- Home

- »

- Plastics, Polymers & Resins

- »

-

Middle East Industrial Packaging Market Size Report, 2030GVR Report cover

![Middle East Industrial Packaging Market Size, Share & Trends Report]()

Middle East Industrial Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Plastic, Metal, Wood, Glass, Foam), By Product, By End Use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-493-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

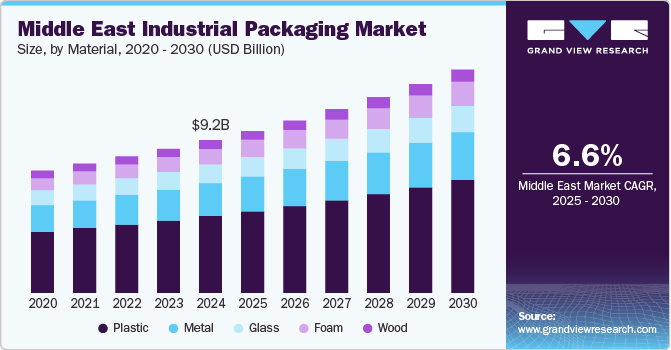

The Middle East industrial packaging market size was estimated at USD 9.15 billion in 2024 and is expected to expand at a CAGR of 6.6% from 2025 to 2030. The growth of key industrial sectors such as oil & gas, chemicals, and construction is a significant driver of the industrial packaging market in the Middle East. Additionally, the expansion of the region’s export-oriented economy, especially in sectors such as food & beverages and pharmaceuticals, is driving the growth of the market.

The Middle East industrial packaging industry is experiencing growth, primarily driven by the region's robust oil and gas sector, which requires specialized packaging solutions for chemicals, lubricants, and petrochemical products. Countries such as Saudi Arabia, UAE, and Qatar are making substantial investments in petrochemical facilities, creating increased demand for industrial bulk containers, drums, and intermediate bulk containers (IBCs). For example, Saudi Aramco's expansion of its petrochemical operations has led to greater adoption of UN-certified dangerous goods packaging and corrosion-resistant containers.

The region's growing manufacturing sector, particularly in areas such as pharmaceuticals, automotive parts, and consumer goods, is another key factor triggering the market growth in the region. The UAE's Operation 300bn industrial strategy, which aims to raise the industrial sector's contribution to GDP to AED 300 billion by 2031, has sparked increased demand for protective packaging solutions. This includes everything from anti-static packaging for electronic components to temperature-controlled packaging for pharmaceutical products manufactured in Dubai Science Park and similar industrial zones across the region.

The evolving landscape of sustainability regulations and environmental awareness is reshaping the Middle East industrial packaging industry. Countries such as the UAE and Saudi Arabia are implementing stricter waste management policies, pushing companies to adopt more sustainable packaging solutions. This has led to increased investment in recyclable materials and reusable packaging systems. For instance, several major industrial parks in Dubai and Abu Dhabi have implemented waste reduction programs that encourage the use of returnable packaging containers and recyclable materials. Additionally, the growth of e-commerce and logistics sectors in the region has created new demands for specialized industrial packaging that can withstand long-distance transportation while maintaining product integrity in the region's challenging climate conditions.

Material Insights

The plastic material segment registered the largest market share of over 50.0% in 2024. The increasing demand for durable, lightweight, and flexible packaging solutions is driving the adoption of plastic in industrial packaging. Its recyclability and advancements in biodegradable and reusable plastics are further fueling growth. Additionally, the growing petrochemical and chemical industries in the Middle East are boosting the demand for plastic drums and IBCs.

Foam-based packaging, such as expanded polystyrene (EPS) and polyethylene foam is commonly used to cushion and protect fragile and sensitive products during transportation. It is especially popular in the electronics, automotive, and industrial equipment sectors. The growth of the electronics and e-commerce industries in the Middle East is significantly driving the demand for foam-based industrial packaging.

Product Insights

The pallets segment accounted for the largest market share of over 34.0% in 2024. Pallets are flat structures made from materials like wood, plastic, or metal, used as a base for assembling, storing, and transporting goods. They are essential in industrial packaging for ensuring the efficient handling of bulk products, particularly in logistics and supply chain operations. The growth of the e-commerce and retail sectors in the Middle East, coupled with the expansion of export-oriented industries, is driving demand for pallets.

