By service, the snubbing segment is expected to grow at a rapid CAGR of 7.8% from 2025 to 2033

- By installation, the trailer mounted segment is expected to grow at a considerable CAGR of 7.2% from 2025 to 2033.

- By application, the offshore segment is expected to grow at a fast-paced CAGR of 9.0% from 2025 to 2033.

- By capacity, the 151 - 200 tons segment is expected to grow at a rapid CAGR of 7.7% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 1,431.1 Million

- 2033 Projected Market Size: USD 2,549.5 Million

- CAGR (2025-2033): 6.8%

Rising demand for well intervention, well completion, and workover operations in mature fields is driving the adoption of hydraulic workover units. The flexibility and efficiency of HWUs for performing high-pressure, deepwater, and onshore well operations further support market growth, alongside investments in upgrading aging infrastructure and optimizing production. Increasing emphasis on well productivity and enhanced oil recovery in mature fields is driving demand for hydraulic workover units in the Middle East. Operators are focusing on maintaining optimal production levels and extending the life of existing wells, which requires frequent well interventions such as stimulation, logging, and workovers.HWUs offer the precision and mobility needed for these tasks, allowing operators to perform operations efficiently without mobilizing large drilling rigs.

Market Concentration & Characteristics

The Middle East hydraulic workover unit industry is moderately concentrated, comprising a mix of established global oilfield service providers and specialized regional manufacturers. Leading companies such as SLB, Halliburton, Baker Hughes, and Weatherford hold significant market share by leveraging advanced technology, strong brand reputation, and extensive project execution capabilities. Their ability to offer comprehensive HWU solutions and support across large-scale onshore and offshore projects reinforces their dominance in key end-user sectors, including upstream oil and gas operations.

Smaller regional suppliers also play an important role by catering to niche or customized operational requirements in local fields. These firms often provide HWUs adapted to specific well conditions, reservoir types, or regulatory standards, enhancing the competitive landscape and ensuring a range of operational needs are met. Consequently, the market maintains a balance, being neither fully consolidated nor highly fragmented.

Regulatory frameworks significantly influence the HWU market in the Middle East. Governments and regional authorities impose strict safety, operational, and environmental standards for well intervention and maintenance activities. Compliance requirements include certifications for high-pressure and deepwater operations, regular equipment inspections, and adherence to occupational safety regulations.

Safety and environmental agencies enforce rigorous guidelines on emissions, operational hazards, and equipment performance, aligning with global standards and national initiatives such as Saudi Arabia’s Vision 2030. Adherence to these regulations drives operators and manufacturers to invest in advanced, safe, and high-performance HWU technologies. In turn, regulatory compliance encourages the adoption of modern, efficient, and technologically sophisticated units, supporting sustained market growth.

Drivers, Opportunities & Restraints

The rising number of offshore exploration and production projects in the Middle East, particularly in deepwater fields in the UAE and Saudi Arabia, is driving demand for hydraulic workover units. Operators require HWUs capable of handling complex well interventions under high-pressure and high-temperature conditions. The ability of these units to perform multiple operations, such as well stimulation, acidizing, and logging, without mobilizing multiple rigs, enhances operational efficiency. Moreover, increasing investments in unconventional reservoirs and mature field redevelopment projects are boosting the need for versatile HWUs that can adapt to diverse well conditions.

High capital and operational costs associated with hydraulic workover units, combined with stringent safety and regulatory requirements, can limit adoption and slow market expansion. Maintenance-intensive components and the need for specialized operators further add to operational challenges, making smaller operators hesitant to invest in or rent HWUs.

The Middle East hydraulic workover unit industry presents significant growth potential through technological innovation and digital integration. Adoption of automated HWUs, IoT-enabled monitoring, and predictive maintenance solutions can improve operational efficiency, reduce downtime, and enhance safety. In addition, expanding exploration into deeper offshore fields and unconventional reservoirs creates demand for advanced HWUs capable of handling complex interventions, offering manufacturers and operators opportunities to introduce high-specification, next-generation units to the region.

Service Insights

The workover segment held the largest market share, accounting for 77.8% in 2024, driven by the need to maintain and optimize production from mature and aging wells across Saudi Arabia, the UAE, and other Gulf countries. Frequent well interventions, including stimulations, logging, and completions, require efficient and reliable HWUs capable of performing high-pressure operations. Operators are increasingly focusing on maximizing recovery rates and reducing downtime, which makes workover units a critical component of well maintenance strategies. In addition, rising investments in enhanced oil recovery and redevelopment of legacy fields are boosting demand for workover services.

The snubbing segment is expected to grow at a significant CAGR of 7.8% from 2025 to 2033 in terms of revenue. The snubbing segment is propelled by the growing demand for safe and controlled operations in live wells, particularly in high-pressure and deepwater environments. Snubbing units enable operators to perform interventions without killing the well, minimizing production loss and enhancing operational safety. Increased offshore exploration and drilling activities in the Gulf region are encouraging the deployment of snubbing units to handle complex and high-risk well operations. The segment also benefits from technological advancements that improve load capacity, automation, and operational efficiency.