IBCs are large, reusable containers designed for the storage and transport of liquids, semi-solids, and granulated substances. Typically made of plastic or metal, they are widely used in industries such as chemicals, food and beverages, and pharmaceuticals due to their high storage efficiency. The rising demand for bulk transportation of liquids and chemicals in the Middle East, coupled with the growth of the food and beverage and oil and gas industries, is driving the adoption of IBCs.

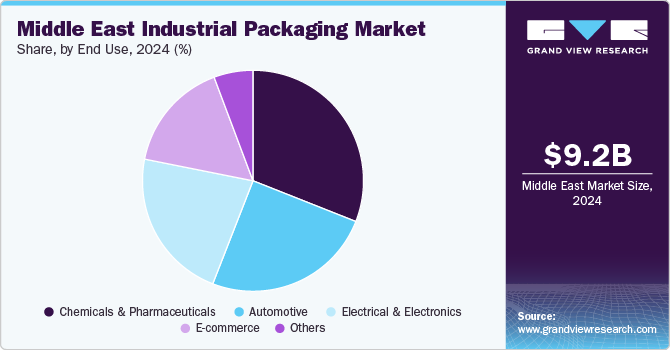

End Use Insights

The chemicals & pharmaceuticals segment recorded the largest market share of over 31.0% in 2024. The chemicals and pharmaceuticals industry in the Middle East demands robust industrial packaging to ensure the safe handling of hazardous materials, chemical compounds, and medical products. Growth in this segment is driven by rising investments in the petrochemical sector, increased demand for pharmaceuticals, and the establishment of regional hubs for chemical exports.

The Middle East's electrical and electronics sector requires high-performance packaging to safeguard sensitive products like semiconductors, circuit boards, and household appliances. The growth of this segment is fueled by increased demand for consumer electronics, the rapid adoption of smart technologies, and investments in renewable energy projects requiring electrical components. Additionally, government initiatives supporting digitalization and infrastructure development contribute to the growing need for secure and specialized packaging solutions.

Country Insights

Saudi Arabia dominated the market and accounted for the largest revenue share of over 34.0% in 2024. Saudi Arabia's dominance in the market is driven by several key factors. The Kingdom's position as the region's largest economy and its ambitious Vision 2030 economic diversification program have catalyzed significant investments in manufacturing, petrochemicals, and industrial infrastructure. This has created substantial demand for industrial packaging solutions across various sectors, particularly in chemical drums, intermediate bulk containers (IBCs), and industrial sacks.

UAE Industrial Packaging Market Trends

The UAE's well-developed infrastructure, including state-of-the-art ports such as Jebel Ali and industrial zones such as Dubai Industrial City and KIZAD (Khalifa Industrial Zone Abu Dhabi), has attracted numerous manufacturing companies across various sectors. For instance, the food and beverage industry has seen substantial growth, with companies such as Al Marai and National Food Products Company requiring sophisticated packaging solutions for their products. Similarly, the chemical and petrochemical sectors, represented by companies such as Borouge and Emirates Global Aluminium, drive demand for specialized industrial packaging materials such as bulk containers, intermediate bulk containers (IBCs), and industrial sacks.

Egypt Industrial Packaging Market Trends

Egypt’s strategic location, extensive infrastructure development, and large consumer base have made it an attractive hub for industrial activities. Egypt's well-developed ports, including Alexandria and Port Said, facilitate efficient import-export operations, while its extensive road network connects major industrial zones. This infrastructure advantage has attracted multinational companies in sectors such as chemicals, pharmaceuticals, and agricultural products, all of which require sophisticated industrial packaging solutions.

Key Middle East Industrial Packaging Company Insights

The competitive environment of the market is characterized by the presence of both global and regional players competing to meet the growing demand for durable, sustainable, and customized packaging solutions. Major players leverage advanced technologies and region-specific strategies to gain market share. Companies focus on innovation, eco-friendly materials, and efficient supply chains to differentiate their offerings, while intense competition leads to price wars and strategic partnerships to expand distribution networks and strengthen market presence.

-

In June 2024, The Arabian Plastic Industrial Company (APICO) inaugurated a new factory in Al-Kharj Industrial City, Saudi Arabia. This facility will produce a range of plastic products using advanced manufacturing techniques such as blow molding and injection molding. Hence, this strategic expansion is expected to enhance the company's production capabilities and contribute to local economic growth.

-

In December 2021, Saudi Arabian Packaging Industry WLL (SAPIN) launched an improved 15L plastic pail, designed to meet customer needs with enhanced features. This new pail is thicker by 0.2 mm, bringing its total thickness to 2.2 mm, which increases its durability and strength, making it suitable for heavy-duty industrial use.

Key Middle East Industrial Packaging Companies:

- Takween Advanced Industries

- IPLAST (I-Plast Ltd.)

- PPC

- Saudi Plastic Packaging Systems CO.LTD

- Saudi Arabian Packaging Industry WLL (SAPIN)

- Arabian Plastics Industrial Company Limited (APICO)

- National Plastic Factory LLC

- GhanPlastco

- SPF

- Al Nawakheth Factory Company

- KANR For Plastic Industries

- Colorful Sun Foundation

- Arnon Plastic Industry Co. Ltd. (Bawan)

- Napco Group (Napco National)

- Sealed Air Corporation (Sealed Air Saudi Arabia)

Middle East Industrial Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.72 billion

Revenue forecast in 2030

USD 13.38 billion

Growth Rate

CAGR of 6.6% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, Product, End Use, Country

Country scope

Saudi Arabia, Qatar, Kuwait, Oman, Bahrain, UAE, Egypt, Morocco, Iraq

Key companies profiled

Takween Advanced Industries; IPLAST (I-Plast Ltd.); PPC; Saudi Plastic Packaging Systems CO.LTD; Saudi Arabian Packaging Industry WLL (SAPIN); Arabian Plastics Industrial Company Limited (APICO); National Plastic Factory LLC; GhanPlastco; SPF; Al Nawakheth Factory Company; KANR For Plastic Industries; Colorful Sun Foundation; Arnon Plastic Industry Co. Ltd. (Bawan); Napco Group (Napco National); Sealed Air Corporation (Sealed Air Saudi Arabia)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Industrial Packaging Market Report Segmentation

This report forecasts revenue growth at a regional level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Middle East industrial packaging market report based on material, product, end use, and country:

-

Material Outlook (Revenue, USD Million 2018 - 2030)

-

Plastic

-

Metal

-

Wood

-

Glass

-

Foam

-

-

Product Outlook (Revenue, USD Million 2018 - 2030)

-

Pallets

-

Crates

-

Intermediate Bulk Containers (IBCs)

-

Drums & Barrels

-

Dunnage

-

Pails

-

Others

-

-

End Use Outlook (Revenue, USD Million 2018 - 2030)

-

Automotive

-

Electrical & Electronics

-

E-commerce

-

Chemicals & Pharmaceuticals

-

Others

-

-

Region Outlook (Revenue, USD Billion 2018 - 2030)

-

Middle East

-

Saudi Arabia

-

Qatar

-

Kuwait

-

Oman

-

Bahrain

-

UAE

-

Egypt

-

Morocco

-

Iraq

-

-

Frequently Asked Questions About This Report

b. The Middle East industrial packaging market was estimated at around USD 9.15 billion in the year 2024 and is expected to reach around USD 9.72 billion in 2025.

b. The Middle East industrial packaging market market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2030 to reach around USD 13.38 Billion by 2030.

b. Chemicals and pharmaceuticals emerged as a dominating end-use segment with a value share of around 31.0% in the year 2024 owing to the rising investments in the petrochemical sector, increased demand for pharmaceuticals, and the establishment of regional hubs for chemical exports in the region.

b. The key players in the Middle East industrial packaging market include Takween Advanced Industries; IPLAST (I-Plast Ltd.); PPC; Saudi Plastic Packaging Systems CO.LTD; Saudi Arabian Packaging Industry WLL (SAPIN); Arabian Plastics Industrial Company Limited (APICO); National Plastic Factory LLC; GhanPlastco; SPF; Al Nawakheth Factory Company; KANR For Plastic Industries; Colorful Sun Foundation; Arnon Plastic Industry Co. Ltd. (Bawan); Napco Group (Napco National); Sealed Air Corporation (Sealed Air Saudi Arabia)

b. The expansion of the region’s export-oriented economy, especially in sectors such as food & beverages and pharmaceuticals is driving the growth of the Middle East industrial packaging market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.