Installation Insights

The skid mounted segment is the largest by market share, accounting for 60.4% in 2024. Skid-mounted HWUs are favored due to their stability, robustness, and suitability for long-term onshore and offshore well operations. These units can handle heavy loads and perform extended workover or snubbing tasks without relocation, making them ideal for high-production wells. Market growth is supported by increasing demand for units that can sustain continuous operations while meeting stringent safety and regulatory standards. Their modular design also allows for easier integration with other well intervention systems, enhancing operational flexibility.

The trailer mounted segment is expected to grow at a significant CAGR of 7.2% from 2025 to 2033 in terms of revenue. Trailer-mounted HWUs are driven by the need for mobility and rapid deployment across multiple well sites, especially in geographically dispersed onshore fields. Operators benefit from the ability to transport units quickly and perform interventions without significant setup time, reducing operational costs. Rising drilling and maintenance activities in desert and remote regions of the Middle East are boosting demand for trailer-mounted units.

Application Insights

The onshore segment represented the largest share of the market in 2024 at 90.8% due to the high concentration of mature and conventional oilfields in Saudi Arabia, Kuwait, and the UAE. Efficient well interventions, production optimization, and field redevelopment initiatives in these regions necessitate reliable and high-capacity HWUs. The accessibility of onshore fields allows operators to deploy larger, more advanced units, supporting extensive well maintenance and enhanced oil recovery projects.

The offshore segment is expected to grow at a rapid CAGR of 9.0% from 2025 to 2033 in terms of revenue. The offshore segment is fueled by deepwater and high-pressure projects in the Arabian Gulf and UAE waters. HWUs are critical for performing workover and snubbing operations under challenging offshore conditions, where downtime is costly. Increasing offshore exploration and production, coupled with technological advancements in unit automation and safety, are major drivers. In addition, the need for compact yet high-capacity units capable of operating on platforms and floating installations enhances offshore HWU demand.

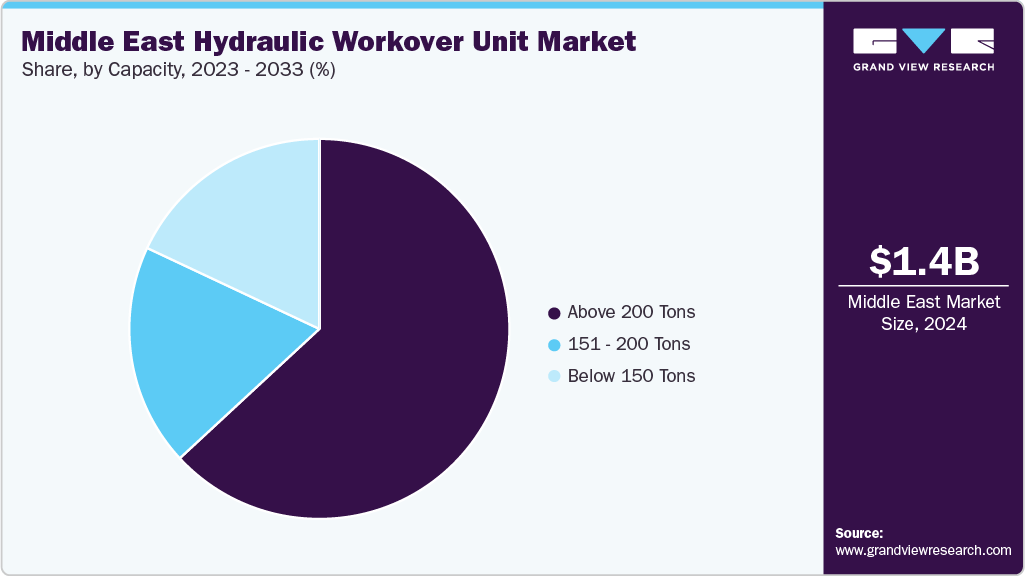

Capacity Insights

The above 200 tons segment held the largest market segment in 2024, accounting for 63.1% of the market. HWUs above 200 tons are primarily driven by high-pressure, deepwater, and ultra-deep onshore projects that demand heavy-duty lifting and intervention capabilities. This segment benefits from growing offshore exploration in the UAE and Saudi Arabia, where operators require units capable of handling deep, high-volume wells safely and efficiently.

The 151 - 200 tons segment is expected to grow at a moderate CAGR of 7.7% from 2025 to 2033 in terms of revenue. The 151–200 tons HWU segment is driven by the increasing number of moderately deep wells and mid-sized onshore and offshore projects across the Middle East. Operators prefer units in this capacity range for their balance of load-handling capability and operational efficiency, making them ideal for workovers, completions, and snubbing operations in conventional reservoirs. Rising investments in mature field redevelopment and enhanced oil recovery programs further support demand, as these units can perform complex interventions without requiring the largest rigs.

Country Insights

Saudi Arabia Hydraulic Workover Unit Market Trends

The hydraulic workover unit industry in Saudi Arabia held the largest regional revenue share, accounting for 32.8% in 2024. The country’s market is witnessing strong growth, driven by extensive upstream investments by Saudi Aramco and the redevelopment of mature oilfields. Rising workover and well intervention activities, along with initiatives to maximize production from existing reservoirs, are fueling demand for advanced HWUs. Large-scale field development projects and enhanced oil recovery programs further accelerate market expansion, as operators require high-capacity, reliable units for both onshore and offshore operations.

UAE Hydraulic Workover Unit Market Trends

The UAE hydraulic workover unit industry is expected to expand considerably with a projected CAGR of 7.8% from 2025 to 2033. Market growth is supported by increasing offshore exploration in the Arabian Gulf and the development of new onshore fields. Rising production targets, coupled with stringent operational and safety standards, are encouraging operators to deploy technologically advanced HWUs capable of performing complex workover and snubbing operations. Strategic investments in digital and automated workover units, along with strong government support for energy infrastructure, are reinforcing the UAE’s position as a key growth market in the region.

Key Middle East Hydraulic Workover Unit Company Insights

Some of the key players operating in the market include NOV and Ocean Oilfield Drilling.

-

NOV is a global provider of oilfield equipment and technologies, offering solutions that enhance safety and efficiency for energy customers worldwide. Their portfolio includes mobile workover rigs designed for well completions and operations, as well as specialized intervention and stimulation equipment ranging from coiled tubing units to comprehensive fracturing spreads.

-

Ocean Oilfield Drilling delivers integrated oilfield solutions across onshore and offshore operations. With their own fleet of drilling rigs and advanced hydraulic workover units (AHWUs), plus support vessels and manned crews, they offer a single point of contact for drilling, intervention, and project services in the region.

Key Middle East Hydraulic Workover Unit Companies:

- Al Suwaiket Group

- Norseman

- NOV

- Ocean Oilfield

- Access Middle East Oil Services

- Meil

- Superior Energy Services

- NIOT

- MB Petroleum Services LLC

- HITECH Egypt Oil & Gas Services

Recent Developments

-

The Middle East hydraulic workover unit industry is being shaped by a combination of rising demand for well intervention services, technological advancements, and regulatory frameworks. Growing investment in oil and gas production sustainability, coupled with the need to extend the life of mature fields, is driving operators to adopt HWUs for cost-effective and efficient well maintenance.

-

Companies are focusing on capacity expansion and equipment upgrades to enhance competitiveness. Investments in higher-capacity units, modular designs, and digitalized monitoring systems enable faster mobilization, improved safety, and greater cost efficiency. Regional players add value by tailoring solutions to local operating conditions, ensuring a balance between technological advancement and affordability.

Middle East Hydraulic Workover Unit Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,502.5 million

Revenue forecast in 2033

USD 2,549.5 million

Growth rate

CAGR of 6.8% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, installation, application, capacity, country

Country scope

Saudi Arabia; UAE; Oman; Kuwait; Qatar

Key companies profiled

Al Suwaiket Group; Norseman; NOV; Ocean Oilfield; Access Middle East Oil Services; Meil; Superior Energy Services; NIOT; MB Petroleum Services LLC; HITECH Egypt Oil & Gas Services

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Hydraulic Workover Unit Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East hydraulic workover unit market report based on service, installation, application, capacity, and country.

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Workover

-

Snubbing

-

-

Installation Outlook (Revenue, USD Million, 2021 - 2033)

-

Skid Mounted

-

Trailer Mounted

-

-

Capacity Outlook (Revenue, USD Million, 2021 - 2033)

-

Below 150 Tons

-

151 - 200 Tons

-

Above 200 Tons

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Offshore

-

Onshore

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Saudi Arabia

-

Oman

-

UAE

-

Qatar

-

Kuwait

-

Frequently Asked Questions About This Report

b. The Middle East hydraulic workover unit market size was estimated at USD 1,431.1 million in 2024 and is expected to be USD 1,502.5 million in 2025.

b. The Middle East hydraulic workover unit market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.8% from 2025 to 2033 to reach USD 2,549.5 million by 2033.

b. The Saudi Arabia hydraulic workover unit market held the largest regional share of the market accounting for 32.8% in 2024 driven by high crude production and ongoing capacity expansion. Heavy investments in upstream projects and Vision 2030 initiatives are sustaining demand for drilling rigs, pressure control, and well intervention tools. Partnerships between international and local firms are further boosting rental activity and diversifying equipment availability.

b. Some of the key players operating in the Middle East hydraulic workover unit market include Al Suwaiket Group, Norseman, NOV, Ocean Oilfield, Access Middle East Oil Services, Meil, Superior Energy Services, NIOT, MB Petroleum Services LLC, and HITECH Egypt Oil & Gas Services.

b. The Middle East hydraulic workover unit market is driven by rising demand for well intervention and maintenance in aging oilfields, alongside the region’s push to maximize recovery rates. Increasing offshore exploration and government-backed investments in upstream projects further accelerate adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.